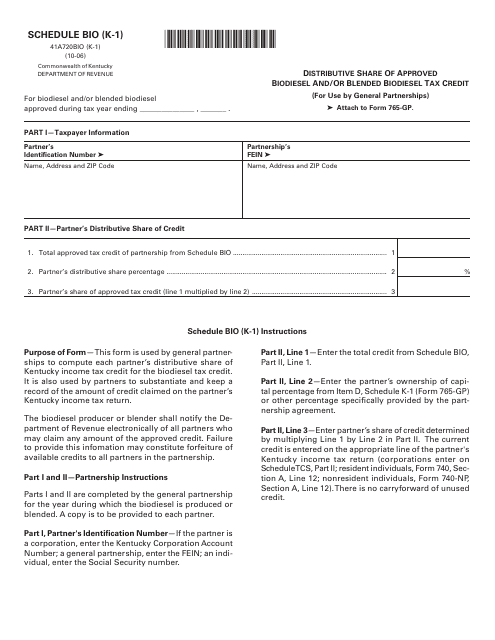

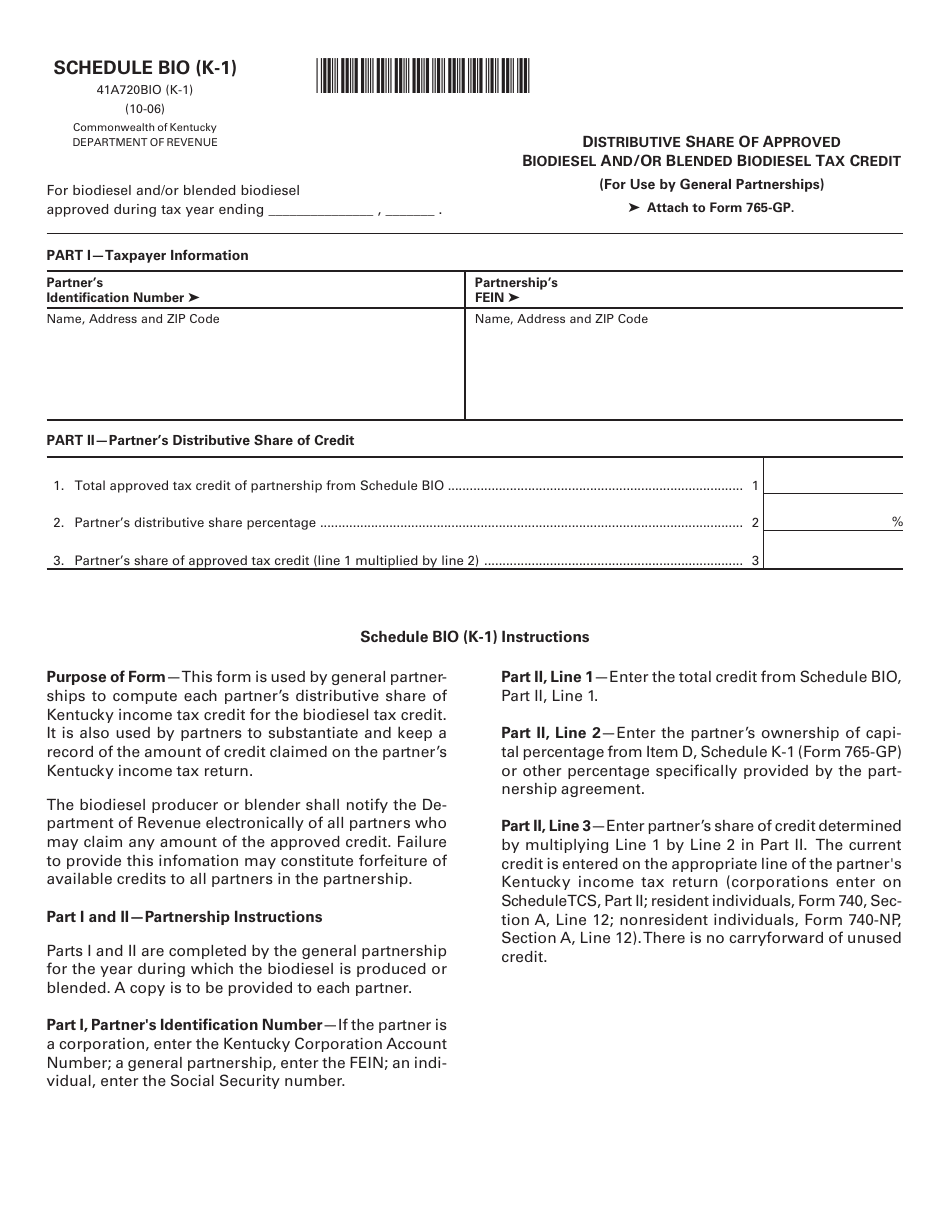

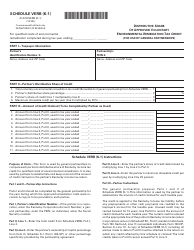

Form 41A720BIO (K-1) Schedule BIO (K-1) Distributive Share of Approved Biodiesel and / or Blended Biodiesel Tax Credit - Kentucky

What Is Form 41A720BIO (K-1) Schedule BIO (K-1)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720BIO (K-1) Schedule BIO?

A: Form 41A720BIO (K-1) Schedule BIO is a tax form used in Kentucky to report the distributive share of approved biodiesel and/or blended biodiesel tax credit.

Q: What is the purpose of Schedule BIO (K-1)?

A: The purpose of Schedule BIO (K-1) is to report the distributive share of approved biodiesel and/or blended biodiesel tax credit for a Kentucky resident.

Q: Who needs to file Schedule BIO (K-1)?

A: Kentucky residents who have a distributive share of approved biodiesel and/or blended biodiesel tax credit should file Schedule BIO (K-1).

Q: What information is required to complete Schedule BIO (K-1)?

A: To complete Schedule BIO (K-1), you will need information about your distributive share of approved biodiesel and/or blended biodiesel tax credit from your partnership or S corporation.

Q: What is the deadline for filing Schedule BIO (K-1)?

A: The deadline for filing Schedule BIO (K-1) in Kentucky is the same as the deadline for filing your state income tax return, which is typically April 15th.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41A720BIO (K-1) Schedule BIO (K-1) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.