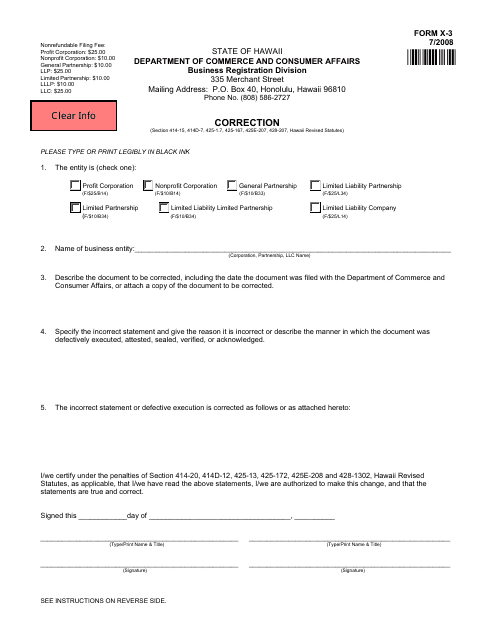

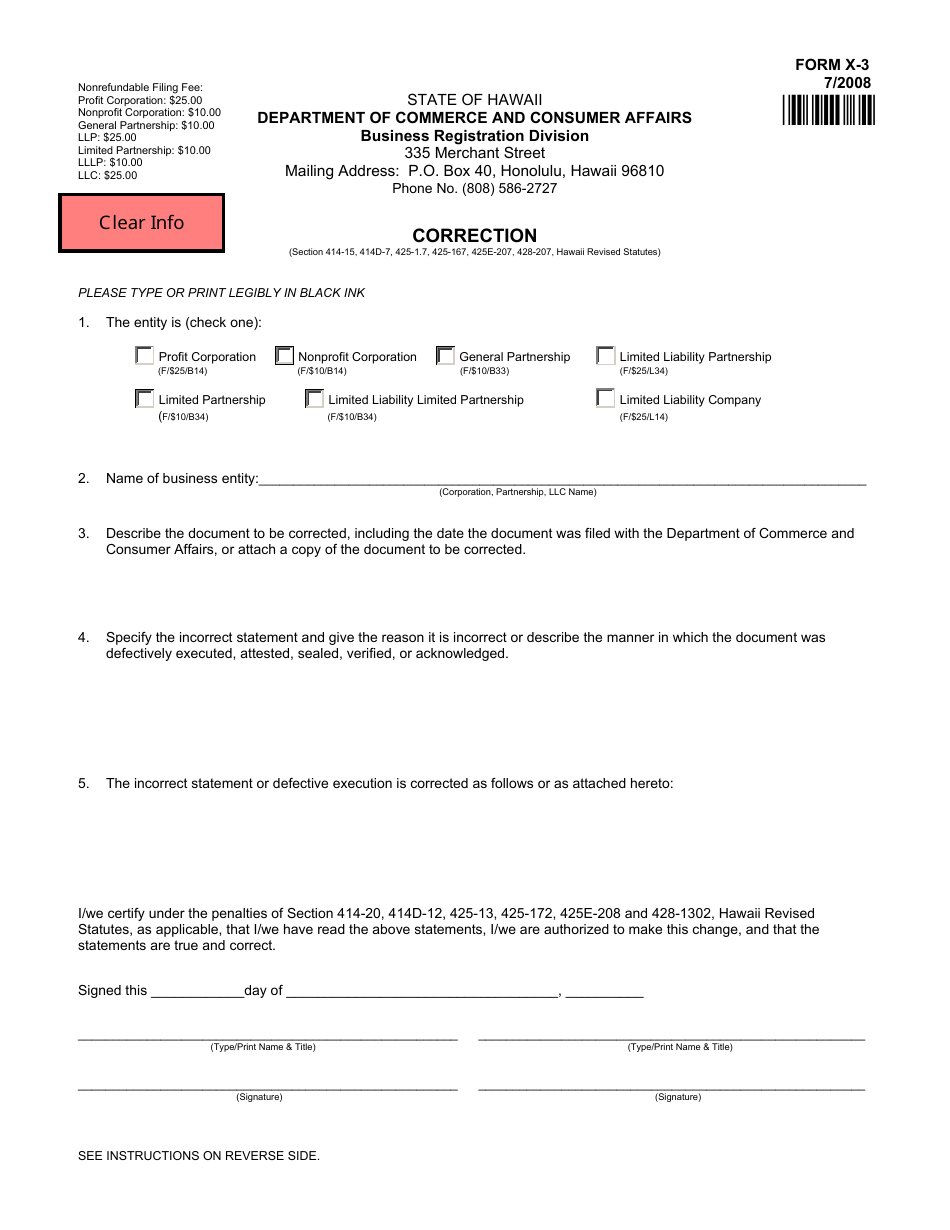

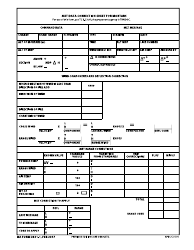

Form X-3 Correction - Hawaii

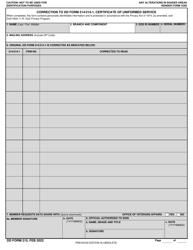

What Is Form X-3?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form X-3 Correction?

A: Form X-3 Correction is a form used in the state of Hawaii to correct errors or make changes to previously filed payroll tax reports.

