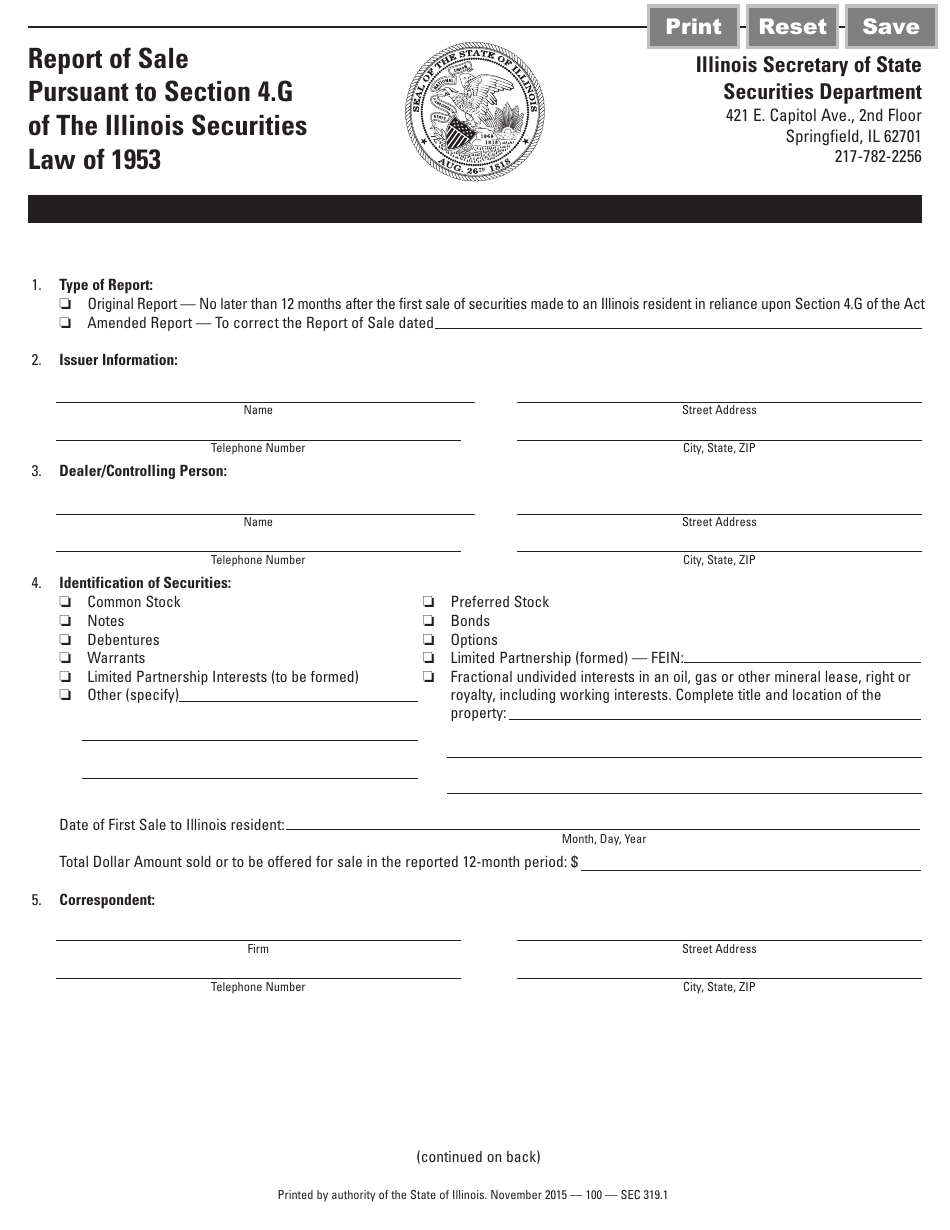

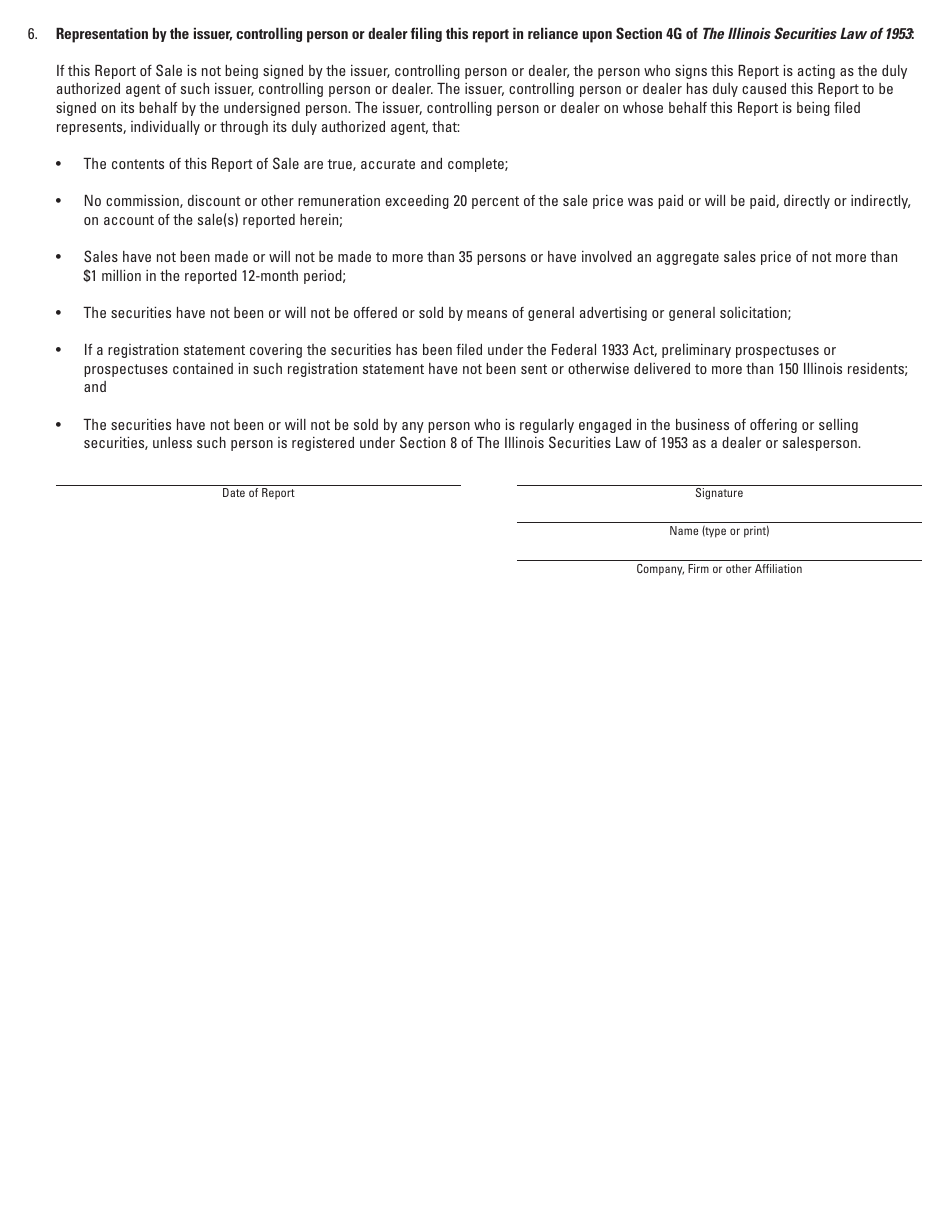

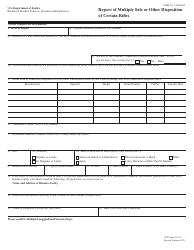

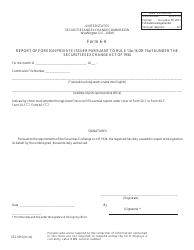

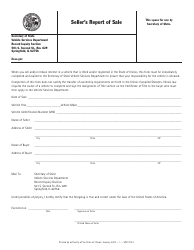

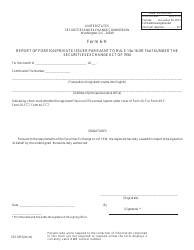

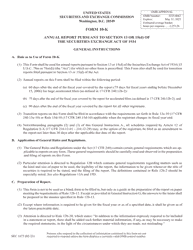

Form SEC319.1 Report of Sale Pursuant to Section 4.g of the Illinois Securities Law of 1953 - Illinois

What Is Form SEC319.1?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEC319.1?

A: Form SEC319.1 is a report of sale that is filed pursuant to Section 4.g of the Illinois Securities Law of 1953.

Q: What is the purpose of Form SEC319.1?

A: The purpose of Form SEC319.1 is to report the sale of securities in compliance with the Illinois Securities Law of 1953.

Q: When should Form SEC319.1 be filed?

A: Form SEC319.1 should be filed within 15 days after the close of the calendar quarter in which the sale of securities occurred.

Q: Who is required to file Form SEC319.1?

A: Any person or entity who sells securities in Illinois and is subject to the Illinois Securities Law of 1953 is required to file Form SEC319.1.

Q: Are there any filing fees for Form SEC319.1?

A: Yes, there are filing fees associated with Form SEC319.1. The fee amount depends on the total value of securities sold.

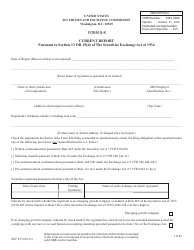

Q: What information is required to be included in Form SEC319.1?

A: Form SEC319.1 requires the disclosure of information such as the names and addresses of the seller and the issuer of the securities, details of the securities being sold, and the terms of the sale.

Q: Is there a deadline for filing Form SEC319.1?

A: Yes, Form SEC319.1 must be filed within 15 days after the close of the calendar quarter in which the sale of securities occurred.

Q: What are the consequences of not filing Form SEC319.1?

A: Failure to file Form SEC319.1 may result in penalties or sanctions imposed by the Illinois Securities Department.

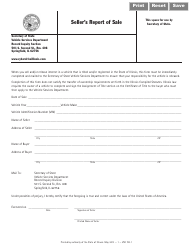

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SEC319.1 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.