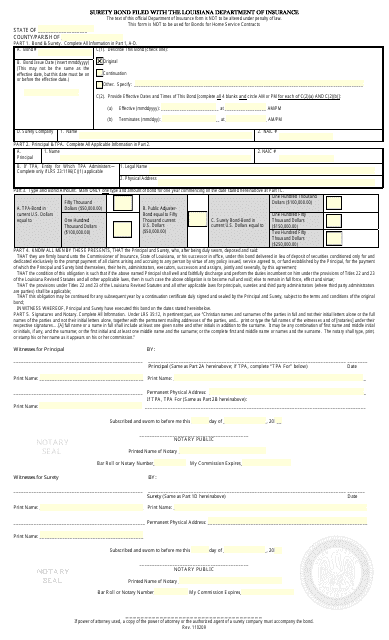

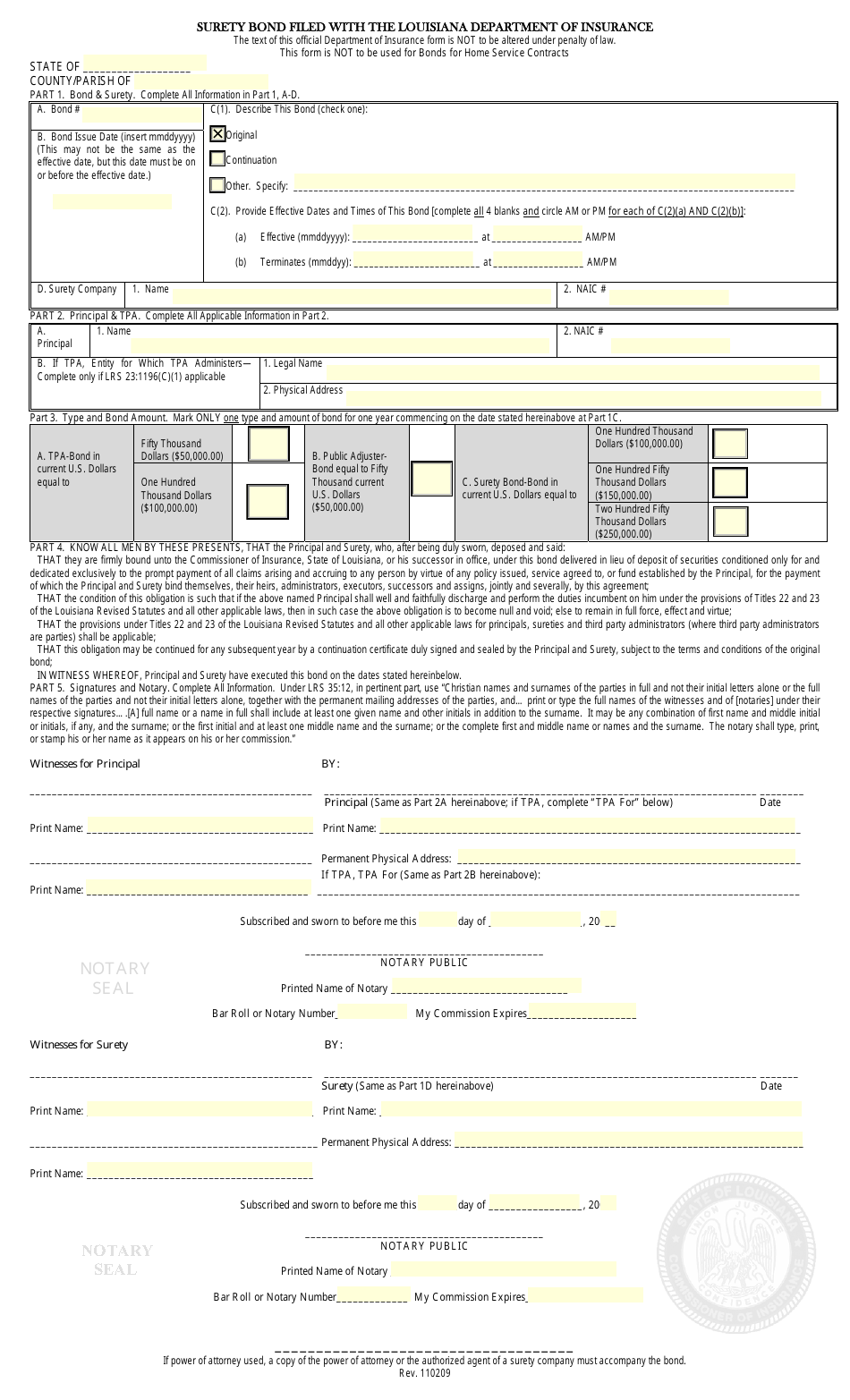

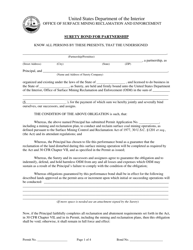

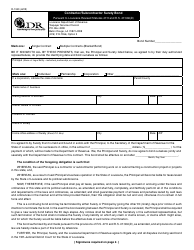

Surety Bond - Louisiana

Surety Bond is a legal document that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana.

FAQ

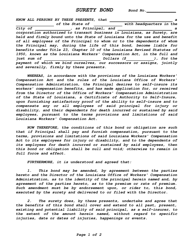

Q: What is a surety bond?

A: A surety bond is a three-party agreement between the principal, the surety, and the obligee, in which the surety guarantees that the principal will fulfill their obligations.

Q: Who are the parties involved in a surety bond in Louisiana?

A: The parties involved in a surety bond in Louisiana are the principal (the party required to post the bond), the surety (the company providing the bond), and the obligee (the party protected by the bond).

Q: What is the purpose of a surety bond in Louisiana?

A: The purpose of a surety bond in Louisiana is to protect the obligee against financial loss if the principal fails to fulfill their obligations.

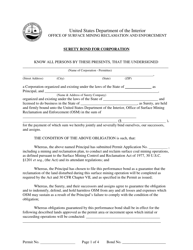

Q: What are the different types of surety bonds in Louisiana?

A: There are various types of surety bonds in Louisiana, including contractor license bonds, performance bonds, payment bonds, and court bonds.

Q: How much does a surety bond cost in Louisiana?

A: The cost of a surety bond in Louisiana varies depending on factors such as the type of bond, the bond amount, and the creditworthiness of the principal.

Q: Are surety bonds in Louisiana refundable?

A: Unlike insurance policies, surety bonds in Louisiana are typically non-refundable.

Q: Do I need a surety bond in Louisiana?

A: Whether or not you need a surety bond in Louisiana depends on the specific requirements of your situation or industry. It is best to consult with the relevant authorities or a surety bond professional to determine if a bond is required.

Q: How long does a surety bond last in Louisiana?

A: The duration of a surety bond in Louisiana depends on the terms specified in the bond agreement. It can vary from one year to multiple years.

Q: What happens if a claim is filed against a surety bond in Louisiana?

A: If a claim is filed against a surety bond in Louisiana, the surety will typically investigate the claim and, if it is found valid, compensate the obligee up to the bond amount. The principal is then usually responsible for reimbursing the surety for the amount paid out.

Form Details:

- Released on November 2, 2009;

- The latest edition currently provided by the Louisiana Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.