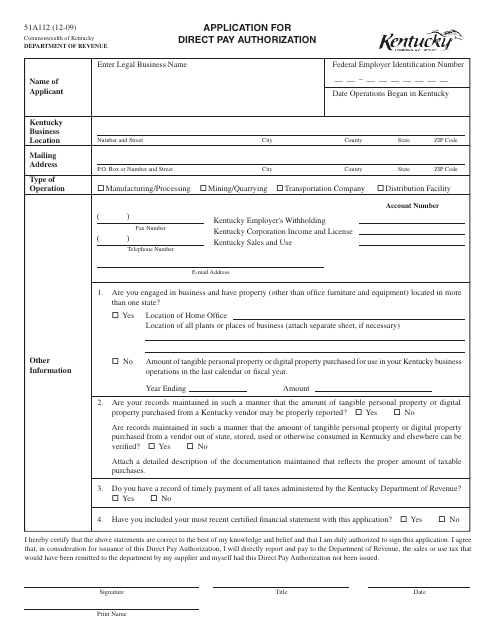

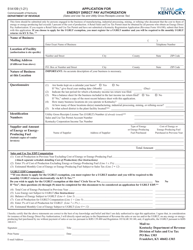

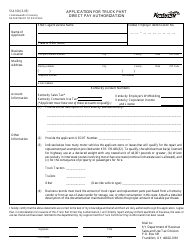

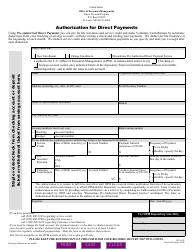

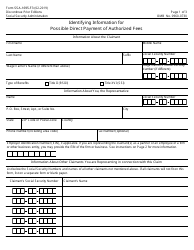

Form 51A112 Application for Direct Pay Authorization - Kentucky

What Is Form 51A112?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A112?

A: Form 51A112 is the Application for Direct Pay Authorization in Kentucky.

Q: What is the purpose of Form 51A112?

A: The purpose of Form 51A112 is to authorize the direct payment of withholding tax liabilities.

Q: Who needs to fill out Form 51A112?

A: Employers in Kentucky who want to authorize the direct payment of withholding tax liabilities need to fill out this form.

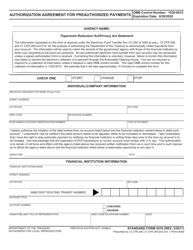

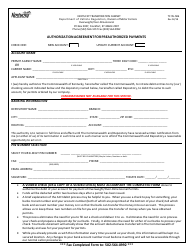

Q: What information do I need to provide on Form 51A112?

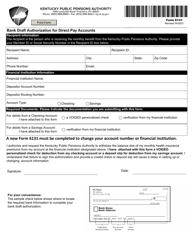

A: You will need to provide your employer information, tax identification number, banking information, and authorization details.

Q: When should I submit Form 51A112?

A: You should submit Form 51A112 at least 90 days before the desired effective date of direct pay.

Q: Are there any fees associated with Form 51A112?

A: No, there are no fees associated with submitting Form 51A112.

Q: Can I make changes to my direct pay authorization?

A: Yes, you can make changes to your direct pay authorization by submitting a new Form 51A112.

Q: Who can I contact for more information about Form 51A112?

A: For more information about Form 51A112, you can contact the Kentucky Department of Revenue.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A112 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.