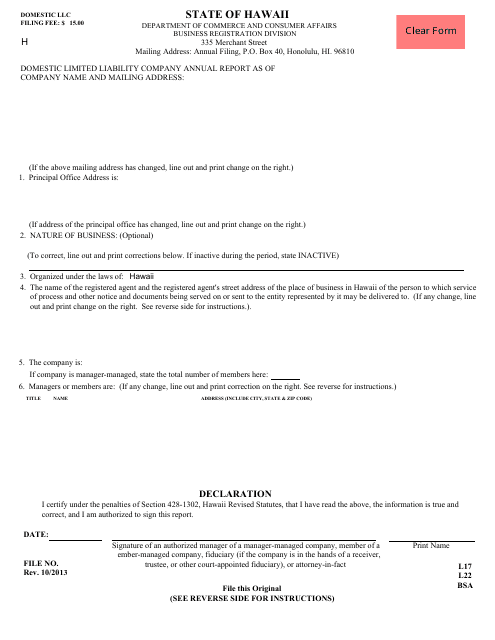

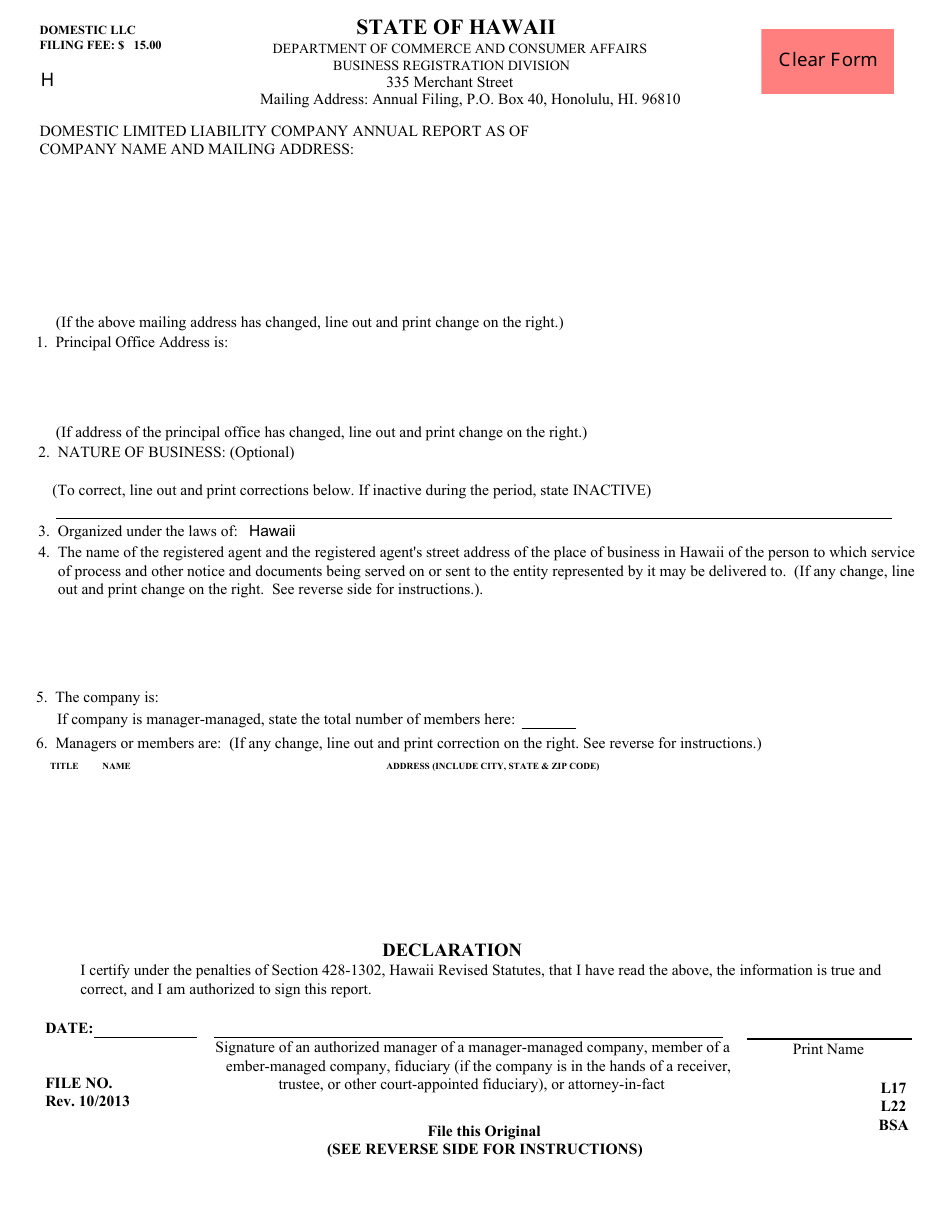

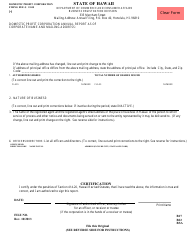

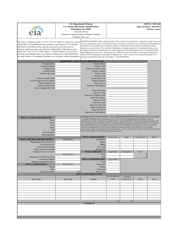

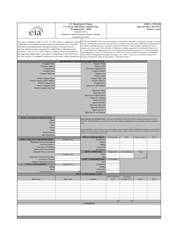

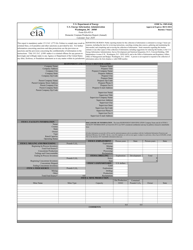

Form C5 Domestic Limited Liability Company Annual Report - Hawaii

What Is Form C5?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C5?

