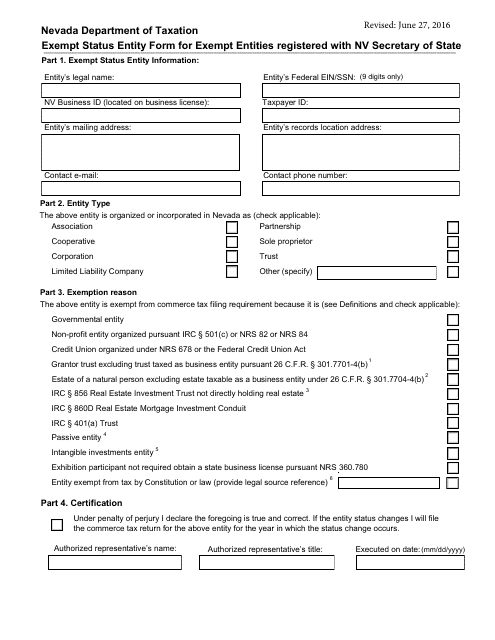

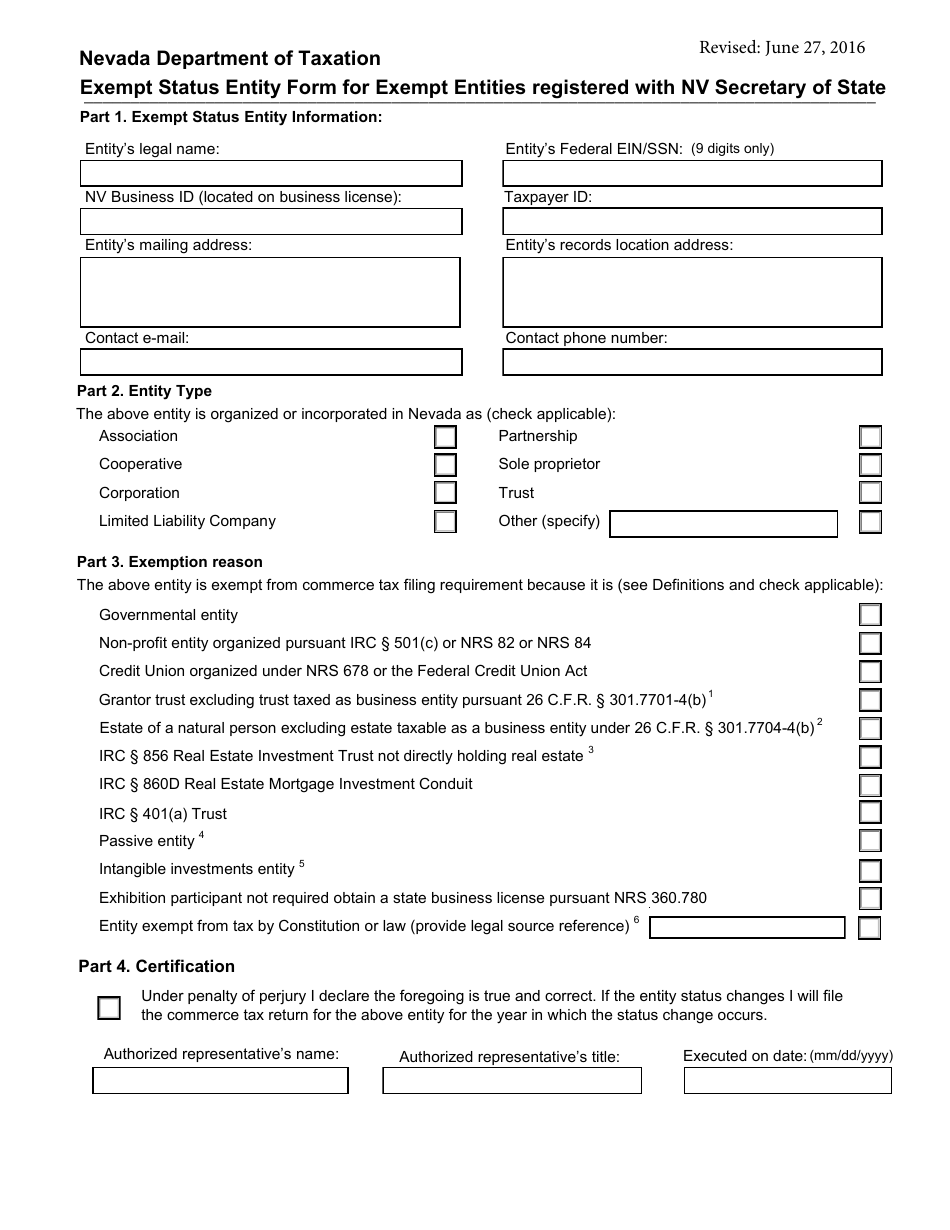

Exempt Status Entity Form for Exempt Entities Registered With Nv Secretary of State - Nevada

Exempt Status Entity Form for Exempt Entities Registered With Nv Secretary of State is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

