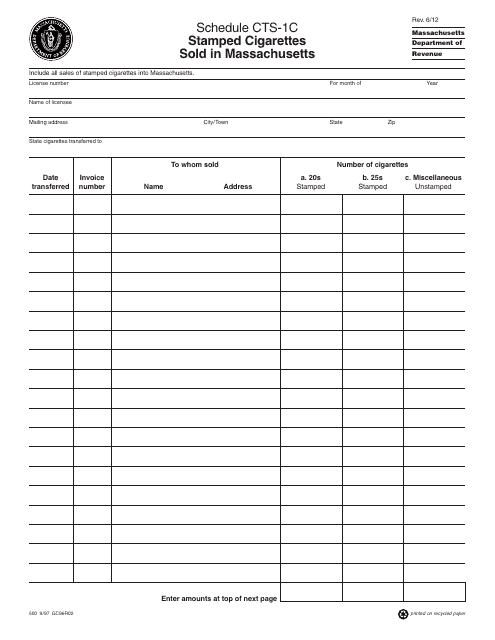

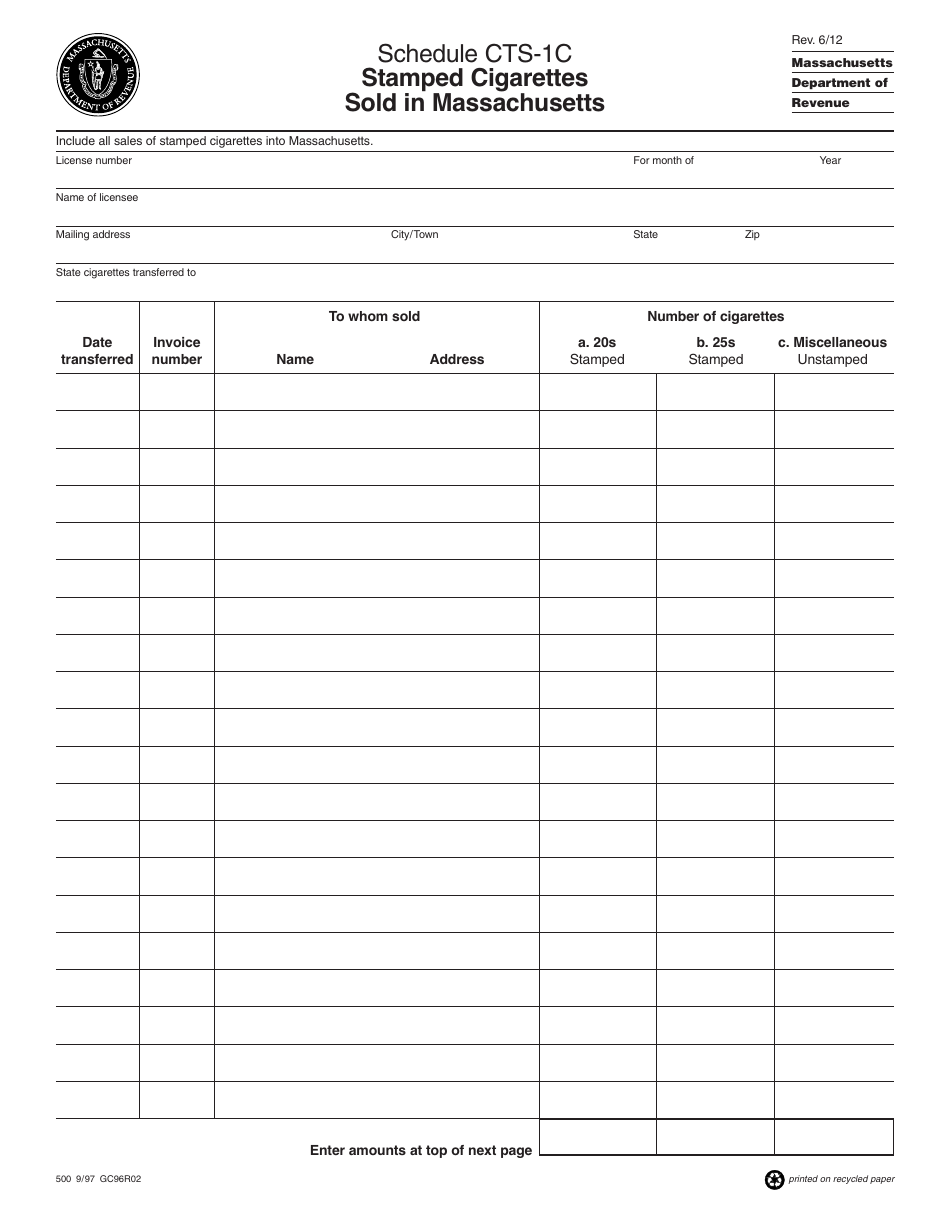

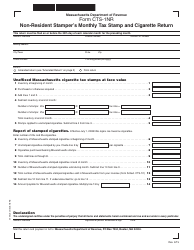

Form CTS-1C Schedule CTS-1C Stamped Cigarettes Sold in Massachusetts - Massachusetts

