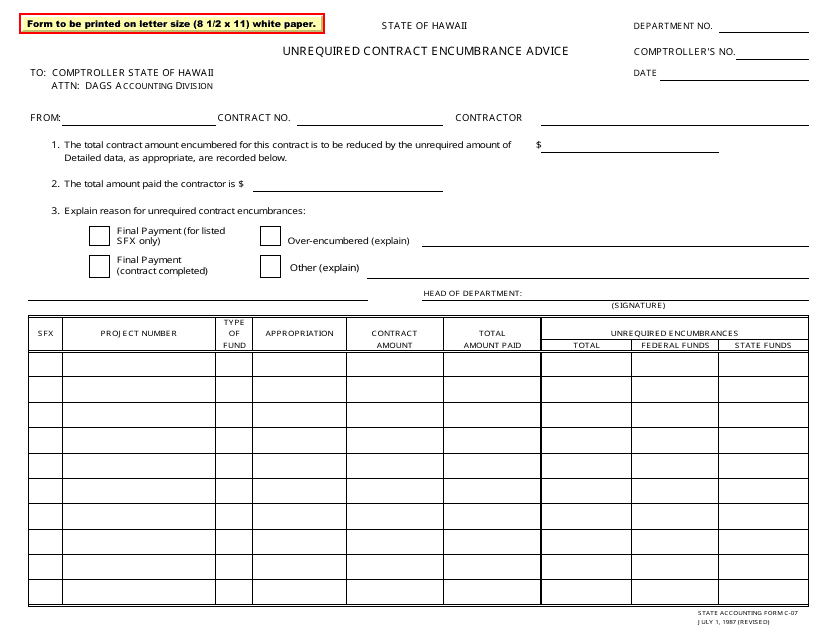

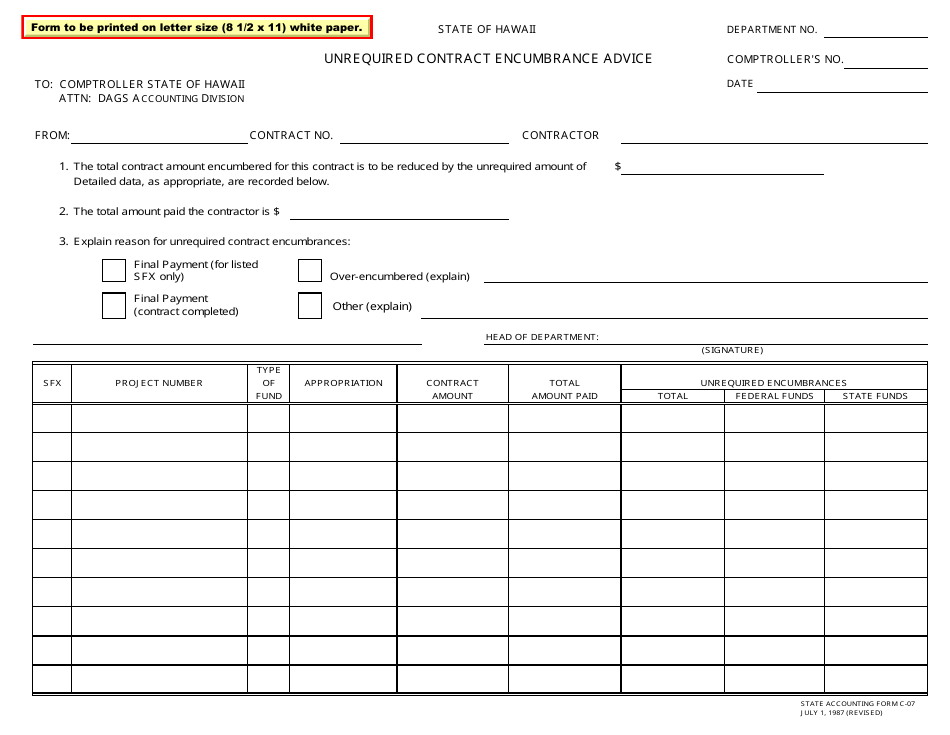

Form C-07 Unrequired Contract Encumbrance Advice - Hawaii

What Is Form C-07?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-07?

A: Form C-07 is a document used in Hawaii.

Q: What is the purpose of Form C-07?

A: Form C-07 is used to provide advice on unrequired contract encumbrance in Hawaii.

Q: What does unrequired contract encumbrance mean?

A: Unrequired contract encumbrance refers to a contract restriction that is not necessary or required.

Q: Who needs to fill out Form C-07?

A: This form is typically completed by individuals or businesses involved in contracts in Hawaii.

Q: Is Form C-07 mandatory?

A: The completion and submission of Form C-07 may be required in certain circumstances, but it is not always mandatory.

Q: Are there any fees associated with Form C-07?

A: There may be fees associated with submitting Form C-07, depending on the specific requirements of the Hawaii government agency or department.

Q: Is Form C-07 specific to Hawaii?

A: Yes, Form C-07 is specific to the state of Hawaii.

Q: What should I do if I have questions about Form C-07?

A: If you have questions about Form C-07, you should contact the appropriate Hawaii government agency or department for guidance.

Q: Can I modify Form C-07?

A: Modifications to Form C-07 may not be allowed, as it is an official document. Any necessary changes should be discussed with the Hawaii government agency or department.

Form Details:

- Released on July 1, 1987;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-07 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.