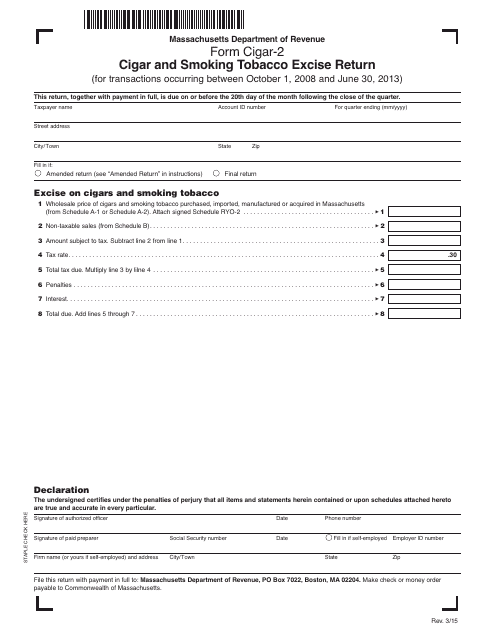

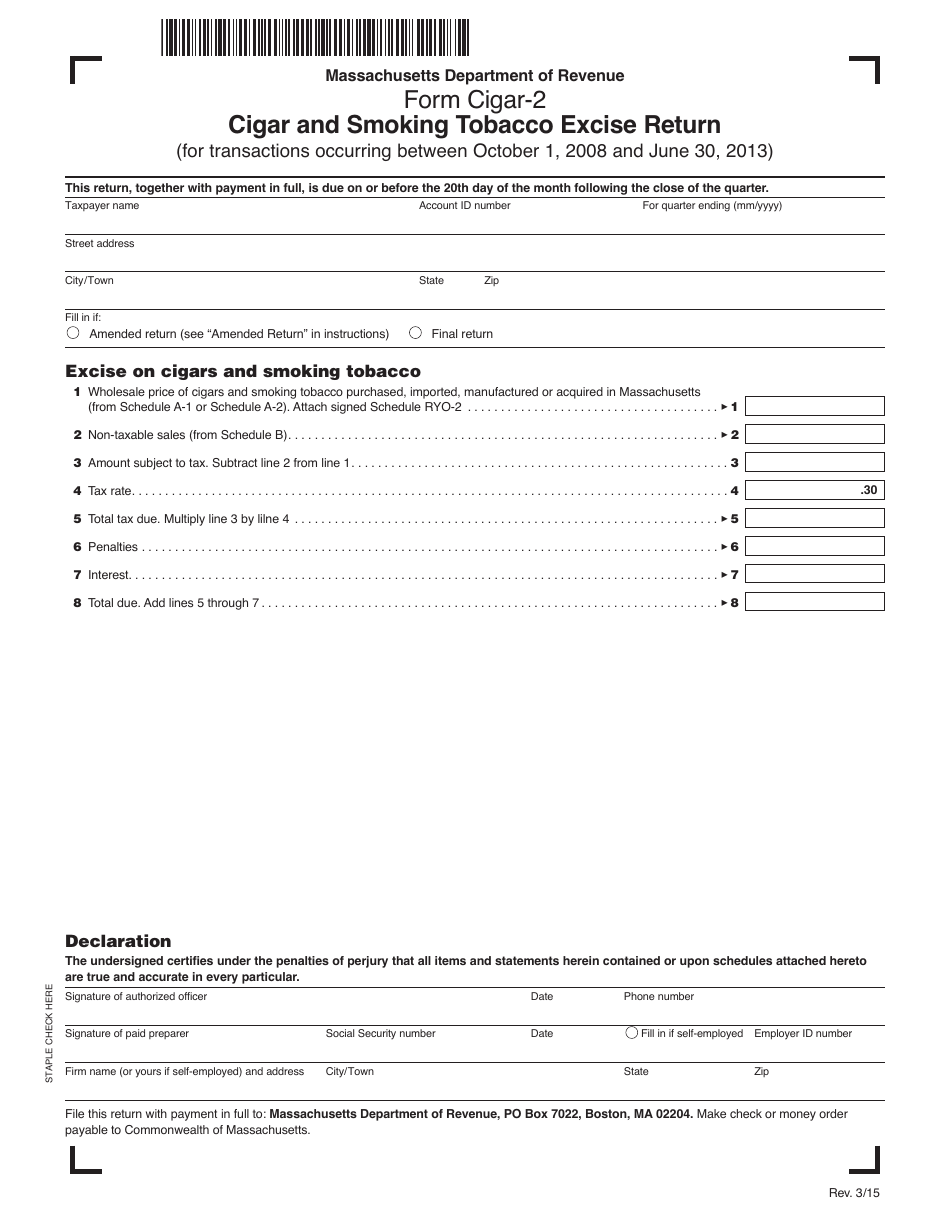

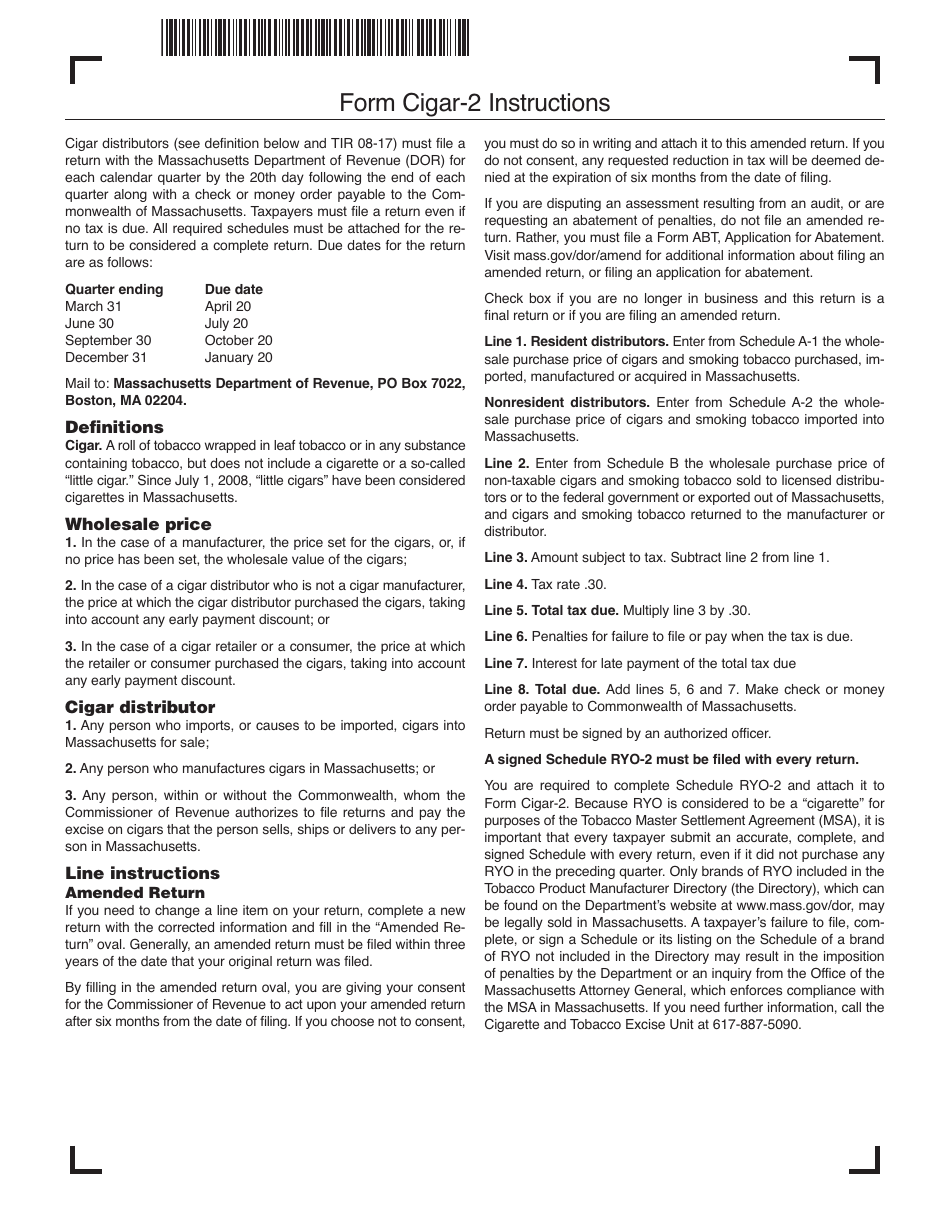

Form Cigar-2 Cigar and Smoking Tobacco Excise Return (October 2008 Through June 2013) - Massachusetts

What Is Form Cigar-2?

