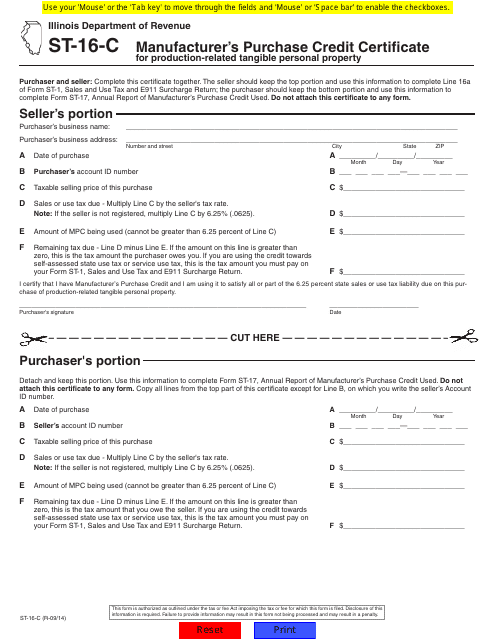

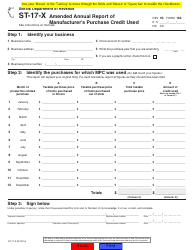

Form ST-16-C Manufacturer's Purchase Credit Certificate for Production-Related Tangible Personal Property - Illinois

What Is Form ST-16-C?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

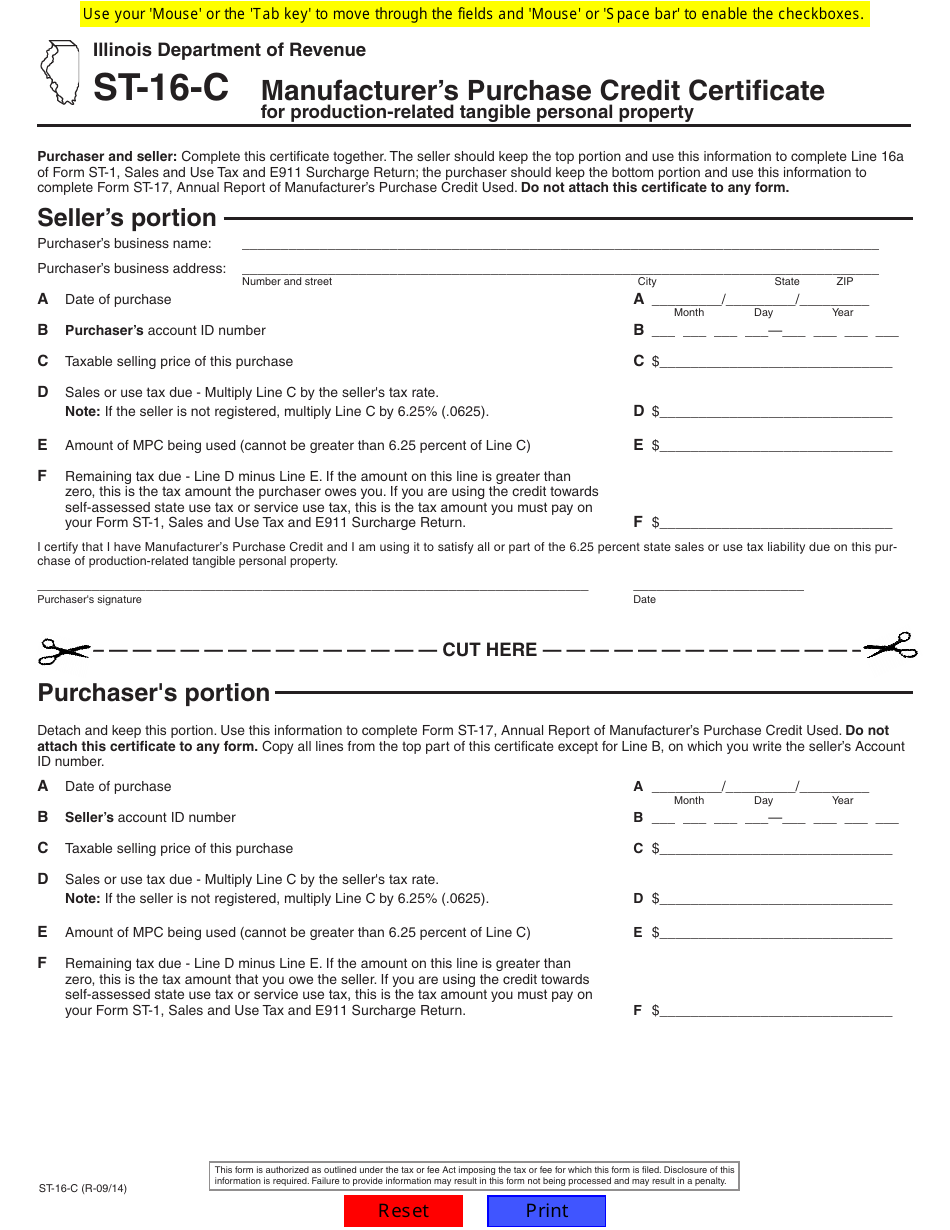

Q: What is Form ST-16-C?

