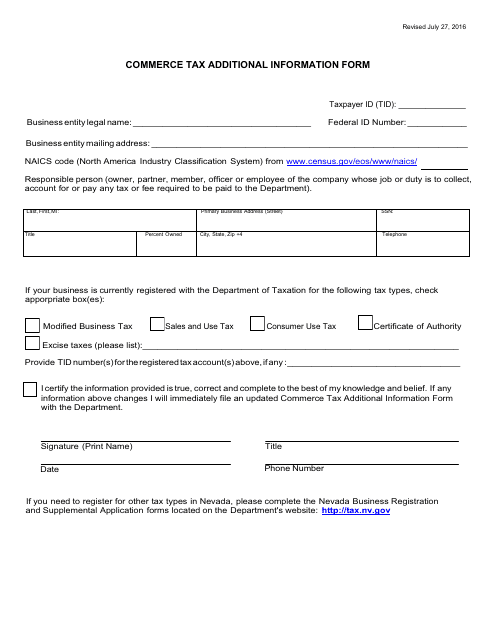

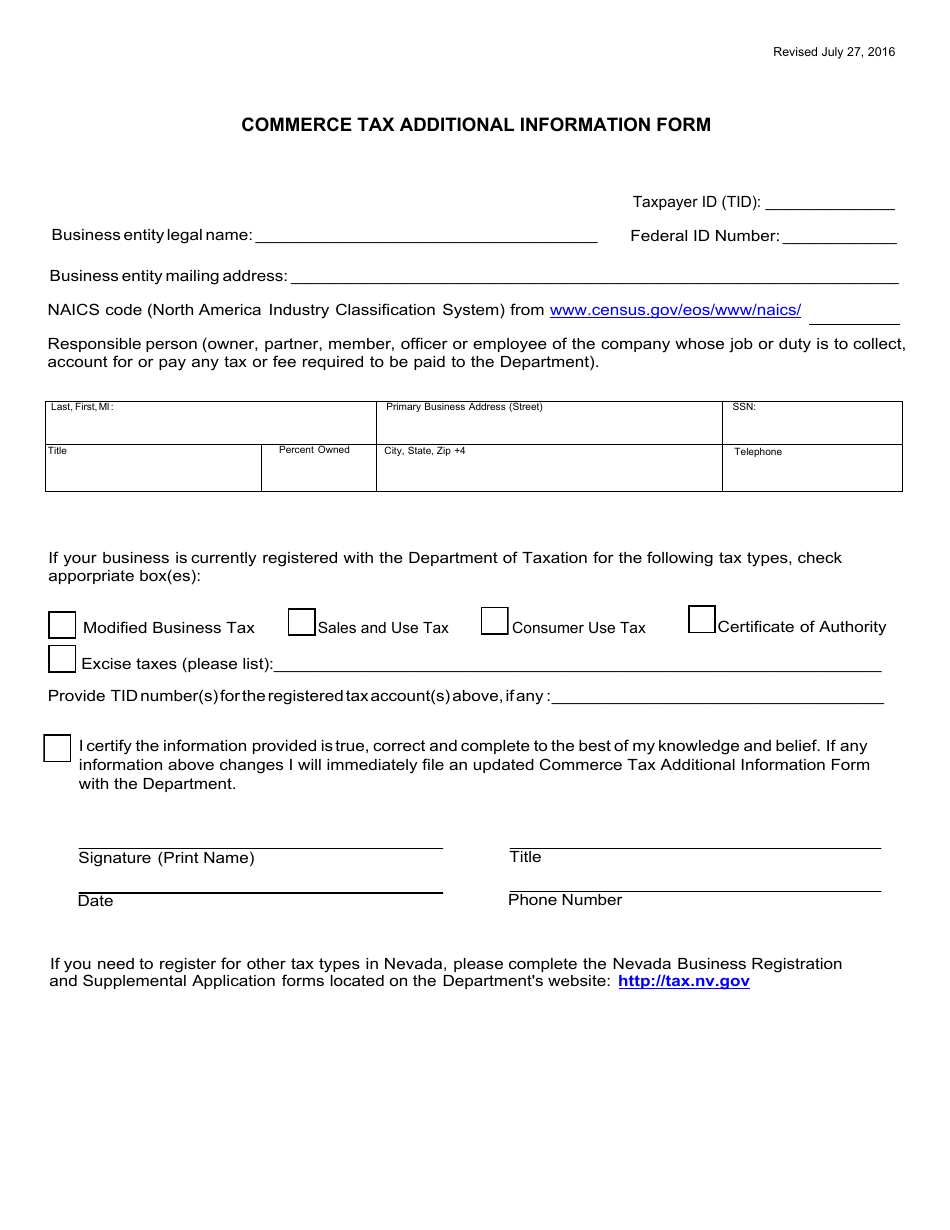

Commerce Tax Additional Information Form - Nevada

Commerce Tax Additional Information Form is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is the Commerce Tax?

A: The Commerce Tax is a tax imposed on businesses in Nevada.

Q: Who needs to pay the Commerce Tax?

A: Most businesses with gross revenue exceeding $4 million in Nevada need to pay the Commerce Tax.

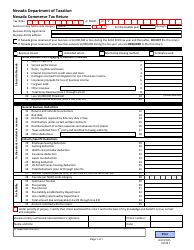

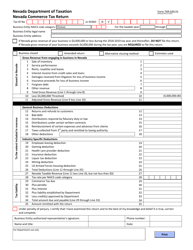

Q: How is the Commerce Tax calculated?

A: The Commerce Tax is calculated based on a Nevada business's gross revenue.

Q: When is the deadline to file the Commerce Tax?

A: The deadline to file the Commerce Tax is the 15th day of the month following the end of the fiscal year.

Q: What is the penalty for late payment or non-payment of the Commerce Tax?

A: Penalties for late payment or non-payment of the Commerce Tax include interest charges and potential collection actions.

Q: Are there any exemptions from the Commerce Tax?

A: Yes, certain entities, such as non-profit organizations and some small businesses, may be exempt from the Commerce Tax.

Q: What information is required on the Commerce Tax Additional Information Form?

A: The Commerce Tax Additional Information Form requires specific information about a business's gross revenue and other related details.

Form Details:

- Released on July 27, 2016;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.