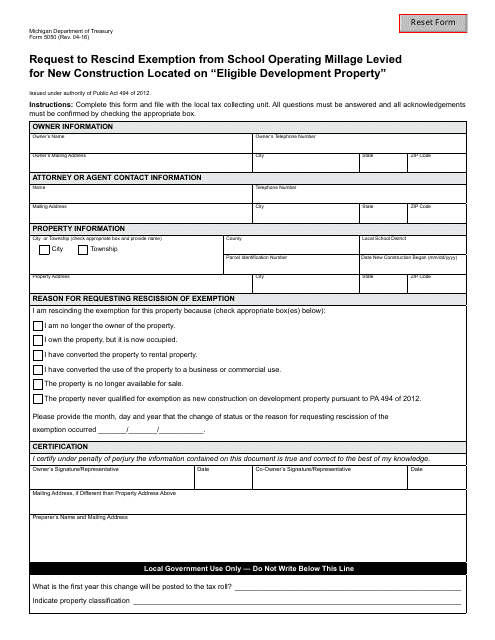

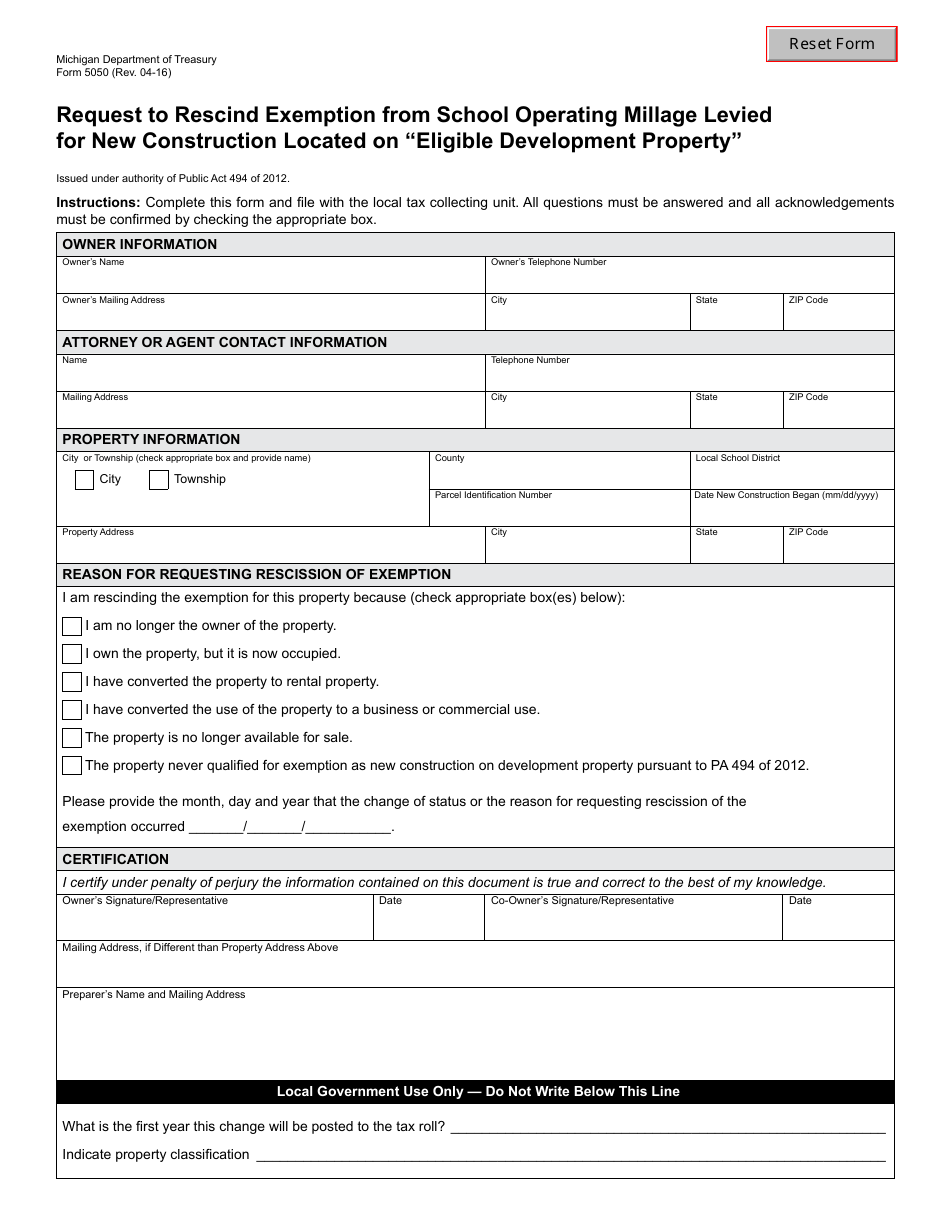

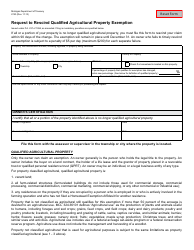

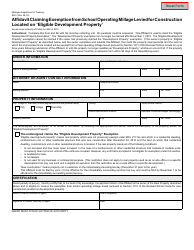

Form 5050 Request to Rescind Exemption From School Operating Millage Levied for New Construction Located on Eligible Development Property - Michigan

What Is Form 5050?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5050?

A: Form 5050 is a request to rescind exemption from school operating millage levied for new construction located on eligible development property.

Q: What is the purpose of Form 5050?

A: The purpose of Form 5050 is to request the rescission of exemption from school operating millage on new construction located on eligible development property in Michigan.

Q: Who needs to fill out Form 5050?

A: Property owners or developers who have received exemption from school operating millage on new construction located on eligible development property in Michigan need to fill out Form 5050.

Q: What information is required on Form 5050?

A: Form 5050 requires information such as the property owner's name, property address, and the reason for requesting rescission of the exemption.

Q: Is there a deadline to submit Form 5050?

A: Yes, Form 5050 must be submitted to the local tax assessor's office within 90 days of the completion of the new construction or within 90 days of the date the property was transferred to a new owner.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5050 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.