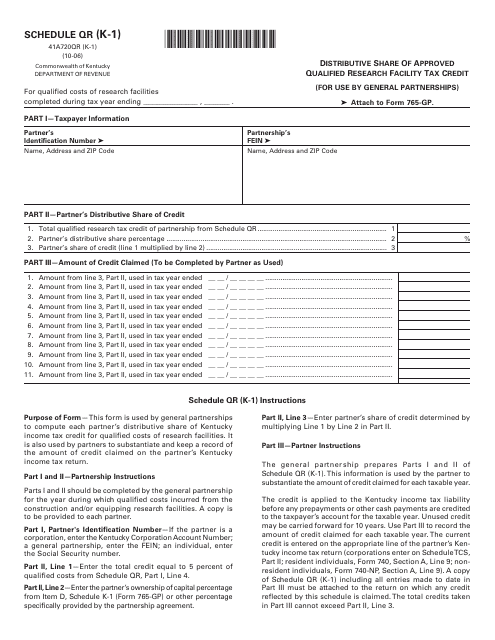

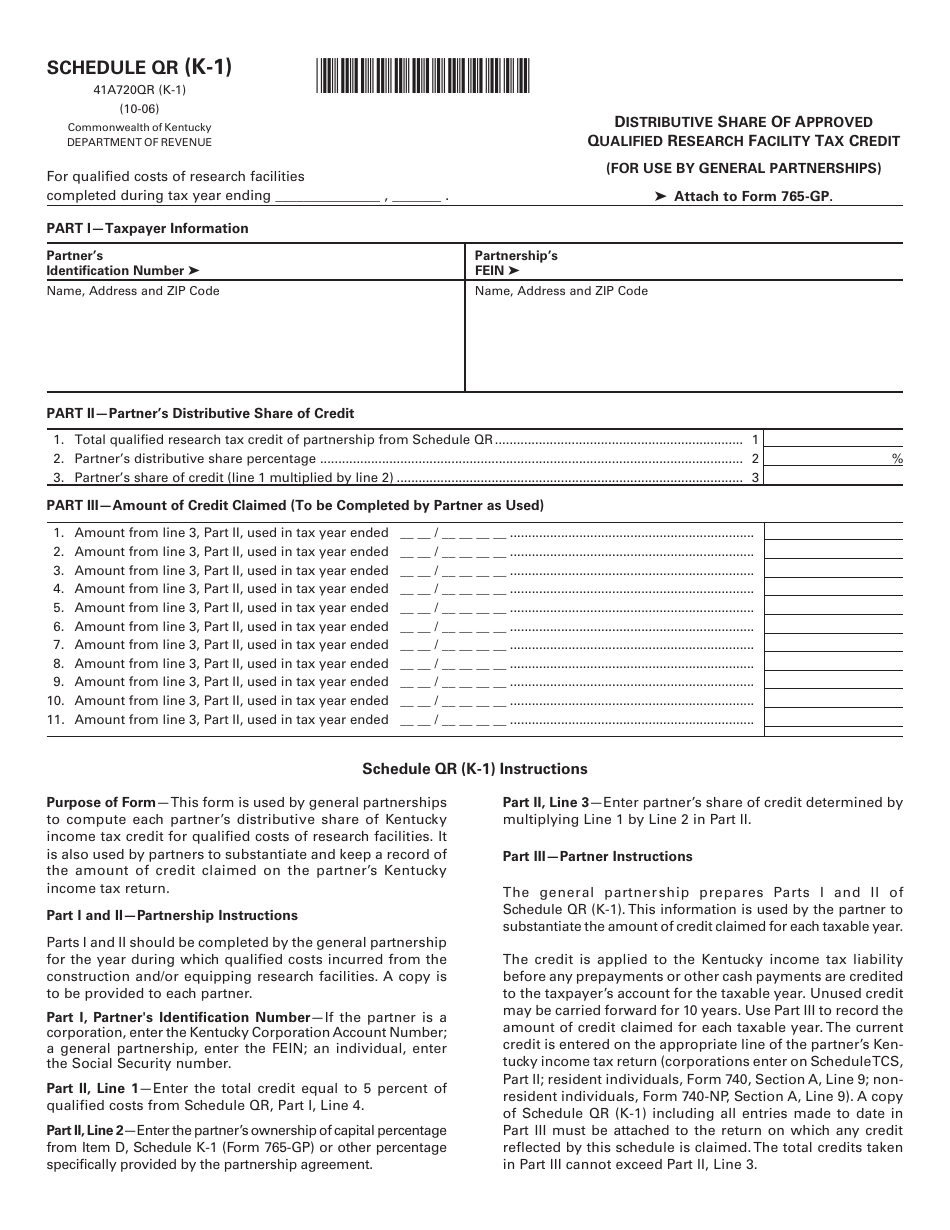

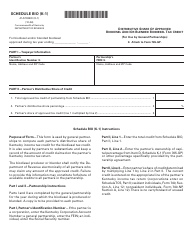

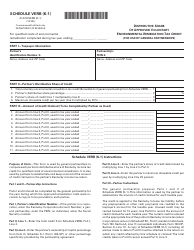

Form 41A720QR (K-1) Schedule QR (K-1) Distributive Share of Approved Qualified Research Facility Tax Credit - Kentucky

What Is Form 41A720QR (K-1) Schedule QR (K-1)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720QR (K-1)?

A: Form 41A720QR (K-1) is a tax form used in Kentucky to report the distributive share of approved qualified research facility tax credit.

Q: What is Schedule QR (K-1)?

A: Schedule QR (K-1) is a part of Form 41A720QR (K-1) where you provide details about the distributive share of approved qualified research facility tax credit.

Q: What is a distributive share?

A: Distributive share refers to the portion of a tax credit that is allocated to a specific individual or entity.

Q: What is the approved qualified research facility tax credit in Kentucky?

A: The approved qualified research facility tax credit is a tax incentive offered in Kentucky to encourage businesses to invest in research and development activities.

Q: Who needs to file Form 41A720QR (K-1)?

A: Partnerships, limited liability companies, and S corporations that have received the approved qualified research facility tax credit in Kentucky need to file Form 41A720QR (K-1).

Q: What information is required in Schedule QR (K-1)?

A: Schedule QR (K-1) requires you to provide details about the distributive share of the approved qualified research facility tax credit, such as the amount, the entity's share percentage, and the partner's or shareholder's share percentage.

Q: When is the deadline for filing Form 41A720QR (K-1)?

A: The deadline for filing Form 41A720QR (K-1) in Kentucky is the same as the deadline for filing the entity's tax return, which is usually April 15th.

Q: Are there any penalties for late filing of Form 41A720QR (K-1)?

A: Yes, if you fail to file Form 41A720QR (K-1) by the deadline, you may be subject to penalties and interest on the unpaid tax amount.

Form Details:

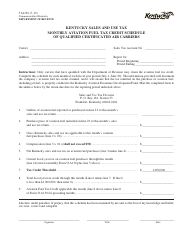

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41A720QR (K-1) Schedule QR (K-1) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.