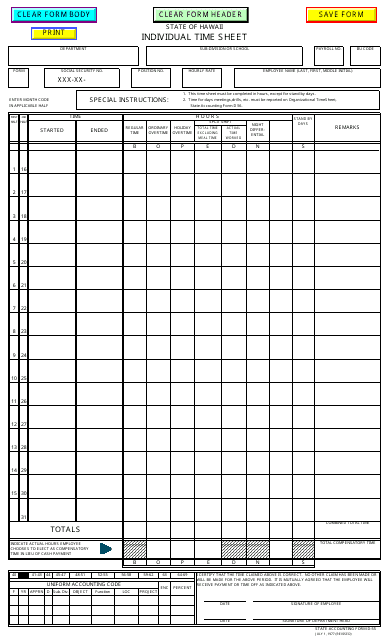

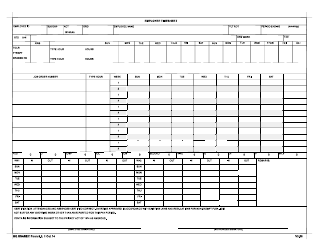

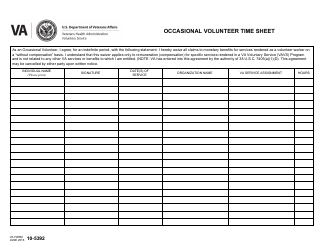

Form D-55 Individual Time Sheet - Hawaii

What Is Form D-55?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-55?

A: Form D-55 is an individual time sheet used in Hawaii.

Q: Who is required to use Form D-55?

A: Employees in Hawaii who are paid on an hourly basis are required to use Form D-55.

Q: What information is required on Form D-55?

A: Form D-55 requires the employee to provide their name, date, hours worked, rate of pay, and total earnings.

Q: How often should Form D-55 be completed?

A: Form D-55 should be completed on a daily basis, recording the hours worked each day.

Q: Is Form D-55 only for employees or can independent contractors use it too?

A: Form D-55 is specifically designed for employees. Independent contractors should use different forms to report their time and earnings.

Q: What should I do with Form D-55 once completed?

A: Once completed, Form D-55 should be submitted to your employer as a record of the hours you worked and the wages you earned.

Form Details:

- Released on July 1, 1977;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-55 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.