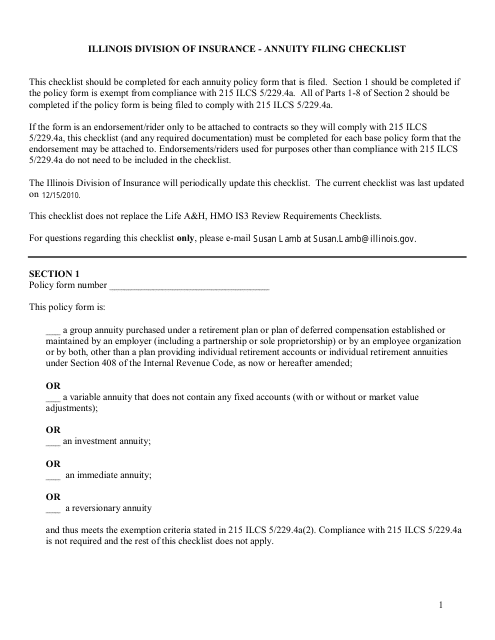

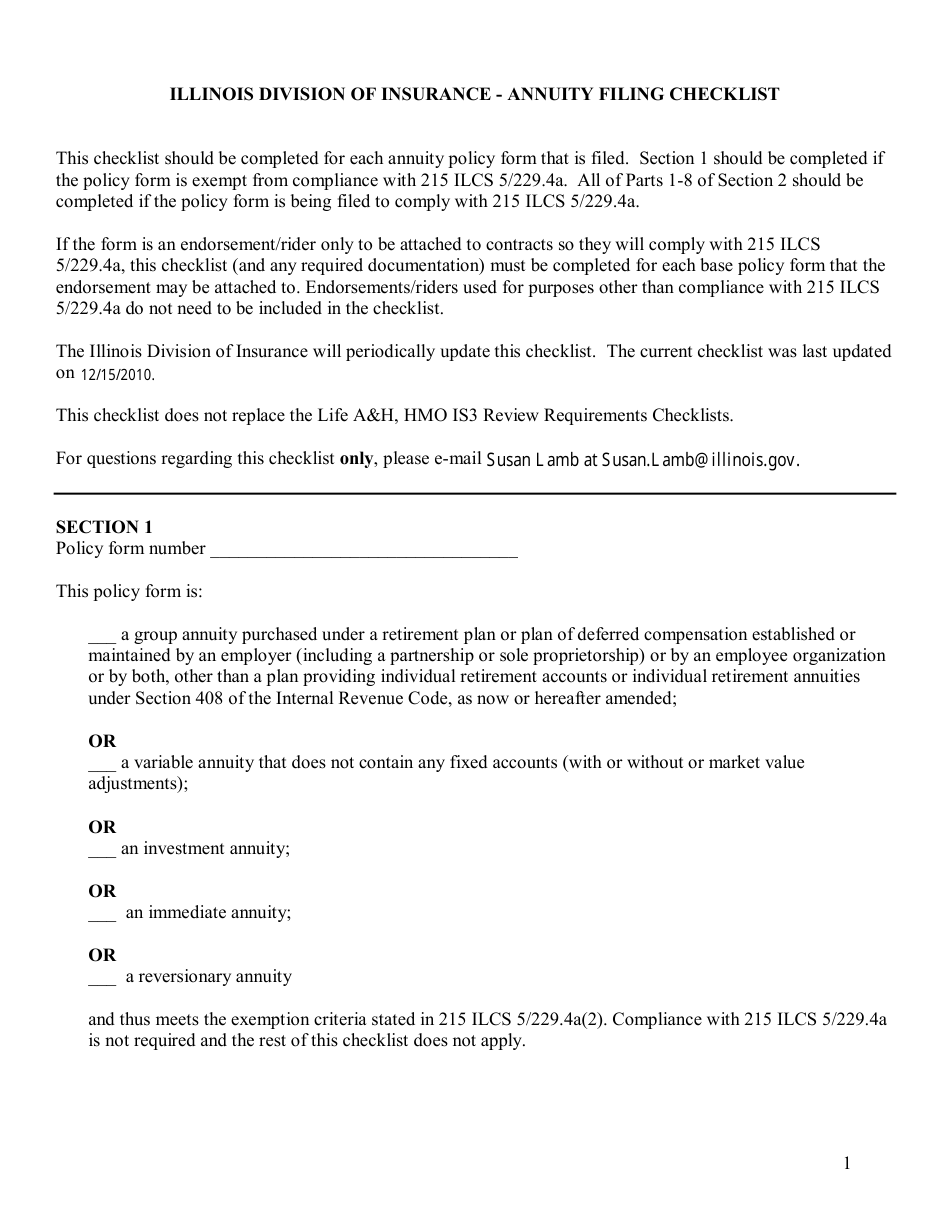

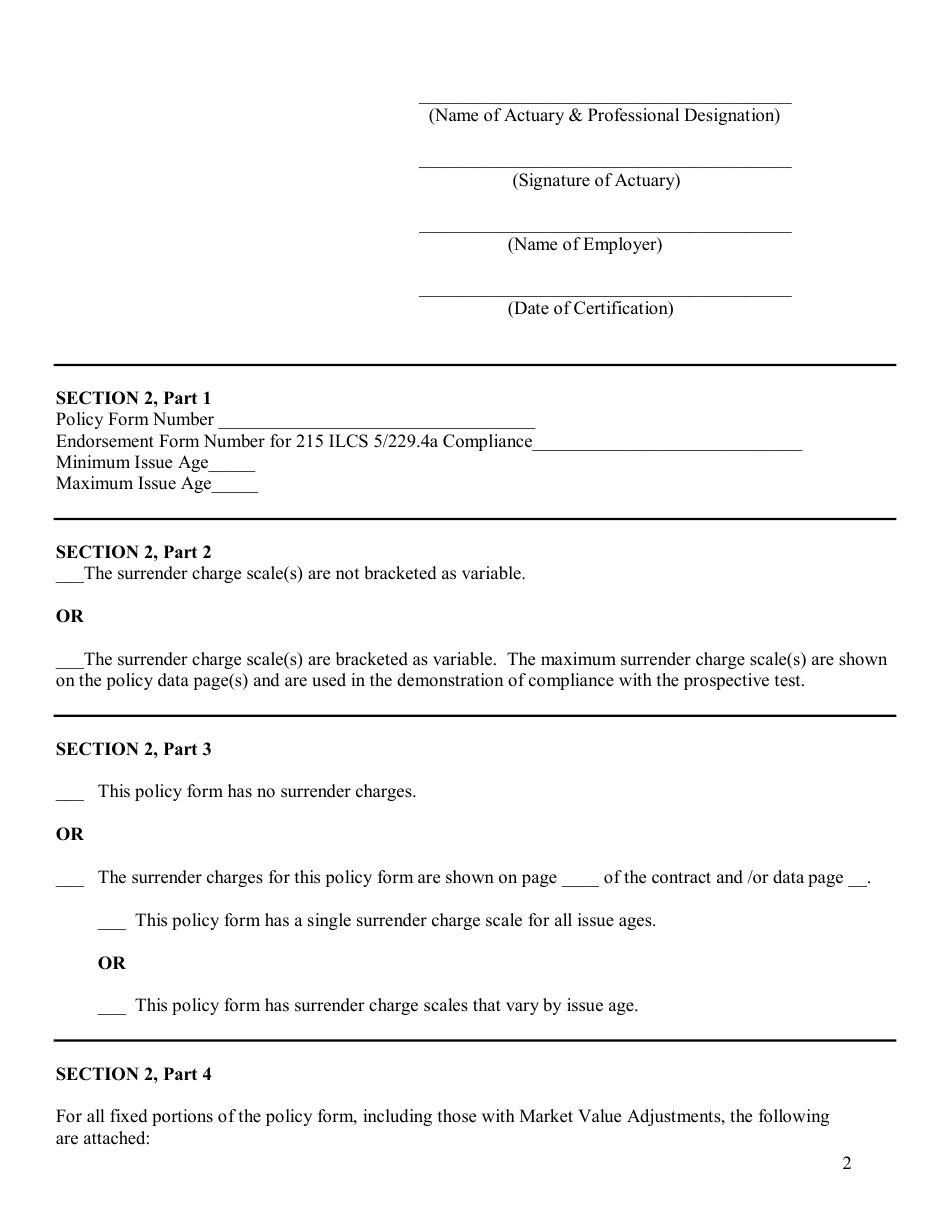

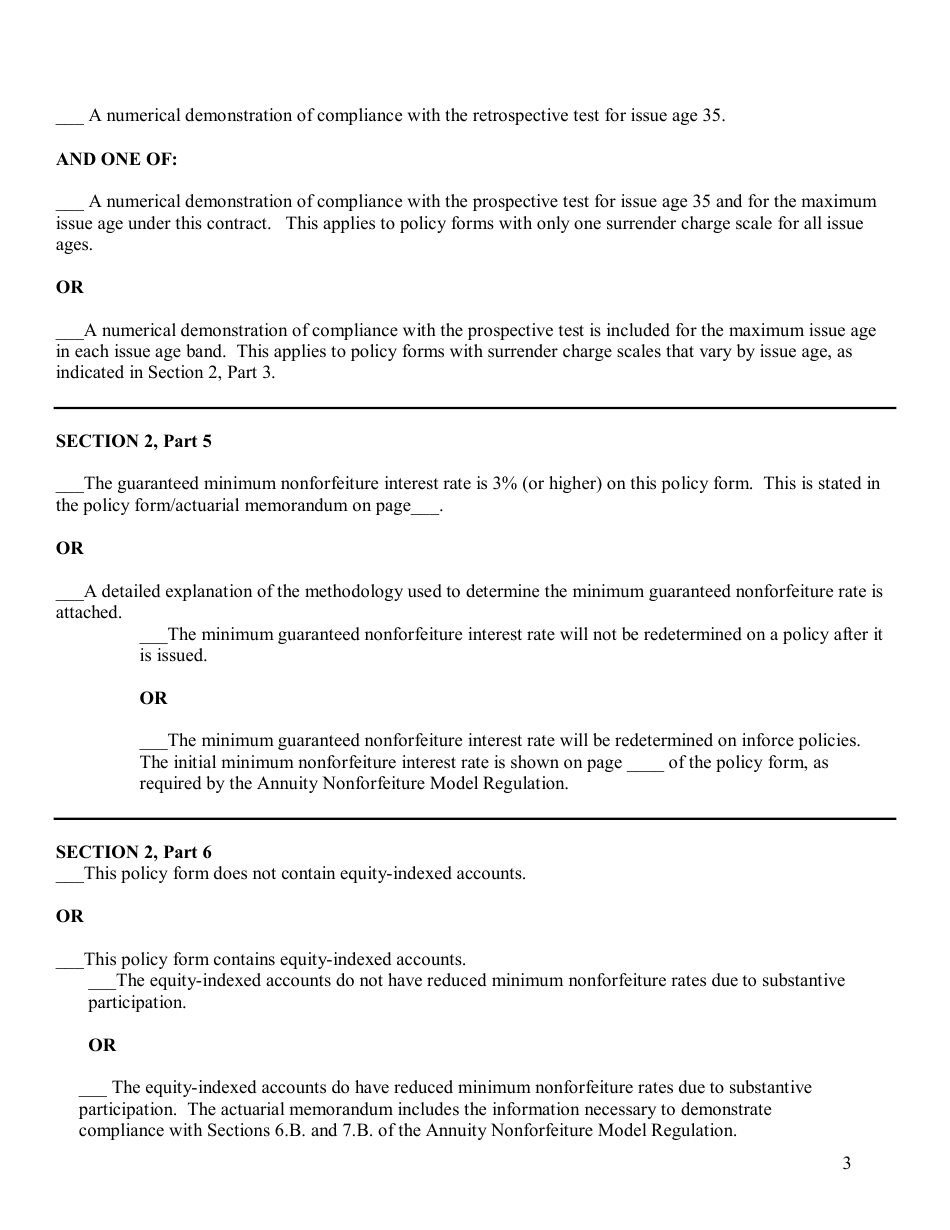

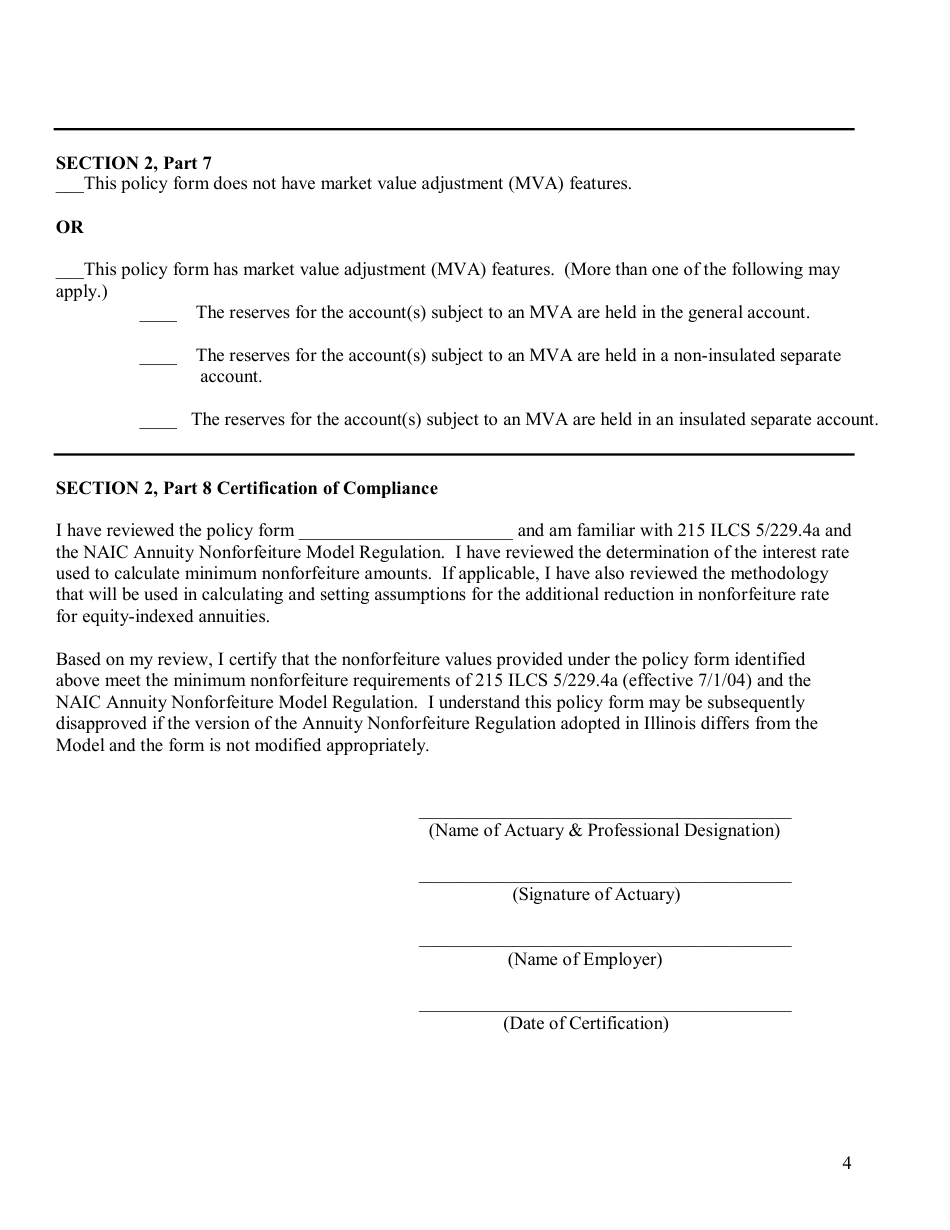

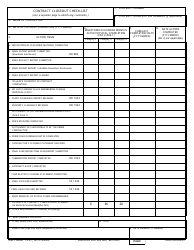

Annuity Filing Checklist - Illinois

Annuity Filing Checklist is a legal document that was released by the Illinois Department of Insurance - a government authority operating within Illinois.

FAQ

Q: What is an annuity?

A: An annuity is a financial product that provides a regular stream of income in exchange for a lump sum or a series of payments.

Q: How do I file an annuity in Illinois?

