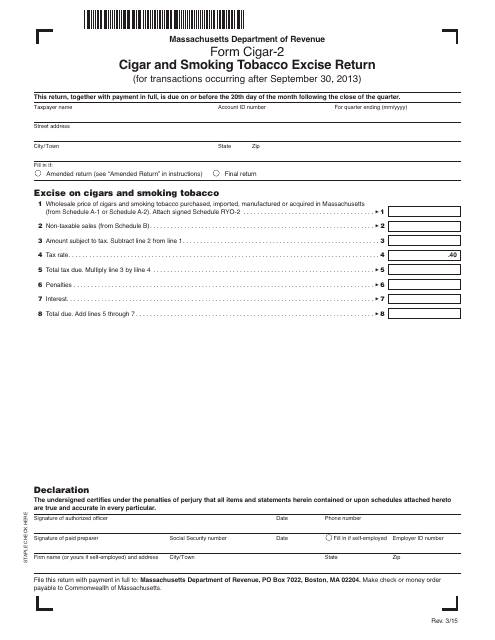

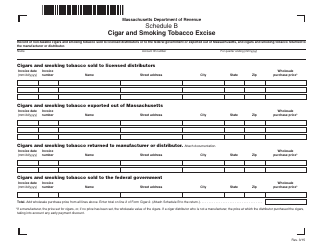

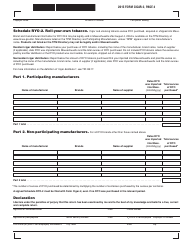

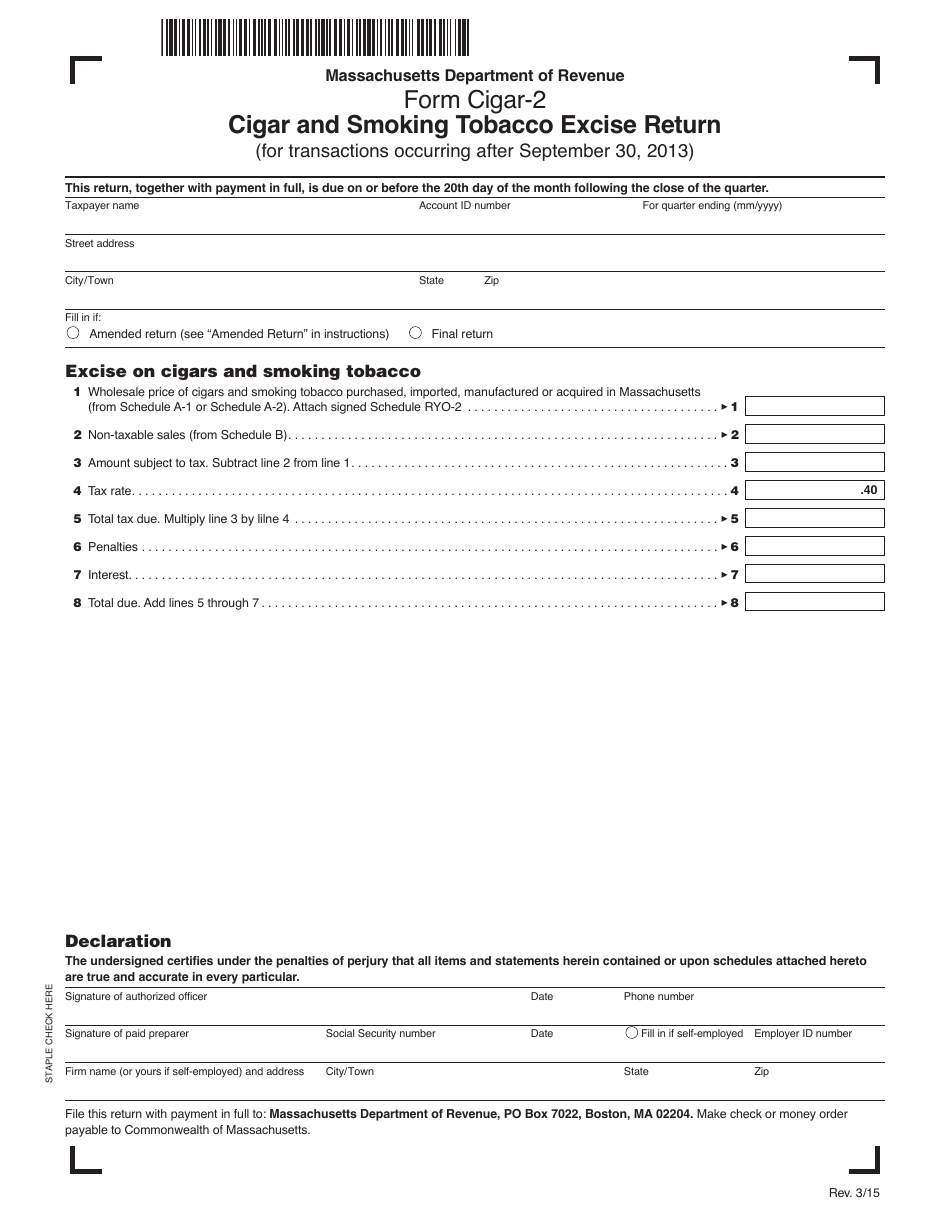

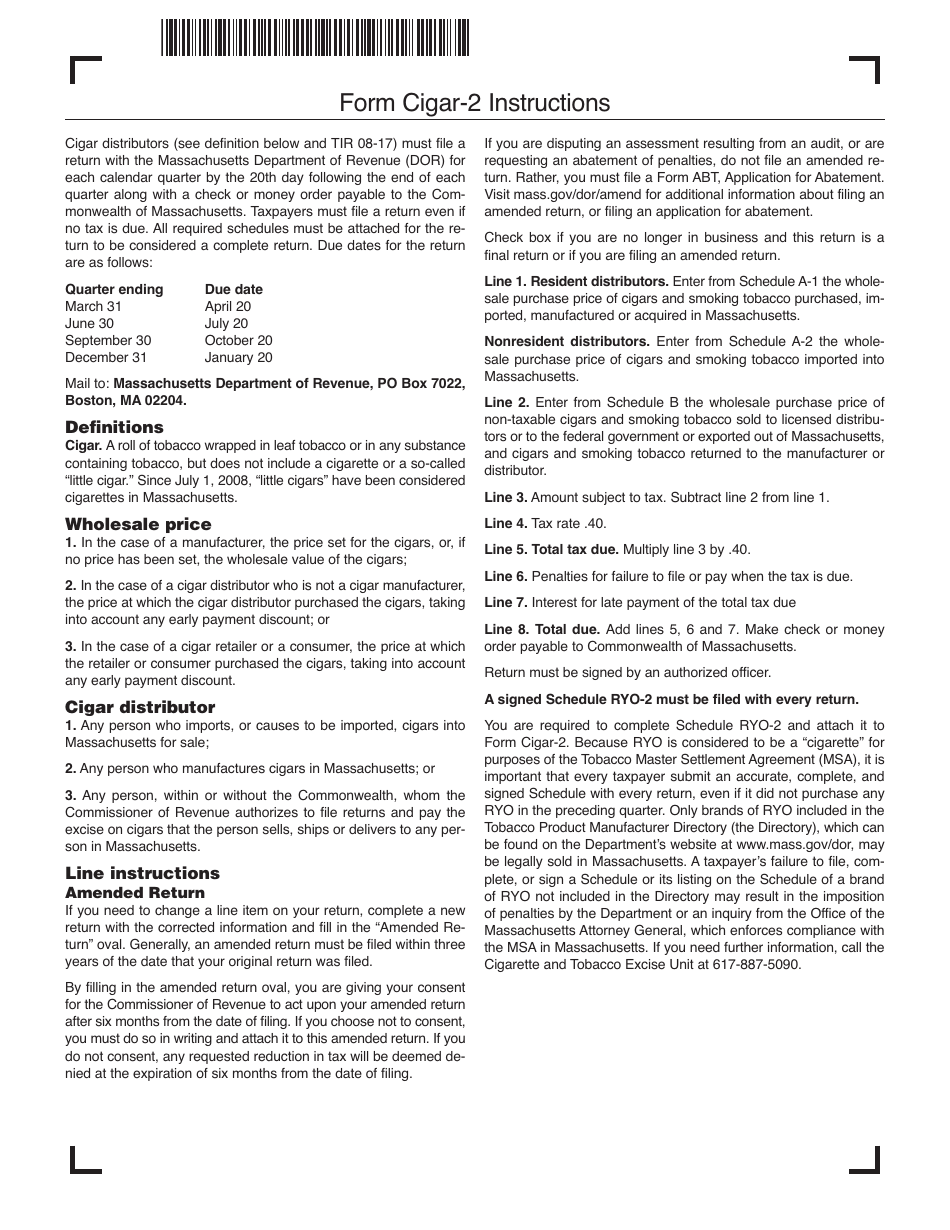

Form Cigar-2 Cigar and Smoking Tobacco Excise Return (For Transactions Occurring After September 30, 2013) - Massachusetts

What Is Form Cigar-2?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form Cigar-2?

A: Form Cigar-2 is a Cigar and Smoking Tobacco Excise Return for transactions occurring after September 30, 2013 in Massachusetts.

Q: Who needs to file Form Cigar-2?

A: Any individual or business that sells cigars or smoking tobacco in Massachusetts after September 30, 2013 needs to file Form Cigar-2.

Q: When should Form Cigar-2 be filed?

A: Form Cigar-2 should be filed regularly for transactions occurring after September 30, 2013 in Massachusetts.

Q: What is the purpose of Form Cigar-2?

A: Form Cigar-2 is used to report and pay the excise tax on cigar and smoking tobacco sales in Massachusetts.

Q: How do I file Form Cigar-2?

A: Form Cigar-2 can be filed electronically or by mail.

Q: Are there any penalties for not filing Form Cigar-2?

A: Yes, there are penalties for not filing Form Cigar-2, including interest and fines.

Q: Can I get an extension to file Form Cigar-2?

A: Yes, you can request an extension to file Form Cigar-2 by contacting the Massachusetts Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form Cigar-2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.