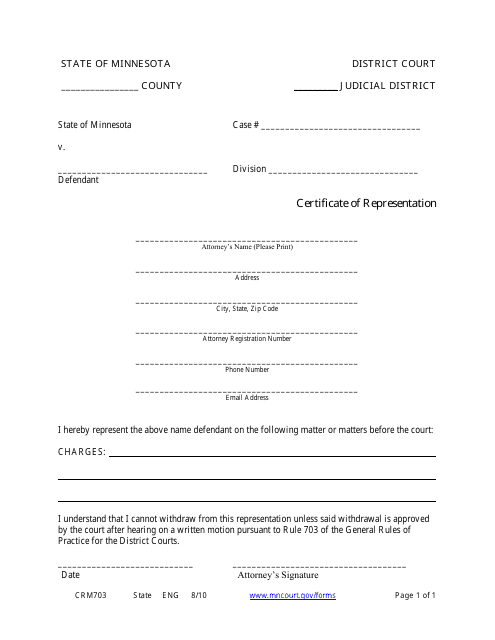

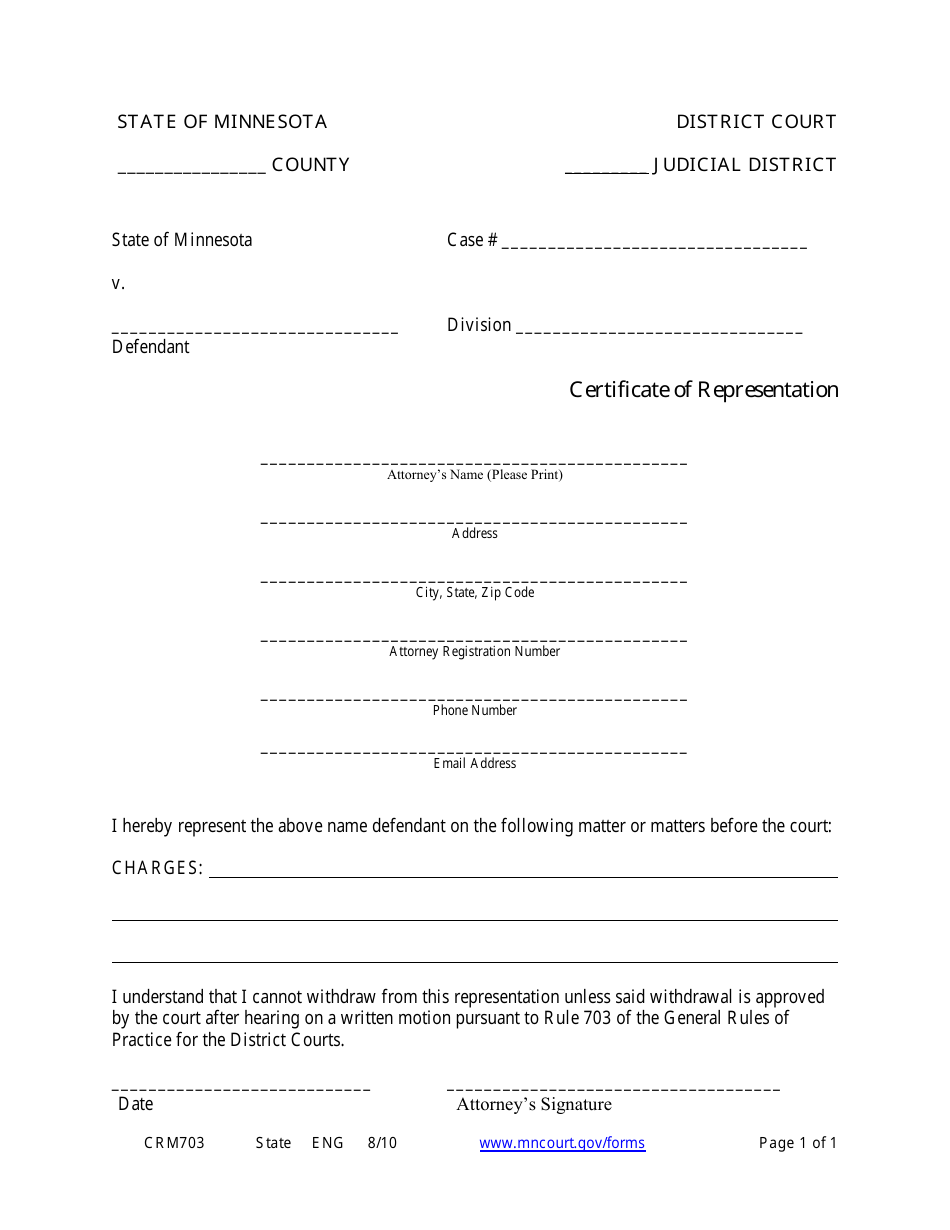

Form CRM703 Certificate of Representation - Minnesota

What Is Form CRM703?

This is a legal form that was released by the Minnesota District Courts - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CRM703 Certificate of Representation?

A: The CRM703 Certificate of Representation is a document used in Minnesota to appoint an authorized representative for tax-related matters.

Q: Who can file a CRM703 Certificate of Representation?

A: Any individual or entity can file a CRM703 Certificate of Representation in Minnesota.

Q: What is the purpose of filing a CRM703 Certificate of Representation?

A: The purpose of filing a CRM703 Certificate of Representation is to authorize someone to act on behalf of the taxpayer in tax-related matters with the Minnesota Department of Revenue.

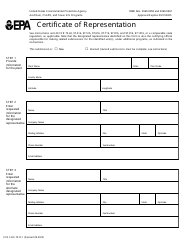

Q: What information is required to complete a CRM703 Certificate of Representation?

A: The CRM703 Certificate of Representation requires the taxpayer's information, the representative's information, and the taxpayer's signature.

Q: Is there a fee to file a CRM703 Certificate of Representation?

A: No, there is no fee to file a CRM703 Certificate of Representation.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Minnesota District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRM703 by clicking the link below or browse more documents and templates provided by the Minnesota District Courts.