A: To file an annuity in Illinois, you need to complete the necessary forms provided by the insurance company issuing the annuity.

Q: What information do I need to file an annuity in Illinois?

A: You will typically need your annuity contract, your personal information (such as name and address), and any relevant tax forms.

Q: Do I need to pay taxes on annuity income in Illinois?

A: Yes, annuity income is generally subject to taxation in Illinois. It is recommended to consult with a tax professional for specific guidance.

Q: Are there any exemptions for annuity income taxation in Illinois?

A: Illinois does offer some exemptions for annuity income taxation. These exemptions may vary depending on factors such as age and the source of the income.

Q: Can I receive a lump sum payment from an annuity in Illinois?

A: Yes, it is possible to receive a lump sum payment from an annuity in Illinois. However, this may have tax implications, so it is important to consult with a professional before making a decision.

Q: What is the minimum age to start receiving annuity payments in Illinois?

A: The minimum age to start receiving annuity payments in Illinois is typically 59½, although this may vary depending on the specific annuity contract.

Q: Can I transfer my annuity to another person in Illinois?

A: Yes, it is generally possible to transfer an annuity to another person in Illinois. However, there may be restrictions and tax implications, so be sure to consult with the insurance company that issued the annuity.

Q: What happens to my annuity if I pass away in Illinois?

A: The treatment of an annuity after the death of the annuity holder can vary depending on the specific terms of the annuity contract. It is recommended to review the contract and consult with a professional for guidance.

Form Details:

- The latest edition currently provided by the Illinois Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.