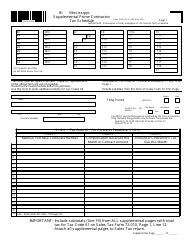

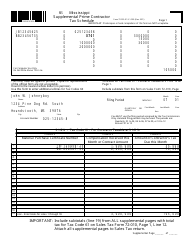

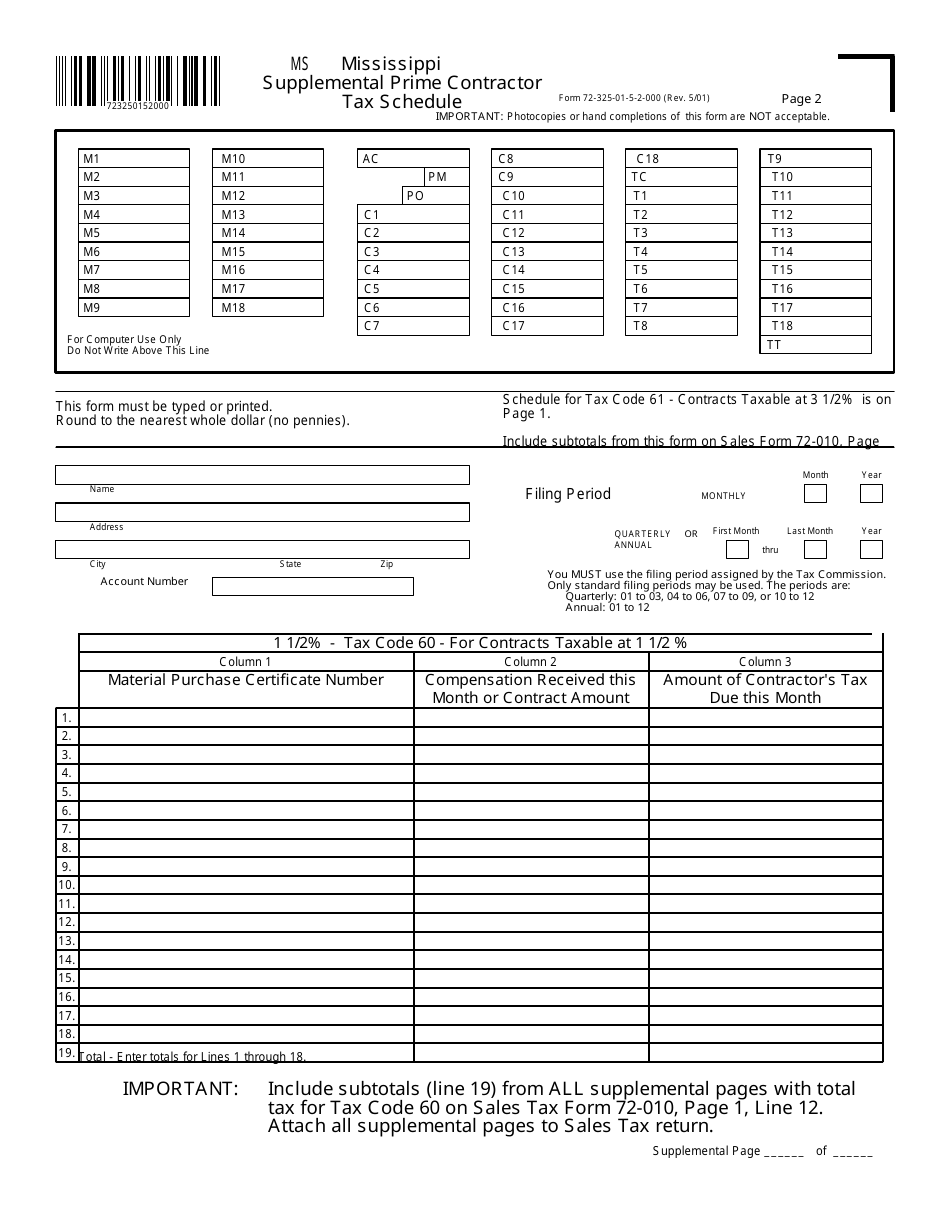

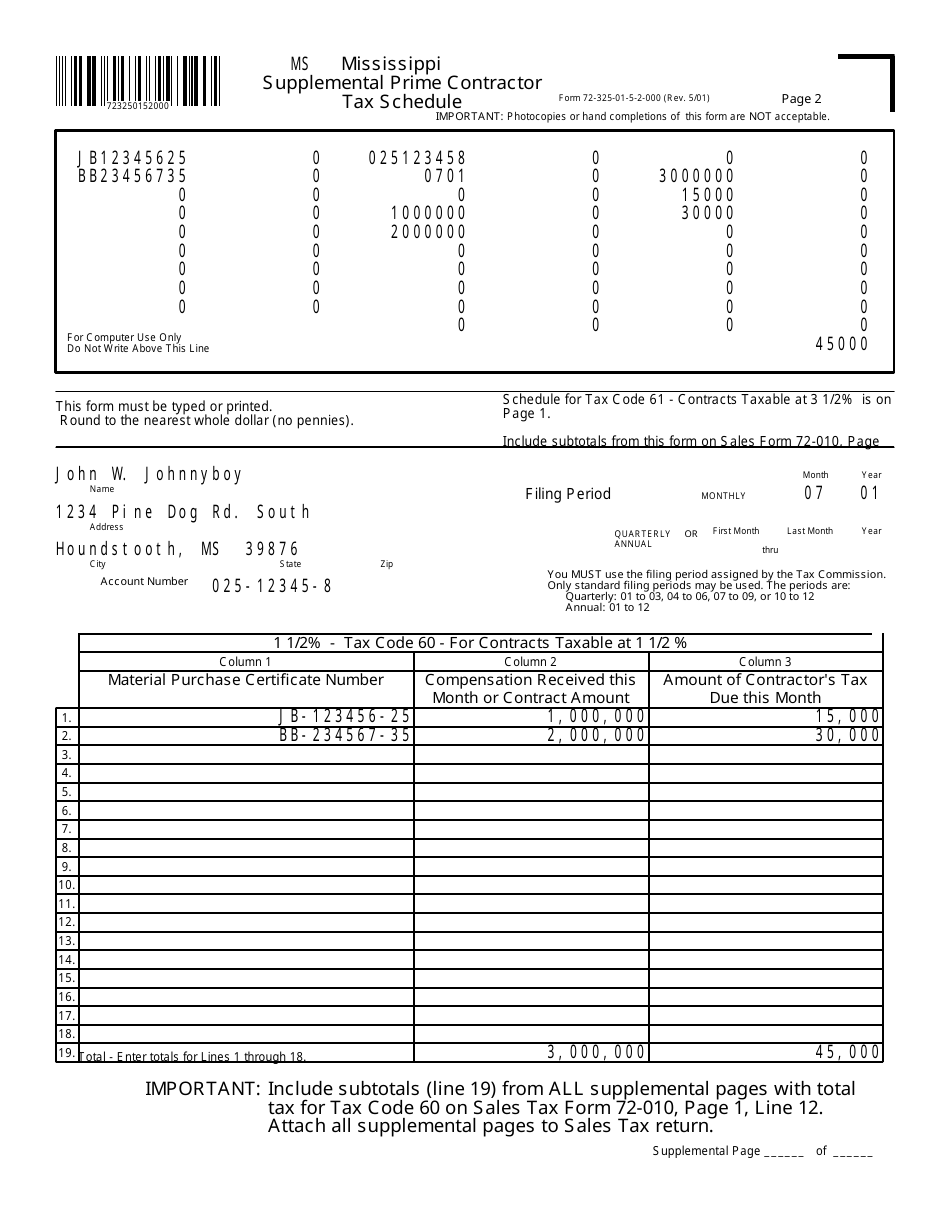

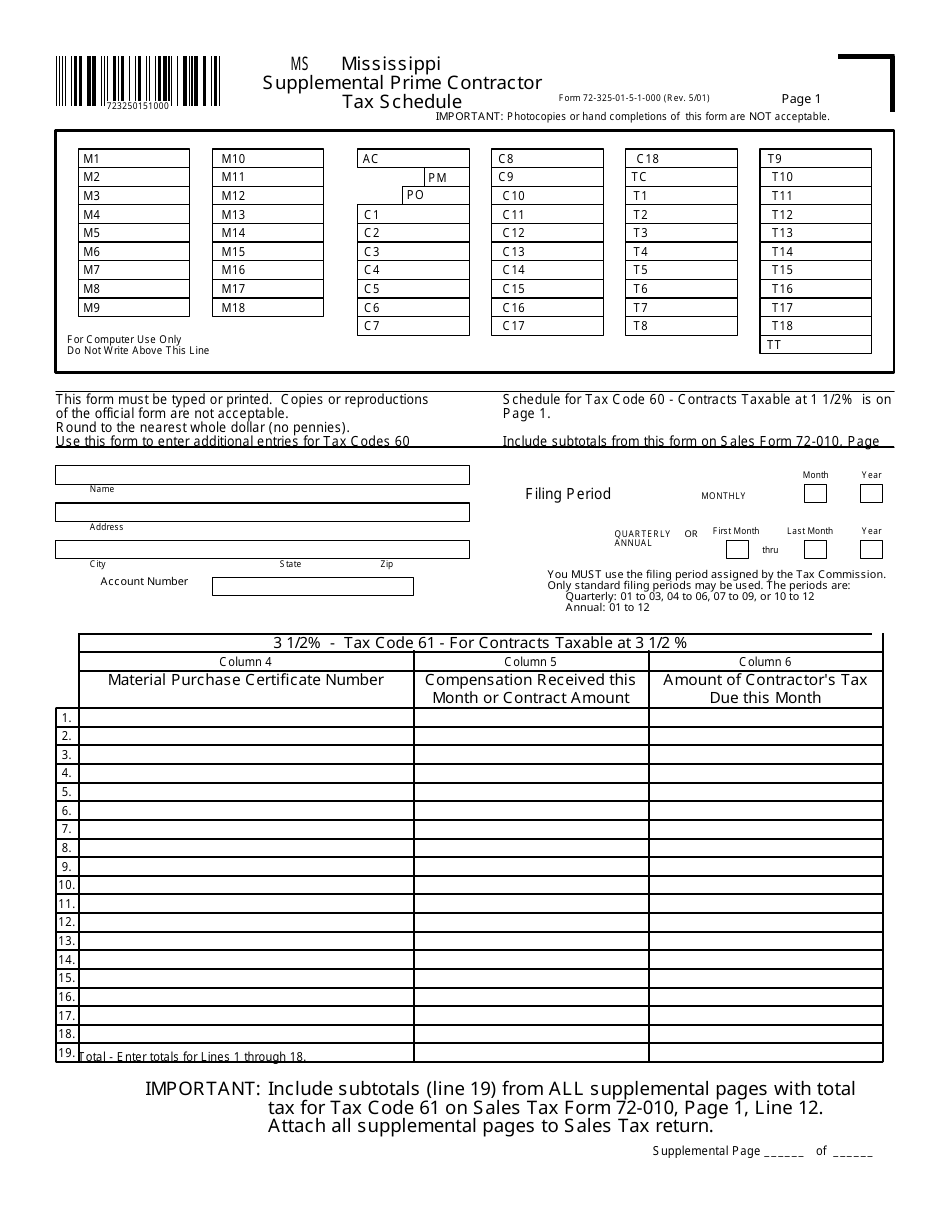

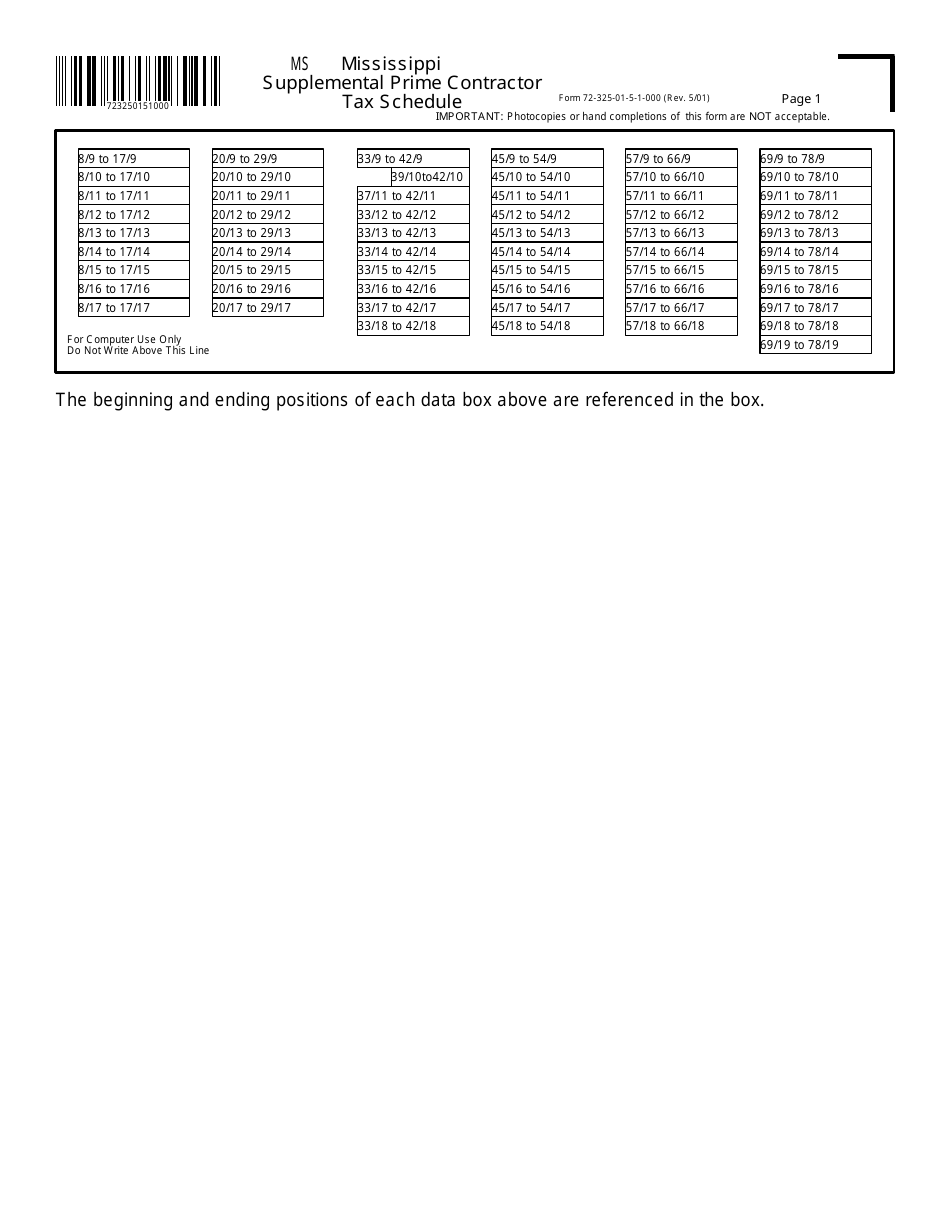

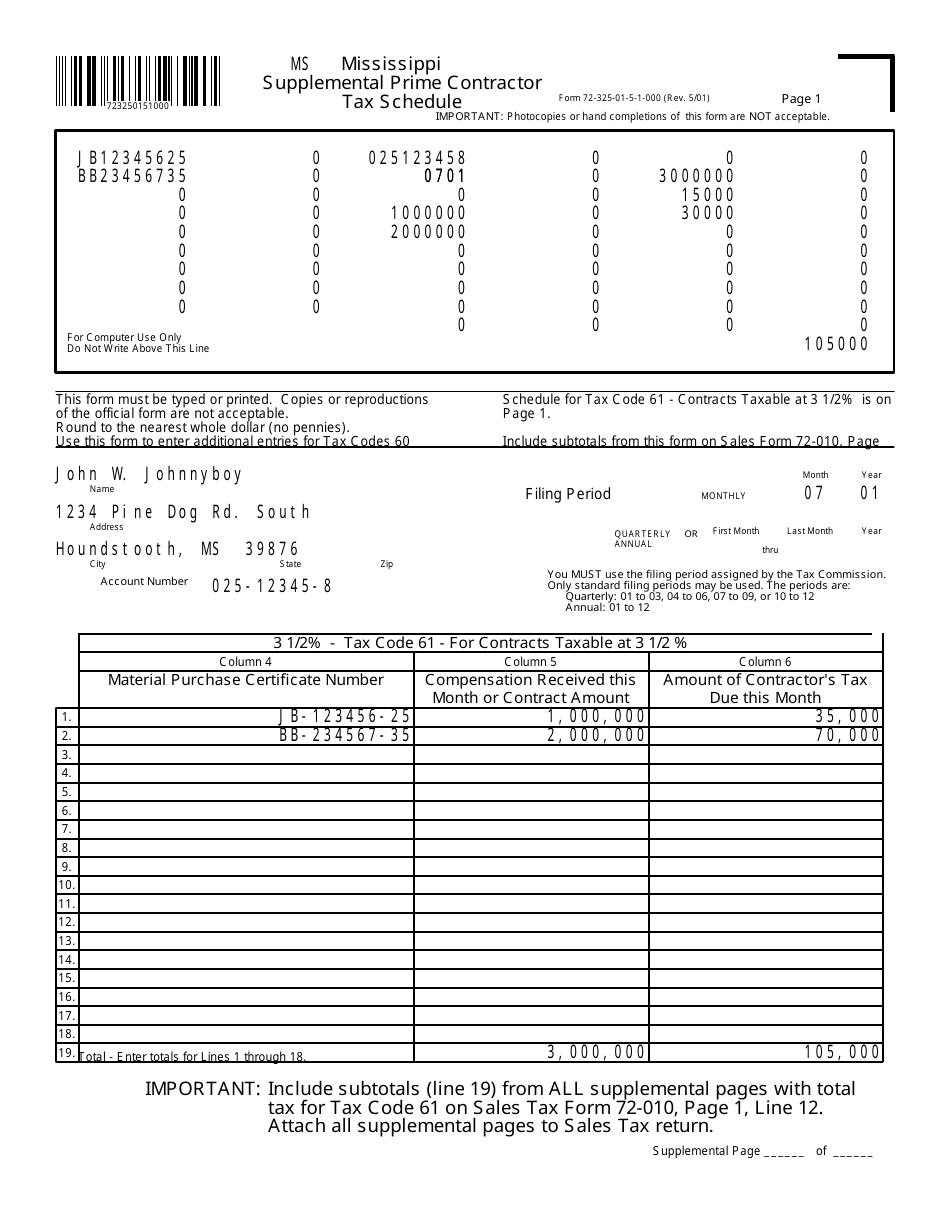