What Is Form CTS-1C Schedule CTS-1C?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

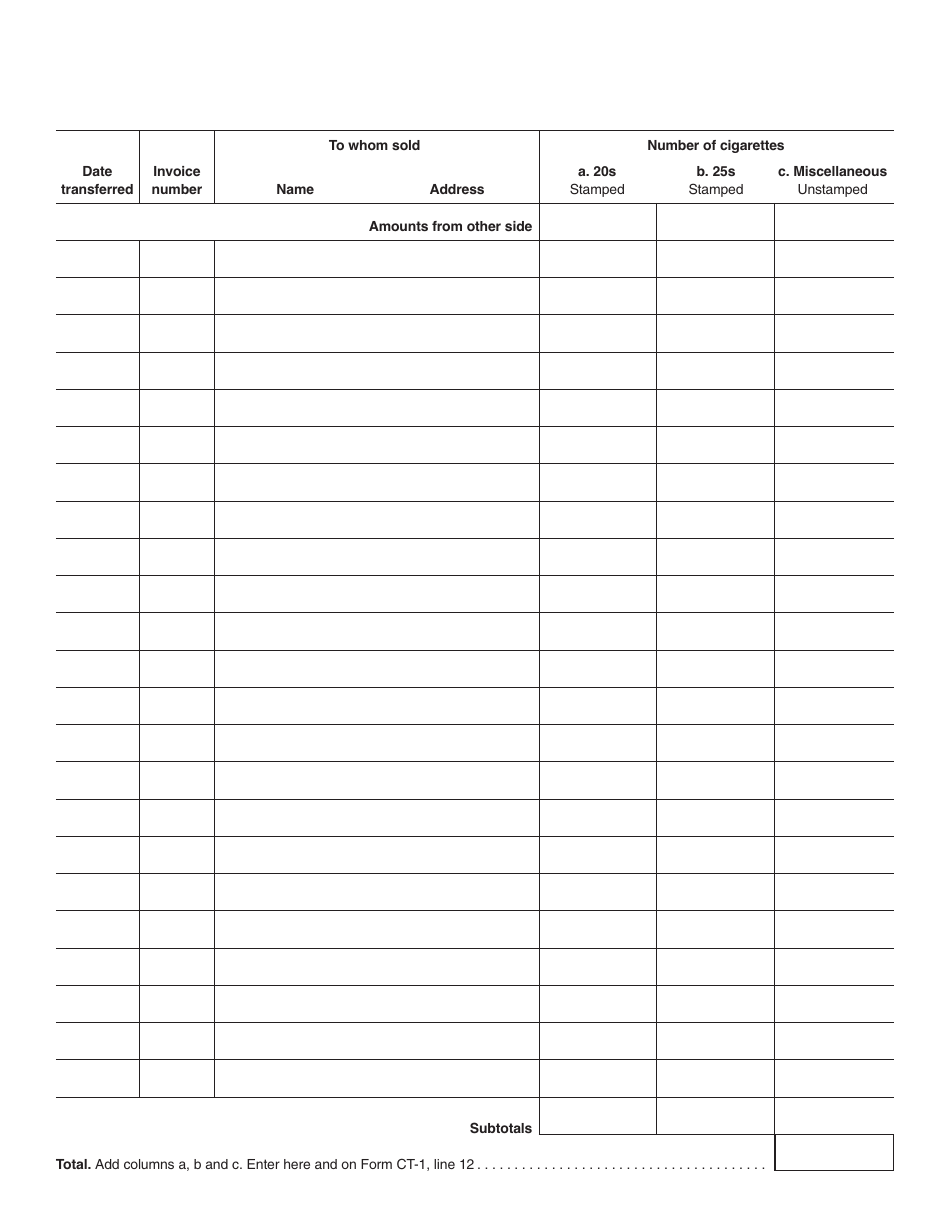

Q: What is Form CTS-1C?

A: Form CTS-1C is a schedule used to report stamped cigarettes sold in Massachusetts.

Q: What is Schedule CTS-1C?

A: Schedule CTS-1C is a form used to report the sale of stamped cigarettes in Massachusetts.

Q: Who needs to file Form CTS-1C?

A: Anyone who sells stamped cigarettes in Massachusetts needs to file Form CTS-1C.

Q: What information is required on Form CTS-1C?

A: Form CTS-1C requires information such as the number of stamped cigarettes sold and the total sales amount.

Q: When is Form CTS-1C due?

A: Form CTS-1C is due by the 20th day of the month following the end of the reporting period.

Q: Is there a penalty for late filing of Form CTS-1C?

A: Yes, there may be penalties for late filing of Form CTS-1C. It is important to file the form on time.

Q: Are there any exemptions to filing Form CTS-1C?

A: There may be exemptions for certain sellers or circumstances. It is best to consult the official instructions or contact the Massachusetts Department of Revenue for more information.

Q: What happens if I don't file Form CTS-1C?

A: Failure to file Form CTS-1C may result in penalties and potential legal consequences. It is important to comply with the reporting requirements.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CTS-1C Schedule CTS-1C by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.