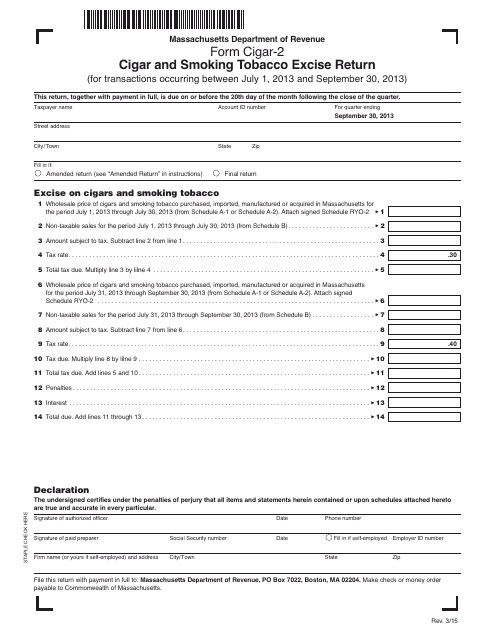

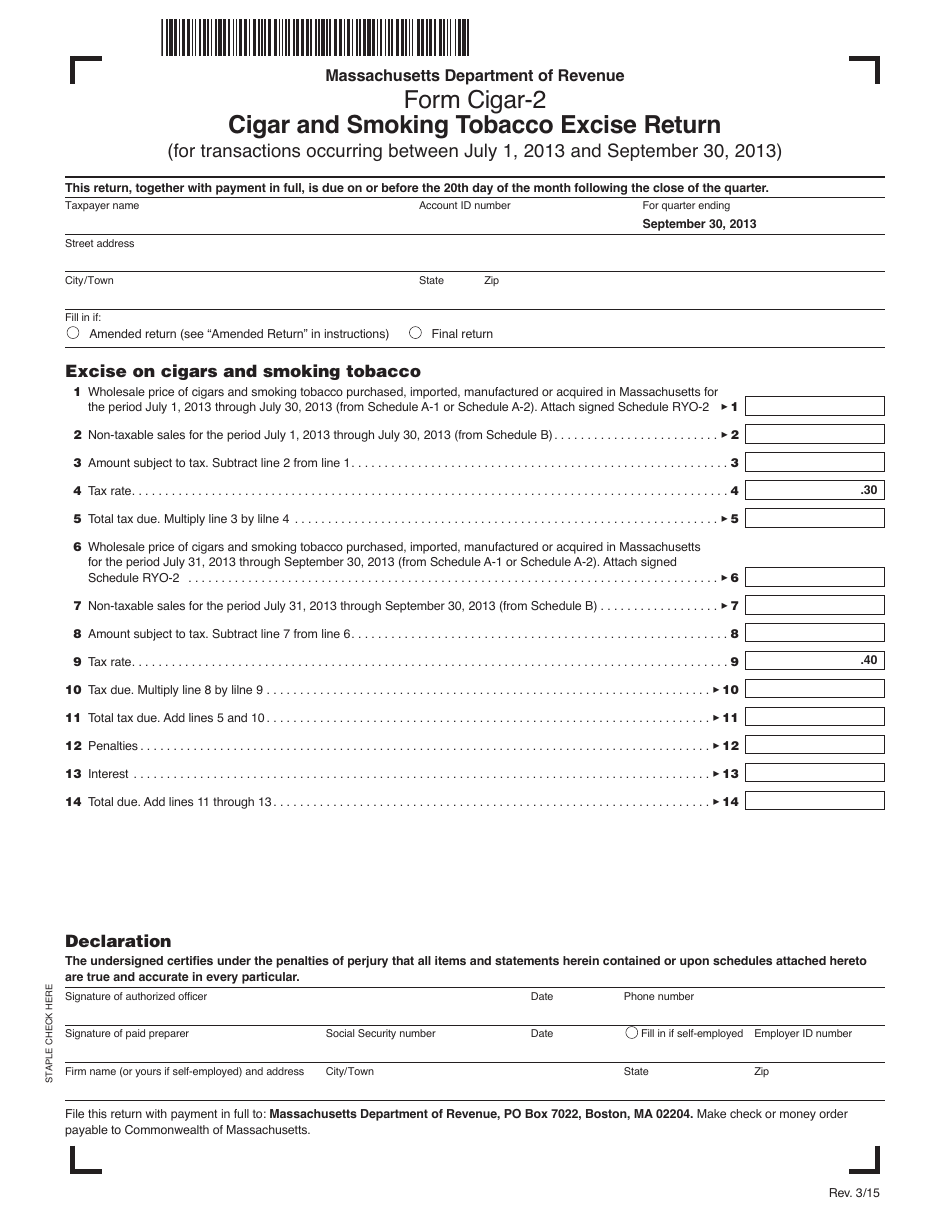

