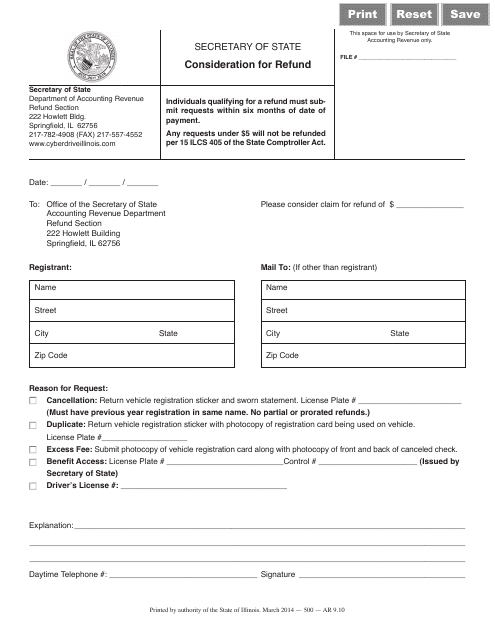

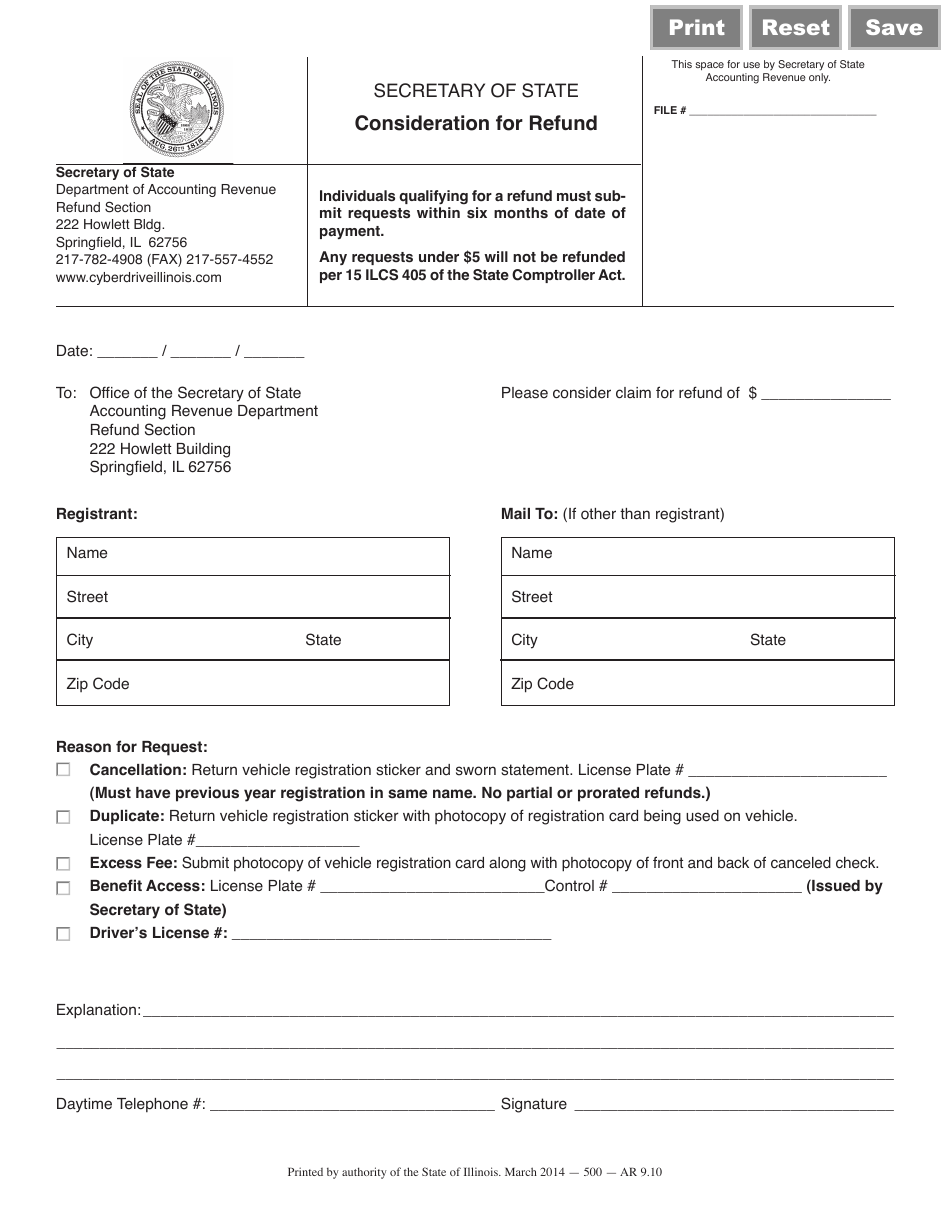

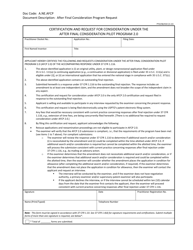

Form AR9.10 Consideration for Refund - Illinois

What Is Form AR9.10?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

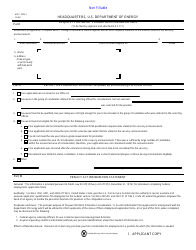

Q: What is Form AR9.10?

A: Form AR9.10 is the Consideration for Refund form specific to the state of Illinois.

Q: What is the purpose of Form AR9.10?

A: The purpose of Form AR9.10 is to request a refund for overpaid taxes in the state of Illinois.

Q: Who needs to fill out Form AR9.10?

A: Anyone who has overpaid taxes in Illinois may need to fill out Form AR9.10 to request a refund.

Q: How long does it take to receive a refund after submitting Form AR9.10?

A: The timeframe for receiving a refund after submitting Form AR9.10 can vary, but it is typically within a few weeks to a few months.

Q: Are there any fees associated with filing Form AR9.10?

A: No, there are no fees associated with filing Form AR9.10.

Q: What should I do if I have questions or need assistance with Form AR9.10?

A: If you have questions or need assistance with Form AR9.10, it is recommended to contact the Illinois Department of Revenue directly.

Q: Can Form AR9.10 be used for refunds in other states?

A: No, Form AR9.10 is specific to refund requests for overpaid taxes in the state of Illinois and cannot be used for refunds in other states.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR9.10 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.