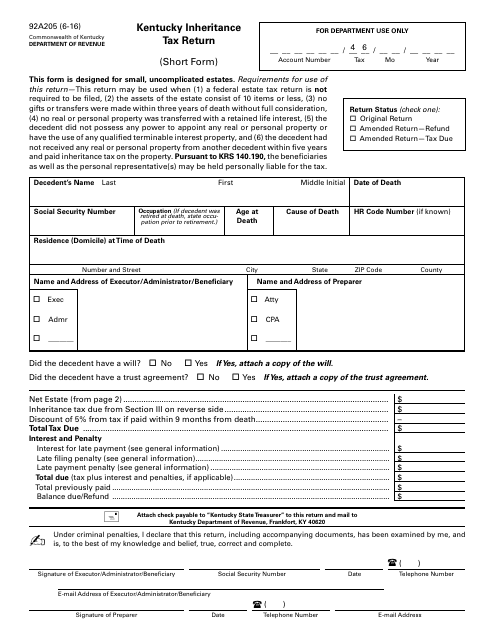

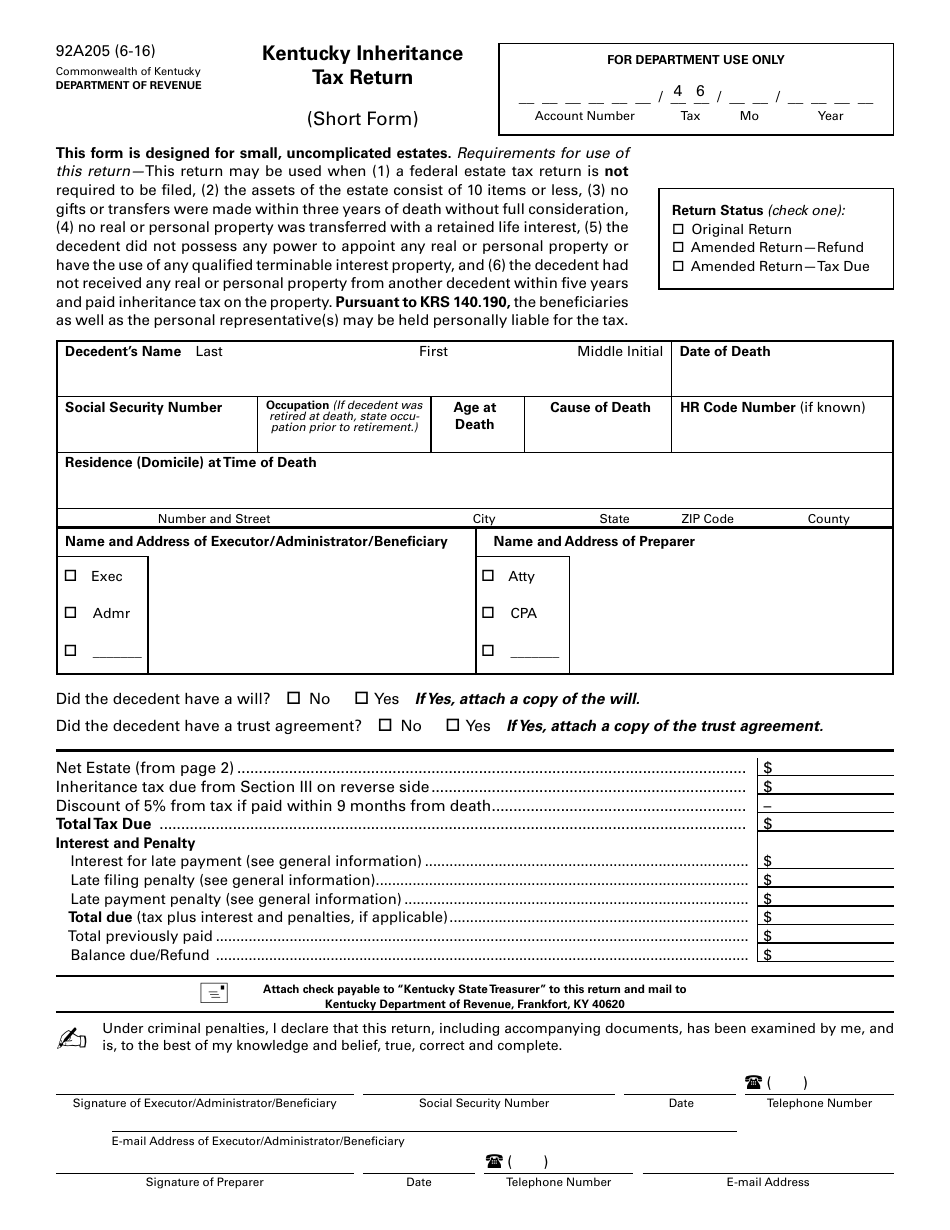

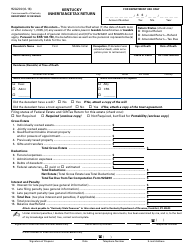

Form 92A205 Kentucky Inheritance Tax Return - Short Form - Kentucky

What Is Form 92A205?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 92A205?

