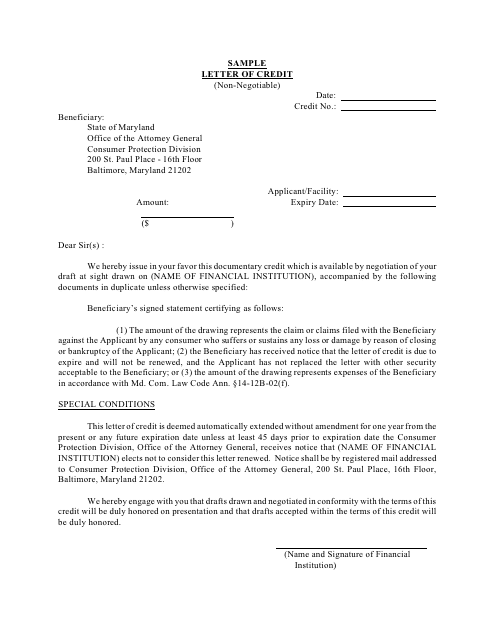

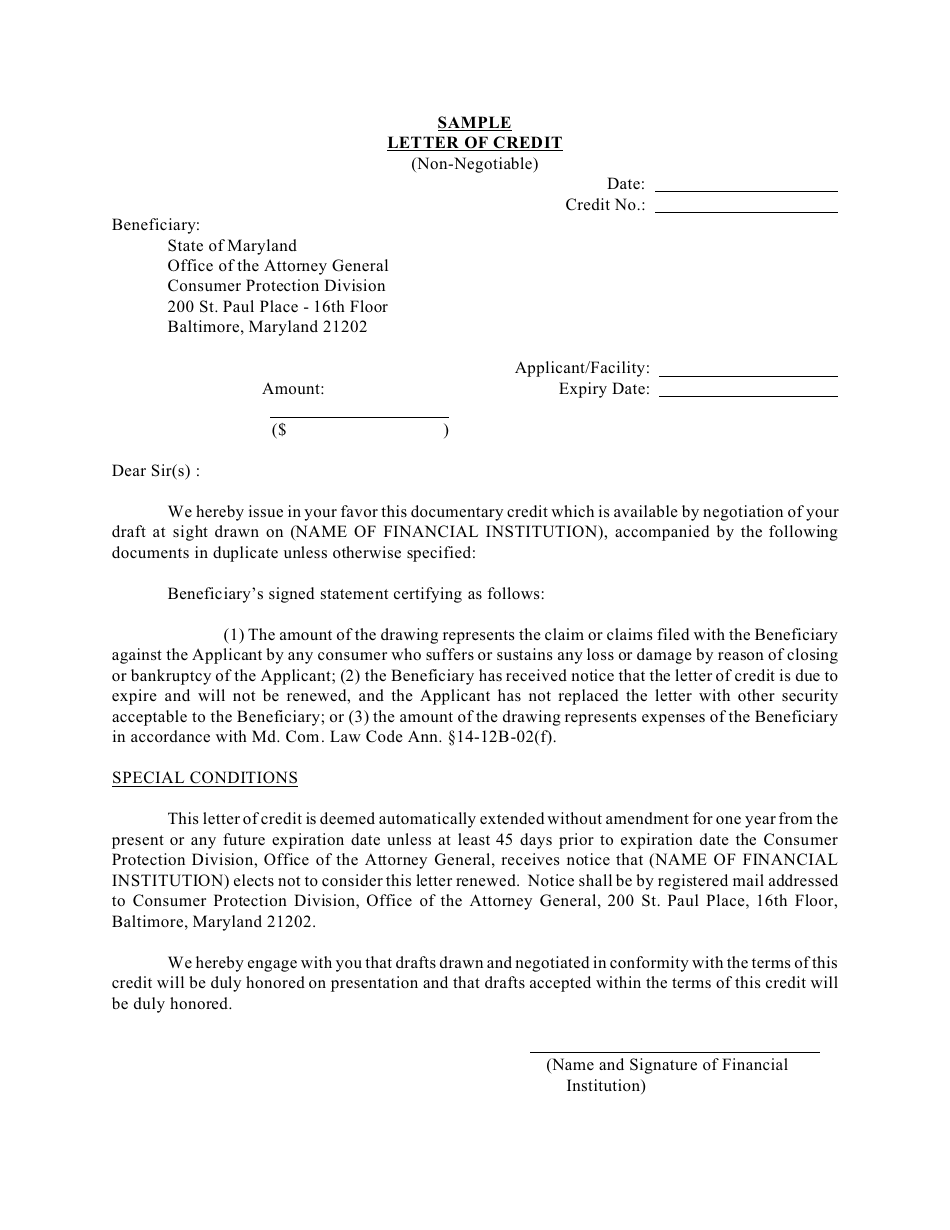

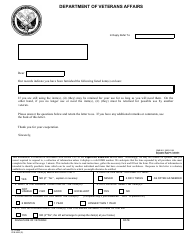

Letter of Credit (Non-negotiable) - Sample - Maryland

Letter of Credit (Non-negotiable) - Sample is a legal document that was released by the Maryland Attorney General - a government authority operating within Maryland.

FAQ

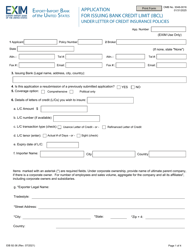

Q: What is a letter of credit?

A: A letter of credit is a financial document commonly used in international trade that guarantees payment to the seller upon completion of certain conditions.

Q: What is a non-negotiable letter of credit?

A: A non-negotiable letter of credit cannot be transferred to another party and is only payable to the designated beneficiary.

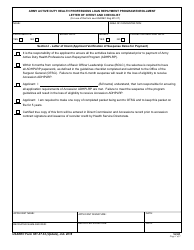

Q: What are the advantages of using a letter of credit?

A: Using a letter of credit provides security to both the buyer and seller in the transaction, ensuring that payment will be made and goods will be delivered.

Q: How does a letter of credit work?

A: When a buyer and seller agree on a transaction, the buyer's bank issues a letter of credit to the seller's bank. The seller then ships the goods and provides the necessary documents to the buyer's bank, who verifies the compliance with the terms of the letter of credit. If everything is in order, the buyer's bank will make payment to the seller.

Q: Are there any risks associated with using a letter of credit?

A: There are risks involved, such as the seller not fulfilling the required conditions or the buyer's bank not making the payment. However, these risks can be mitigated with careful planning and due diligence.

Q: How long does it take to process a letter of credit?

A: The processing time can vary depending on the complexity of the transaction and the banks involved. It is advisable to allow for sufficient time for the issuance and verification of the letter of credit.

Q: Is a letter of credit legally binding?

A: Yes, a properly issued and accepted letter of credit is legally binding on all parties involved.

Q: Can a non-negotiable letter of credit be amended?

A: Yes, a non-negotiable letter of credit can be amended if all parties involved agree to the changes. However, it is important to follow the proper procedures for amending a letter of credit.

Q: Can a non-negotiable letter of credit be cancelled?

A: Yes, a non-negotiable letter of credit can be cancelled if all parties involved agree to the cancellation and follow the established cancellation process.

Q: What happens if the buyer does not make payment under a letter of credit?

A: If the buyer fails to make payment under a letter of credit, the seller can pursue legal action to recover the payment.

Q: Can a letter of credit be used for domestic trade?

A: Yes, a letter of credit can be used for both international and domestic trade transactions.

Q: What documents are typically required for a letter of credit?

A: The specific documents required can vary depending on the terms of the letter of credit, but commonly requested documents include invoices, packing lists, bills of lading, and insurance certificates.

Form Details:

- The latest edition currently provided by the Maryland Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Attorney General.