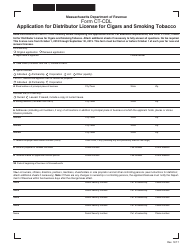

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form Cigar-2?

A: Form Cigar-2 is a Cigar and Smoking Tobacco Excise Return for the period spanning October 2008 through June 2013 in Massachusetts.

Q: Who needs to file the Form Cigar-2?

A: Anyone who sells cigars or smoking tobacco in Massachusetts during the specified period needs to file the Form Cigar-2.

Q: What is the purpose of the Form Cigar-2?

A: The purpose of the Form Cigar-2 is to report and remit the excise tax on cigars and smoking tobacco sold in Massachusetts during the specified period.

Q: What is the filing period for the Form Cigar-2?

A: The filing period for the Form Cigar-2 is from October 2008 through June 2013.

Q: Is the Form Cigar-2 specific to Massachusetts?

A: Yes, the Form Cigar-2 is specific to Massachusetts.

Q: What happens if I don't file the Form Cigar-2?

A: Failure to file the Form Cigar-2 may result in penalties and interest being assessed by the Massachusetts Department of Revenue.

Q: Can I e-file the Form Cigar-2?

A: No, the Form Cigar-2 cannot be e-filed and must be filed by mail with the Massachusetts Department of Revenue.

