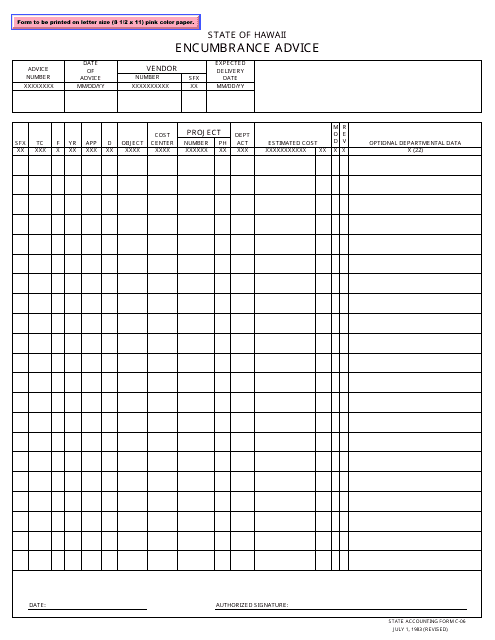

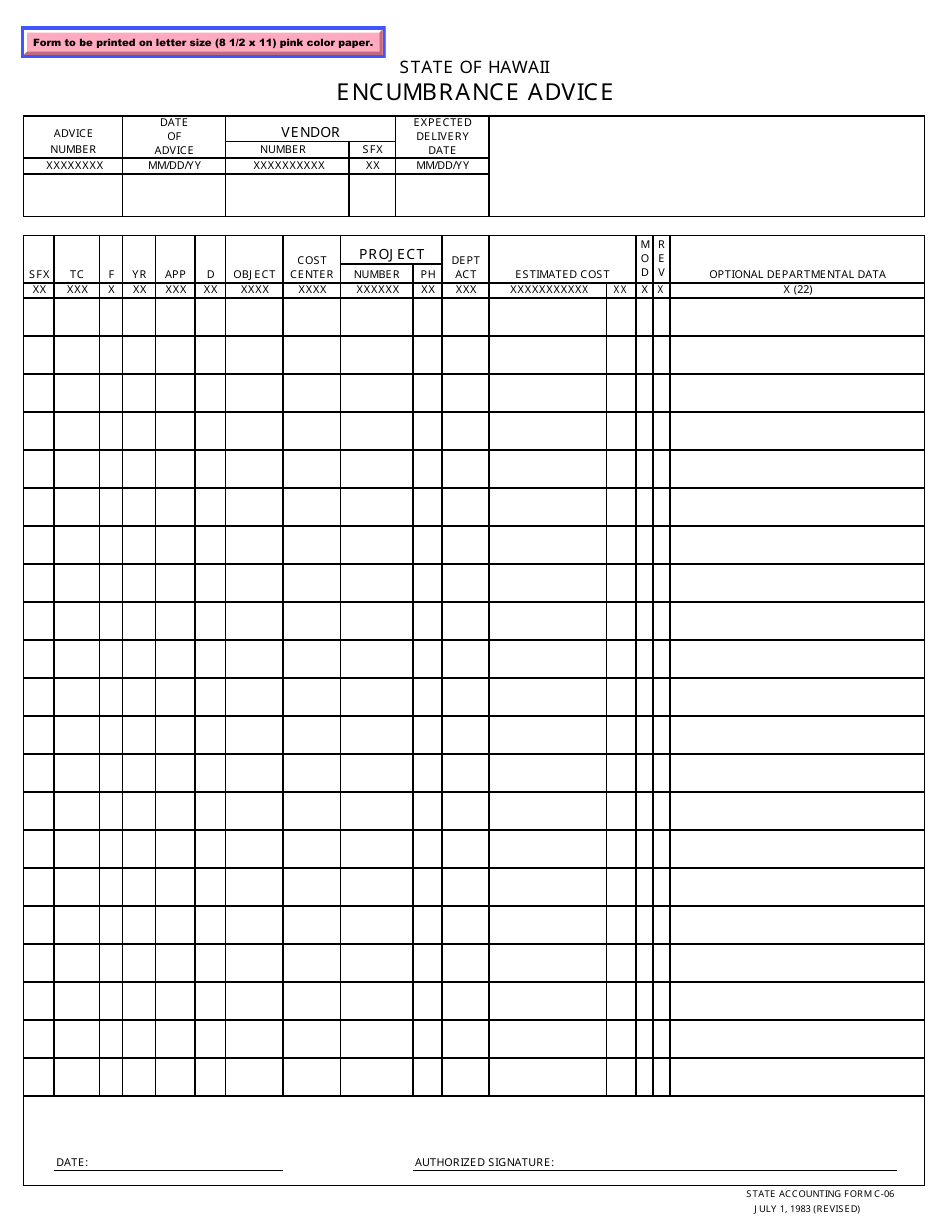

Form C-06 Encumbrance Advice - Hawaii

What Is Form C-06?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-06?

A: Form C-06 is an Encumbrance Advice document.

Q: What is an Encumbrance Advice?

A: An Encumbrance Advice is a document that provides information about any outstanding obligations or encumbrances on a property.

Q: Who issues the Form C-06 Encumbrance Advice?

A: The Form C-06 Encumbrance Advice is issued by the State of Hawaii.

Q: What kind of information does the Form C-06 contain?

A: The Form C-06 contains information about any outstanding mortgages, liens, or other encumbrances on the property.

Q: Why is the Form C-06 important?

A: The Form C-06 is important because it allows potential buyers or lenders to be aware of any existing encumbrances on the property before making a decision.

Q: Is the Form C-06 specific to Hawaii?

A: Yes, the Form C-06 is specific to properties located in Hawaii.

Q: Can I use the Form C-06 for properties outside of Hawaii?

A: No, the Form C-06 is only applicable to properties located in Hawaii.

Q: What should I do if the Form C-06 shows outstanding encumbrances on a property?

A: If the Form C-06 shows outstanding encumbrances, you may need to work with the property owner or consult with a real estate attorney to address these issues.

Form Details:

- Released on July 1, 1983;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-06 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.