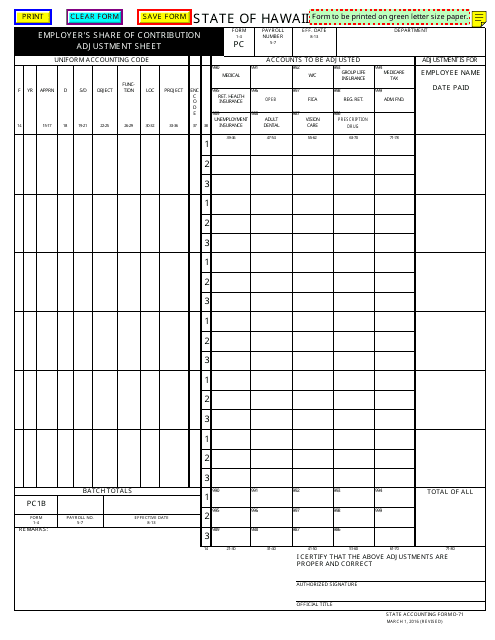

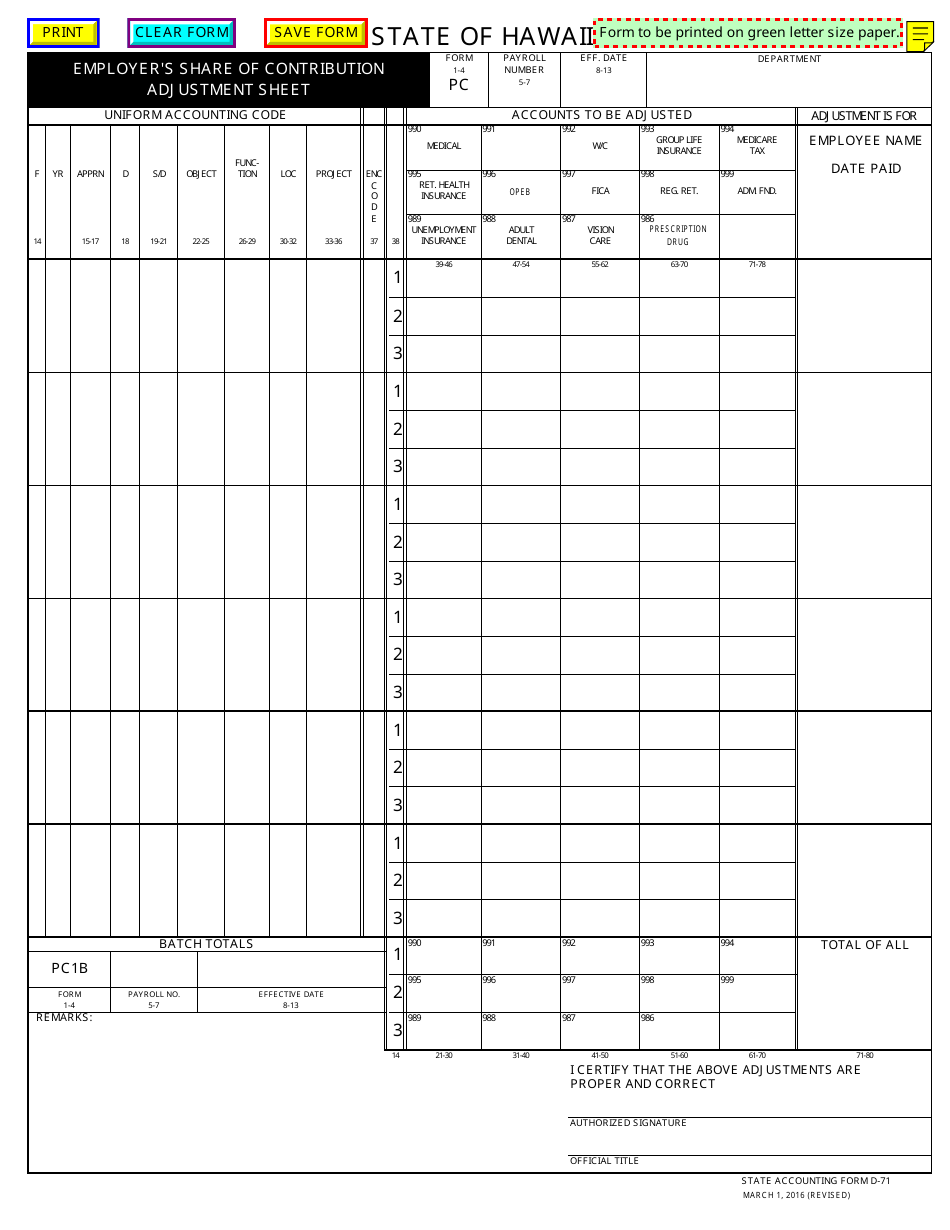

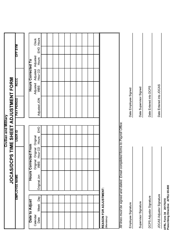

Form D-71 Employer's Share of Contibution Adjustment Sheet - Hawaii

What Is Form D-71?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-71?

A: Form D-71 is the Employer's Share of Contribution Adjustment Sheet.

Q: What is the purpose of Form D-71?

A: The purpose of Form D-71 is to report adjustments to the employer's share of contributions for unemployment insurance in Hawaii.

Q: Who needs to file Form D-71?

A: Employers in Hawaii who need to report adjustments to their share of contributions for unemployment insurance must file Form D-71.

Q: When is Form D-71 due?

A: Form D-71 is due quarterly, with the due dates falling on the last day of the months of April, July, October, and January.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-71 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.