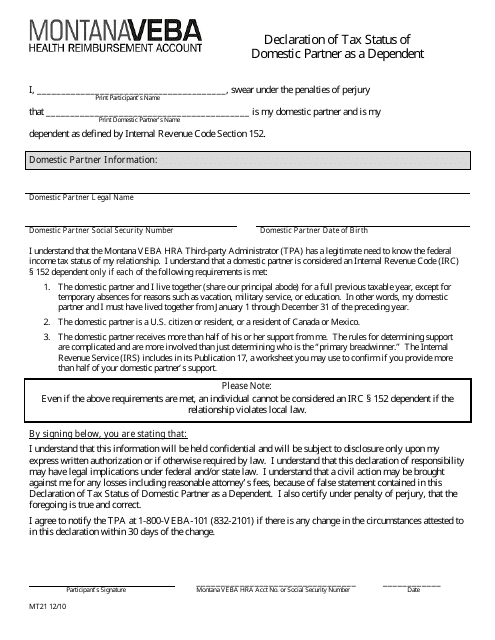

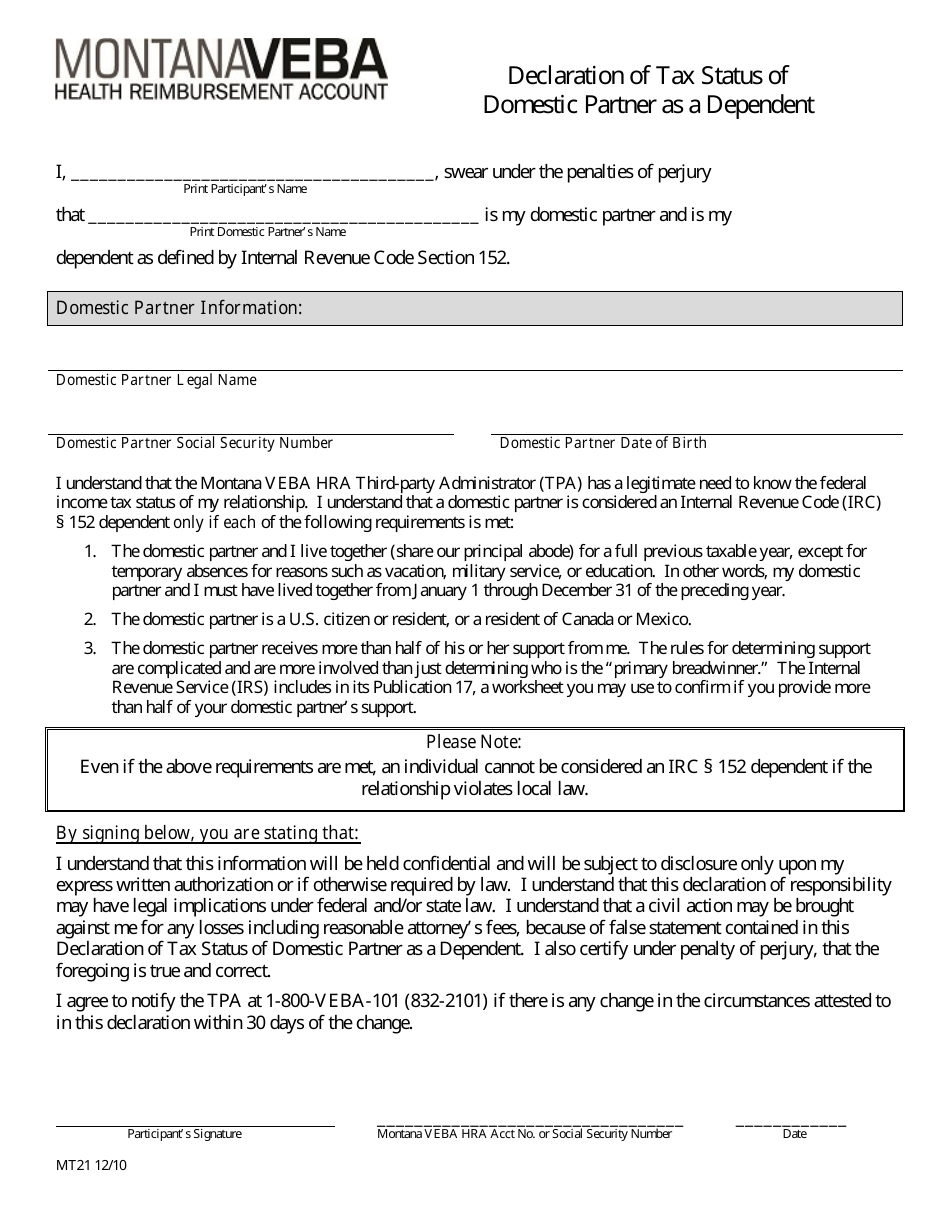

Form MT21 Declaration of Tax Status of Same-Sex Domestic Partner as a Dependent - Montana

What Is Form MT21?

This is a legal form that was released by the Montana Department of Administration - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT21?

A: Form MT21 is the Declaration of Tax Status of Same-Sex Domestic Partner as a Dependent.

Q: Who needs to file Form MT21?

A: This form is for same-sex domestic partners who want to declare their partner as a dependent for tax purposes in Montana.

Q: Why would someone file Form MT21?

A: Filing Form MT21 allows same-sex domestic partners to claim their partner as a dependent and potentially save on taxes.

Q: Are there any eligibility requirements to file Form MT21?

A: Yes, there are eligibility requirements, which can be found in the instructions of Form MT21.

Q: When is the deadline to file Form MT21?

A: The deadline to file Form MT21 is the same as the deadline for filing your Montana state tax return.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Montana Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MT21 by clicking the link below or browse more documents and templates provided by the Montana Department of Administration.