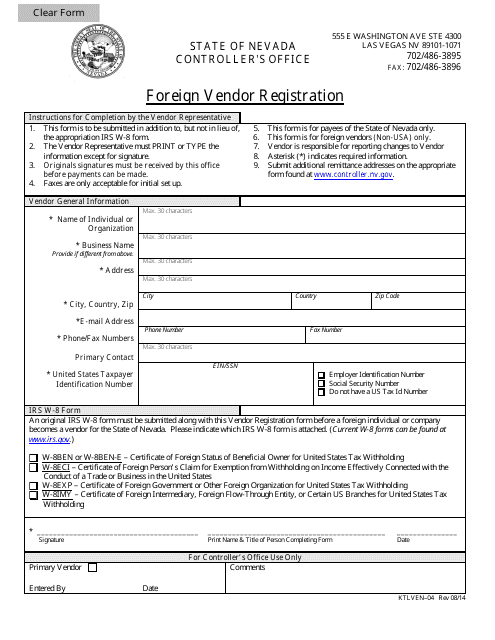

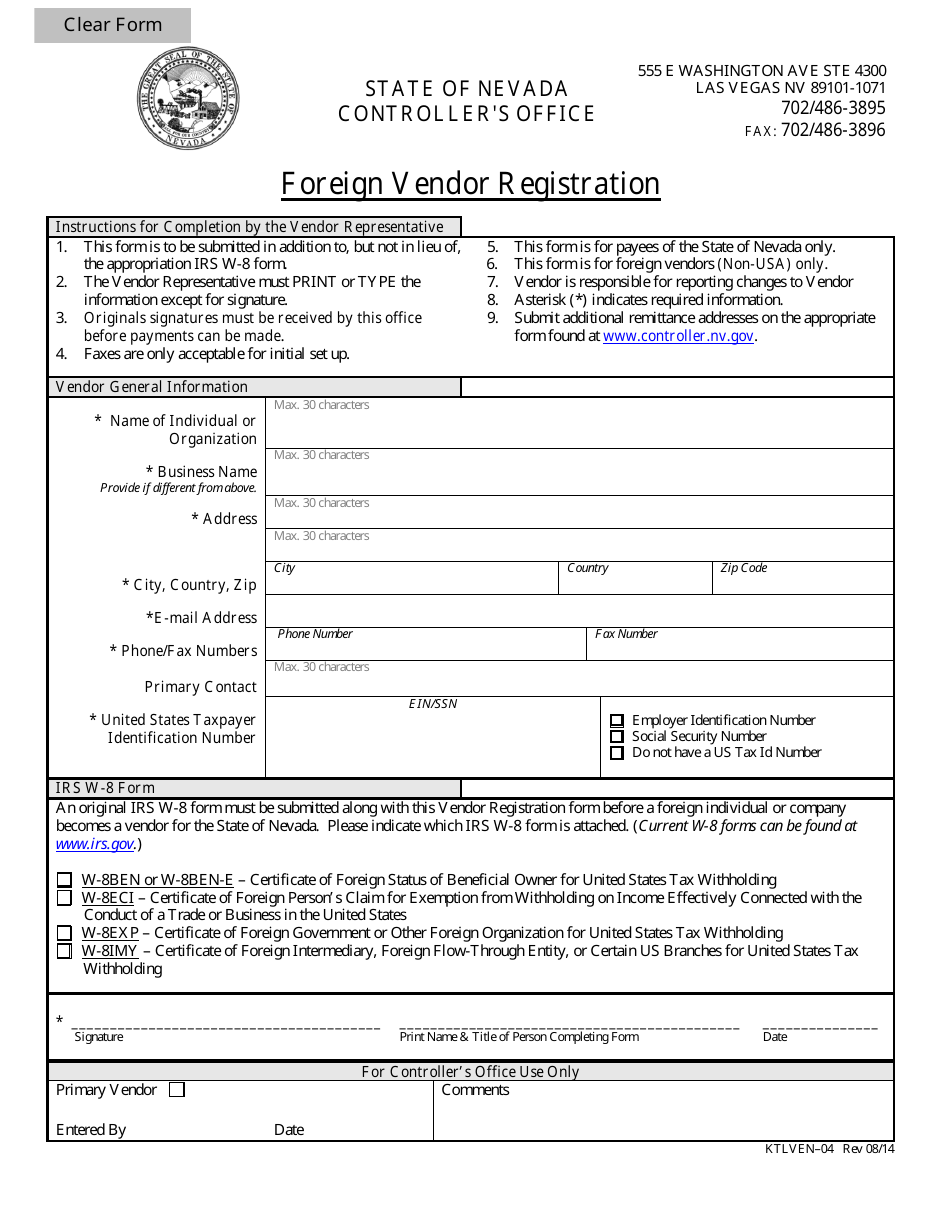

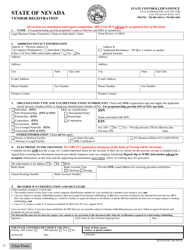

Form KTLVEN-04 Foreign Vendor Registration - Nevada

What Is Form KTLVEN-04?

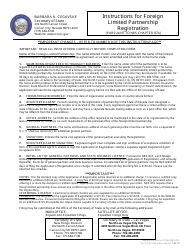

This is a legal form that was released by the Nevada State Controller's Office - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KTLVEN-04?

A: Form KTLVEN-04 is the Foreign Vendor Registration form for Nevada.

Q: Who needs to fill out Form KTLVEN-04?

A: Foreign vendors who wish to do business in Nevada need to fill out Form KTLVEN-04.

Q: What is the purpose of Form KTLVEN-04?

A: The purpose of Form KTLVEN-04 is to register foreign vendors for tax purposes in Nevada.

Q: What information do I need to provide on Form KTLVEN-04?

A: You need to provide information such as your business name, address, contact information, and details about your business activities in Nevada.

Q: Are there any fees associated with filing Form KTLVEN-04?

A: Yes, there are fees associated with filing Form KTLVEN-04. The fee amount may vary, so it's best to check the form or contact the Nevada Department of Taxation for the current fee schedule.

Q: When should I submit Form KTLVEN-04?

A: Form KTLVEN-04 should be submitted before you begin doing business in Nevada.

Q: What happens after I submit Form KTLVEN-04?

A: After you submit Form KTLVEN-04, the Nevada Department of Taxation will review your application and determine if you meet the requirements for foreign vendor registration.

Q: Do I need to renew my foreign vendor registration in Nevada?

A: Yes, foreign vendor registration in Nevada needs to be renewed annually.

Q: What are the consequences of not registering as a foreign vendor in Nevada?

A: Failure to register as a foreign vendor in Nevada can result in penalties and legal consequences.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Nevada State Controller's Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KTLVEN-04 by clicking the link below or browse more documents and templates provided by the Nevada State Controller's Office.