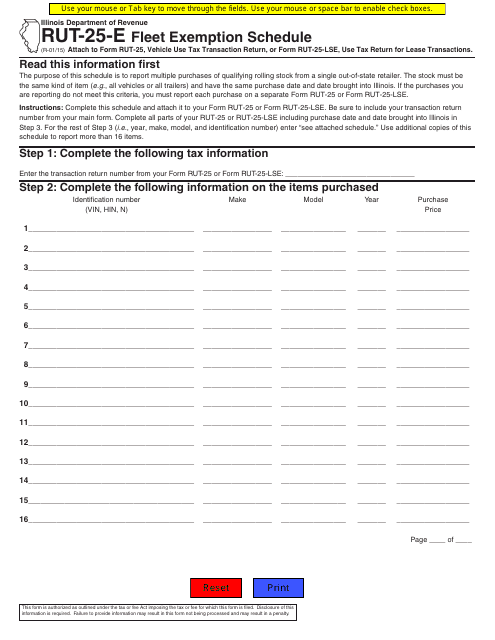

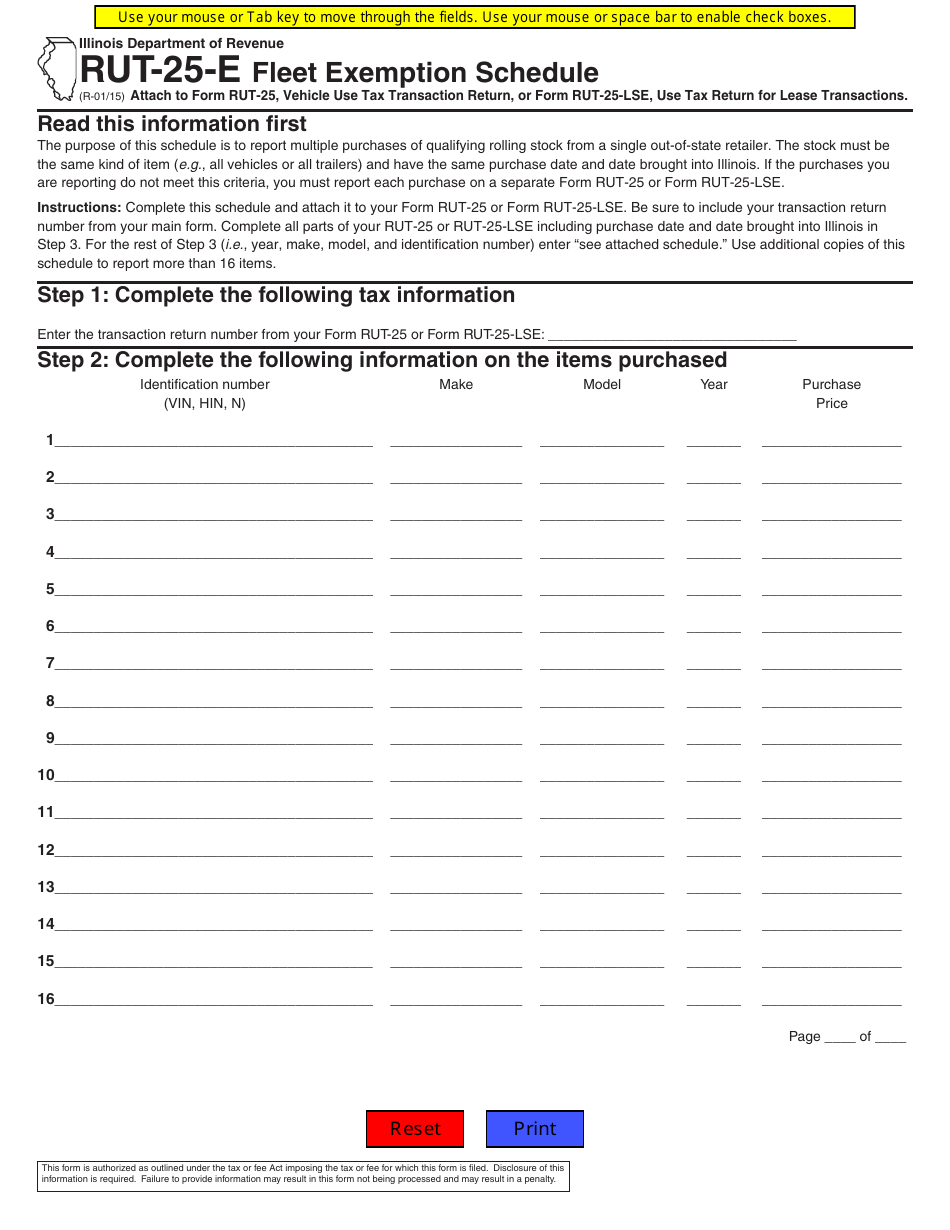

Form RUT-25-E Fleet Exemption Schedule - Illinois

What Is Form RUT-25-E?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RUT-25-E?

A: Form RUT-25-E is the Fleet Exemption Schedule for vehicle registration in Illinois.

Q: Who needs to file Form RUT-25-E?

A: Owners of fleets of 10 or more qualifying vehicles in Illinois need to file Form RUT-25-E.

Q: What is the purpose of Form RUT-25-E?

A: The purpose of Form RUT-25-E is to apply for fleet registration and obtain exemptions for individual vehicles within the fleet.

Q: What is a fleet in the context of Form RUT-25-E?

A: A fleet is a group of 10 or more qualifying vehicles owned or operated by the same person or company.

Q: What are qualifying vehicles for Form RUT-25-E?

A: Qualifying vehicles for Form RUT-25-E are motor vehicles used exclusively for the transportation of persons or property for hire, compensation, or profit.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-25-E by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.