A: Form C5 is the Domestic Limited Liability Company Annual Report for businesses in Hawaii.

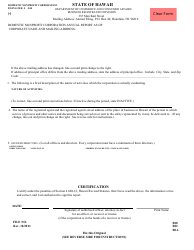

Q: Who needs to file Form C5?

A: All domestic limited liability companies in Hawaii are required to file Form C5.

Q: What is the purpose of Form C5?

A: Form C5 is used to provide updated information about the domestic limited liability company to the state of Hawaii.

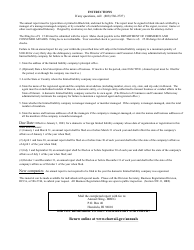

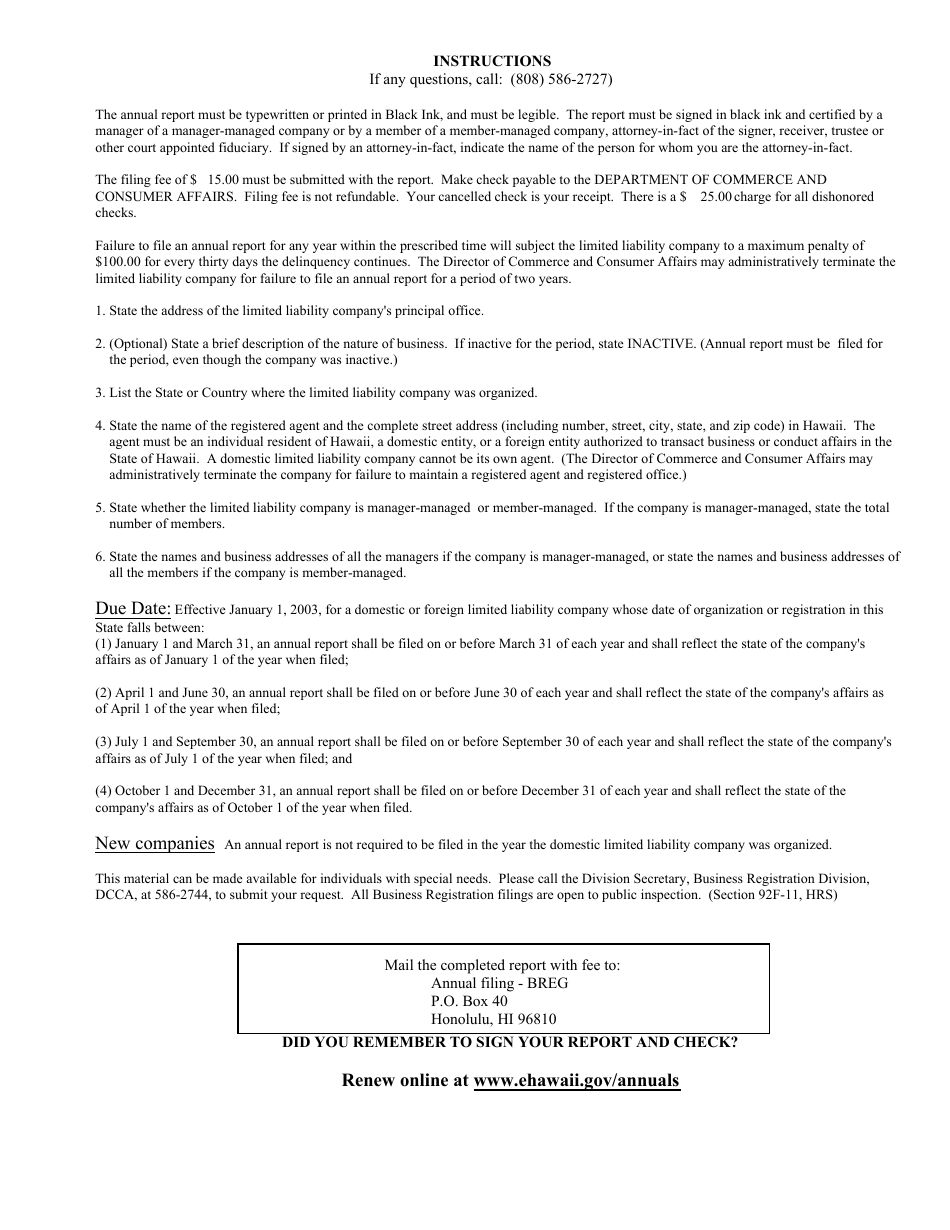

Q: When is Form C5 due?

A: Form C5 is due annually by the last day of the anniversary month of the domestic limited liability company.

Q: What information is required on Form C5?

A: Form C5 requires information such as the company's name, address, registered agent, members or managers, and any changes since the last filing.

Q: Are there any fees associated with filing Form C5?

A: Yes, there is a filing fee of $15 for each annual report submitted with Form C5.

Q: What happens if Form C5 is not filed?

A: Failure to file Form C5 may result in penalties, such as the loss of the company's good standing status.

Q: Is there a paperless filing option for Form C5?

A: Yes, businesses have the option to file Form C5 electronically through the Hawaii Business Express system.

Q: Can I get an extension to file Form C5?

A: No, there are no extensions available for filing Form C5. It must be filed by the due date.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C5 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.