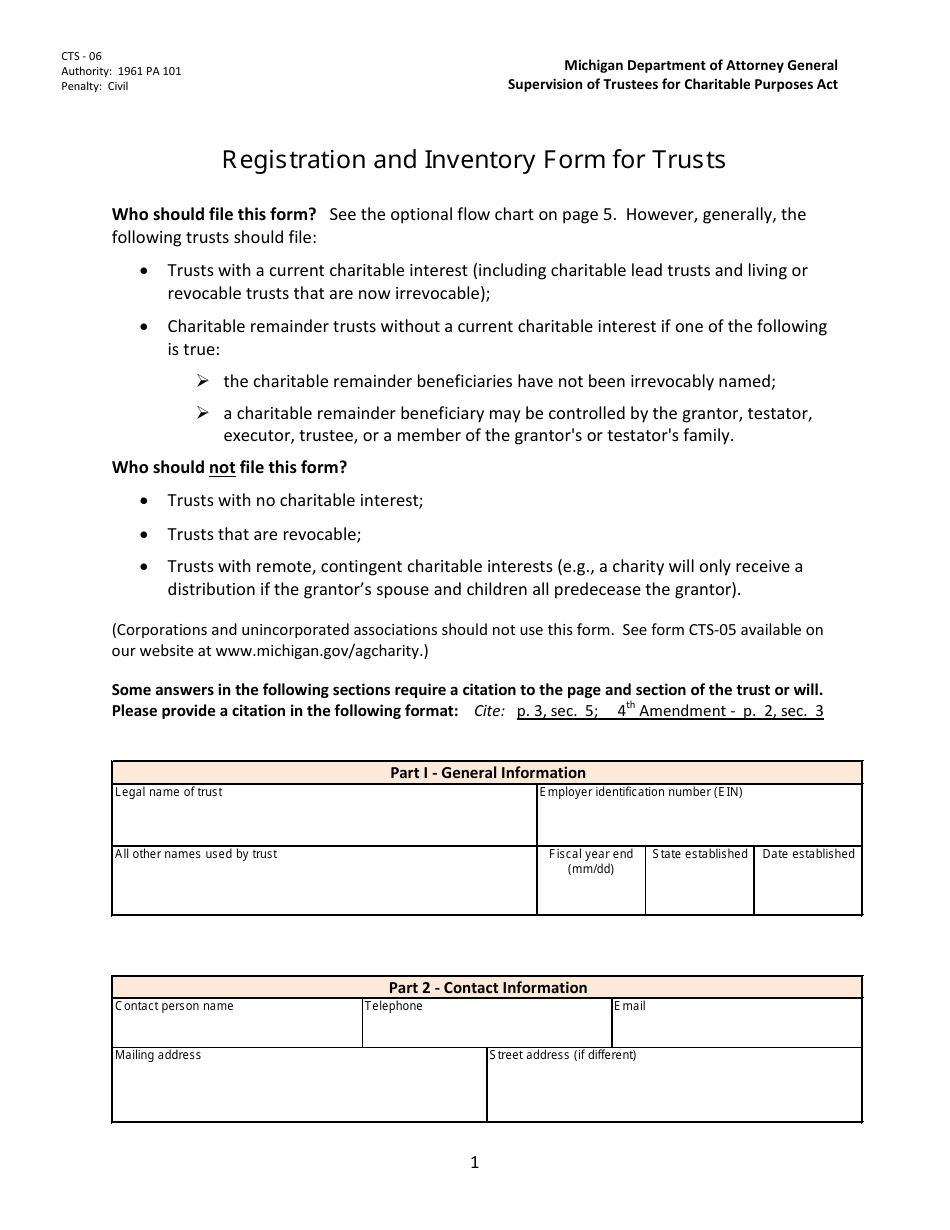

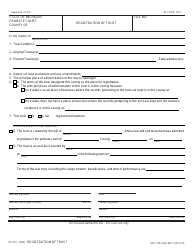

Form CTS-06 Registration and Inventory Form for Trusts - Michigan

What Is Form CTS-06?

This is a legal form that was released by the Michigan Department of Attorney General - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CTS-06 Registration and Inventory Form for Trusts?

A: The CTS-06 form is a registration and inventory form specifically designed for trusts.

Q: Who needs to fill out the CTS-06 form?

A: Trusts in the state of Michigan need to fill out the CTS-06 form.