Q: Who needs to file Form X-3 Correction?

A: Employers in Hawaii who have made errors or need to make changes to their previously filed payroll tax reports need to file Form X-3 Correction.

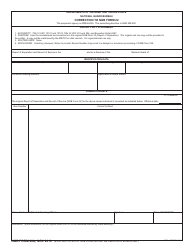

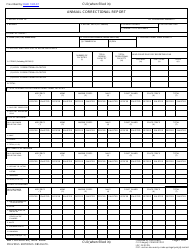

Q: What types of changes can be made using Form X-3 Correction?

A: Form X-3 Correction can be used to make corrections or changes to various payroll tax information such as wages, taxes withheld, and Hawaii Employment & Training Fund assessments.

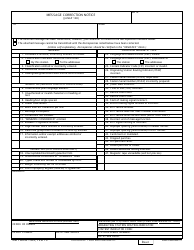

Q: Is there a deadline for filing Form X-3 Correction?

A: Yes, Form X-3 Correction must be filed within 20 calendar days after the date of determination for any changes or corrections to be considered.

Q: Are there any penalties for not filing Form X-3 Correction?

A: Yes, failure to file Form X-3 Correction or filing it late may result in penalties and interest on the amount due.

Q: Can Form X-3 Correction be used to make changes to multiple reporting periods?

A: No, each Form X-3 Correction can only be used to make changes to a single reporting period.

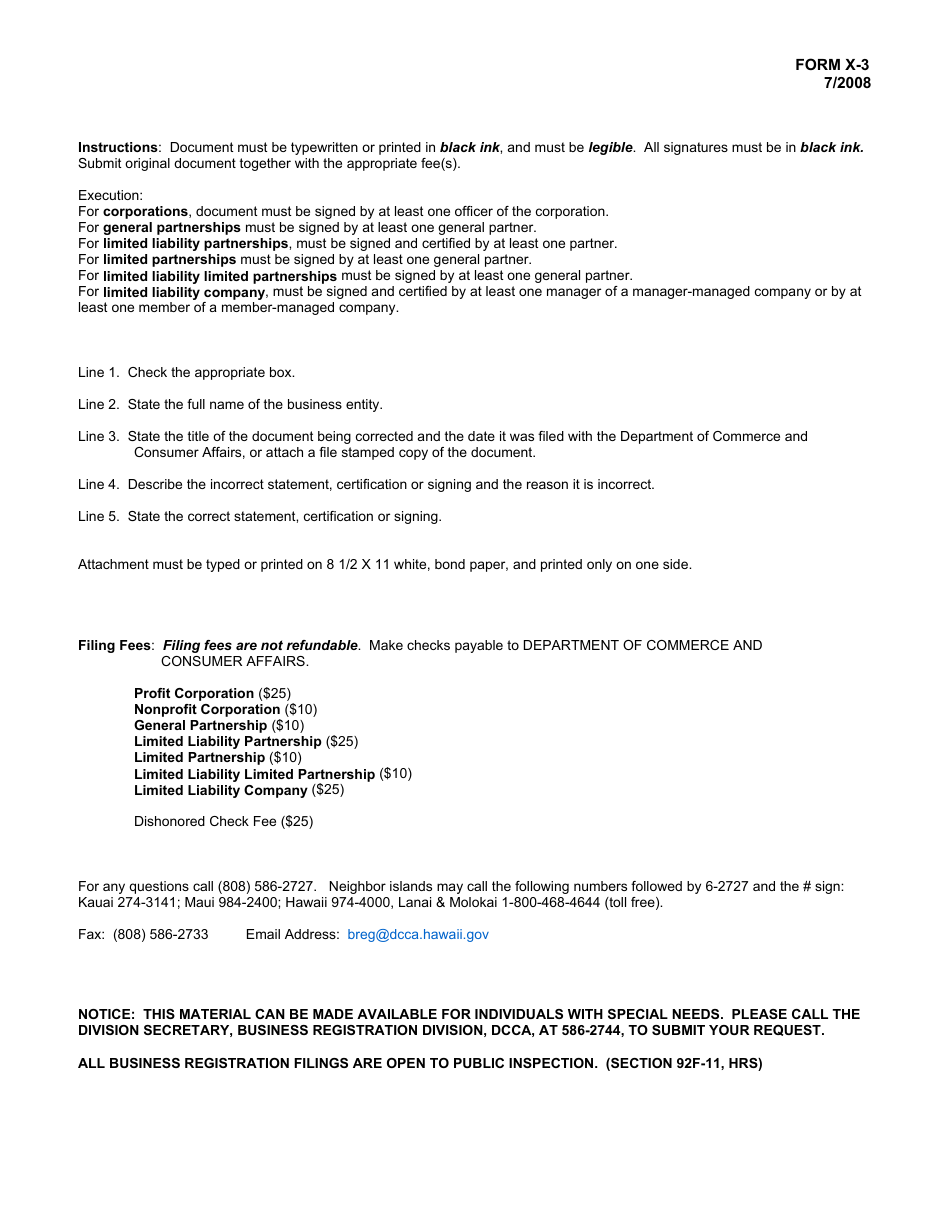

Q: What supporting documentation should be included with Form X-3 Correction?

A: Copies of any relevant payroll records or documentation supporting the changes or corrections made on the form should be included.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form X-3 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.