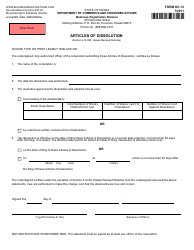

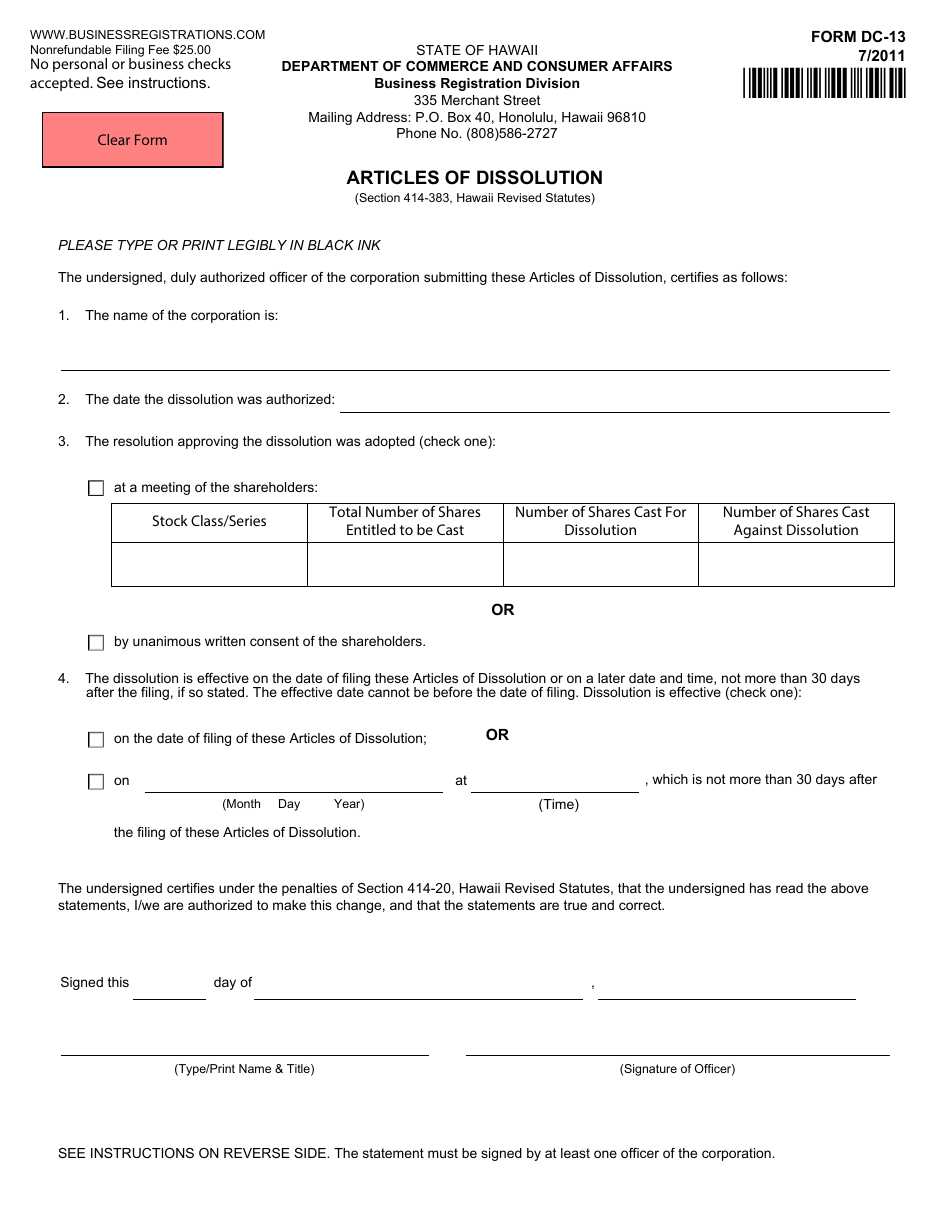

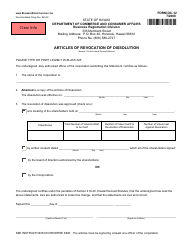

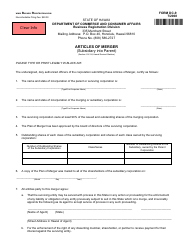

Form DC-13 Articles of Dissolution - Hawaii

What Is Form DC-13?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

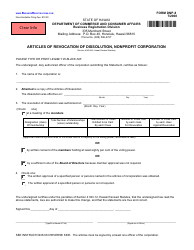

Q: What is Form DC-13?

A: Form DC-13 is the Articles of Dissolution for the state of Hawaii.

Q: What is the purpose of Form DC-13?

A: The purpose of Form DC-13 is to dissolve a business entity in Hawaii.