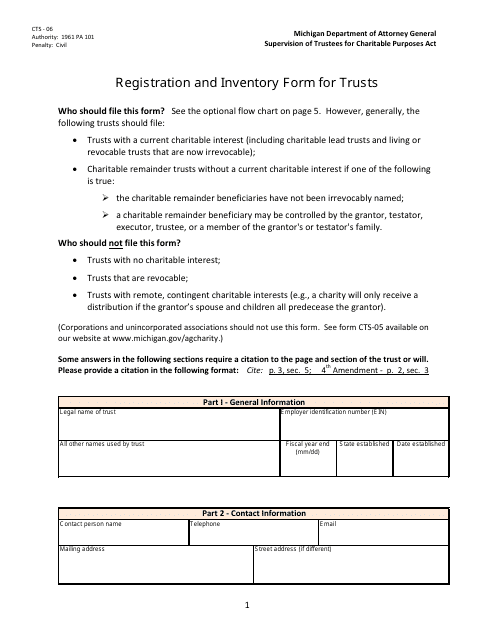

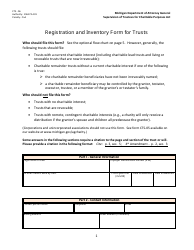

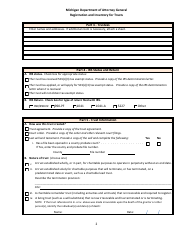

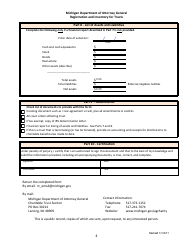

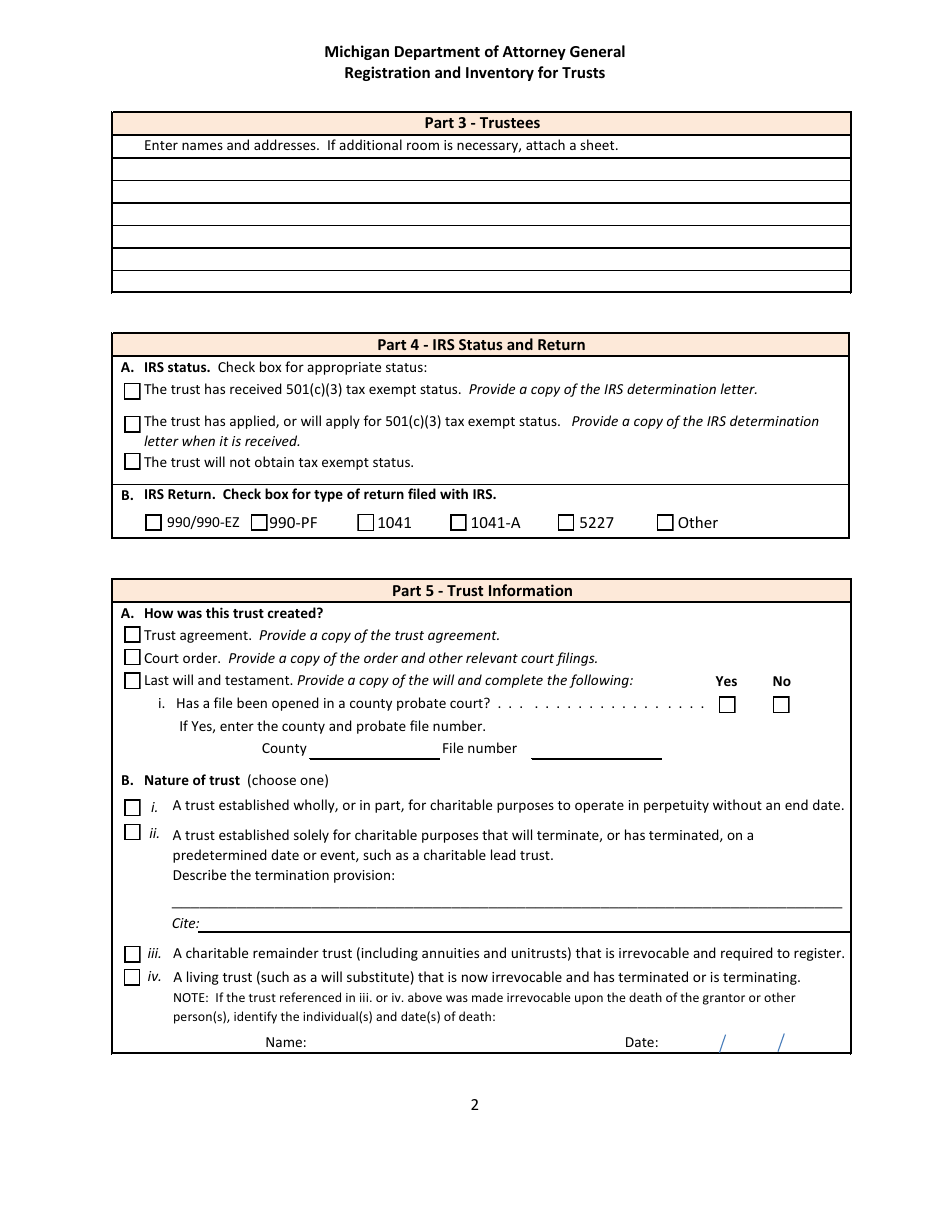

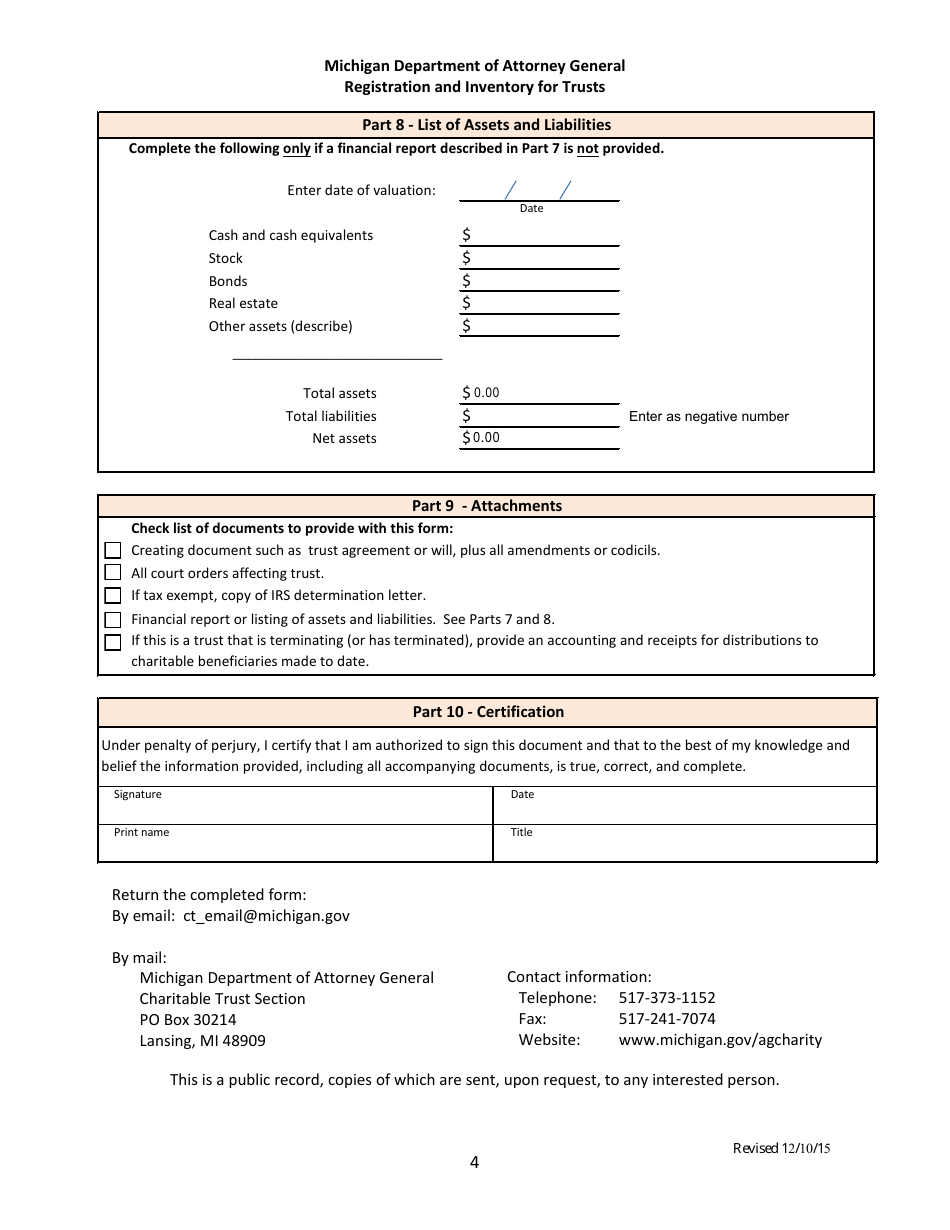

Q: What information is required on the CTS-06 form?

A: The form requires various information about the trust, including its name, date of creation, names of trustees, and details of trust assets.

Q: What is the deadline for filing the CTS-06 form?

