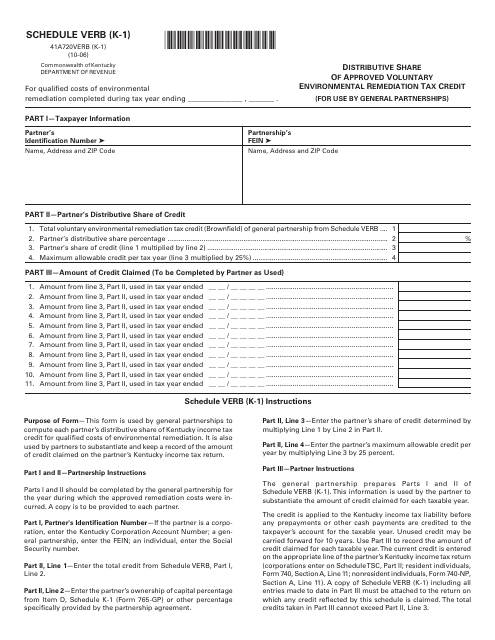

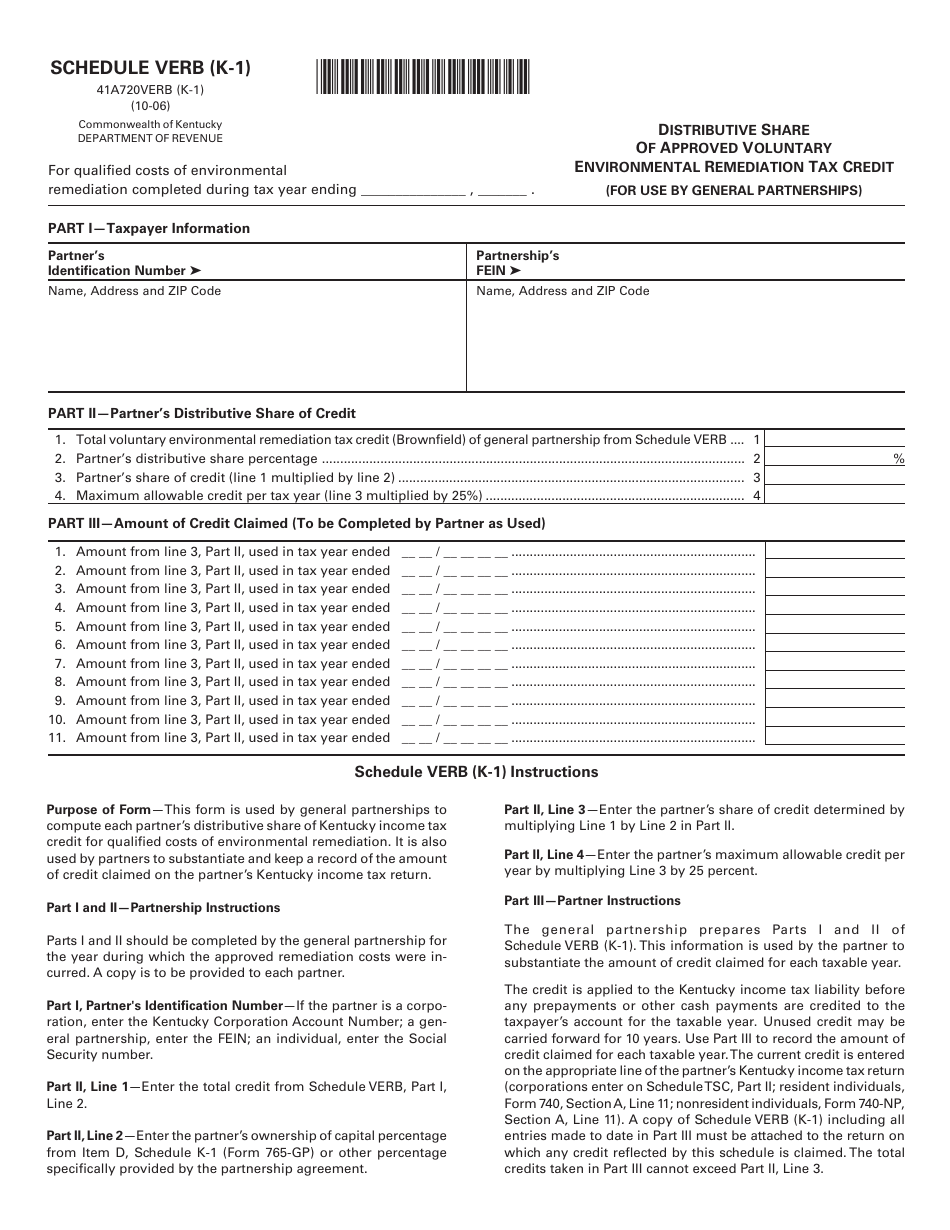

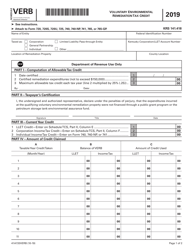

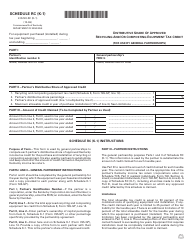

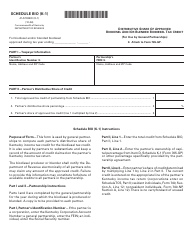

Form 41A720VERB (K-1) Schedule VERB (K-1) Distributive Share of Approved Voluntary Environmental Remediation Tax Credit - Kentucky

What Is Form 41A720VERB (K-1) Schedule VERB (K-1)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720VERB?

A: Form 41A720VERB is a tax form used in Kentucky.

Q: What is the purpose of Schedule VERB (K-1)?

A: Schedule VERB (K-1) is used to report the distributive share of approved voluntary environmental remediationtax credit in Kentucky.

Q: What is a distributive share?

A: A distributive share refers to the portion of income, expense, or tax credit that is allocated to each partner or shareholder in a partnership, LLC, or S corporation.

Q: What is the Approved Voluntary Environmental Remediation Tax Credit?

A: The Approved Voluntary Environmental Remediation Tax Credit is a tax credit available in Kentucky for costs incurred in cleaning upcontaminated sites.

Q: Who needs to file Form 41A720VERB?

A: Individuals, fiduciaries, partnerships, and limited liability companies who have a distributive share of the approved voluntary environmental remediation tax credit in Kentucky need to file Form 41A720VERB.

Q: Are there any specific instructions for filling out Form 41A720VERB?

A: Yes, there are specific instructions provided by the Kentucky Department of Revenue. These instructions should be followed carefully.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41A720VERB (K-1) Schedule VERB (K-1) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.