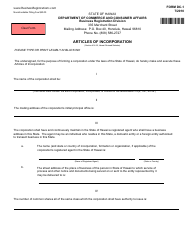

Q: Who can file Form DC-13?

A: The form can be filed by the authorized representative or owner of the business entity.

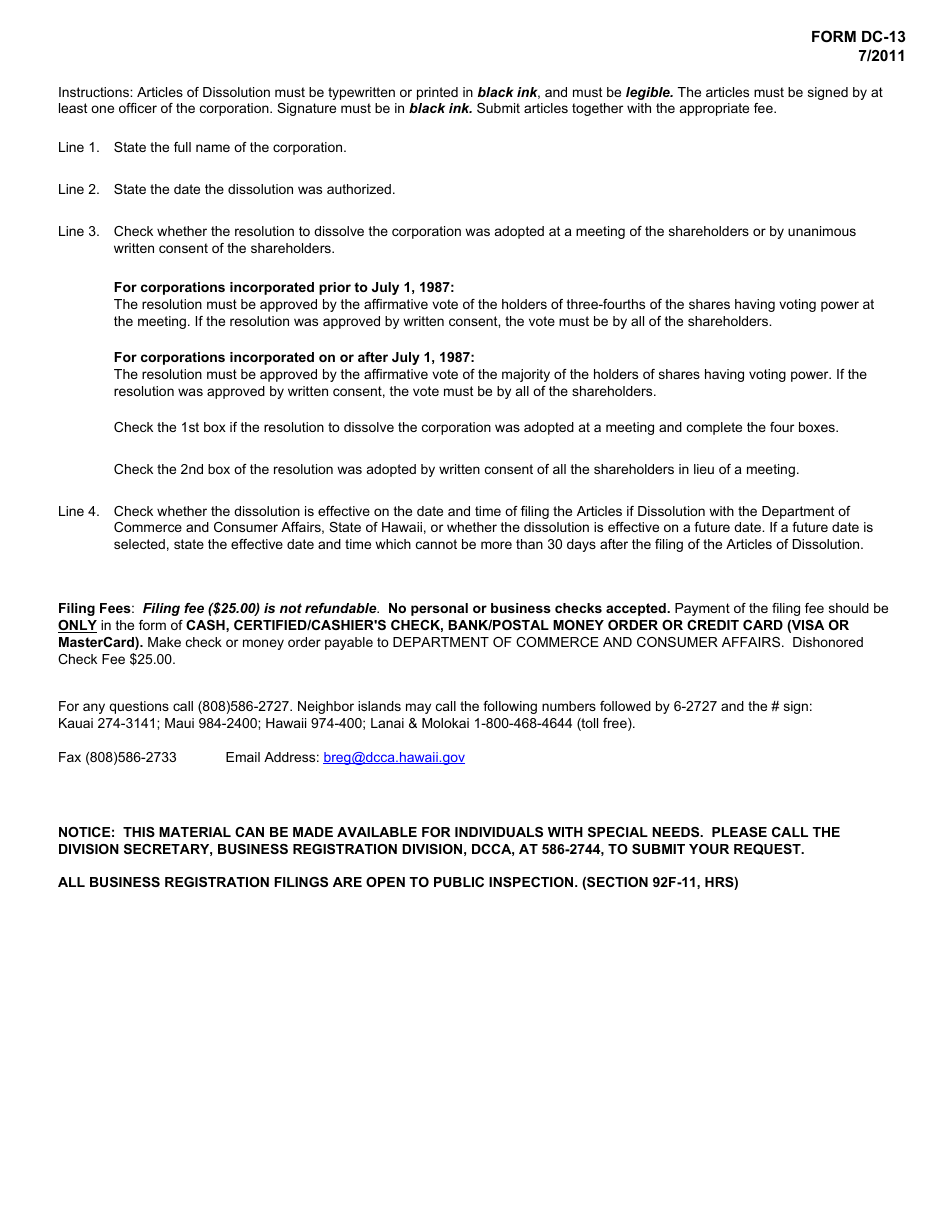

Q: What information is required in Form DC-13?

A: The form requires information about the business entity, the reason for dissolution, and the effective date of dissolution.

Q: Are there any fees associated with filing Form DC-13?

A: Yes, there is a filing fee that must be paid when submitting the form.

Q: Are there any additional documents that need to be submitted with Form DC-13?

A: No, Form DC-13 does not require any additional documents to be submitted.

Q: What happens after Form DC-13 is filed?

A: Once Form DC-13 is filed and approved, the business entity will be officially dissolved.

Q: Is it necessary to hire a lawyer to file Form DC-13?

A: While it is not mandatory, it is recommended to consult with a lawyer or legal professional when filing Form DC-13 to ensure compliance with all legal requirements.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DC-13 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.