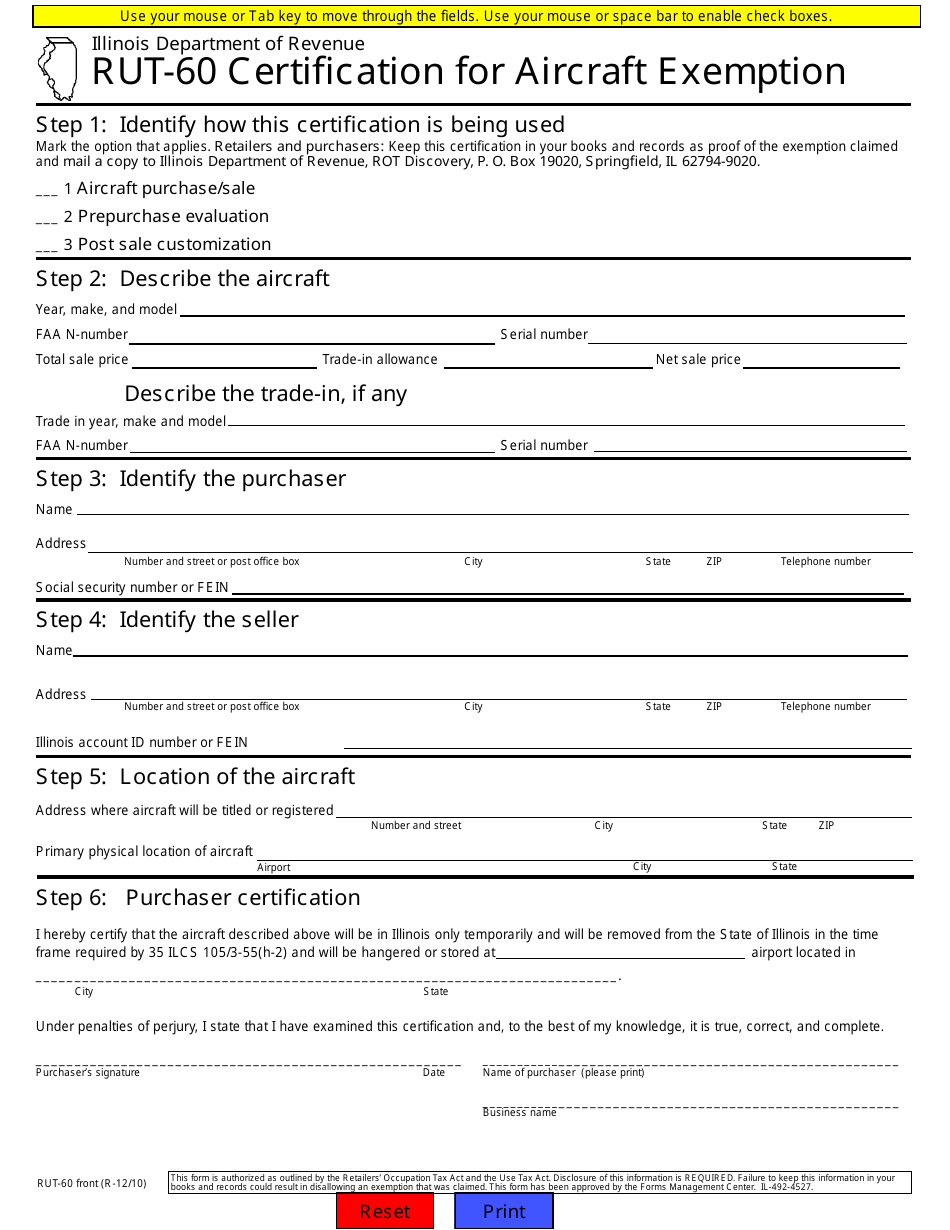

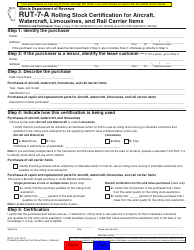

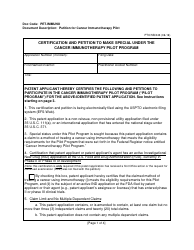

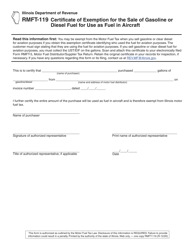

Form RUT-60 Certification for Aircraft Exemption - Illinois

What Is Form RUT-60?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

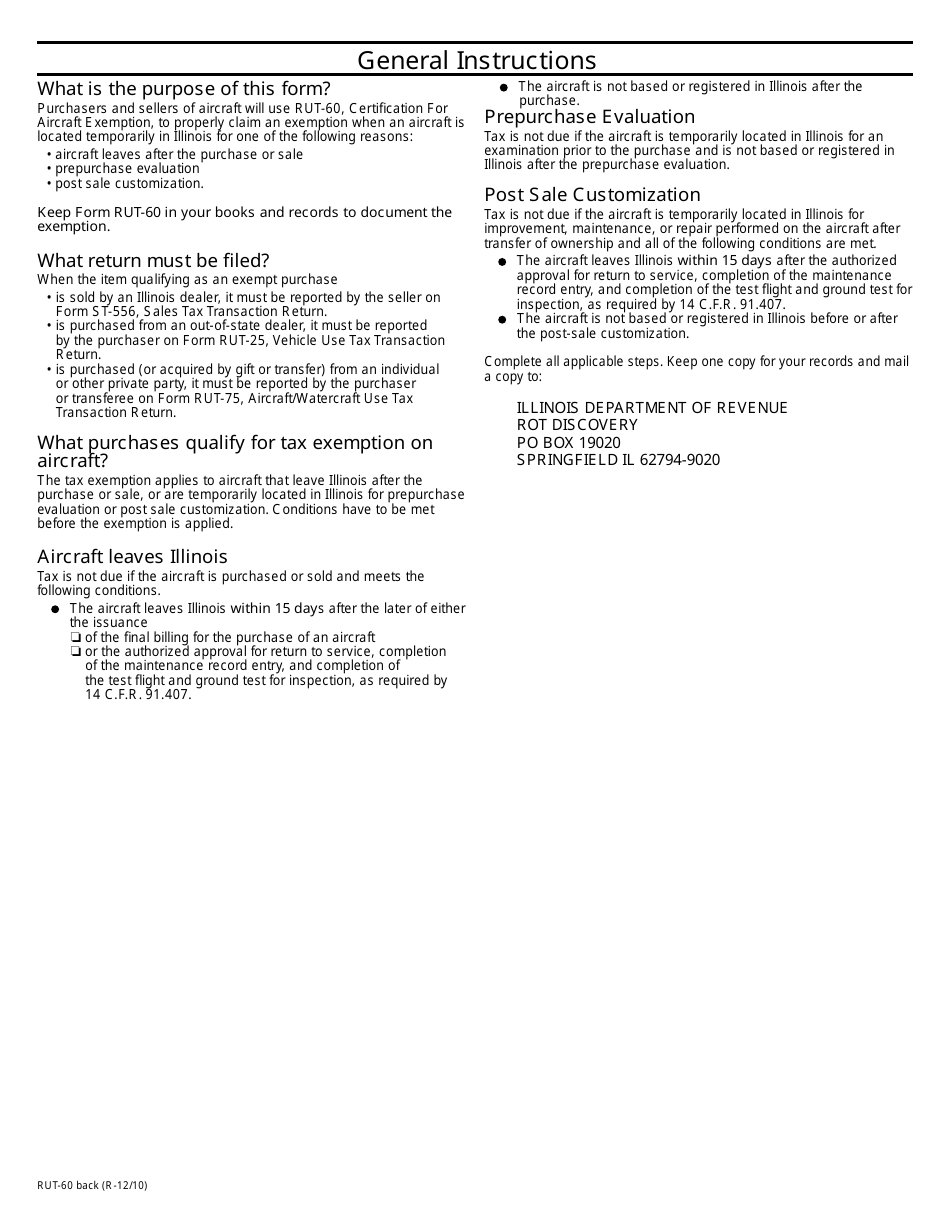

Q: What is the Form RUT-60 Certification for Aircraft Exemption?

A: The Form RUT-60 is a certification used in Illinois to claim aircraft exemption from certain taxes.

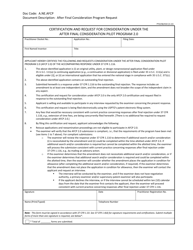

Q: Who needs to file the Form RUT-60 Certification for Aircraft Exemption?

A: Aircraft owners or operators who meet the eligibility criteria for tax exemption in Illinois need to file this form.

Q: What is the purpose of the Form RUT-60 Certification?

A: The purpose of this form is to certify that an aircraft qualifies for exemption from certain taxes in Illinois.

Q: What taxes does the Form RUT-60 Certification exempt an aircraft from?

A: The Form RUT-60 Certification exempts aircraft from Illinois Use Tax and Aircraft Use Tax.

Q: What are the eligibility criteria for aircraft exemption in Illinois?

A: To be eligible for aircraft exemption in Illinois, the aircraft must be used primarily for non-business purposes and not operated for hire.

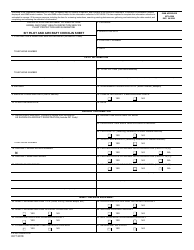

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

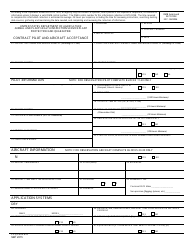

Download a fillable version of Form RUT-60 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.