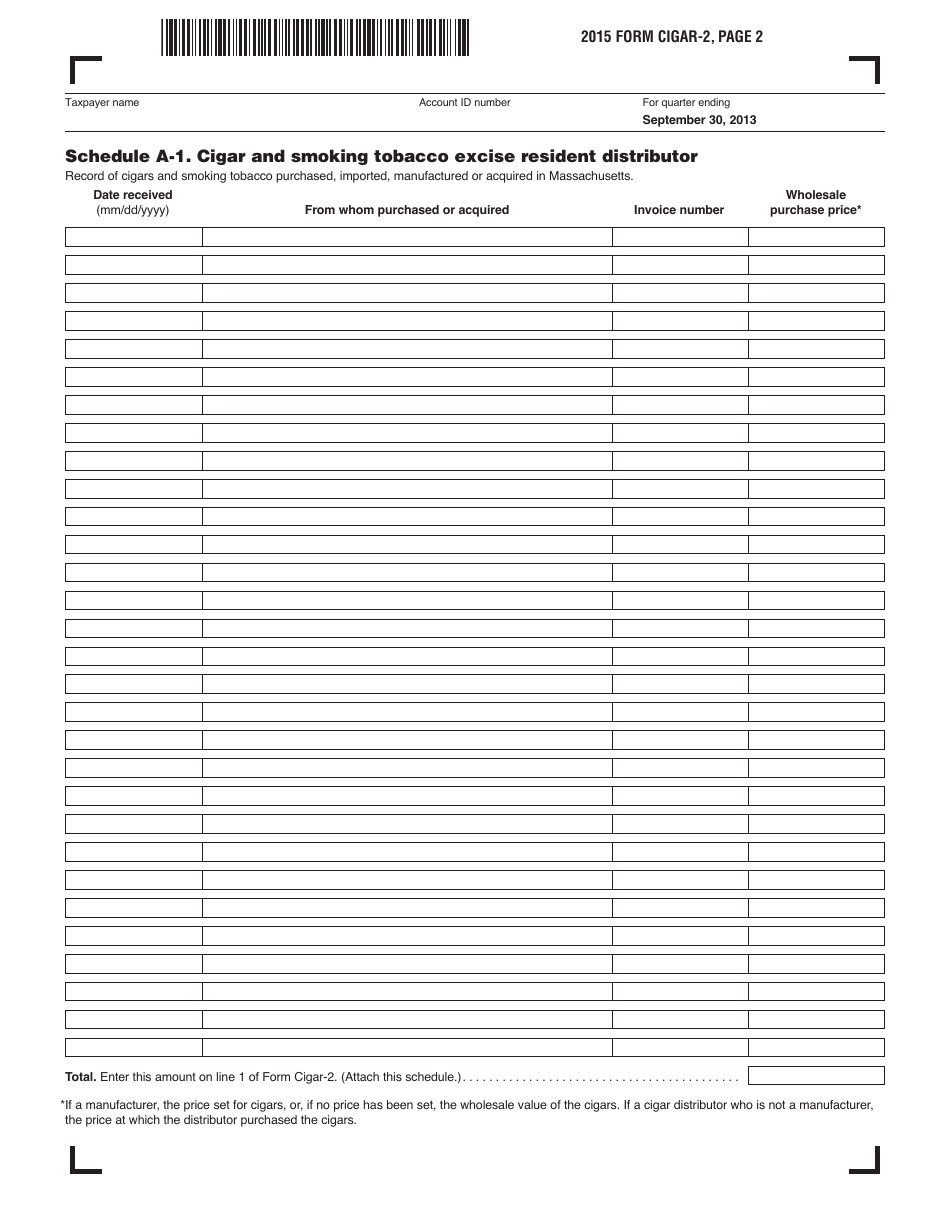

