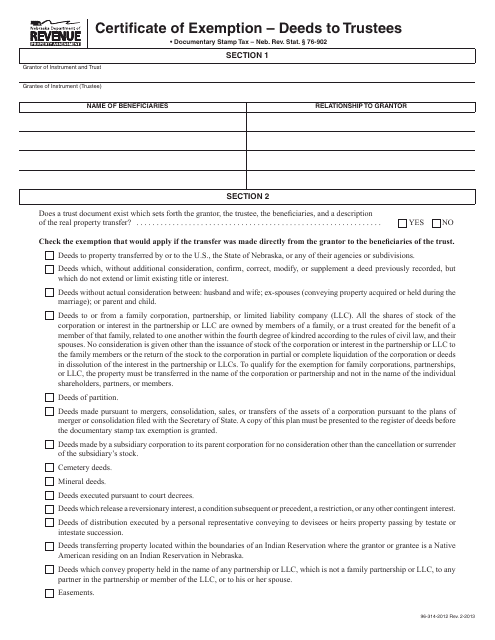

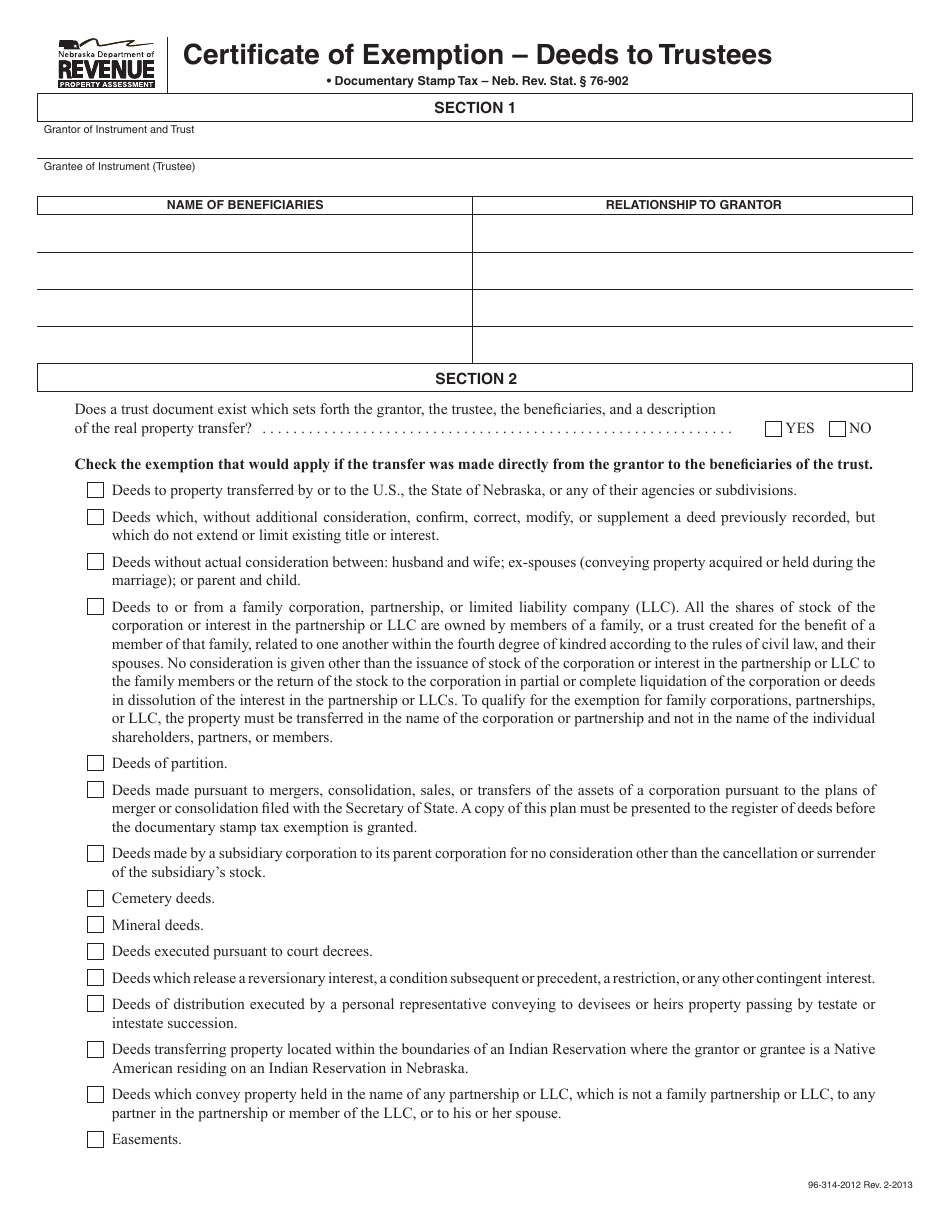

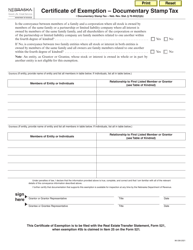

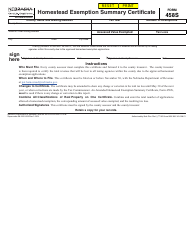

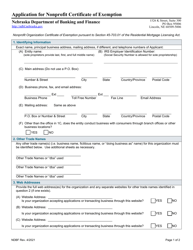

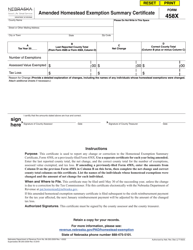

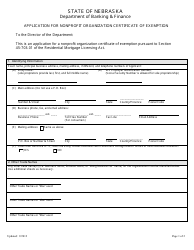

Certificate of Exemption - Deeds to Trustees - Nebraska

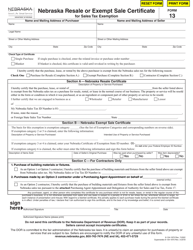

Certificate of Exemption - Deeds to Trustees is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is a Certificate of Exemption for Deeds to Trustees in Nebraska?

A: A Certificate of Exemption for Deeds to Trustees is a document that allows certain types of trustee deeds to be exempted from paying transfer taxes in Nebraska.

Q: What is a trustee deed?

A: A trustee deed is a legal document that transfers property from a trust to a trustee.

Q: What types of trustee deeds are eligible for exemption?

A: Trustee deeds that fall under specified categories, such as transfers between trusts, transfers to or from an individual or a spouse, transfers to a revocable trust, and transfers pursuant to court orders, may be eligible for exemption.

Q: How can I obtain a Certificate of Exemption for Deeds to Trustees?

A: You can obtain a Certificate of Exemption for Deeds to Trustees by submitting the necessary documentation and payment of applicable fees to the appropriate county clerk's office in Nebraska.

