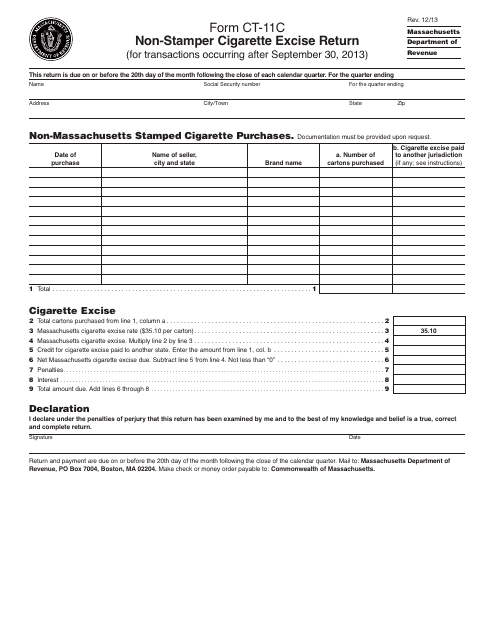

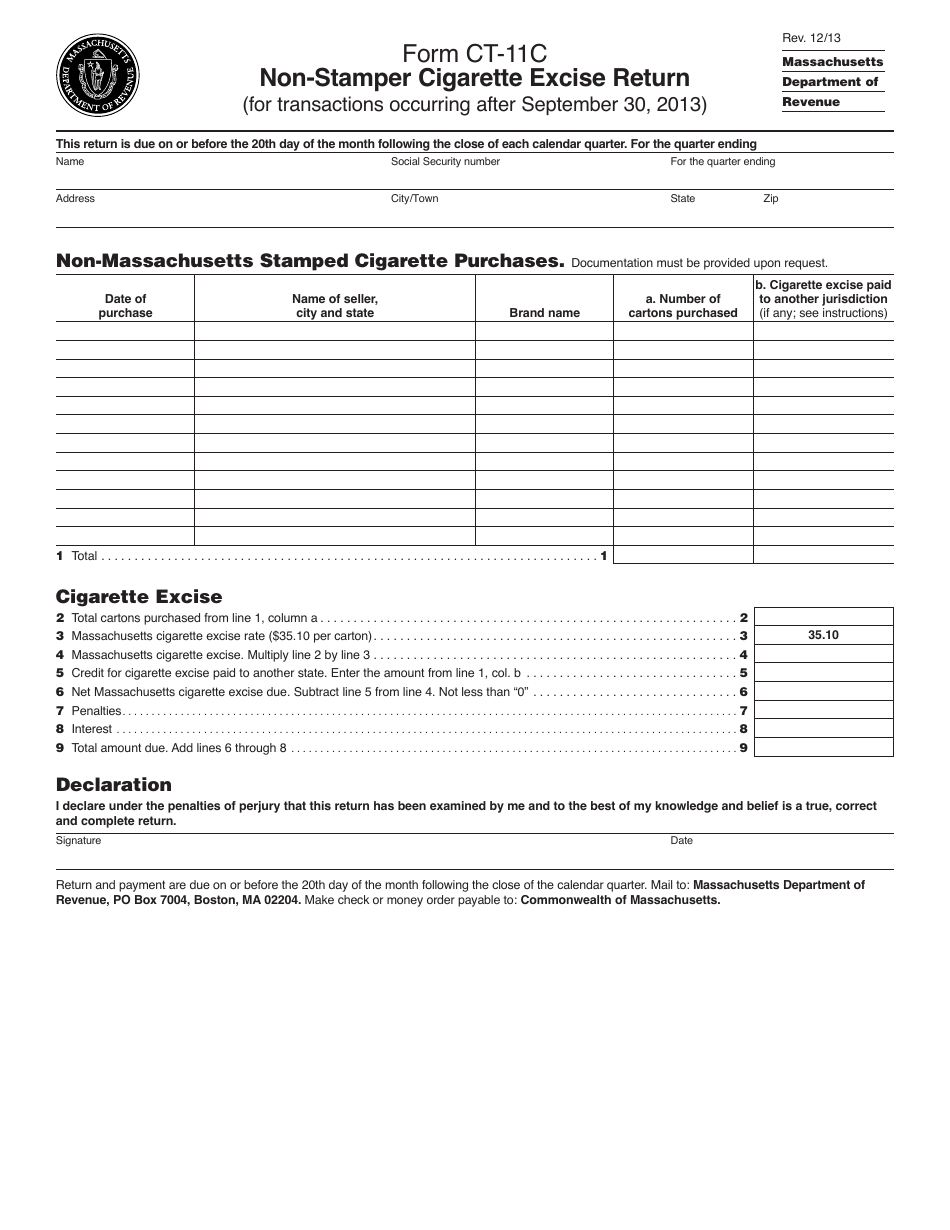

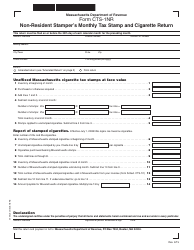

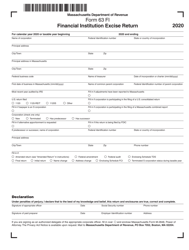

Form CT-11C Non-stamper Cigarette Excise Return - Massachusetts

What Is Form CT-11C?

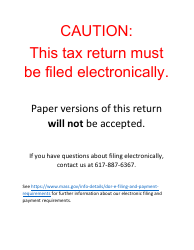

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-11C?

A: Form CT-11C is a Non-stamper Cigarette Excise Return in Massachusetts.

Q: Who needs to file Form CT-11C?

A: Any person engaged in the business of selling cigarettes in Massachusetts who is not a licensed distributor must file Form CT-11C.

Q: What is the purpose of Form CT-11C?

A: Form CT-11C is used to report and pay the cigarette excise tax for non-stamper cigarette sales.

Q: When is Form CT-11C due?

A: Form CT-11C is due on a monthly basis, with the due date being the 20th day of the following month.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-11C by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.