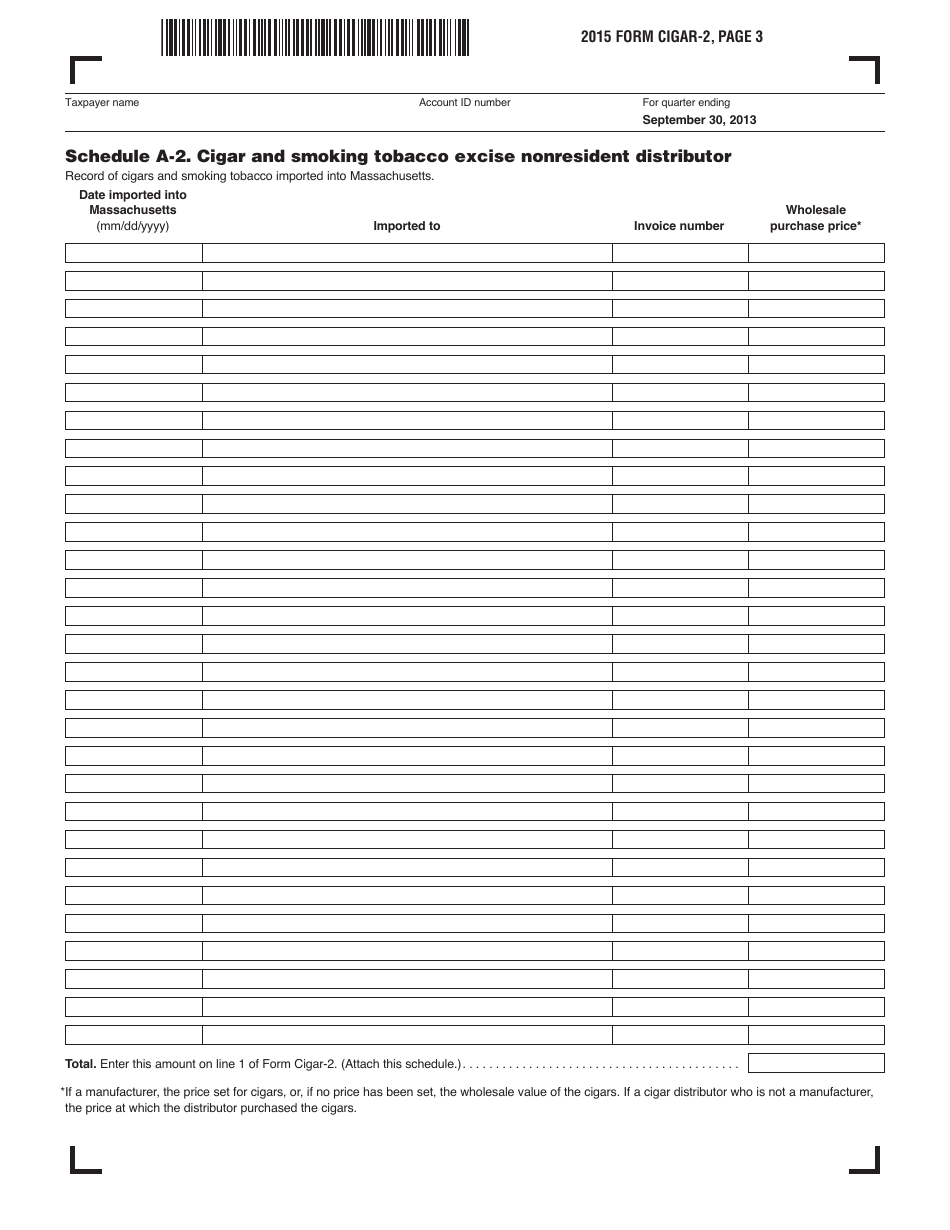

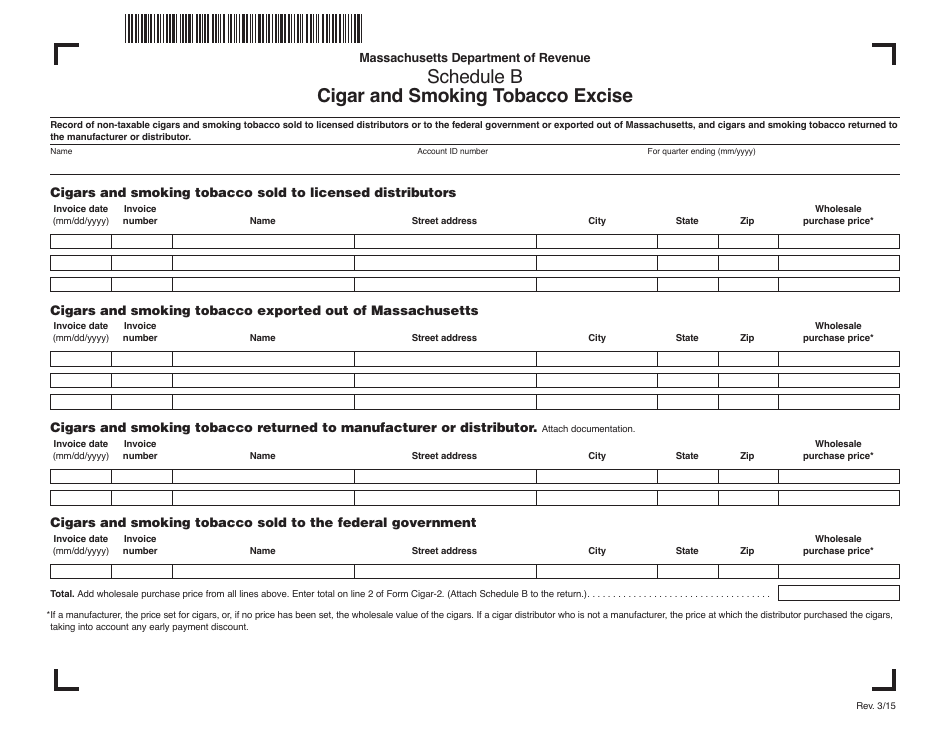

