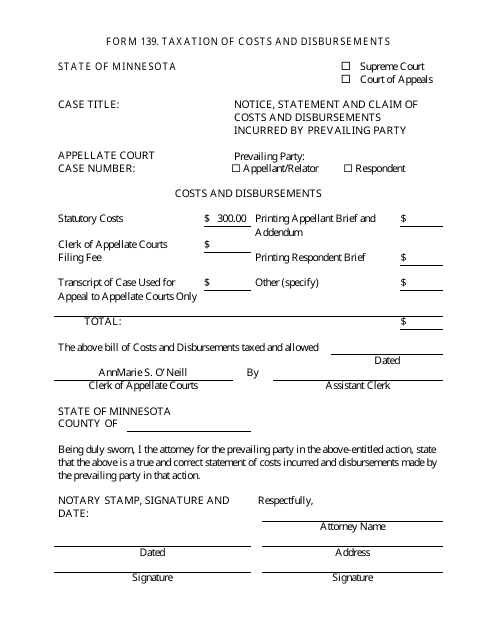

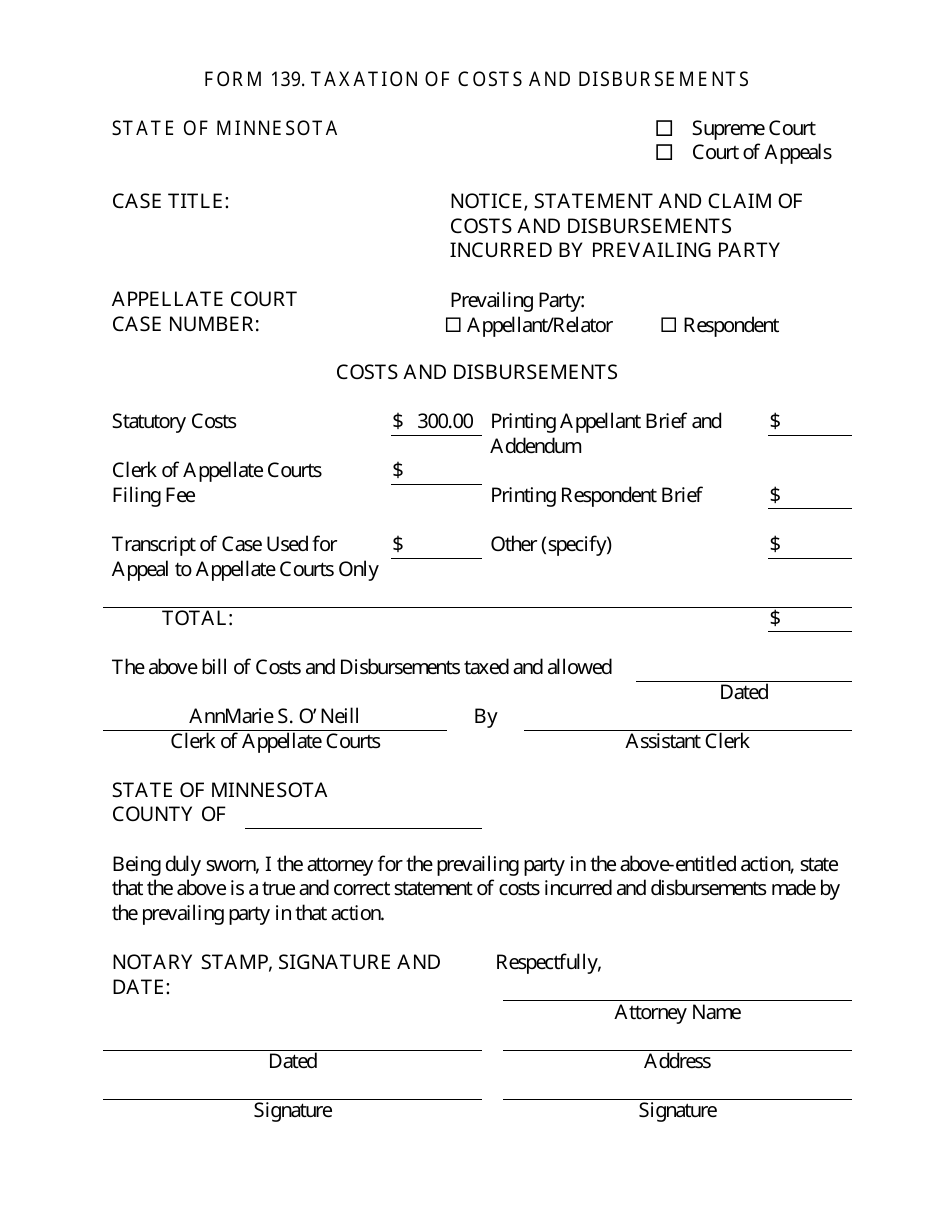

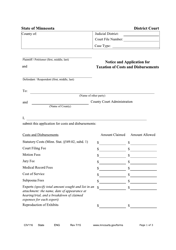

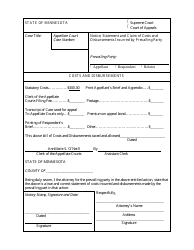

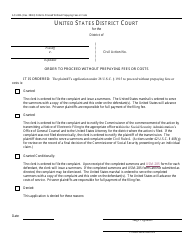

Form 139 Taxation of Costs and Disbursements - Minnesota

What Is Form 139?

This is a legal form that was released by the Minnesota Supreme Court - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 139?

A: Form 139 is a document used in Minnesota to address the taxation of costs and disbursements in a legal case.

Q: What does Form 139 address?

A: Form 139 addresses the allocation and taxation of costs and disbursements incurred in a legal case.

Q: Who uses Form 139?

A: Form 139 is used by attorneys and parties involved in a legal case in Minnesota.

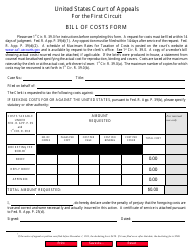

Q: What is the purpose of Form 139?

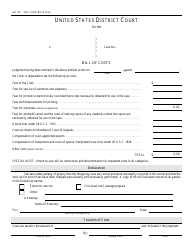

A: The purpose of Form 139 is to provide a detailed breakdown of costs and disbursements incurred in a legal case, which may be subject to taxation.

