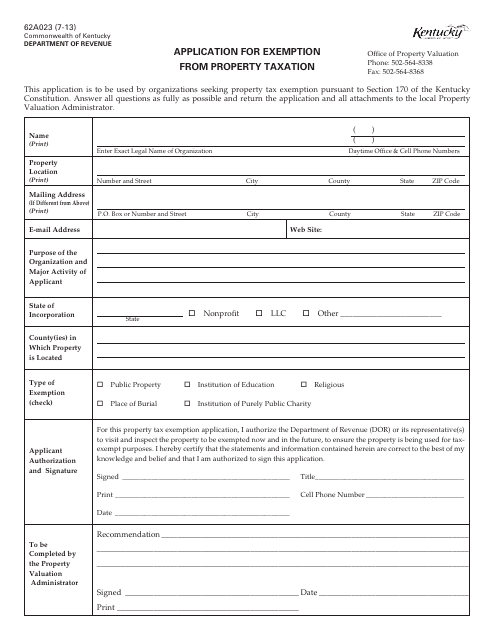

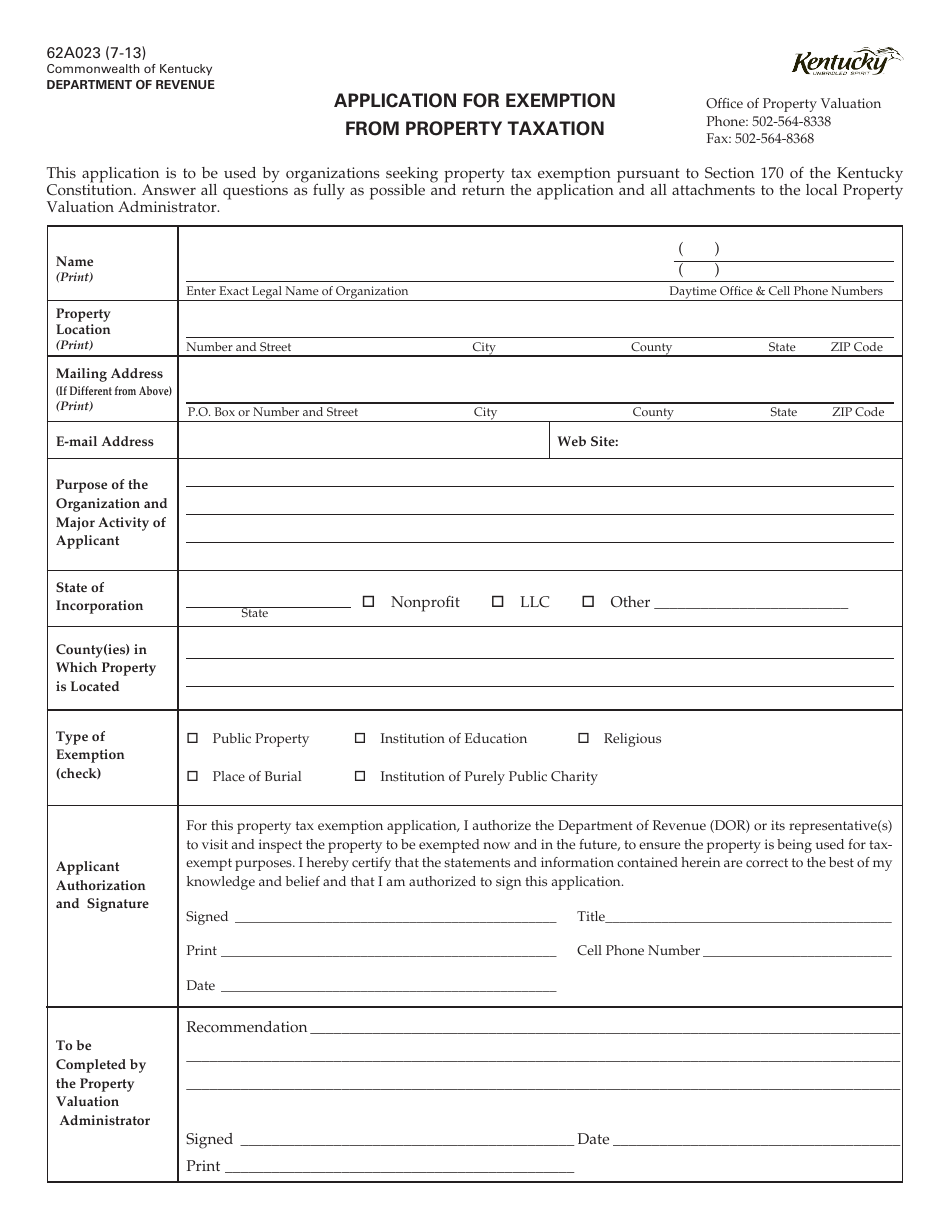

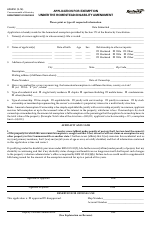

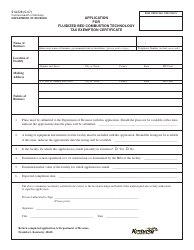

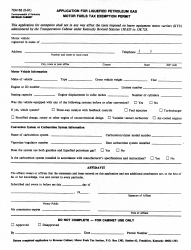

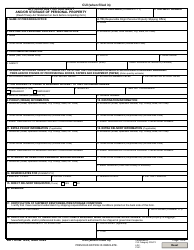

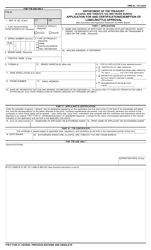

Form 62A023 Application for Exemption From Property Taxation - Kentucky

What Is Form 62A023?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A023?

A: Form 62A023 is the Application for Exemption From Property Taxation in Kentucky.

Q: Who is this form for?

A: This form is for individuals or organizations seeking exemption from property taxation in Kentucky.

Q: What is the purpose of this form?

A: The purpose of this form is to request an exemption from property taxation in Kentucky.

