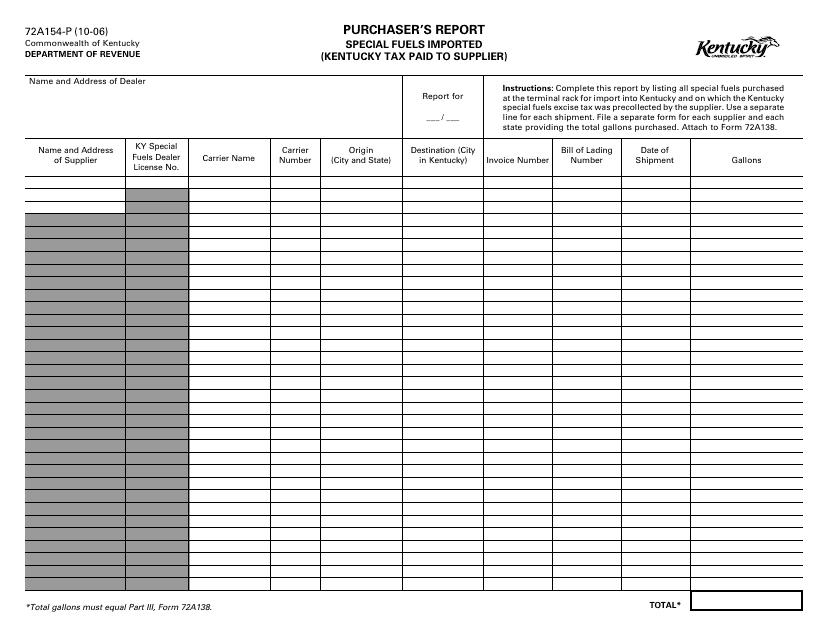

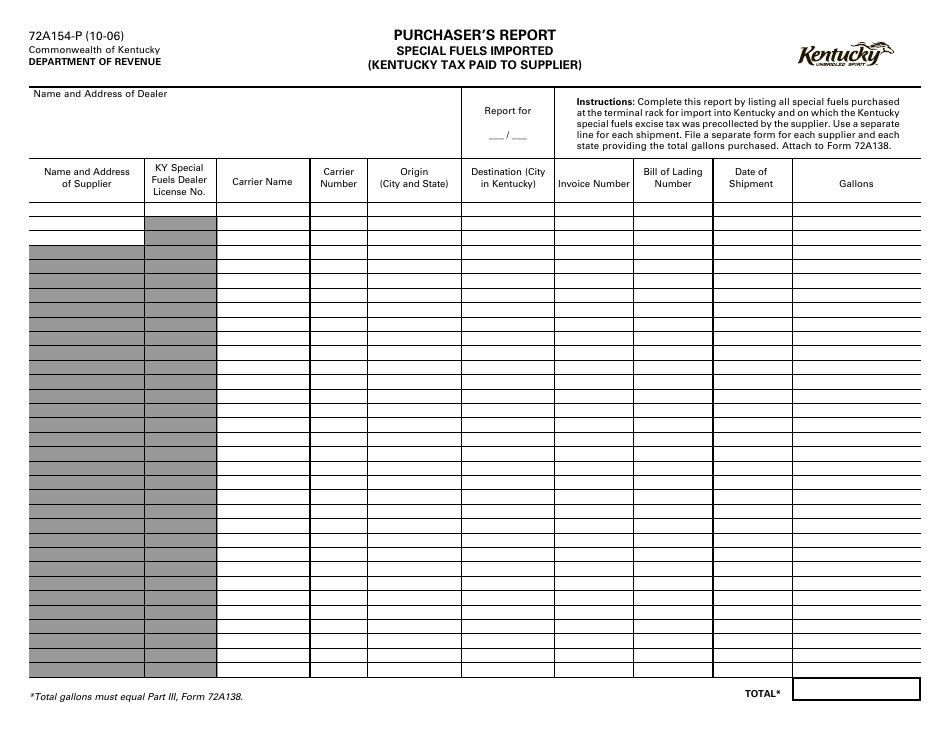

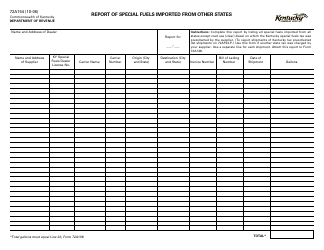

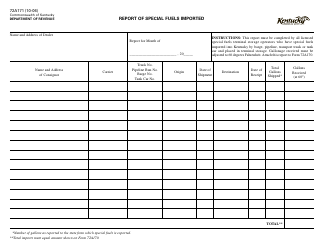

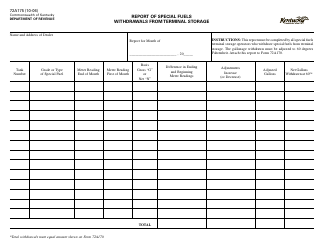

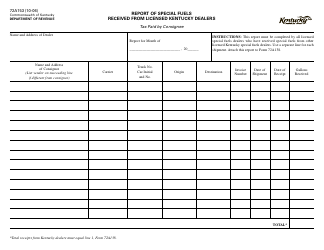

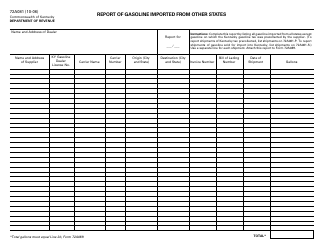

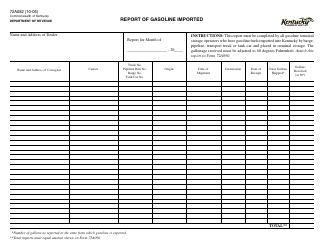

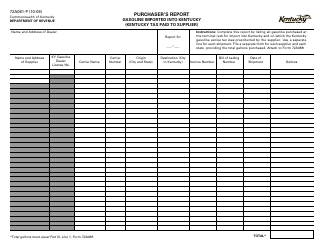

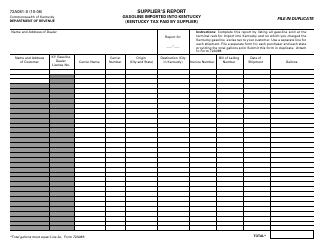

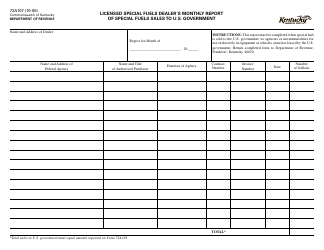

Form 72A154-P Purchaser's Report - Special Fuels Imported (Kentucky Tax Paid to Supplier) - Kentucky

What Is Form 72A154-P?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A154-P?

A: Form 72A154-P is a Purchaser's Report for Special Fuels Imported from Kentucky.

Q: What is the purpose of Form 72A154-P?

A: The purpose of Form 72A154-P is to report special fuels imported from Kentucky, on which taxes have been paid to the supplier.

Q: Who needs to file Form 72A154-P?

A: Anyone who imports special fuels from Kentucky and has paid taxes to the supplier needs to file Form 72A154-P.

Q: What is considered special fuels?

A: Special fuels refer to fuels such as diesel, natural gas, and other fuels used in motor vehicles.

Q: What information is required on Form 72A154-P?

A: Form 72A154-P requires information such as the importer's name, address, tax identification number, and details of the special fuels imported.

Q: Are there any deadlines for filing Form 72A154-P?

A: Yes, Form 72A154-P must be filed on a monthly basis, and the deadline is the 25th day of the following month.

Q: Are there any penalties for not filing Form 72A154-P?

A: Yes, failure to file Form 72A154-P or filing it late may result in penalties and interest charges.

Q: Is there any additional documentation required with Form 72A154-P?

A: Yes, supporting documentation such as purchase invoices and receipts should be kept for record-keeping purposes.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A154-P by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.