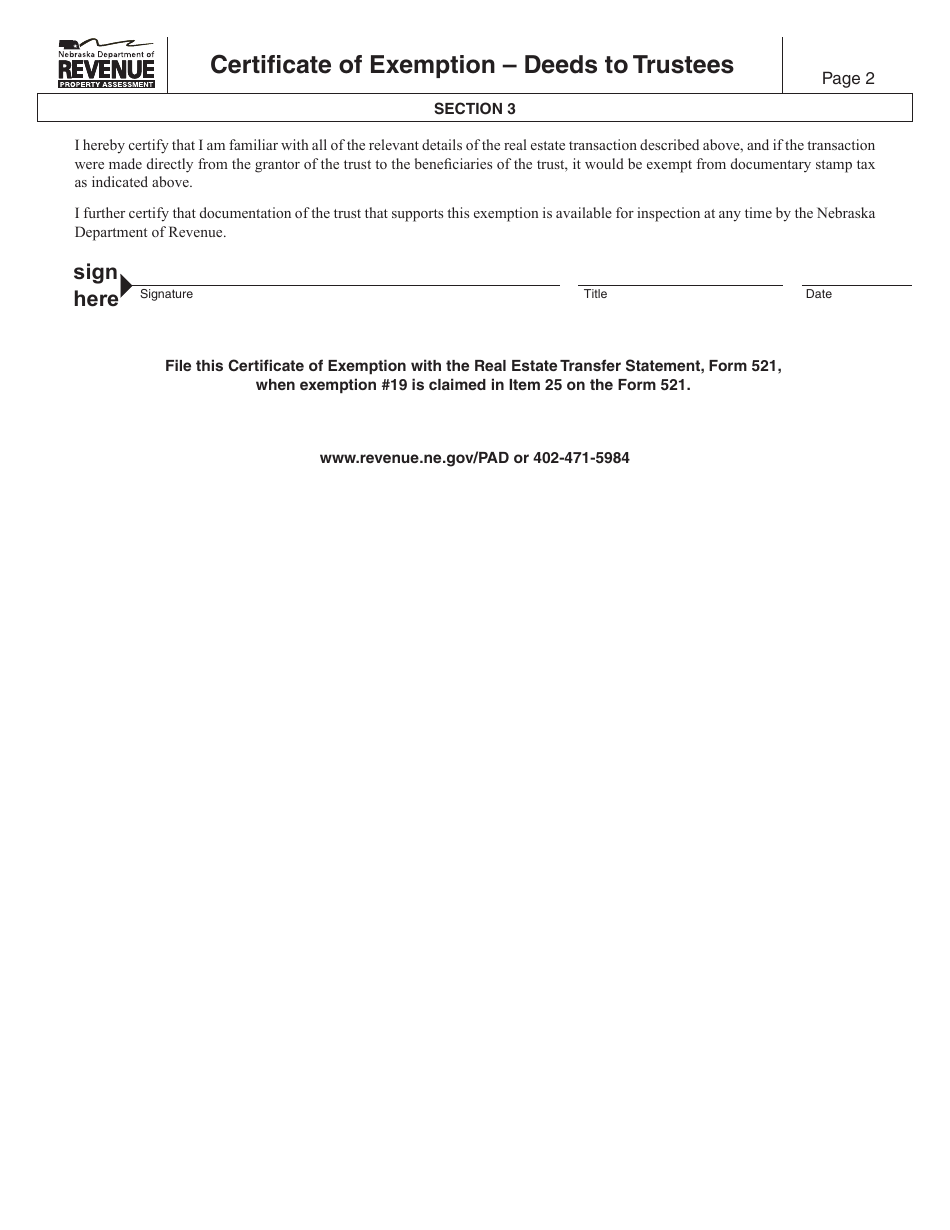

Q: What is the purpose of the Certificate of Exemption?

A: The purpose of the Certificate of Exemption is to provide proof that a trustee deed is eligible for exemption from paying transfer taxes.

Q: How much does it cost to obtain a Certificate of Exemption?

A: The cost of obtaining a Certificate of Exemption may vary depending on the county in Nebraska. It is recommended to check with the county clerk's office for the exact fee.

Q: Is the Certificate of Exemption transferable?

A: No, the Certificate of Exemption is not transferable. It applies only to the specific trustee deed for which it was issued.

Q: Do I need to provide any supporting documentation when applying for a Certificate of Exemption?

A: Yes, you will generally need to provide supporting documentation, such as a copy of the trust agreement, to prove that the trustee deed qualifies for exemption.

Q: Is there a deadline for applying for the Certificate of Exemption?

A: There is no specific deadline, but it is recommended to apply for the Certificate of Exemption as soon as possible after the trustee deed is executed.

Q: Can the Certificate of Exemption be used for multiple trustee deeds?

A: No, each trustee deed requires its own separate Certificate of Exemption.

Form Details:

- Released on February 1, 2013;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.