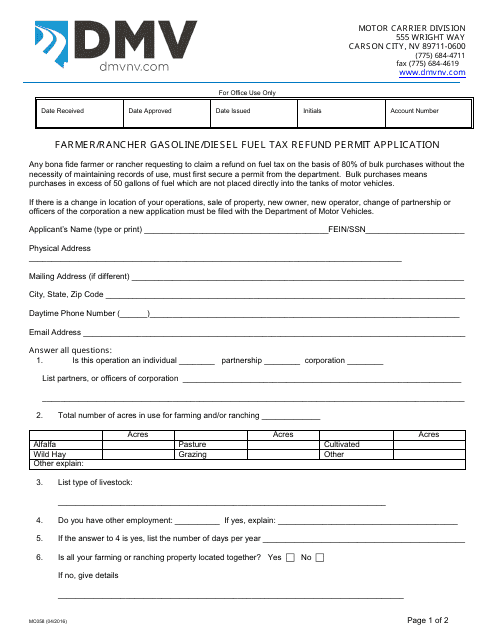

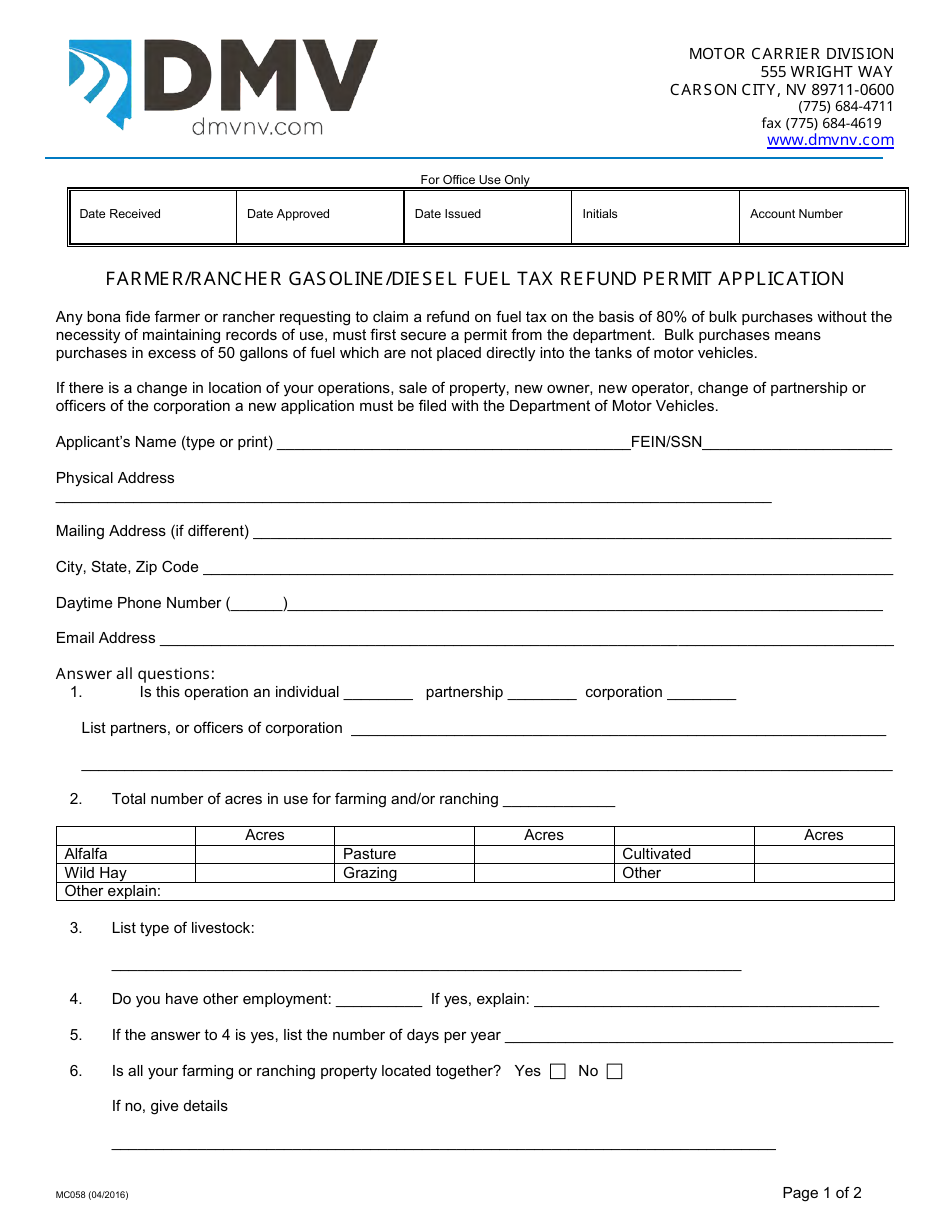

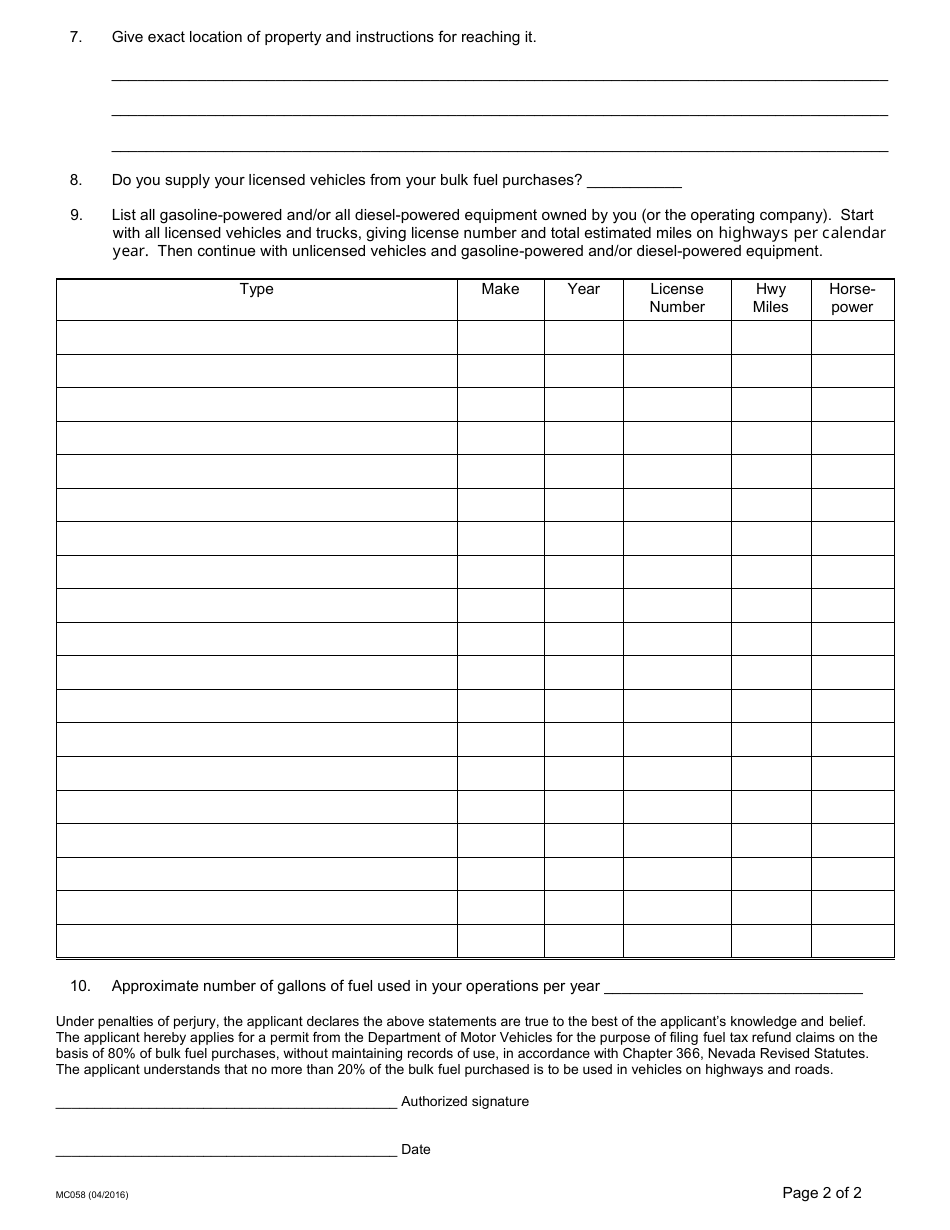

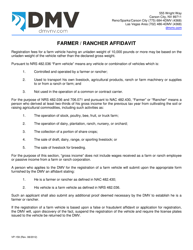

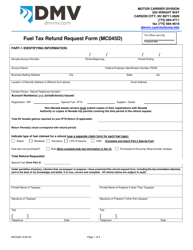

Form MC058 Farmer / Rancher Gasoline / Diesel Fuel Tax Refund Permit Application - Nevada

What Is Form MC058?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MC058?

A: Form MC058 is a Farmer/Rancher Gasoline/Diesel Fuel Tax Refund Permit Application specifically for Nevada.

Q: Who is eligible to use form MC058?

A: Farmers and ranchers in Nevada who purchase gasoline or diesel fuel for non-highway agricultural purposes are eligible to use form MC058.

Q: What is the purpose of form MC058?

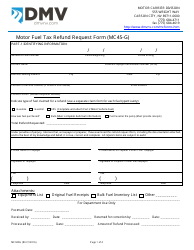

A: The purpose of form MC058 is to apply for a refund of the gasoline and diesel fuel taxes paid by farmers and ranchers in Nevada.

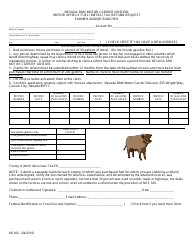

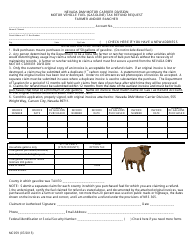

Q: What information do I need to complete form MC058?

A: To complete form MC058, you will need to provide information such as your name, address, and the quantity of gasoline or diesel fuel purchased for non-highway agricultural purposes.

Q: Is there a deadline for submitting form MC058?

A: Yes, form MC058 must be submitted to the Nevada Department of Taxation within one year from the date of purchase of the gasoline or diesel fuel.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC058 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.