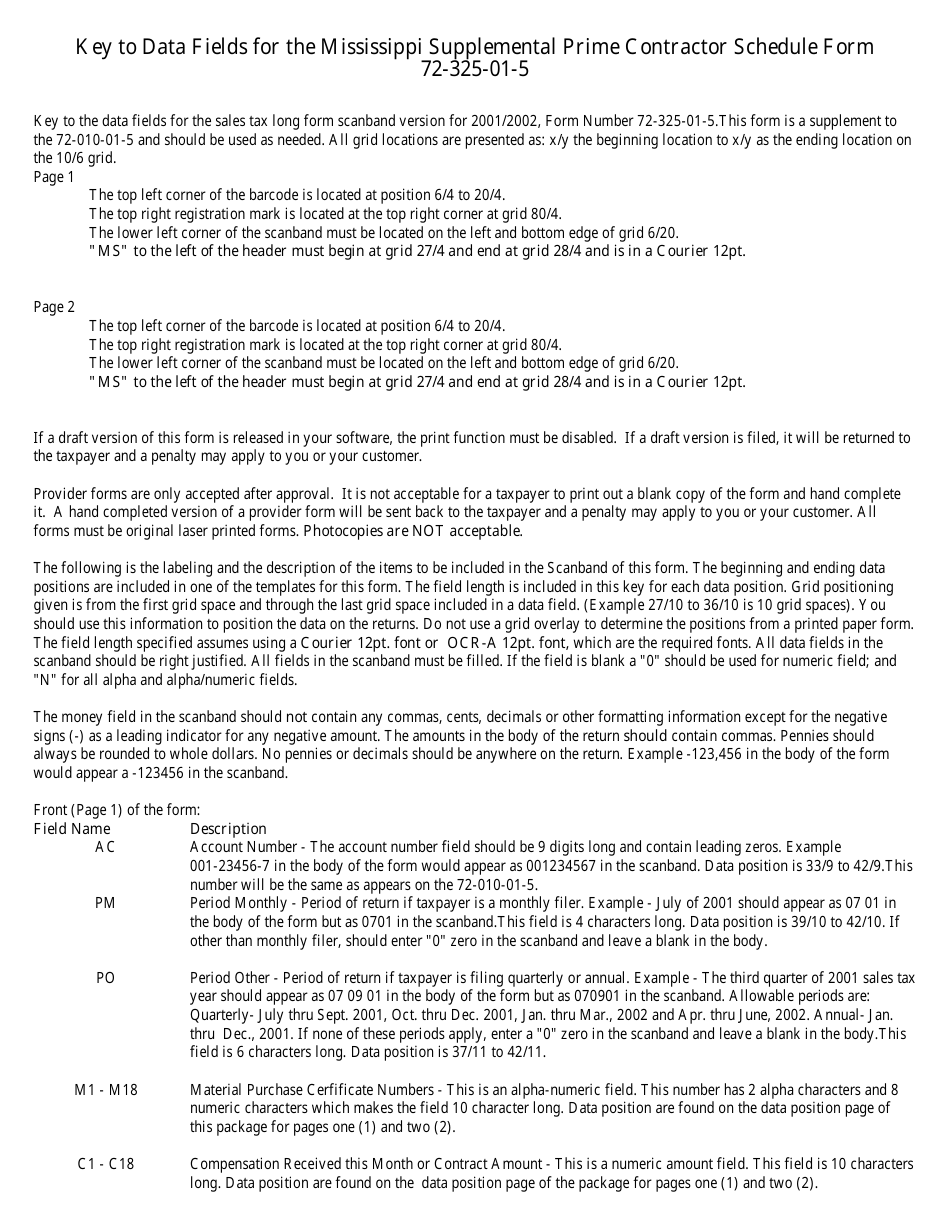

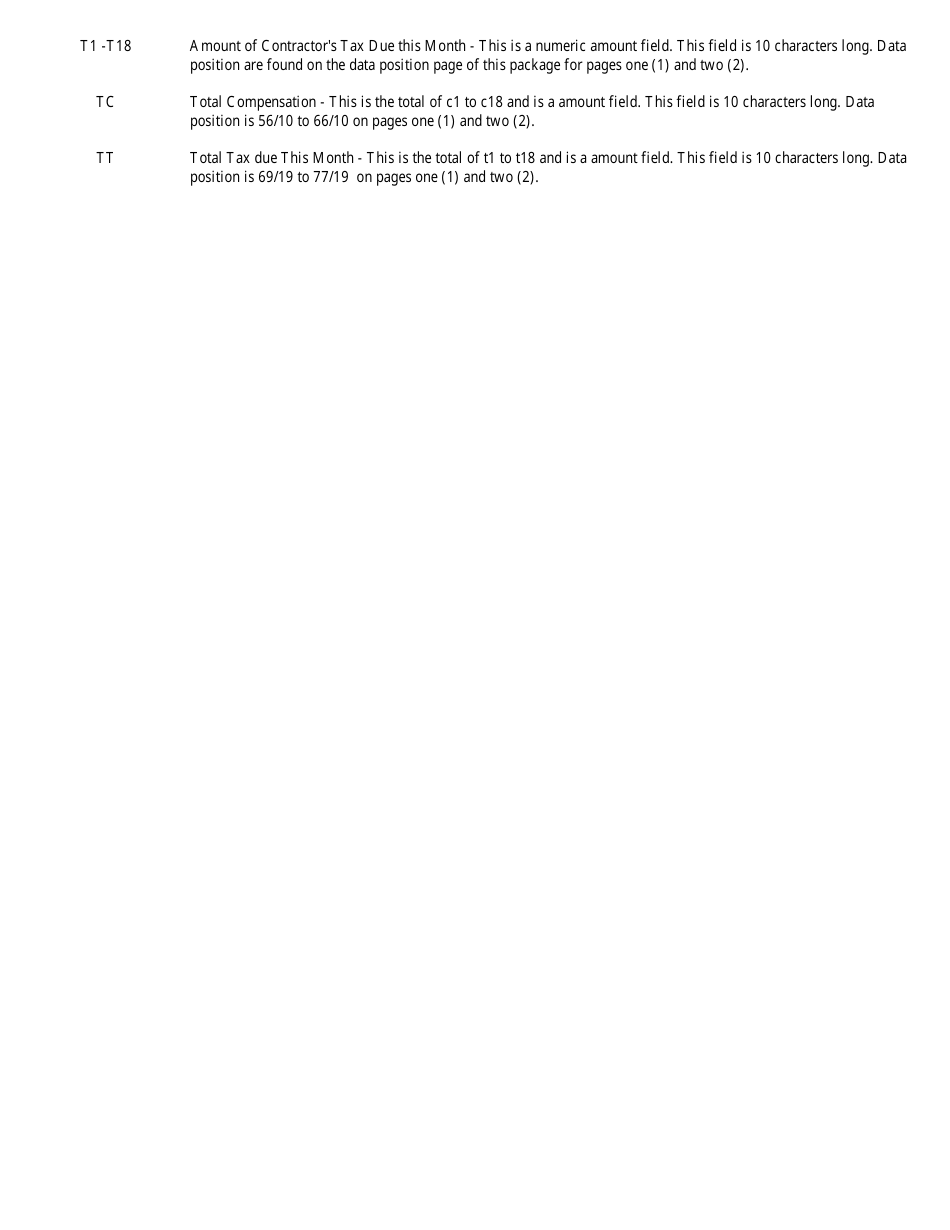

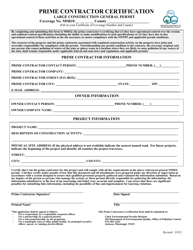

Form 72-325-01-5 Supplemental Prime Contractor Tax Schedule - Mississippi

What Is Form 72-325-01-5?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 72-325-01-5?