A: Form ST-16-C is a Manufacturer's Purchase Credit Certificate for Production-Related Tangible Personal Property in Illinois.

Q: Who uses Form ST-16-C?

A: Manufacturers use Form ST-16-C in Illinois.

Q: What is the purpose of Form ST-16-C?

A: The purpose of Form ST-16-C is to claim a purchase credit for production-related tangible personal property.

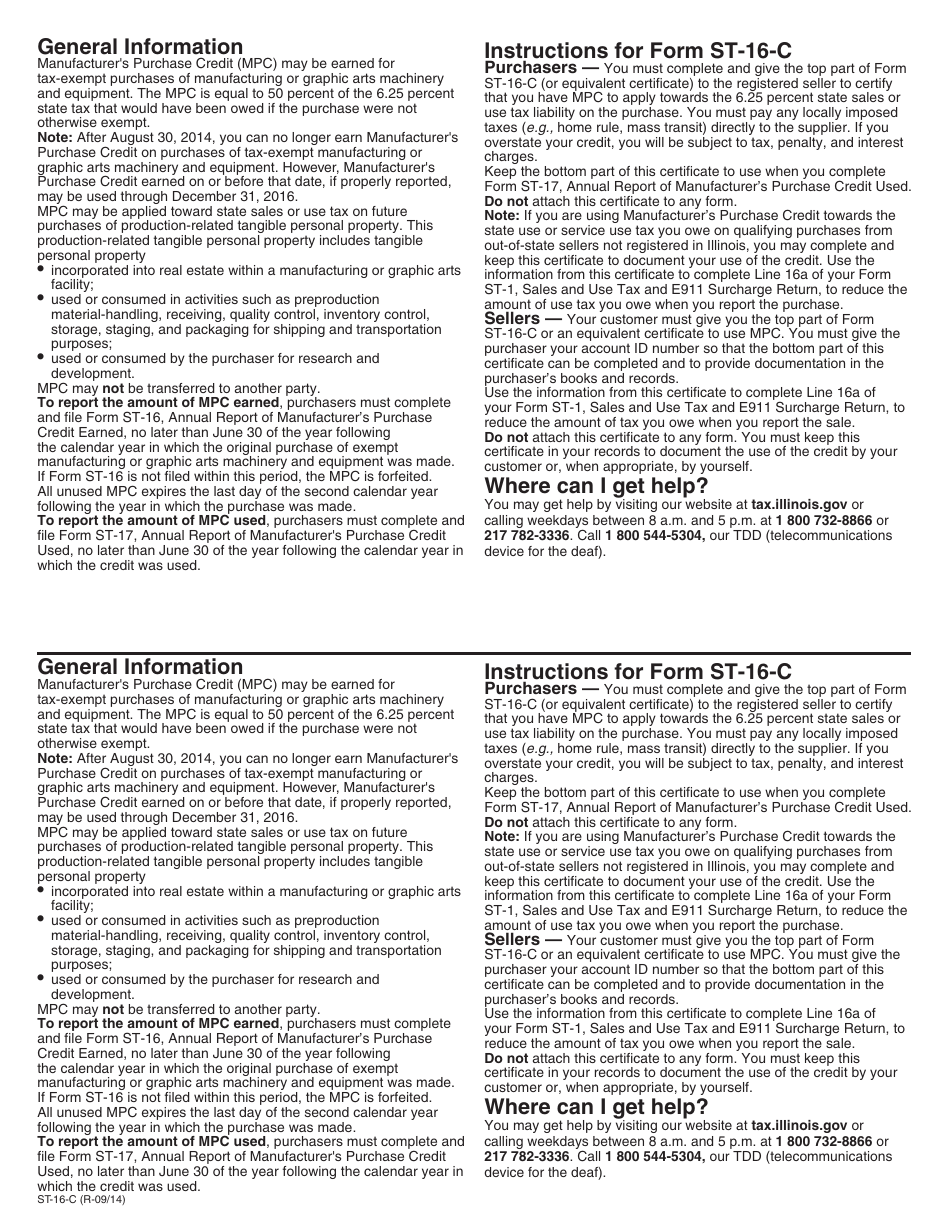

Q: What is production-related tangible personal property?

A: Production-related tangible personal property refers to equipment and supplies used in the manufacturing process.

Q: How do I file Form ST-16-C?

A: Form ST-16-C can be filed electronically or by mail with the Illinois Department of Revenue.

Q: What documentation is required with Form ST-16-C?

A: Supporting documentation such as purchase invoices and receipts must be provided with Form ST-16-C.

Q: Are there any deadlines for filing Form ST-16-C?

A: Yes, Form ST-16-C must be filed within 90 days of the purchase of the production-related tangible personal property.

Q: Can I claim a credit for used equipment on Form ST-16-C?

A: No, Form ST-16-C only allows for the credit on purchases of new production-related tangible personal property.

Q: What happens after filing Form ST-16-C?

A: If approved, a credit certificate will be issued, which can then be used to offset future tax liabilities.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-16-C by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.