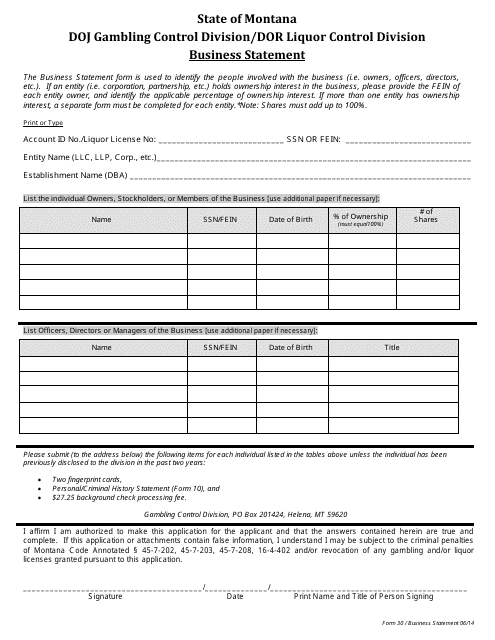

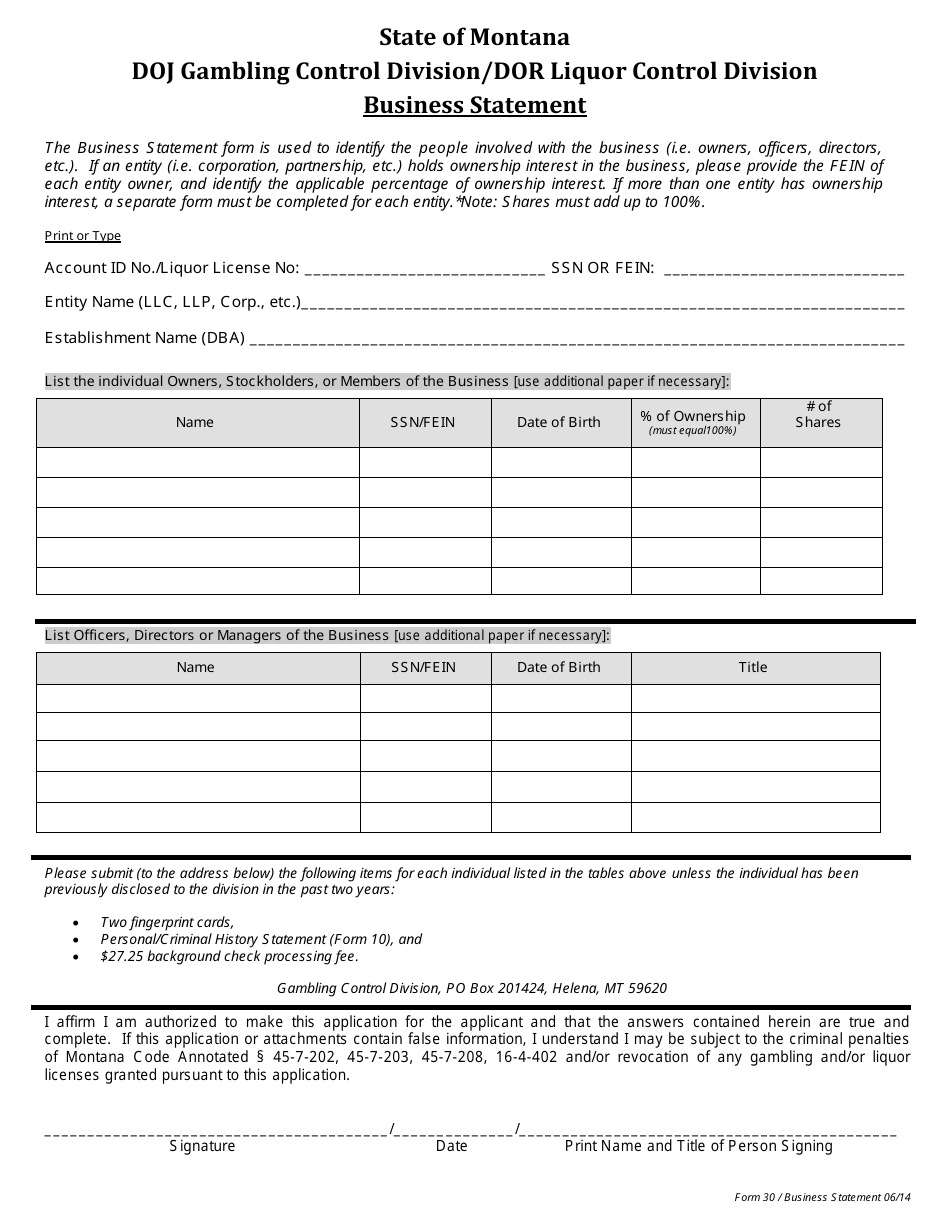

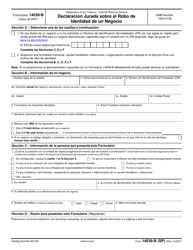

Form 30 Business Statement - Montana

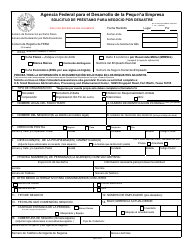

What Is Form 30?

This is a legal form that was released by the Montana Department of Justice - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

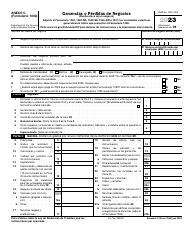

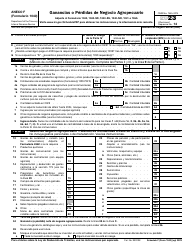

Q: What is a Form 30 Business Statement?

A: Form 30 Business Statement is a document used in Montana to report business income and expenses.

Q: Who needs to file a Form 30 Business Statement?

A: Business owners in Montana who have a net income of $7,800 or more need to file a Form 30 Business Statement.

Q: When is the deadline for filing a Form 30 Business Statement?

A: The deadline for filing a Form 30 Business Statement in Montana is April 15th.

Q: What information do I need to complete a Form 30 Business Statement?

A: You will need to provide information about your business income, expenses, and deductions.

Q: Are there any penalties for not filing a Form 30 Business Statement?

A: Yes, there are penalties for failure to file a Form 30 Business Statement, including late filing penalties and interest charges on any unpaid taxes.

Q: Is a Form 30 Business Statement required for all types of businesses?

A: No, certain types of businesses, such as sole proprietorships with less than $7,800 in net income, are not required to file a Form 30 Business Statement.

Q: Can I amend a filed Form 30 Business Statement?

A: Yes, you can amend a filed Form 30 Business Statement by using the amended return form provided by the Montana Department of Revenue.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Montana Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 30 by clicking the link below or browse more documents and templates provided by the Montana Department of Justice.