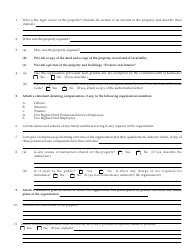

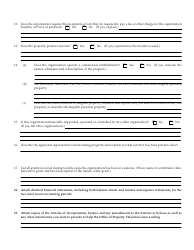

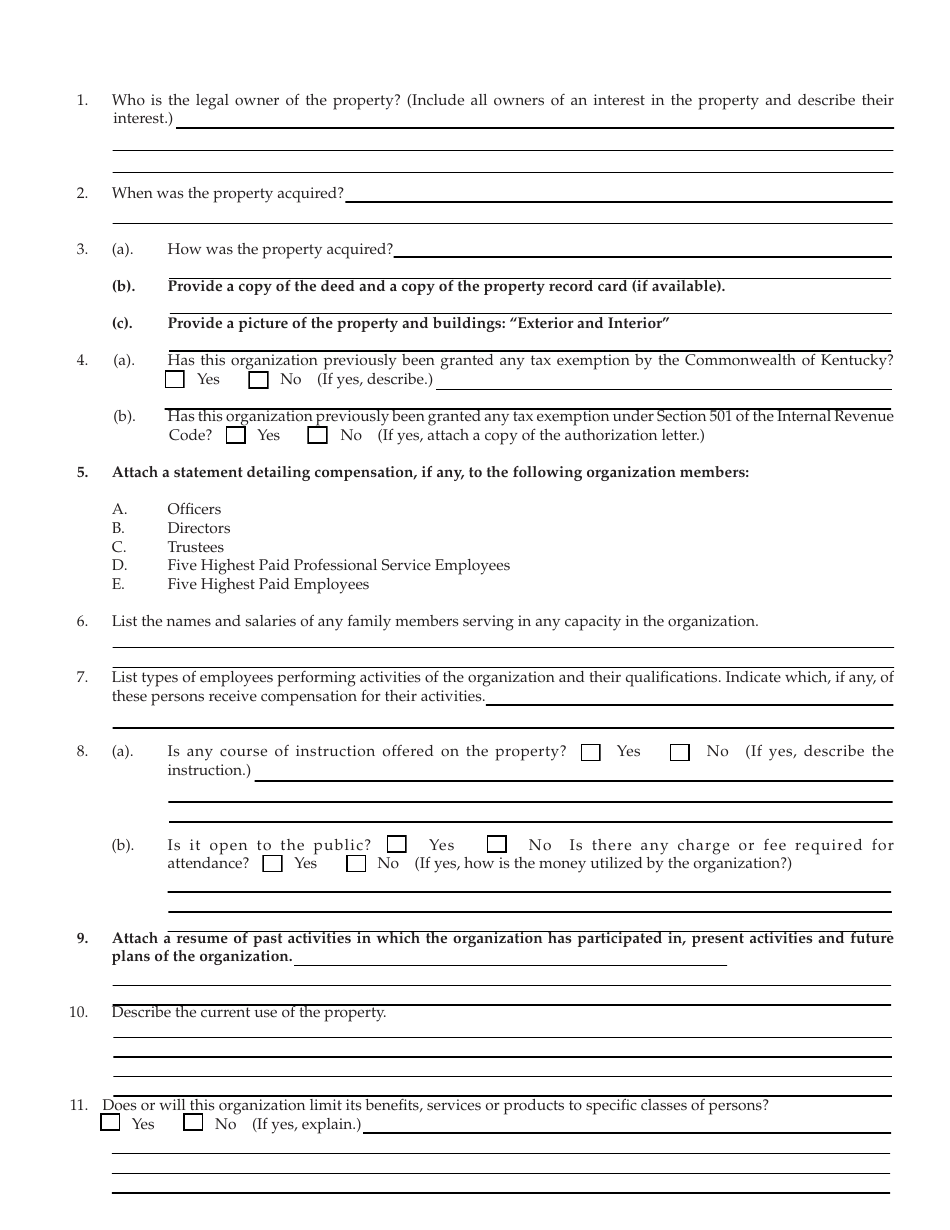

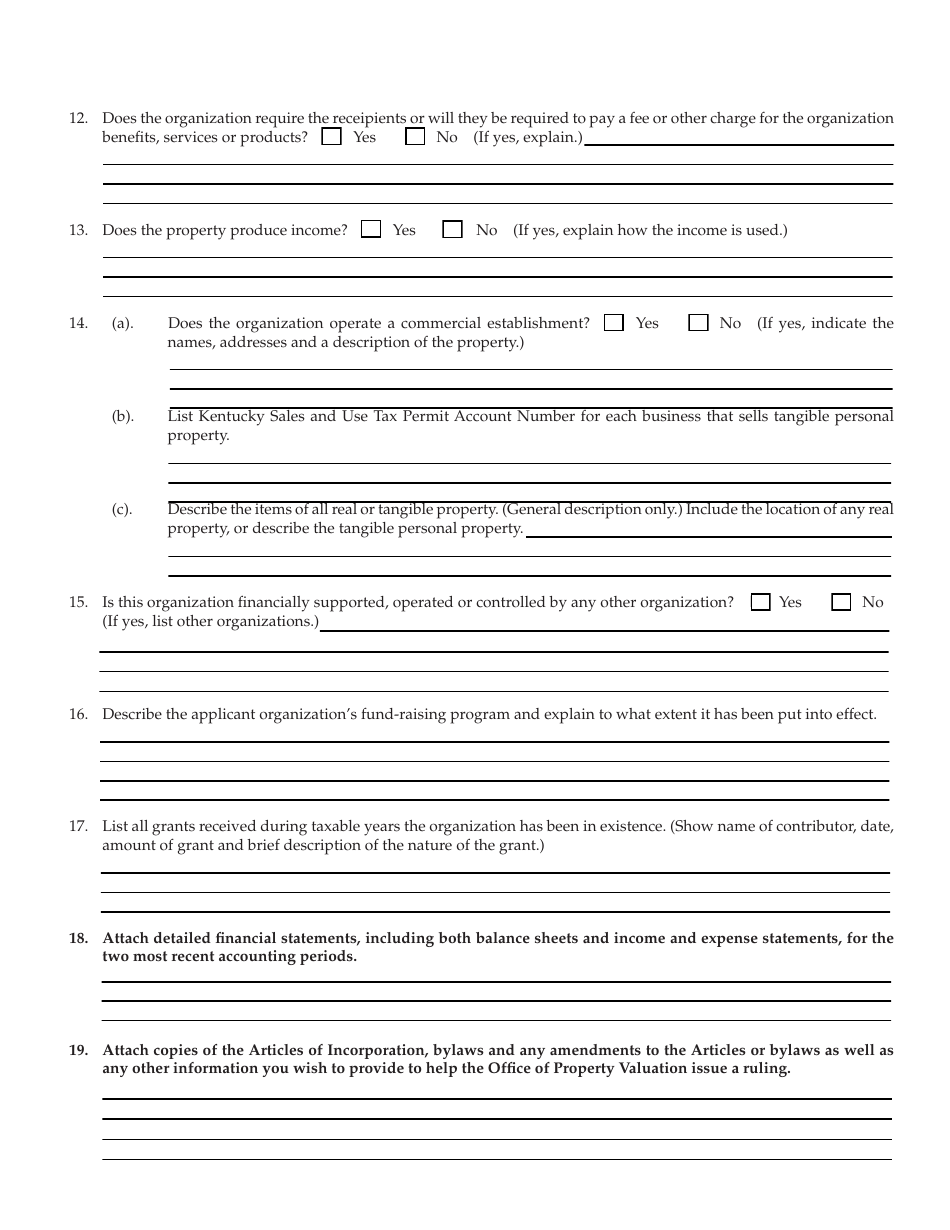

Q: How do I fill out this form?

A: To fill out this form, provide all requested information accurately and completely, following the instructions provided.

Q: What documents do I need to include with this form?

A: You may need to include supporting documents such as proof of eligibility for the exemption.

Q: Is there a deadline for submitting this form?

A: Yes, there is a deadline for submitting this form. Check the instructions or contact your local county clerk's office for the deadline.

Q: What happens after I submit this form?

A: After you submit this form, it will be reviewed by the appropriate authorities. You will be notified of their decision.

Q: Can I appeal if my application is denied?

A: Yes, you can appeal if your application is denied. Follow the appeals process outlined by the Kentucky Department of Revenue.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 62A023 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.