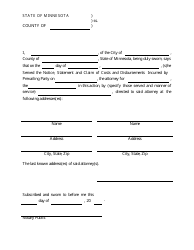

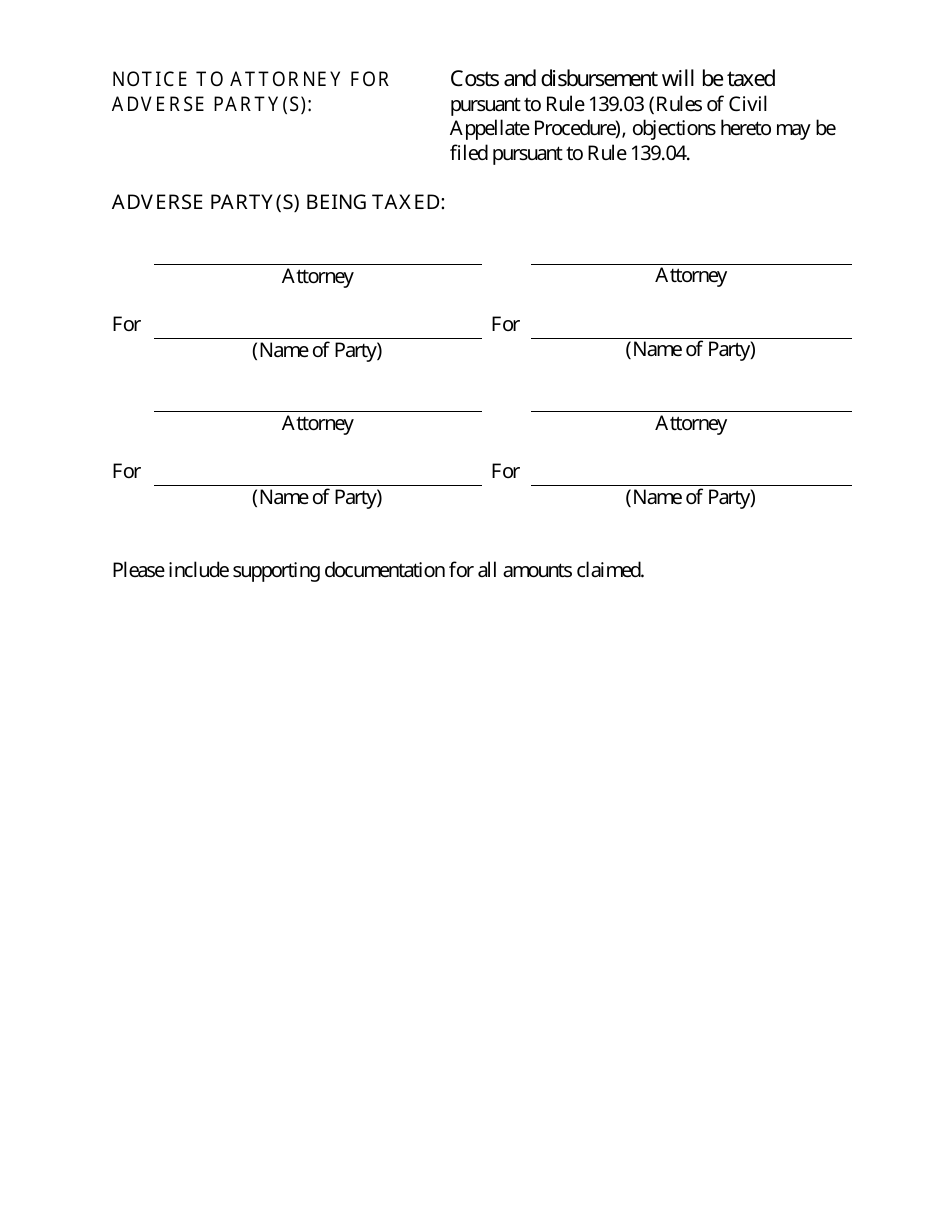

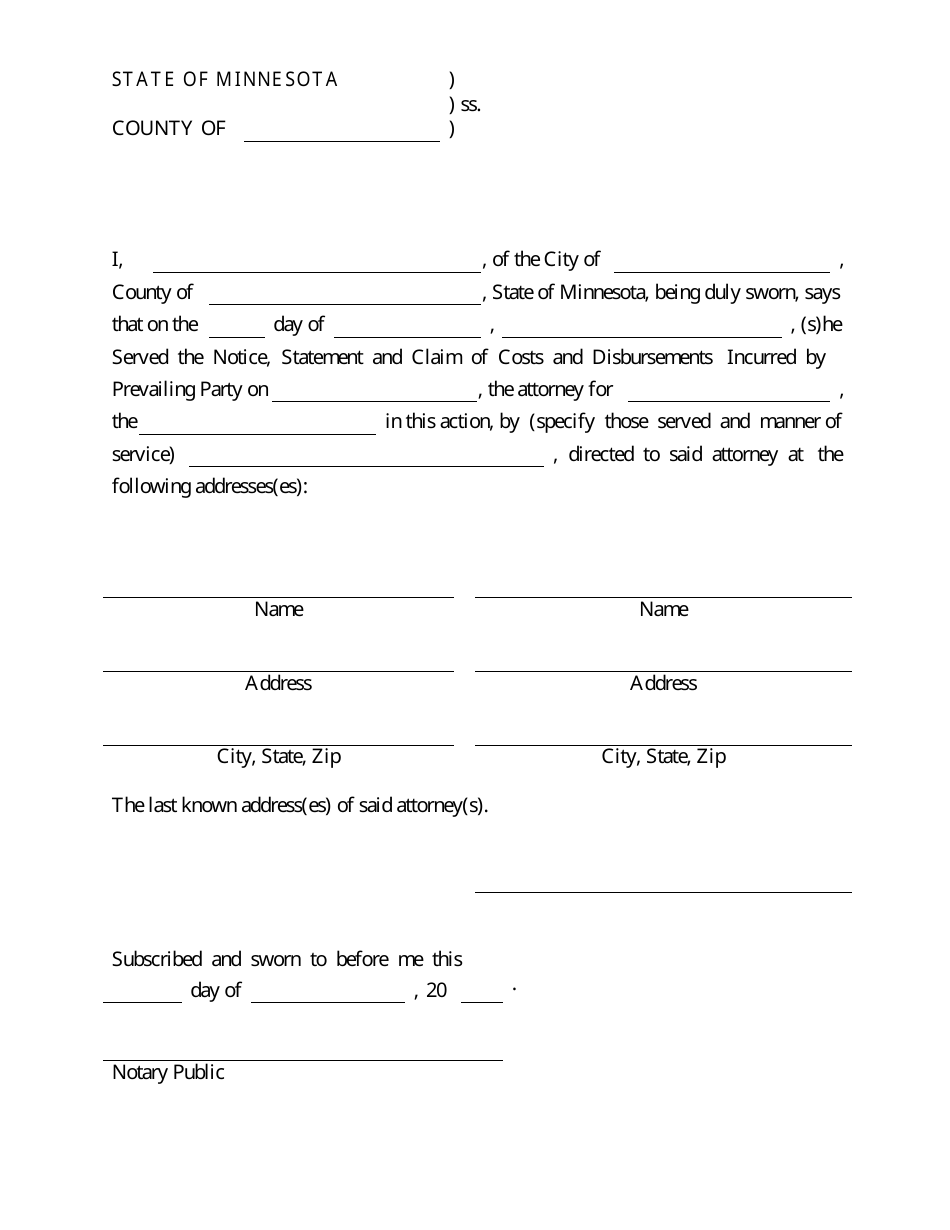

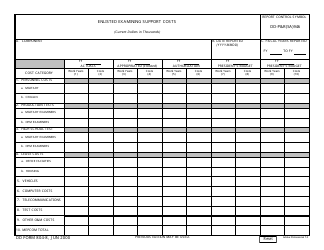

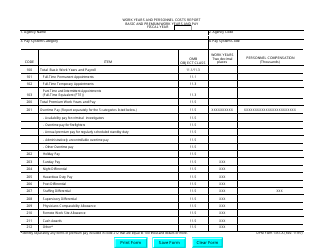

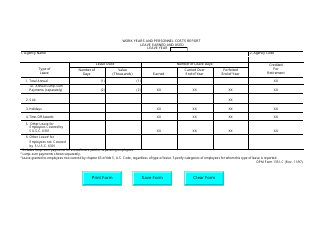

Q: What information is required on Form 139?

A: Form 139 requires information such as the case caption, the party requesting taxation, and a detailed itemization of costs and disbursements.

Q: What happens after I submit Form 139?

A: After you submit Form 139, the court will review the information provided and make a determination on the taxation of costs and disbursements.

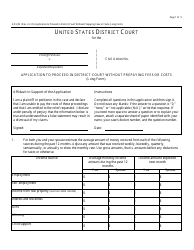

Q: Are there any fees associated with filing Form 139?

A: Yes, there may be fees associated with filing Form 139. You should check with the court or consult with your attorney to determine the applicable fees.

Form Details:

- The latest edition provided by the Minnesota Supreme Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 139 by clicking the link below or browse more documents and templates provided by the Minnesota Supreme Court.