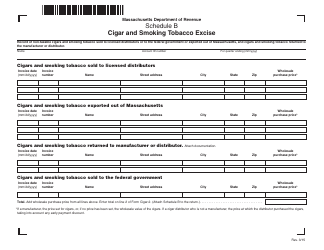

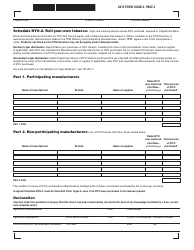

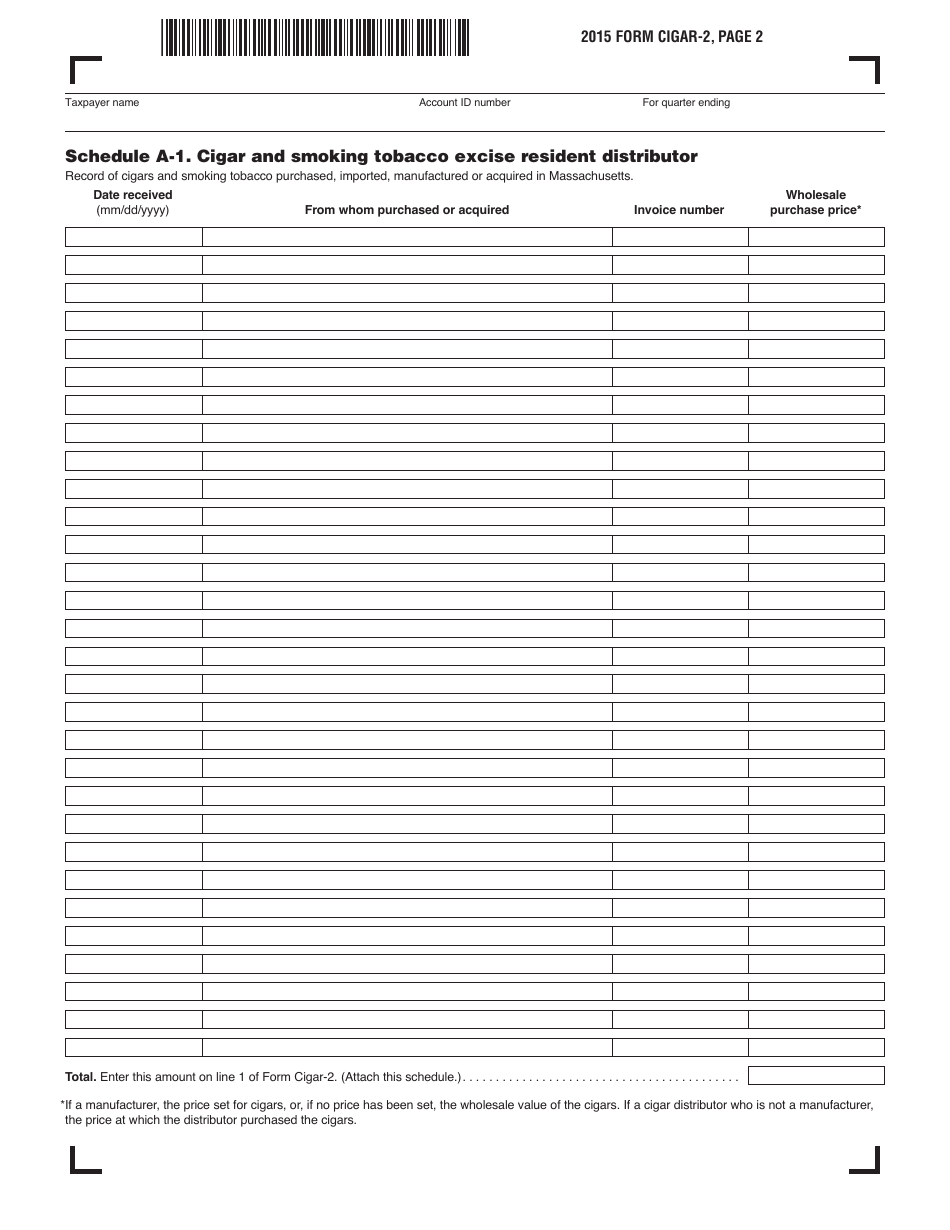

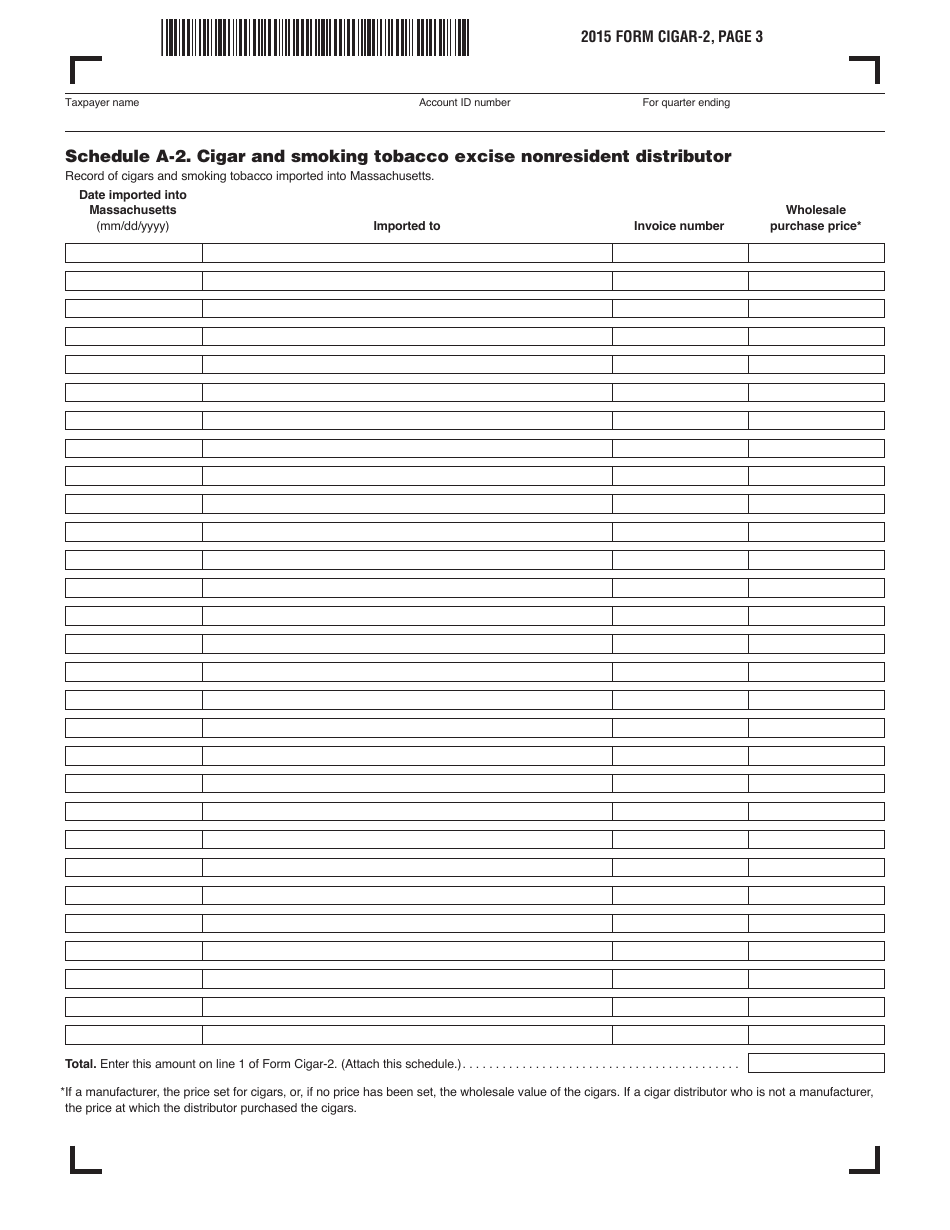

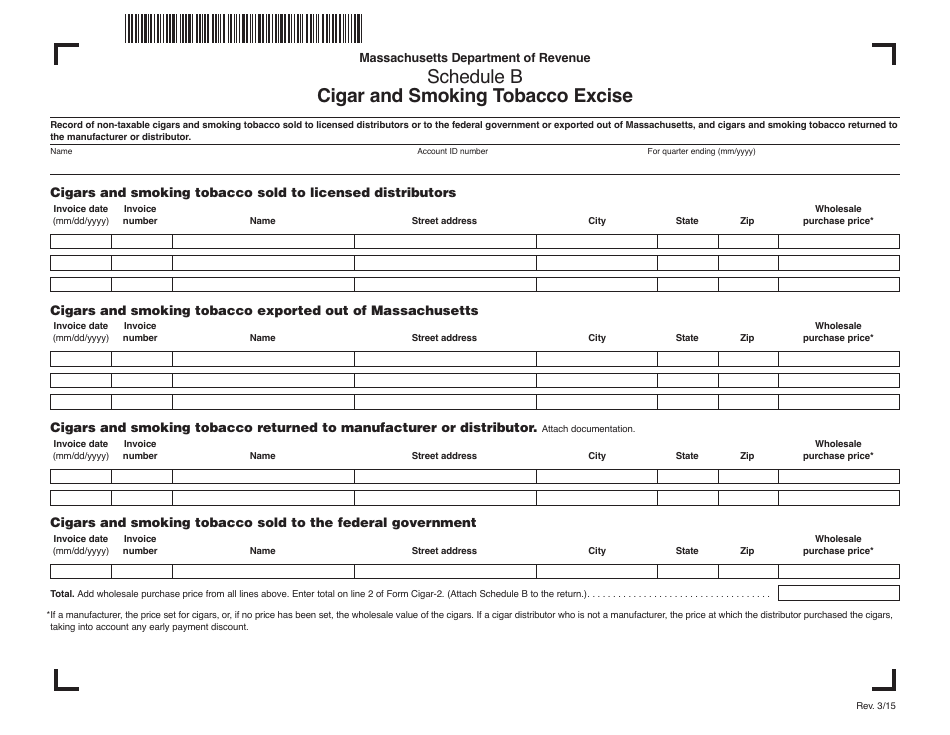

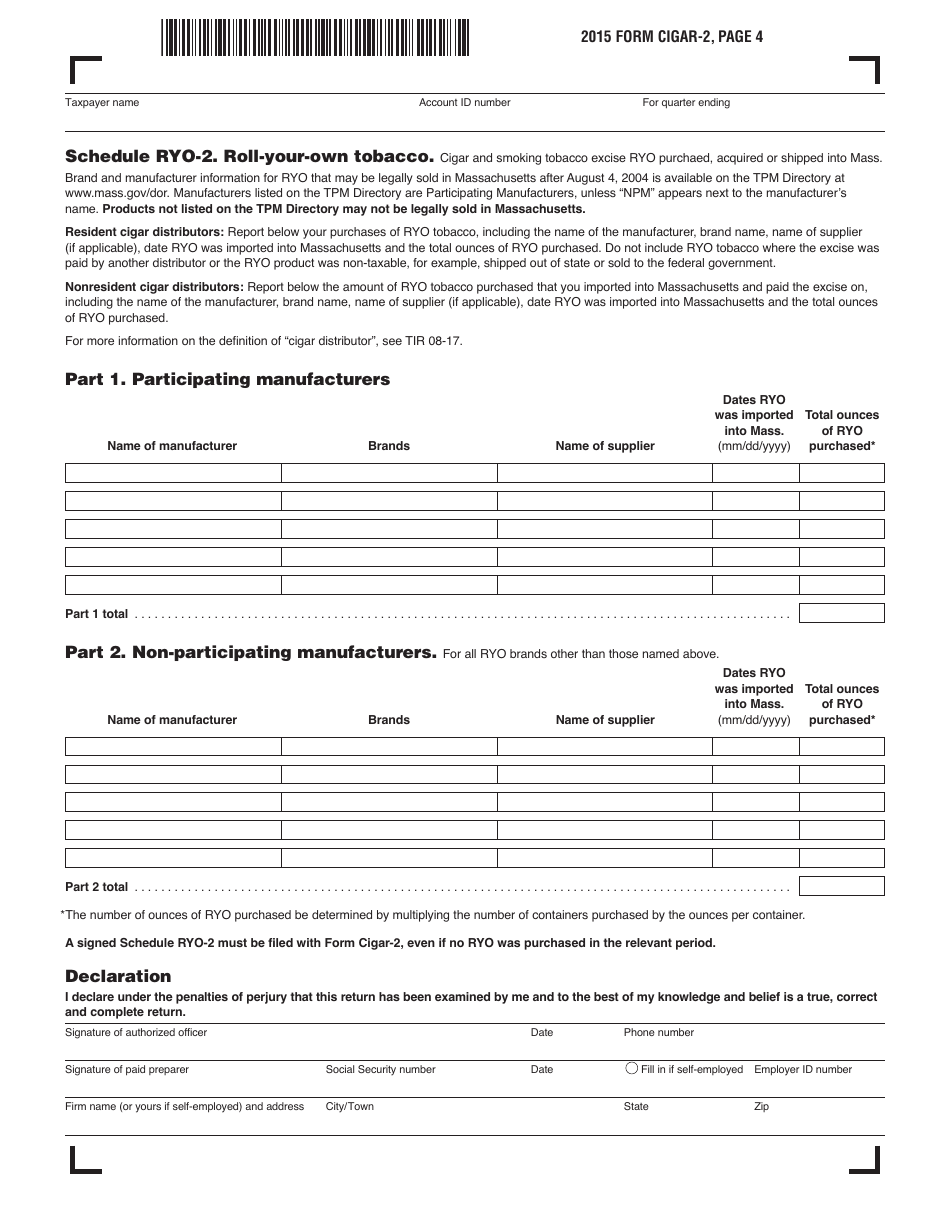

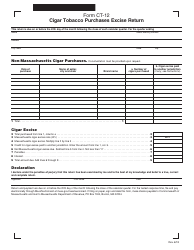

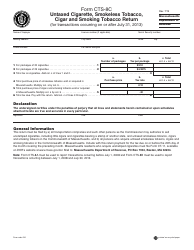

Q: What information do I need to complete the Form Cigar-2?

A: You will need to provide information about the quantity and value of cigars and smoking tobacco sold during the specified period.

Q: Can I amend my Form Cigar-2 after filing?

A: Yes, you can amend your Form Cigar-2 if you discover any errors or omissions after filing.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form Cigar-2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.