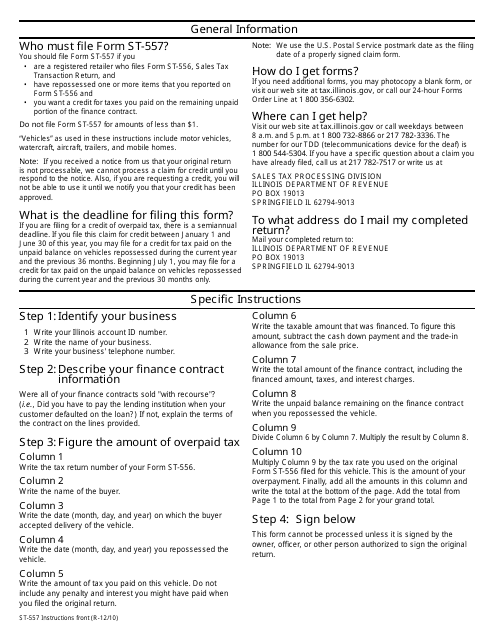

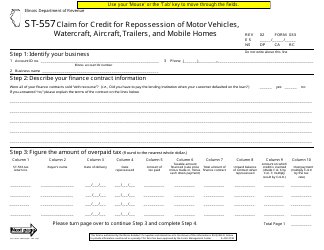

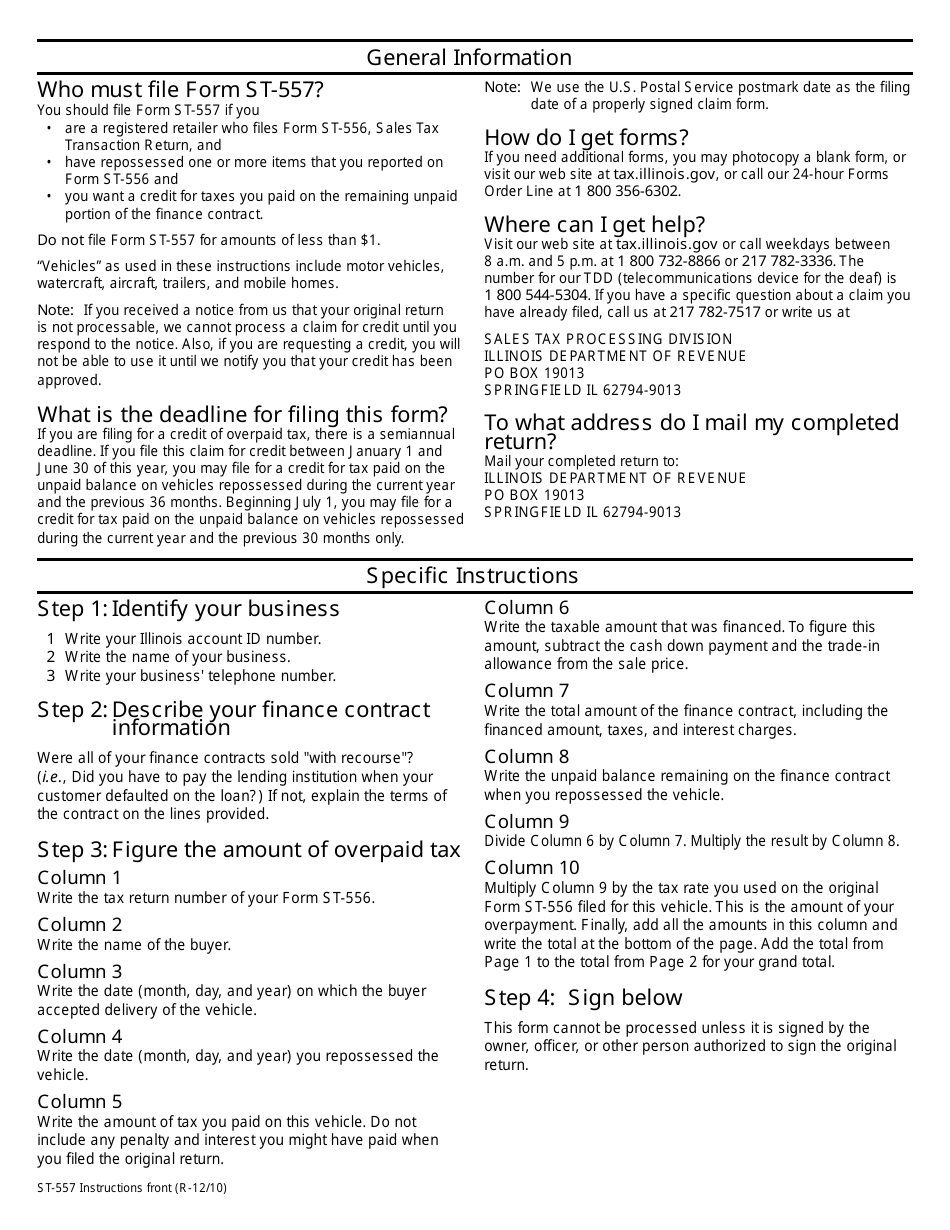

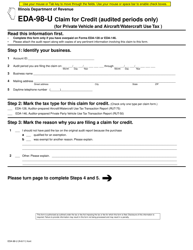

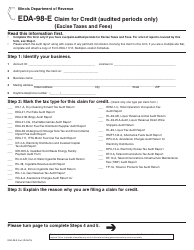

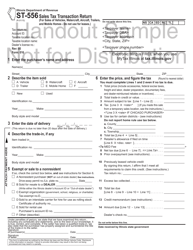

Instructions for Form ST-557, 033 Claim for Credit for Repossession of Motor Vehicles, Watercraft, Aircraft, Trailers, and Mobile Homes - Illinois

This document contains official instructions for Form ST-557 , and Form 033 . Both forms are released and collected by the Illinois Department of Revenue. An up-to-date fillable Form ST-557 (033) is available for download through this link.

FAQ

Q: What is Form ST-557?

A: Form ST-557 is a claim form for credit for repossession of motor vehicles, watercraft, aircraft, trailers, and mobile homes in Illinois.

Q: What can I claim credit for with Form ST-557?

A: You can claim credit for the repossession of motor vehicles, watercraft, aircraft, trailers, and mobile homes in Illinois.

Q: Who is eligible to claim credit with Form ST-557?

A: Individuals, corporations, partnerships, and other entities that have repossessed motor vehicles, watercraft, aircraft, trailers, or mobile homes in Illinois are eligible to claim credit.

Q: What supporting documents do I need to include with Form ST-557?

A: You need to include a copy of the security agreement or contract, a certified copy of the court order or judgment, and any invoices or receipts showing the costs incurred for the repossession.

Q: Is there a deadline for filing Form ST-557?

A: Yes, Form ST-557 must be filed within 12 months after the date the vehicle, watercraft, aircraft, trailer, or mobile home was repossessed.

Q: How long does it take to process Form ST-557?

A: The processing time for Form ST-557 varies, but it may take several weeks to receive a response from the Illinois Department of Revenue.

Q: Can I claim credit for multiple repossessions on one Form ST-557?

A: Yes, you can claim credit for multiple repossessions on one Form ST-557, as long as they were all repossessed in Illinois.

Q: Is there a fee for filing Form ST-557?

A: No, there is no fee for filing Form ST-557.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.