A: The CTS-06 form must be filed within 90 days after the creation of the trust or after it becomes a reporting trust.

Q: Are there any penalties for not filing the CTS-06 form?

A: Failure to file the CTS-06 form may result in penalties, including late fees and potential legal consequences.

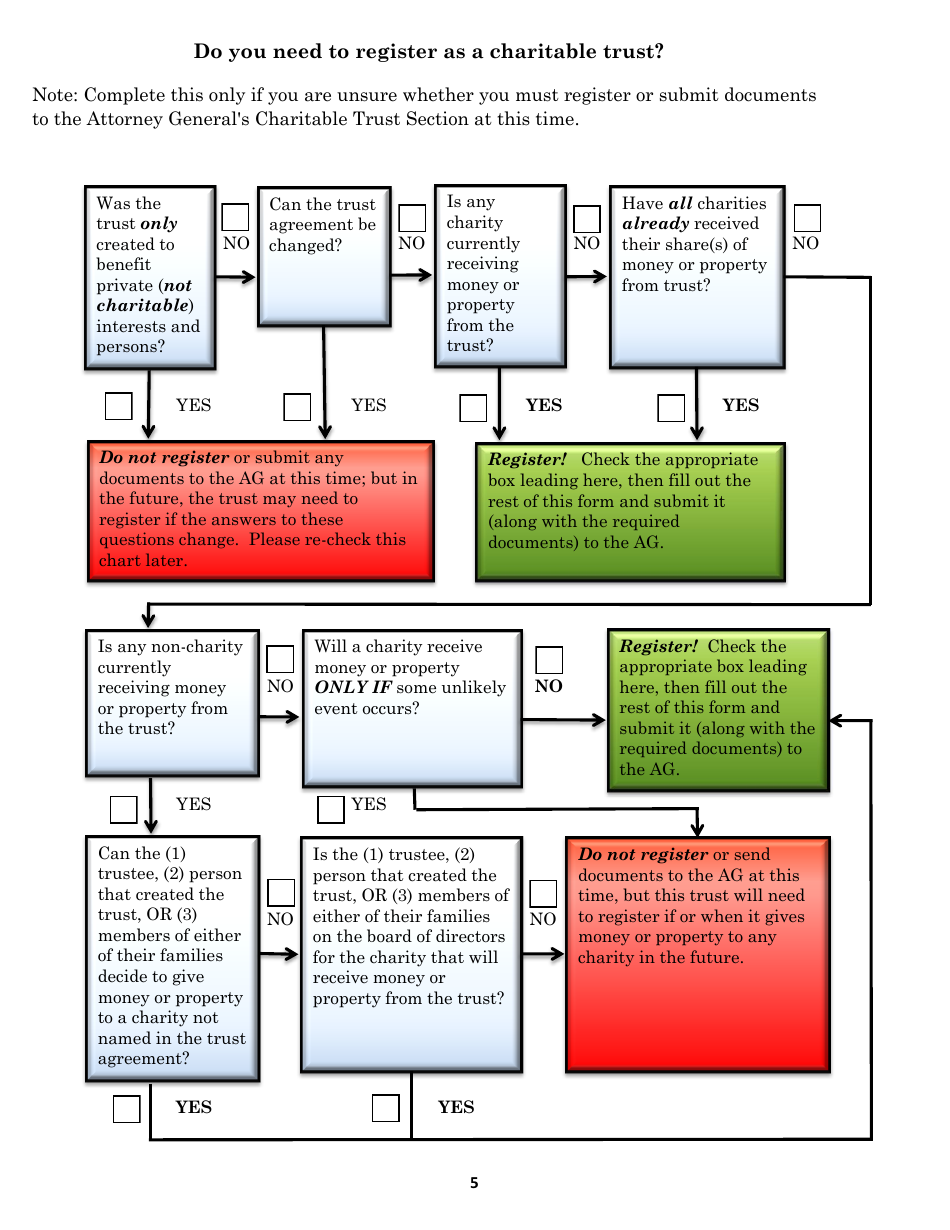

Q: Do all trusts in Michigan need to file the CTS-06 form?

A: No, only trusts that meet specific criteria outlined by the state of Michigan are required to file the CTS-06 form.

Q: What is the purpose of the CTS-06 form?

A: The purpose of the CTS-06 form is to provide the state of Michigan with information about trusts and their assets for regulatory and taxation purposes.

Form Details:

- Released on December 10, 2015;

- The latest edition provided by the Michigan Department of Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTS-06 by clicking the link below or browse more documents and templates provided by the Michigan Department of Attorney General.