A: Form 92A205 is the Kentucky Inheritance Tax Return - Short Form.

Q: Who needs to file Form 92A205?

A: Individuals who need to report and pay inheritance tax in Kentucky.

Q: What is the purpose of Form 92A205?

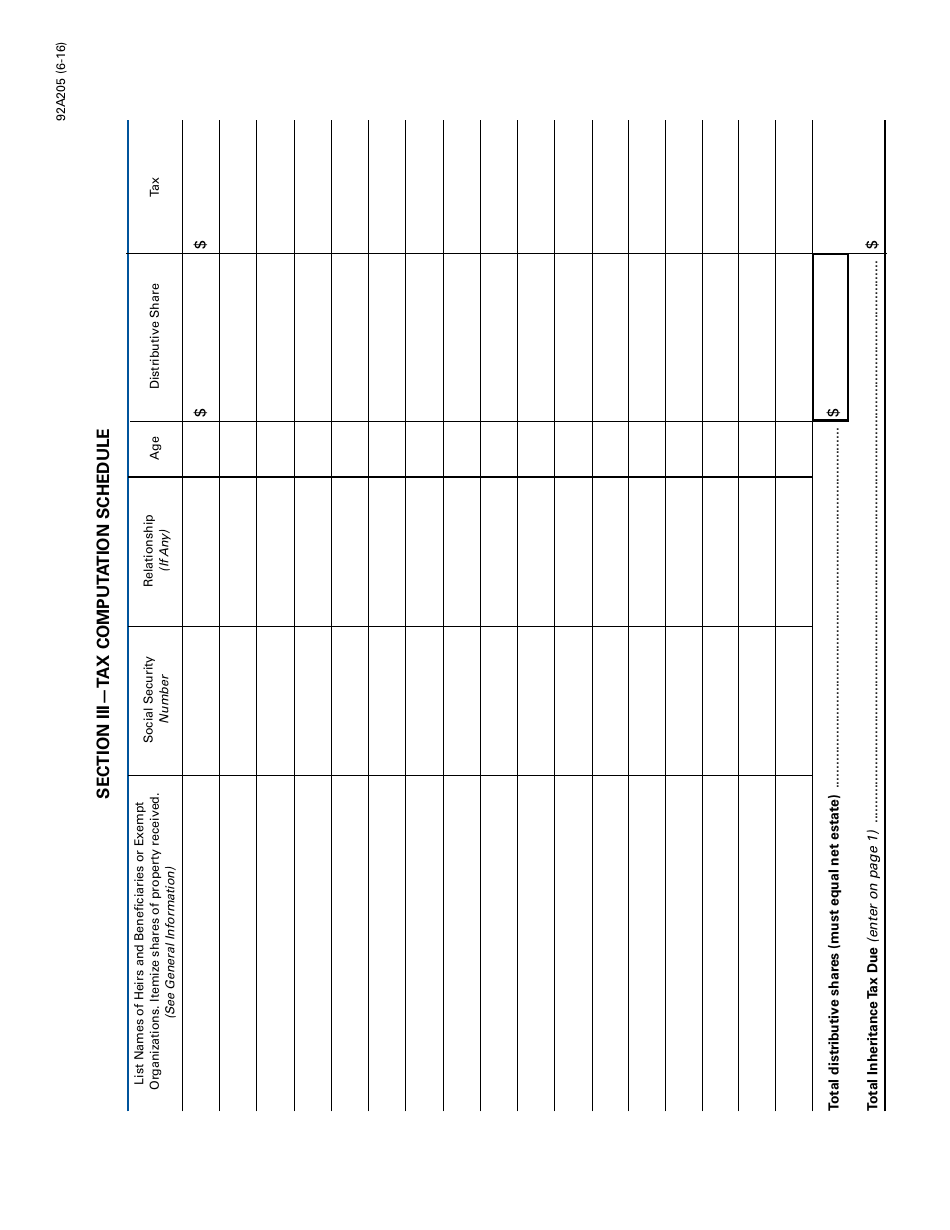

A: Form 92A205 is used to calculate the inheritance tax owed to the state of Kentucky.

