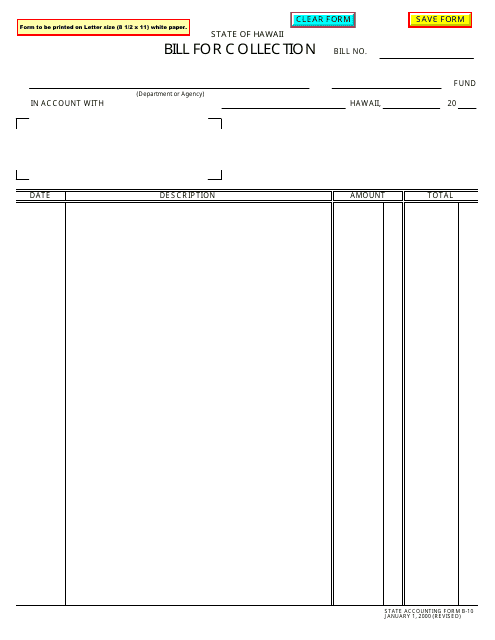

Form B-10 Bill for Collection - Hawaii

What Is Form B-10?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-10?

A: Form B-10 is a Bill for Collection.

Q: Who uses Form B-10?

A: Form B-10 is used by businesses and individuals in Hawaii.

Q: What is the purpose of Form B-10?

A: The purpose of Form B-10 is to collect payment for goods or services.

Q: Is Form B-10 specific to Hawaii?

A: Yes, Form B-10 is specific to Hawaii.

Q: Is there a fee for using Form B-10?

A: There may be a fee for using Form B-10, depending on the specific circumstances.

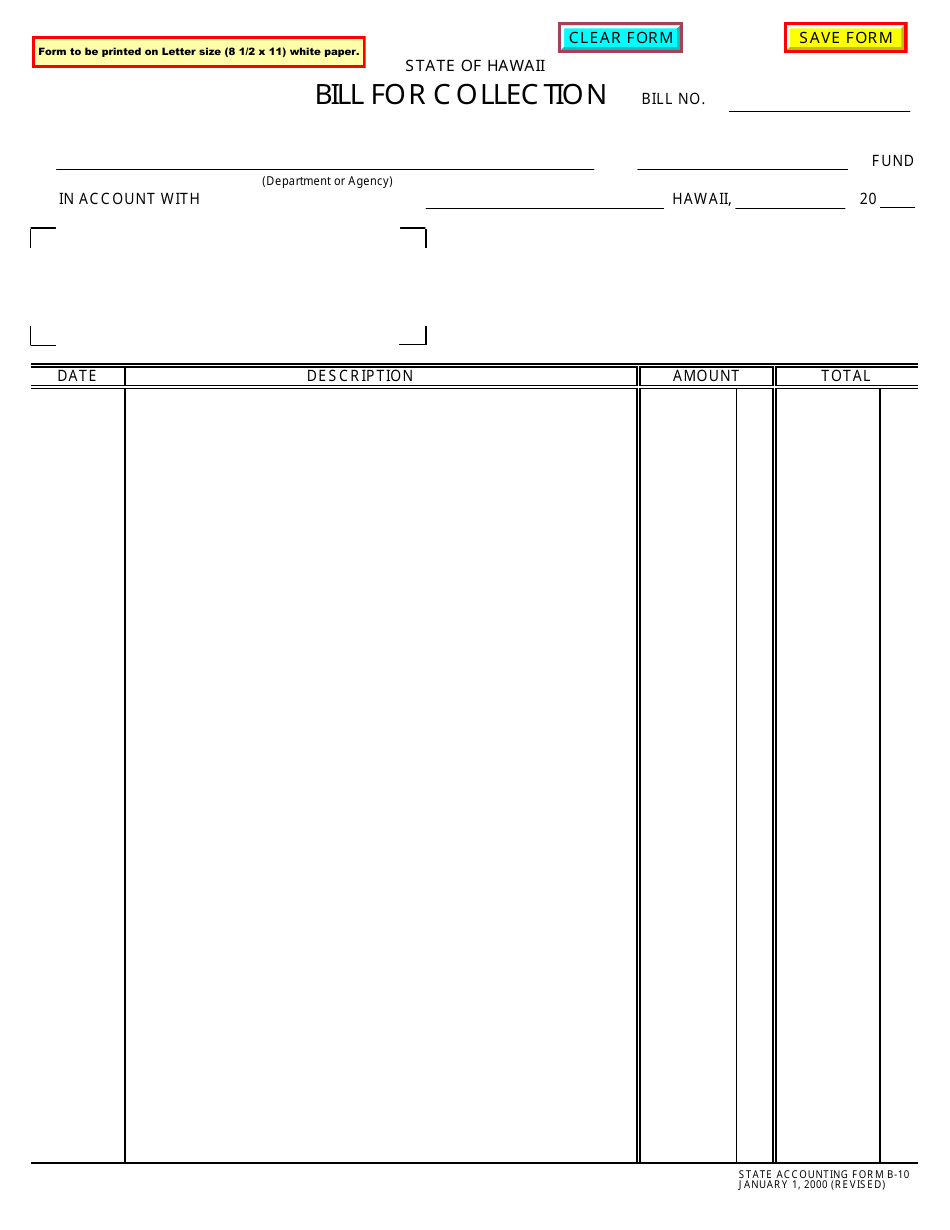

Q: What information is required on Form B-10?

A: Form B-10 requires information such as the debtor's name, address, and amount owed.

Q: Can Form B-10 be used for international transactions?

A: No, Form B-10 is only for domestic transactions within Hawaii.

Q: Are there any deadlines for submitting Form B-10?

A: Yes, the deadline for submitting Form B-10 varies depending on the circumstances.

Q: What should I do if I have questions about Form B-10?

A: If you have questions about Form B-10, you should contact the Hawaii Department of Taxation or consult with a tax professional.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-10 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.