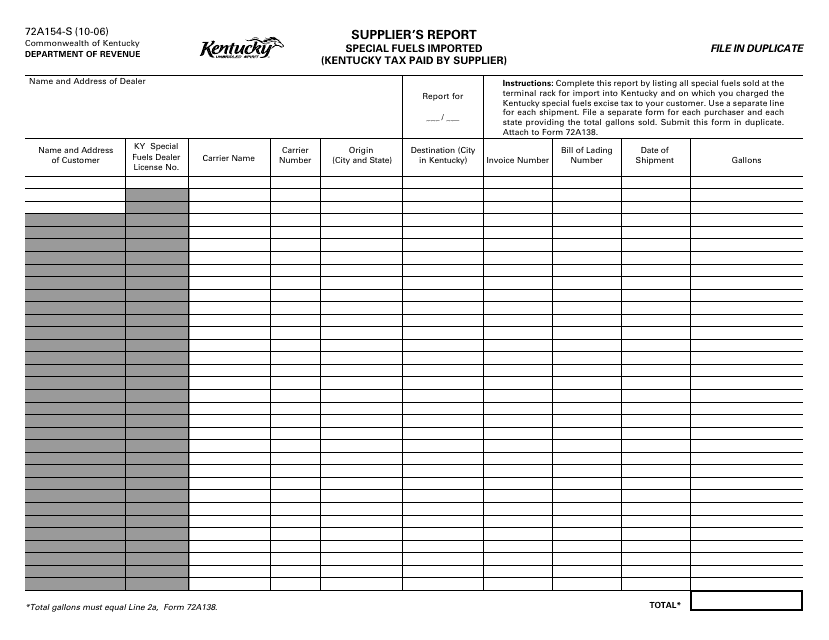

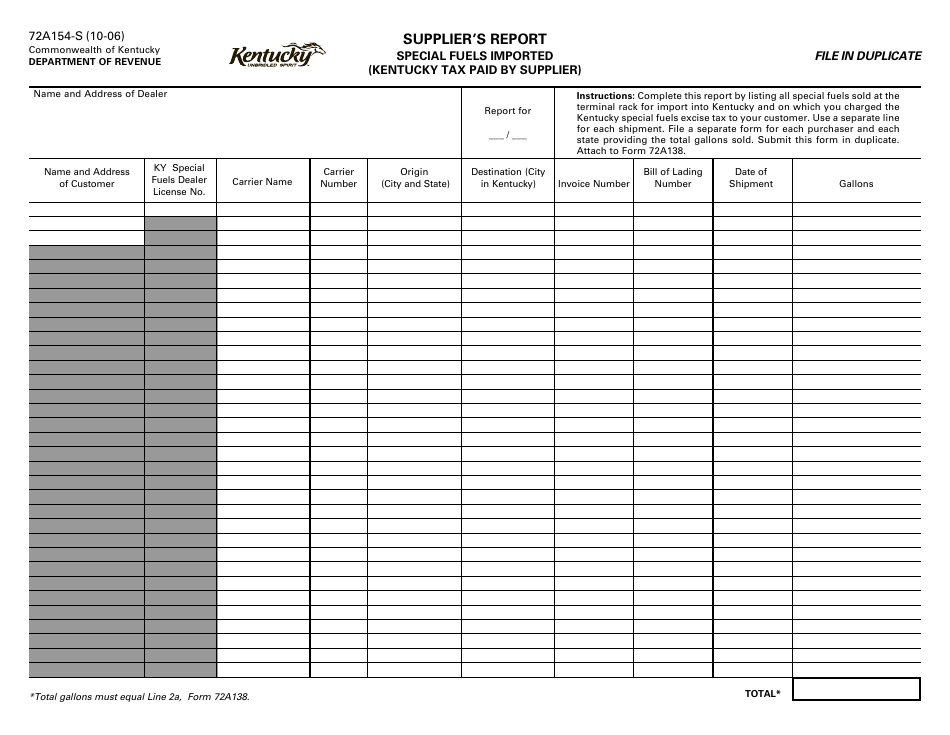

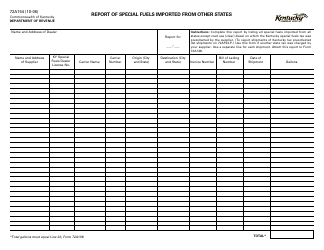

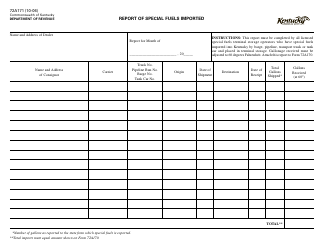

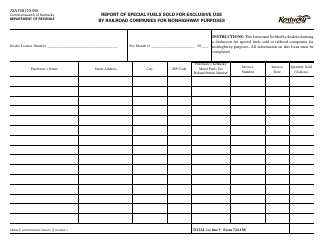

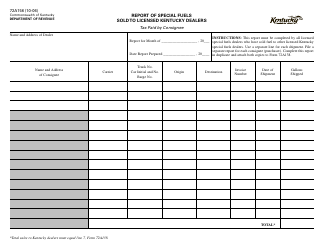

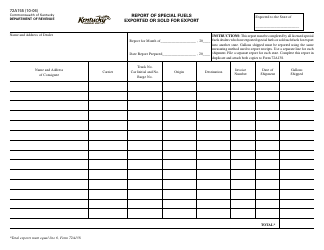

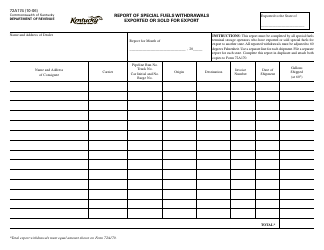

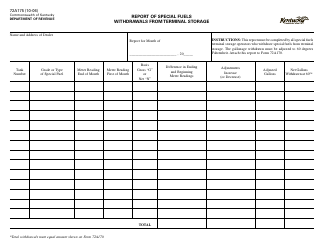

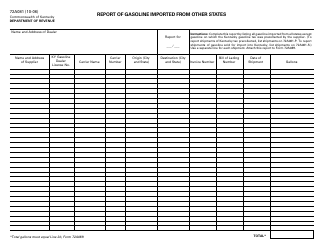

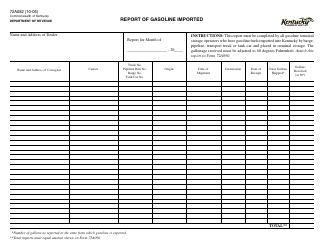

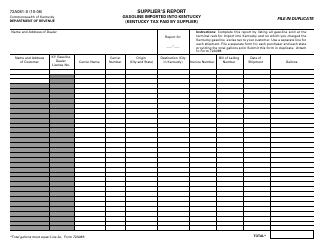

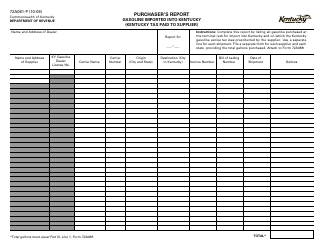

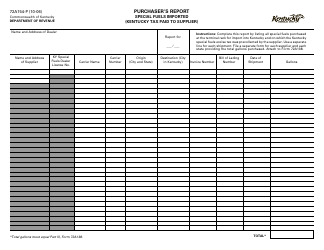

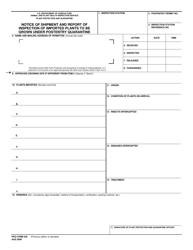

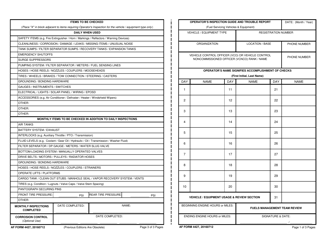

Form 72A154-S Supplier's Report - Special Fuels Imported (Kentucky Tax Paid by Supplier) - Kentucky

What Is Form 72A154-S?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A154-S?

A: Form 72A154-S is the Supplier's Report for Special Fuels Imported (Kentucky Tax Paid by Supplier) in Kentucky.

Q: Who needs to fill out Form 72A154-S?

A: Suppliers of special fuels imported into Kentucky and who have paid the Kentucky tax on those fuels need to fill out Form 72A154-S.

Q: What is special fuel?

A: Special fuel refers to any diesel fuel or motor fuel that is not gasoline.

Q: What information is required on Form 72A154-S?

A: Form 72A154-S requires suppliers to provide details about the imported special fuels, including the type of fuel, quantity, supplier information, and details of the Kentucky tax paid.

Q: When is Form 72A154-S due?

A: Form 72A154-S is due on or before the 20th day of the month following the end of the calendar quarter in which the special fuels were imported.

Q: Are there any penalties for late filing of Form 72A154-S?

A: Yes, there may be penalties for late or non-filing of Form 72A154-S, including monetary fines.

Q: Is Form 72A154-S only applicable to suppliers in Kentucky?

A: Yes, Form 72A154-S is specific to suppliers of special fuels imported into Kentucky.

Q: Can I file Form 72A154-S electronically?

A: Yes, the Kentucky Department of Revenue allows suppliers to file Form 72A154-S electronically.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A154-S by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.