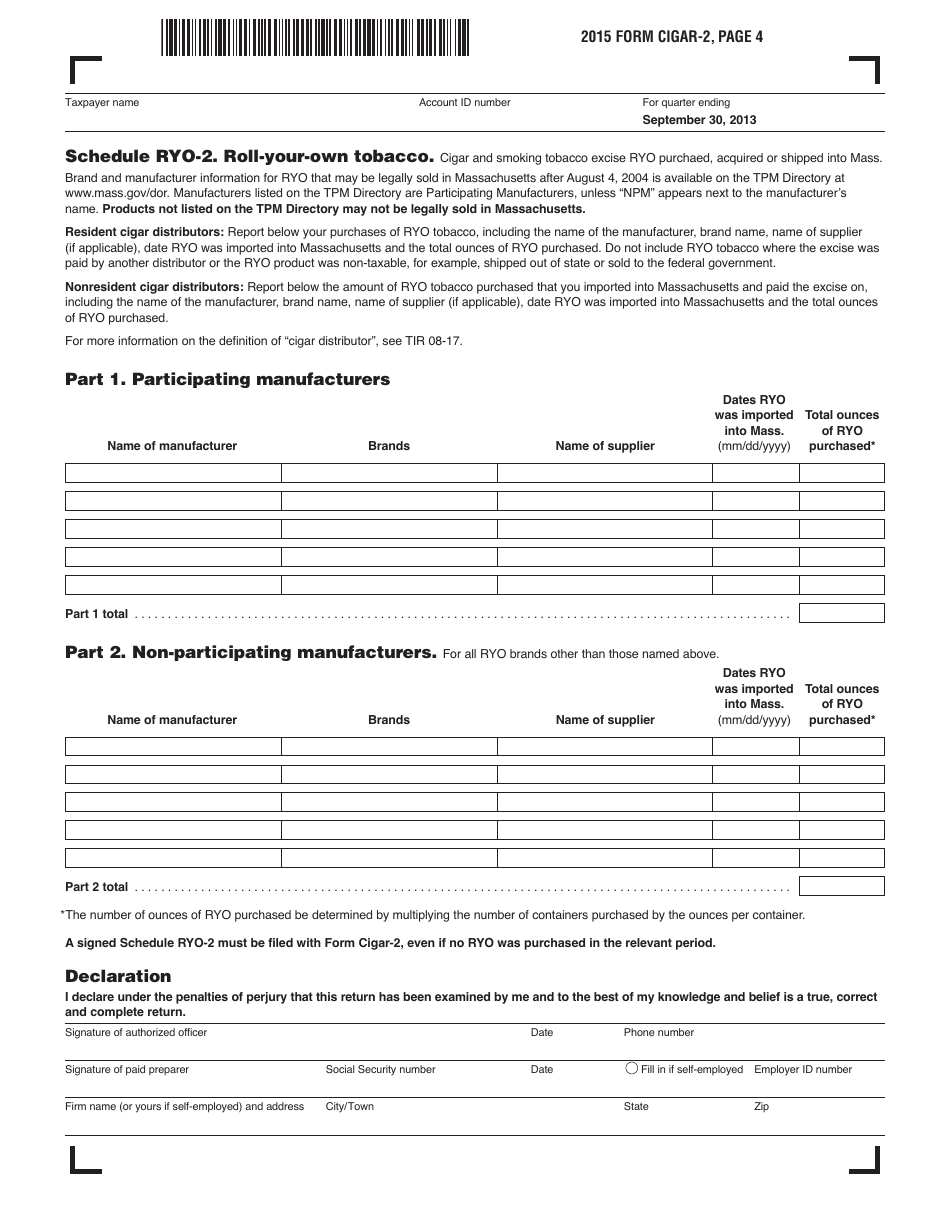

Form Cigar-2 Cigar and Smoking Tobacco Excise Return (July Through September 2013) - Massachusetts

