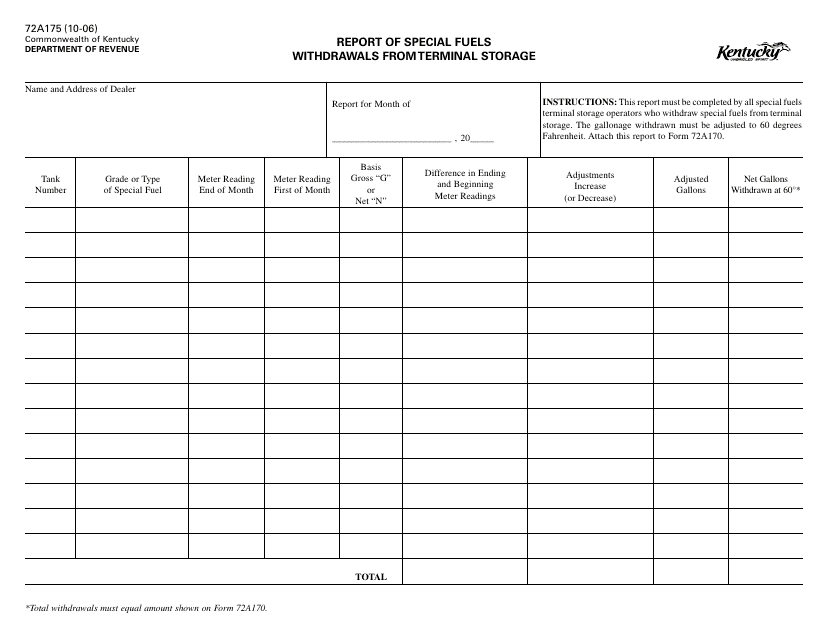

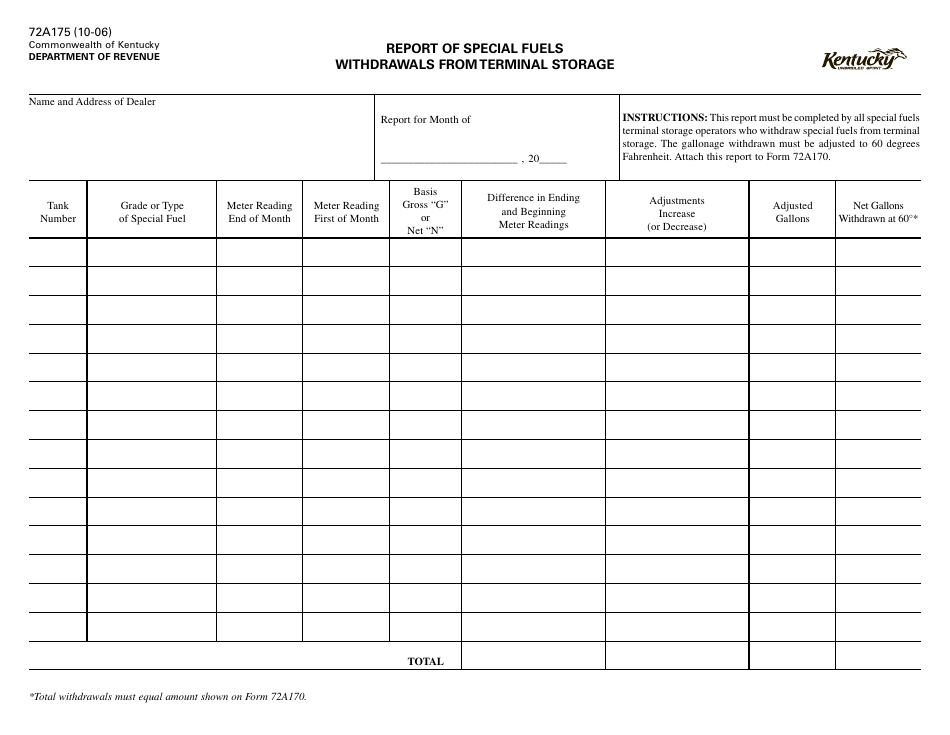

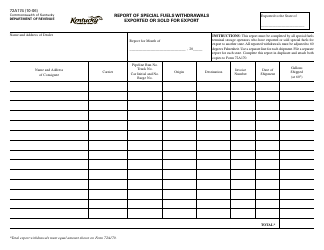

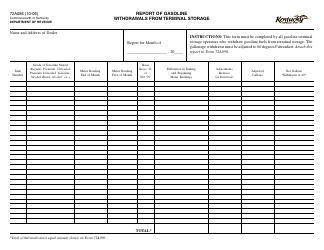

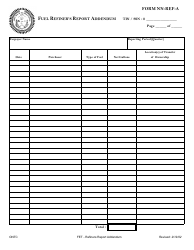

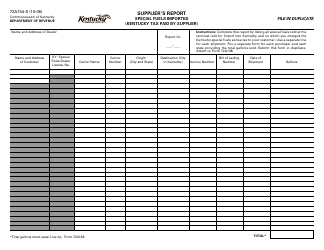

Form 72A175 Report of Special Fuels Withdrawals From Terminal Storage - Kentucky

What Is Form 72A175?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A175?

A: Form 72A175 is a report of special fuels withdrawals from terminal storage in Kentucky.

Q: Who needs to file Form 72A175?

A: Anyone who withdraws special fuels from terminal storage in Kentucky needs to file Form 72A175.

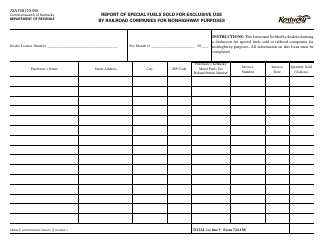

Q: What are special fuels?

A: Special fuels include products such as diesel fuel and kerosene that are used for non-highway purposes.

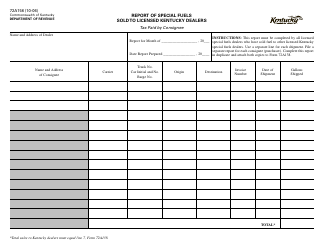

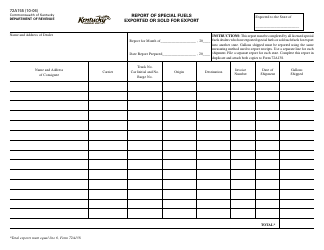

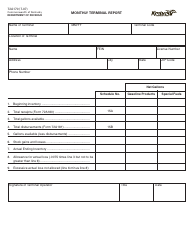

Q: What information is required on Form 72A175?

A: Form 72A175 requires information such as the quantity of fuel withdrawn, the date of withdrawal, and the destination of the fuel.

Q: How often does Form 72A175 need to be filed?

A: Form 72A175 needs to be filed on a monthly basis.

Q: Are there any penalties for not filing Form 72A175?

A: Yes, failing to file Form 72A175 or filing it late can result in penalties and interest charges.

Q: Is there a deadline for filing Form 72A175?

A: Yes, Form 72A175 must be filed by the 25th day of the month following the month in which the withdrawals were made.

Q: Can Form 72A175 be filed electronically?

A: Yes, Form 72A175 can be filed electronically through the Kentucky Department of Revenue's e-filing system.

Q: Are there any exemptions from filing Form 72A175?

A: Yes, certain entities may be exempt from filing Form 72A175. It is recommended to consult the Kentucky Department of Revenue for more information.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A175 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.