A: Form 72-325-01-5 is the Supplemental Prime Contractor Tax Schedule used in Mississippi.

Q: Who uses form 72-325-01-5?

A: This form is used by prime contractors in Mississippi.

Q: What is the purpose of form 72-325-01-5?

A: The purpose of this form is to report supplemental contractor tax information.

Q: Do I need to file form 72-325-01-5?

A: If you are a prime contractor in Mississippi, you may need to file this form. It is advised to consult with a tax professional or the Mississippi Department of Revenue for specific filing requirements.

Q: Are there any filing deadlines for form 72-325-01-5?

A: Yes, the filing deadlines for this form may vary. It is recommended to check the instructions on the form or contact the Mississippi Department of Revenue for the specific deadlines.

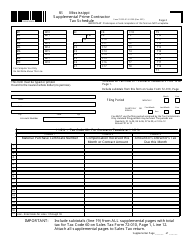

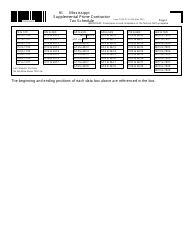

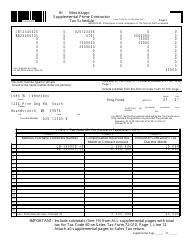

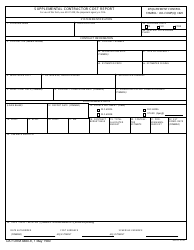

Q: What information is required on form 72-325-01-5?

A: The form typically requires information such as contractor details, project information, and tax calculations.

Q: Is form 72-325-01-5 only for Mississippi residents?

A: No, this form is specifically for contractors operating in Mississippi, regardless of their residence.

Form Details:

- Released on May 1, 2001;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-325-01-5 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.