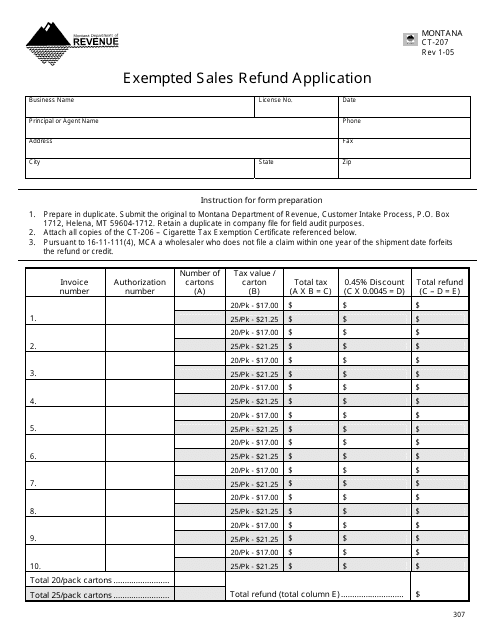

Form CT-207 Exempted Sales Refund Application - Montana

What Is Form CT-207?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-207?

A: Form CT-207 is the Exempted Sales Refund Application for Montana.

Q: Who can use Form CT-207?

A: Businesses that have made exempted sales in Montana can use Form CT-207 to apply for a refund.

Q: What is the purpose of Form CT-207?

A: The purpose of Form CT-207 is to apply for a refund of sales taxes paid on exempted sales in Montana.

Q: How do I fill out Form CT-207?

A: You need to provide information about your business, the exempted sales for which you are seeking a refund, and the amount of sales tax paid.

Q: Is there a deadline to submit Form CT-207?

A: Yes, Form CT-207 must be submitted to the Montana Department of Revenue within 12 months from the date of purchase.

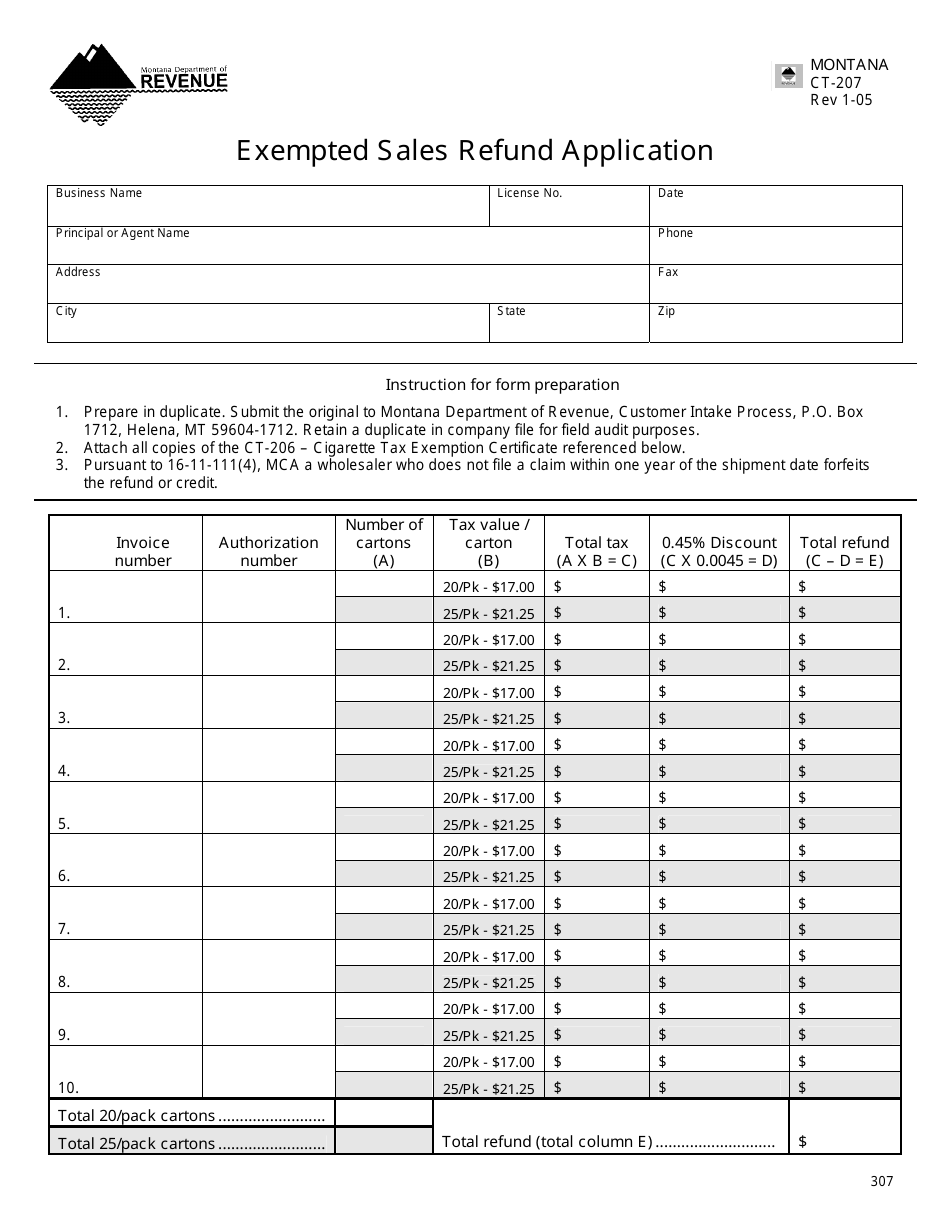

Q: Are there any supporting documents required with Form CT-207?

A: Yes, you must attach copies of invoices or receipts for the exempted sales for which you are seeking a refund.

Q: How long does it take to process Form CT-207?

A: The processing time for Form CT-207 may vary, but it generally takes a few weeks to several months to receive a refund.

Q: Can I file Form CT-207 electronically?

A: No, currently the Montana Department of Revenue does not accept electronic filing of Form CT-207. It must be submitted by mail or in person.

Q: What should I do if I have additional questions about Form CT-207?

A: If you have additional questions about Form CT-207 or need assistance with filling it out, you should contact the Montana Department of Revenue.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-207 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.