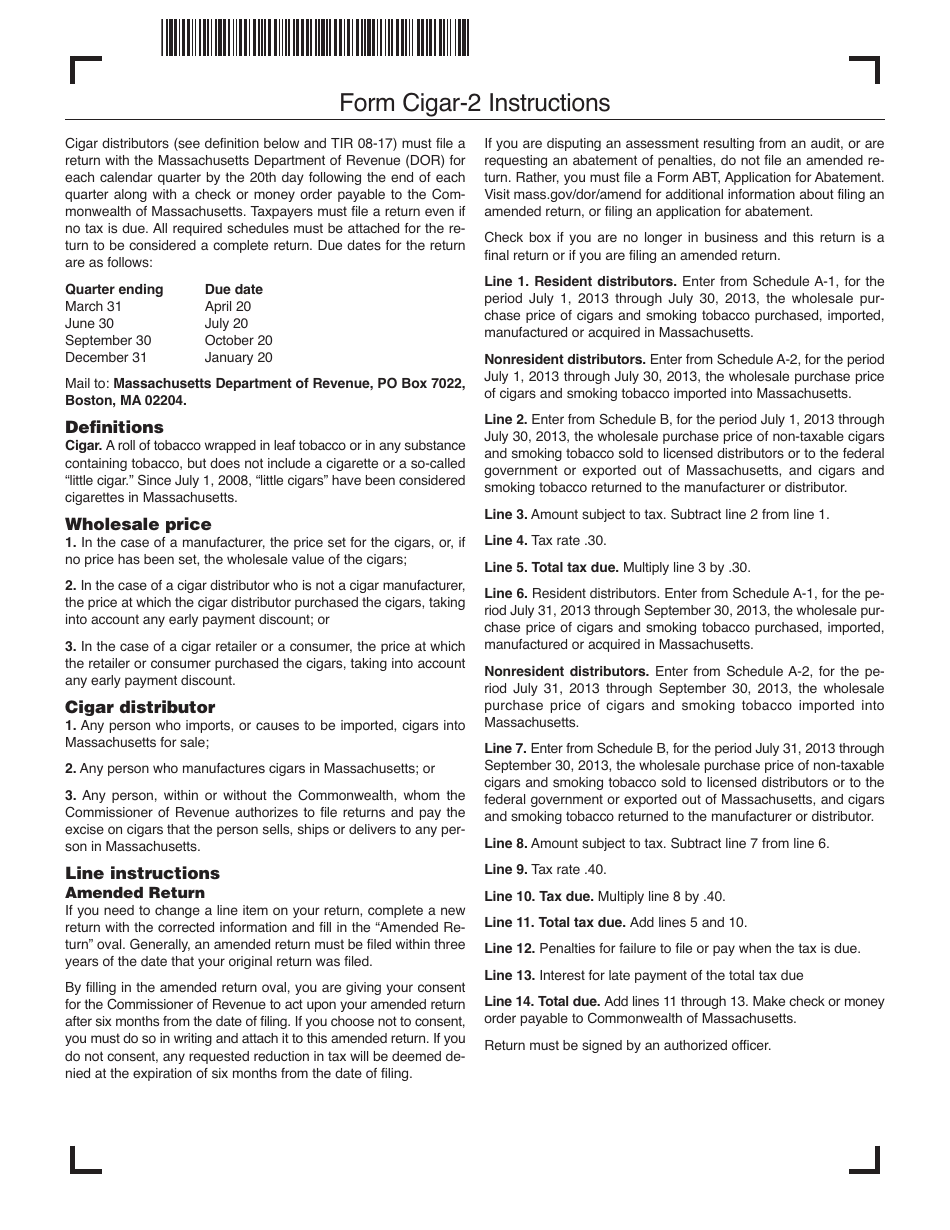

What Is Form Cigar-2?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form Cigar-2?

A: Form Cigar-2 is an excise tax return for cigar and smoking tobacco in Massachusetts.

Q: When is the Form Cigar-2 filed?

A: The Form Cigar-2 is filed for the period from July through September 2013.

Q: What is the purpose of Form Cigar-2?

A: The purpose of Form Cigar-2 is to report and pay the excise tax on cigars and smoking tobacco.

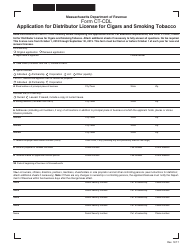

Q: Who is required to file Form Cigar-2?

A: Individuals or businesses engaged in the sale of cigars or smoking tobacco in Massachusetts are required to file Form Cigar-2.

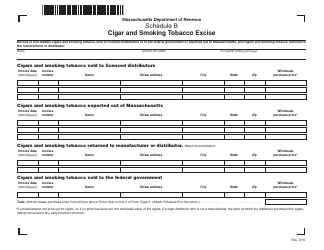

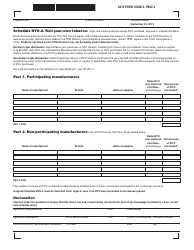

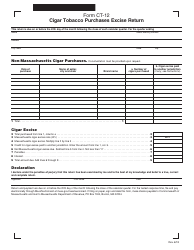

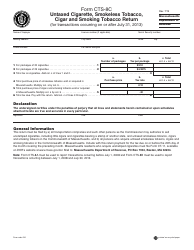

Q: What information is required on Form Cigar-2?

A: Form Cigar-2 requires information such as sales of cigars and smoking tobacco, tax rates, and calculations of the excise tax due.

Q: When is the deadline to file Form Cigar-2?

A: The deadline to file Form Cigar-2 for the period from July through September 2013 is typically the last day of the following month.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form Cigar-2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.