Q: What is the deadline for filing Form 92A205?

A: The deadline for filing Form 92A205 is nine months from the date of death of the decedent.

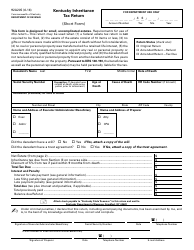

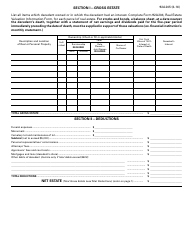

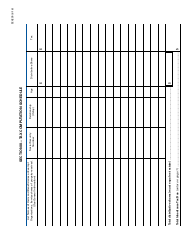

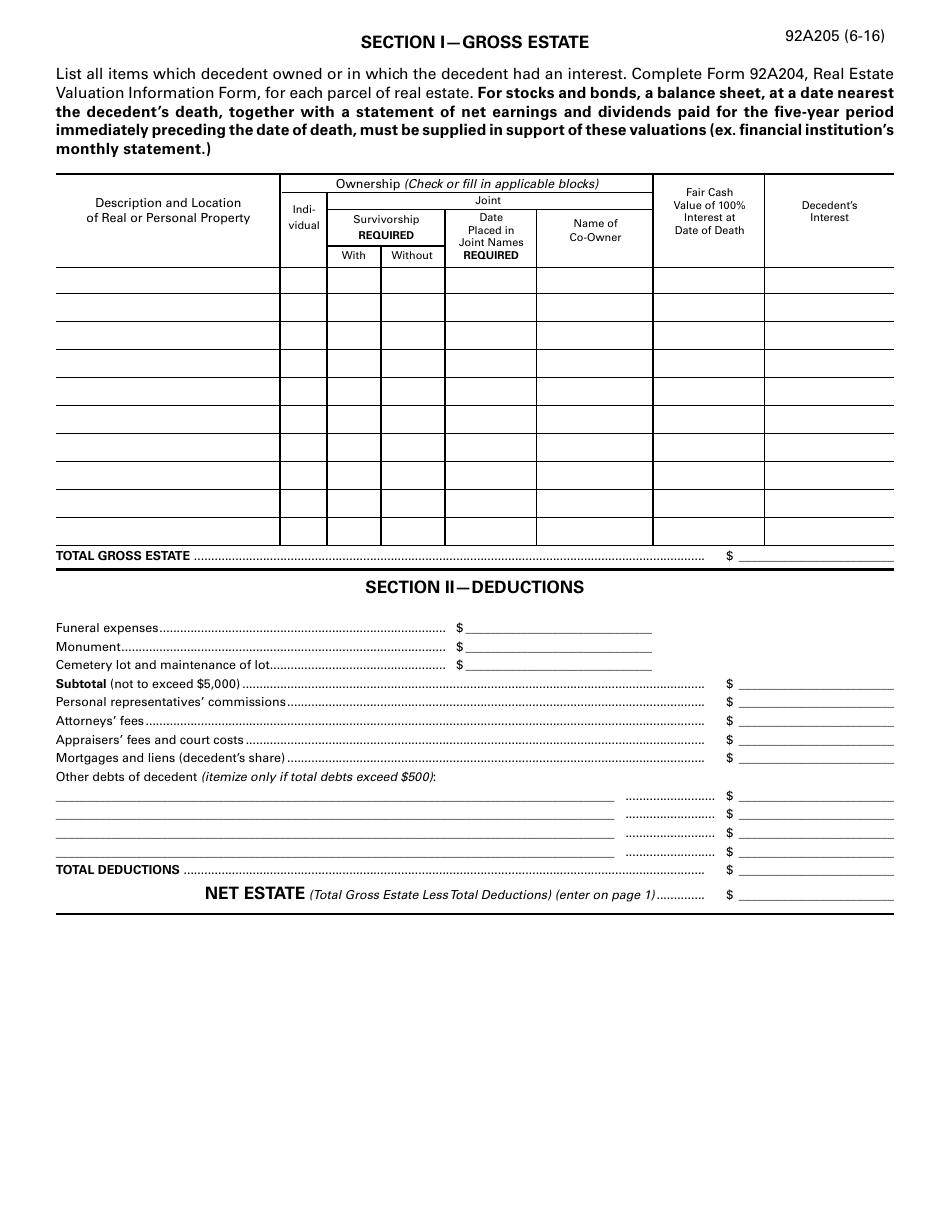

Q: Are there any exemptions or deductions available on Form 92A205?

A: Yes, there are certain exemptions and deductions available on Form 92A205 that may reduce the amount of inheritance tax owed.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 92A205 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.