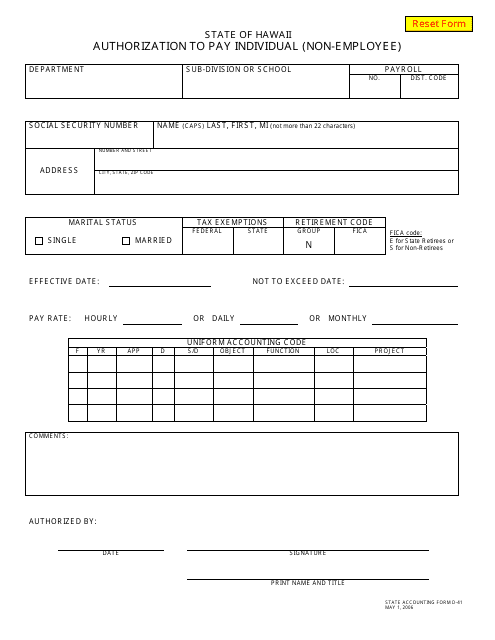

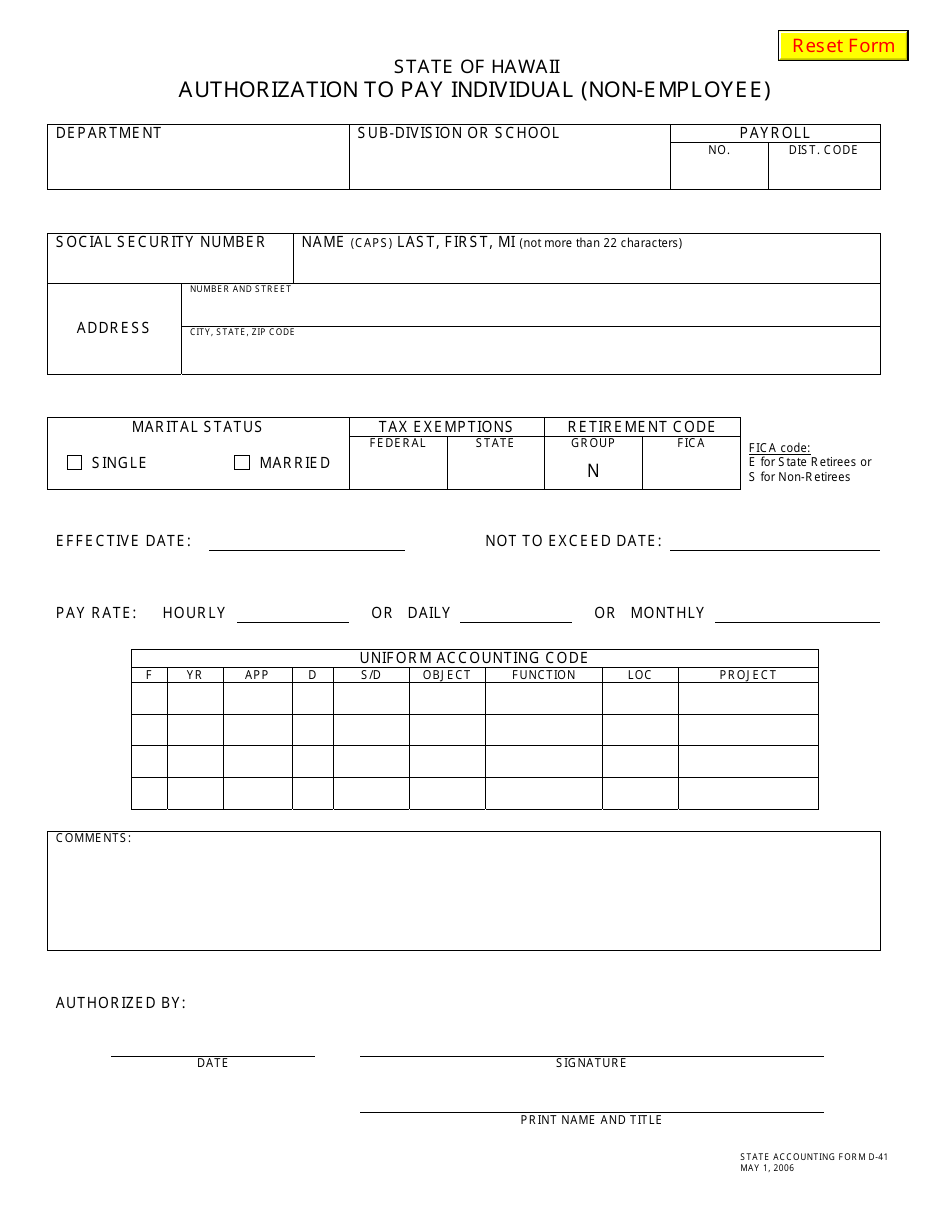

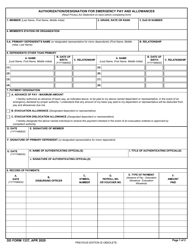

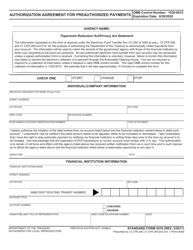

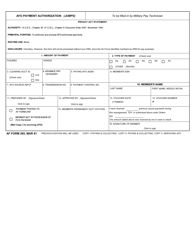

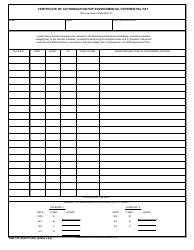

Form D-41 Authorization to Pay Individual (Non-employee) - Hawaii

What Is Form D-41?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-41?

A: Form D-41 is a document used in Hawaii for authorization to pay an individual who is not an employee.

Q: Who needs to use Form D-41?

A: Any organization or business in Hawaii that needs to pay an individual who is not an employee should use Form D-41.

Q: What is the purpose of Form D-41?

A: The purpose of Form D-41 is to obtain authorization to pay an individual who is not an employee.

Q: Is Form D-41 only for individuals in Hawaii?

A: Yes, Form D-41 is specifically used in Hawaii for authorization to pay individuals who are not employees.

Q: Do I need to file Form D-41 with my tax return?

A: No, Form D-41 is not filed with your tax return. It is used separately to obtain authorization for non-employee payments.

Form Details:

- Released on May 1, 2006;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-41 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.