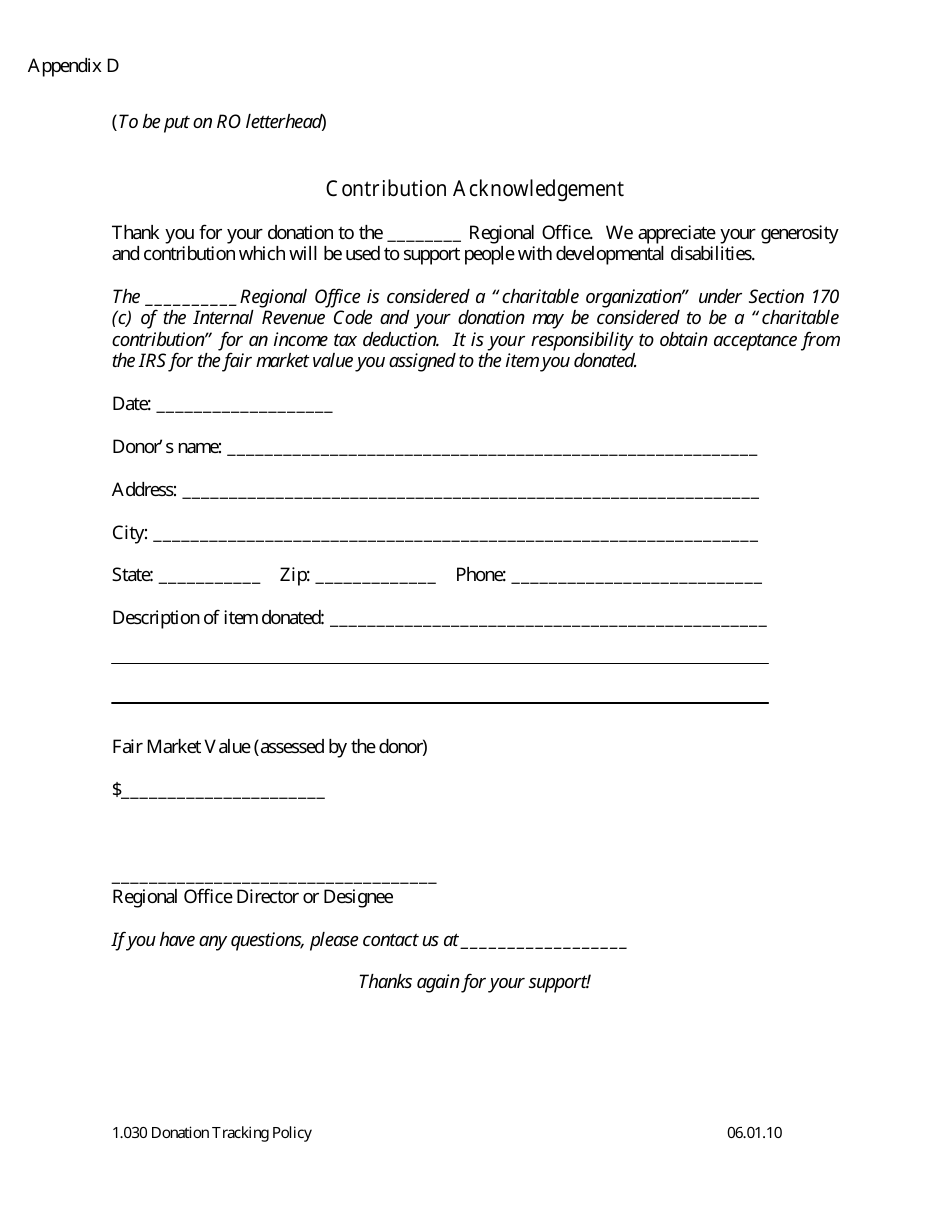

Appendix D Donation Tracking - Contribution Acknowledgement - Missouri

What Is Appendix D?

This is a legal form that was released by the Missouri Department of Mental Health - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Appendix D?

A: Appendix D is a section of the document that provides information on donation tracking and contribution acknowledgement specifically for Missouri.

Q: What is donation tracking?

A: Donation tracking is a process of keeping records and documentation of contributions made to an organization or charity.

Q: What is contribution acknowledgement?

A: Contribution acknowledgement refers to the practice of recognizing and thanking individuals or organizations for their donations or contributions.

Q: Why is donation tracking important?

A: Donation tracking is important for organizations to maintain accurate financial records, acknowledge donors, and comply with tax regulations.

Q: Who is responsible for donation tracking?

A: Organizations are responsible for tracking and documenting the donations they receive.

Q: What information should be included in a contribution acknowledgement?

A: A contribution acknowledgement should include the organization's name, the donor's name, the date and amount of the contribution, and a statement of whether any goods or services were provided in return.

Q: Is contribution acknowledgement required for tax purposes?

A: Yes, contribution acknowledgement is required for donors to claim charitable deductions on their taxes.

Q: Are there any specific requirements for contribution acknowledgements in Missouri?

A: The document (Appendix D) provides guidelines and sample language for contribution acknowledgements in Missouri.

Form Details:

- Released on June 1, 2010;

- The latest edition provided by the Missouri Department of Mental Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Appendix D by clicking the link below or browse more documents and templates provided by the Missouri Department of Mental Health.