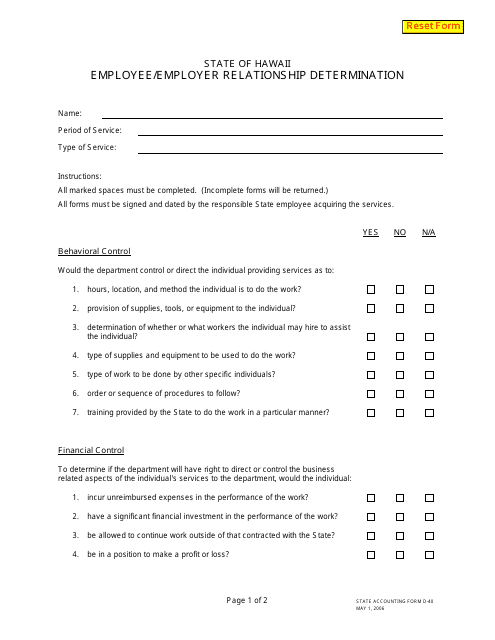

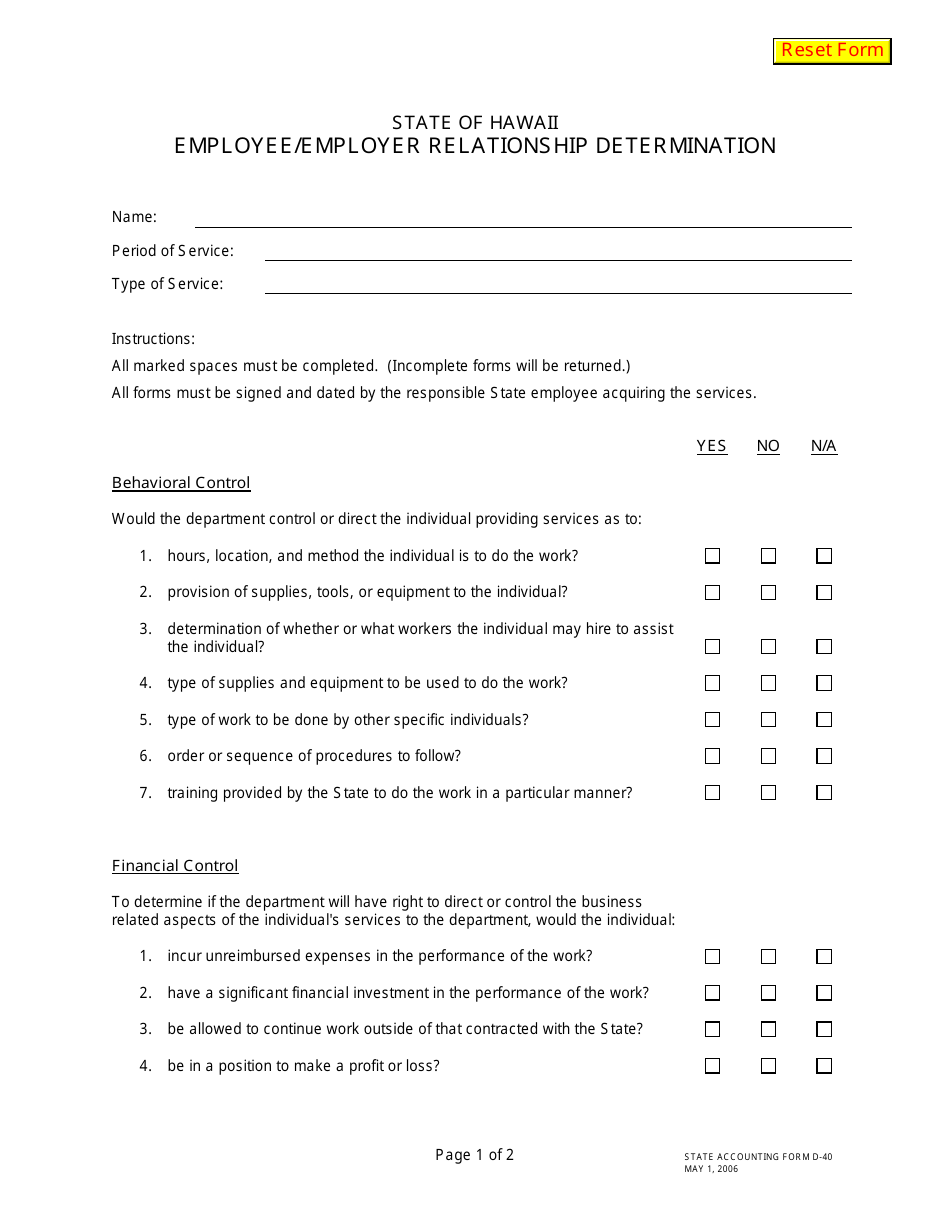

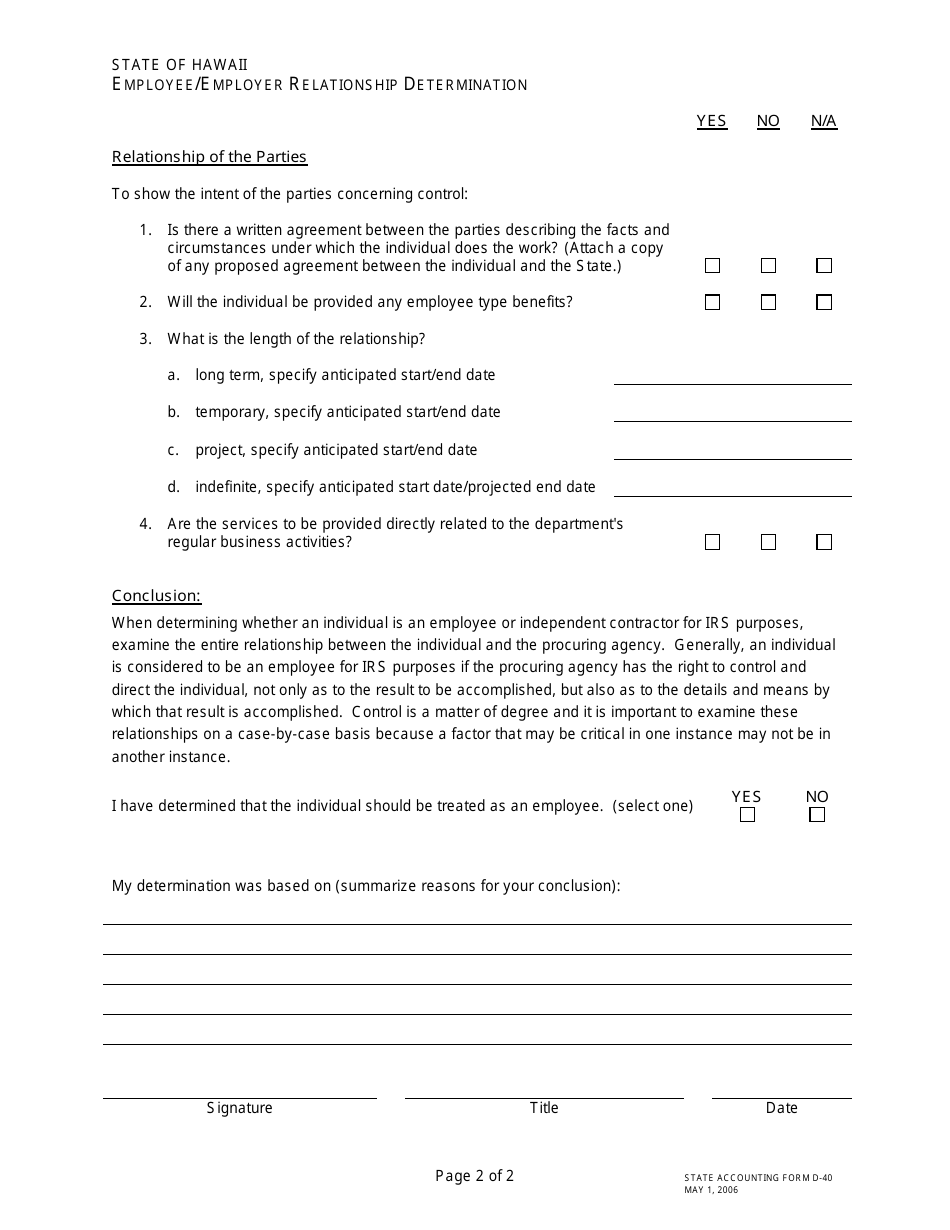

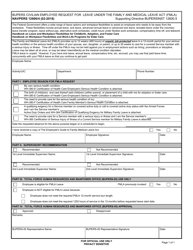

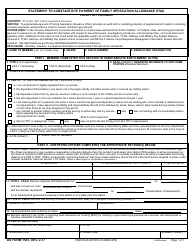

Form D-40 Employee / Employer Relationship Determination - Hawaii

What Is Form D-40?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-40?

A: Form D-40 is a document used in Hawaii to determine the employee/employer relationship.

Q: What is the purpose of Form D-40?

A: The purpose of Form D-40 is to determine if a worker should be classified as an employee or an independent contractor.

Q: How is the employee/employer relationship determined?

A: The employee/employer relationship is determined based on various factors, such as control over work, payment method, and provision of tools.

Q: Who needs to complete Form D-40?

A: Both employers and workers may need to complete Form D-40 to determine the nature of their working relationship.

Q: Are there penalties for misclassifying workers?

A: Yes, there can be penalties for misclassifying workers, including fines and other legal consequences.

Q: Can I consult an attorney for help with Form D-40?

A: Yes, consulting an attorney can be helpful in understanding the implications of Form D-40 and ensuring compliance with labor laws.

Q: What should I do if I am unsure about the classification?

A: If you are unsure about the classification of a worker, it is recommended to seek professional advice to avoid potential legal issues.

Form Details:

- Released on May 1, 2006;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-40 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.