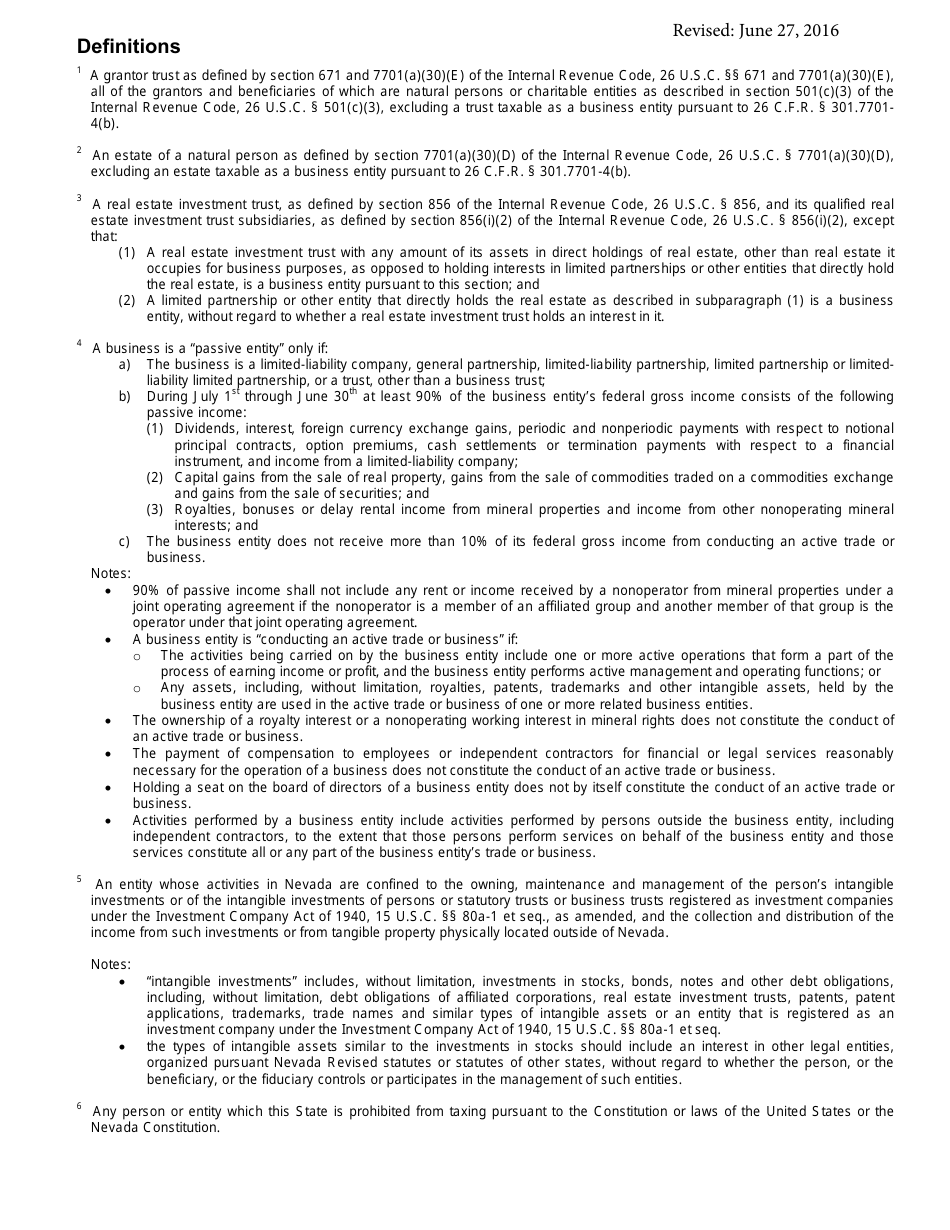

Q: What is an exempt entity?

A: An exempt entity is an organization that is not required to pay certain taxes or disclose certain financial information.

Q: Who should file the Exempt Status Entity Form?

A: Exempt entities registered with the Nevada Secretary of State should file the Exempt Status Entity Form.

Q: What is the purpose of the Exempt Status Entity Form?

A: The Exempt Status Entity Form is used to declare and maintain the exempt status of an organization.

Q: What information is required on the Exempt Status Entity Form?

A: The form may require information such as the organization's name, address, federal tax identification number, and a description of its activities.

Q: Are there any fees associated with filing the Exempt Status Entity Form?

A: There may be a filing fee associated with the Exempt Status Entity Form. The exact fee amount can be obtained from the Nevada Secretary of State.

Q: When should the Exempt Status Entity Form be filed?

A: The Exempt Status Entity Form should be filed upon registration as an exempt entity and may need to be renewed periodically.

Q: What happens if an exempt entity does not file the Exempt Status Entity Form?

A: Failure to file the Exempt Status Entity Form may result in the loss of the organization's exempt status and could have tax and legal implications.

Q: Can an exempt entity lose its exempt status?

A: Yes, an exempt entity can lose its exempt status if it fails to meet certain requirements or if there are changes in its activities that no longer qualify for exemption.

Q: Are all exempt entities required to file the Exempt Status Entity Form?

A: Yes, all exempt entities registered with the Nevada Secretary of State are required to file the Exempt Status Entity Form.

Form Details:

- Released on July 27, 2016;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.