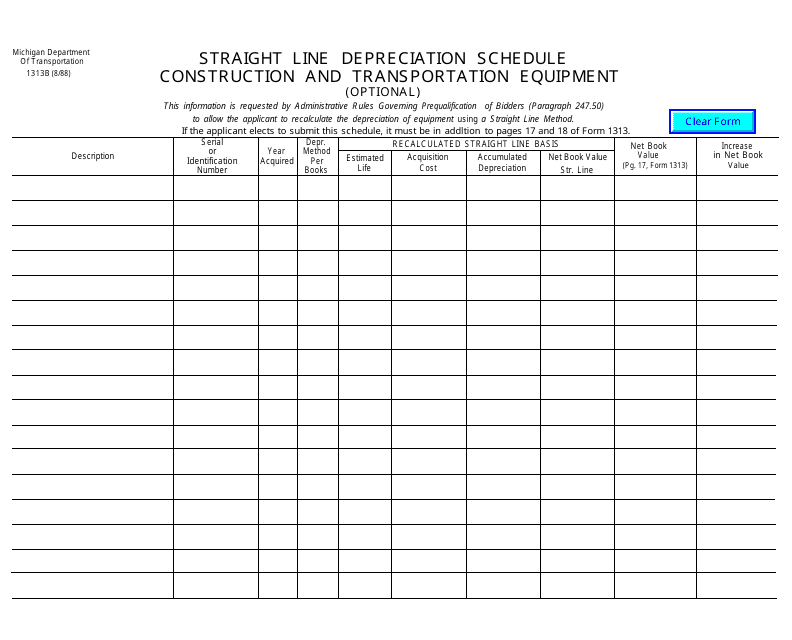

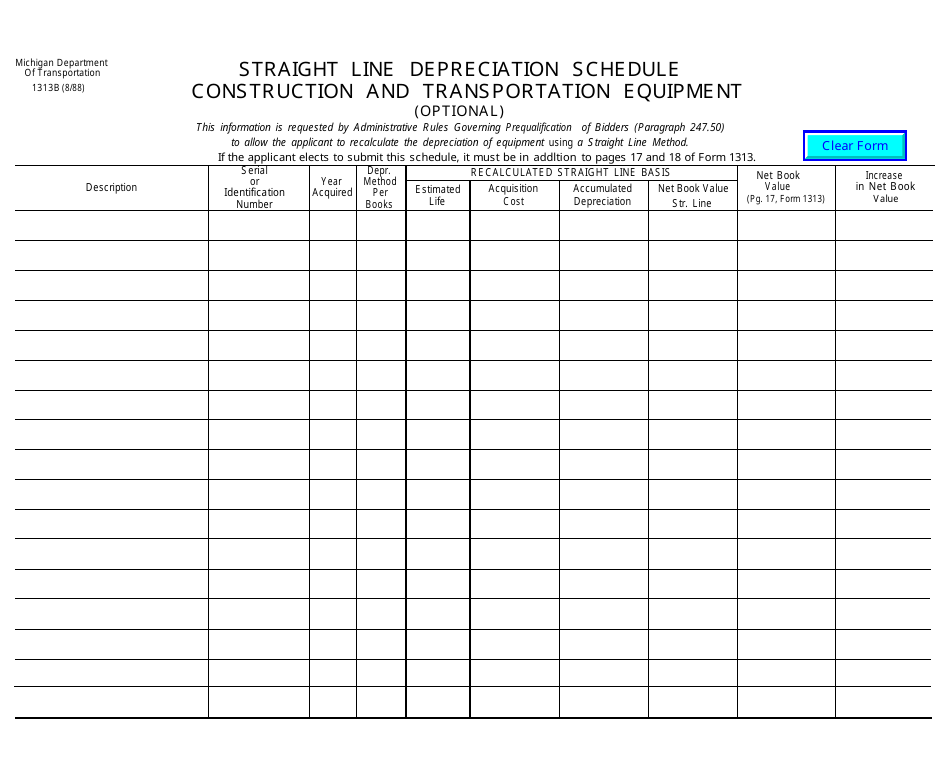

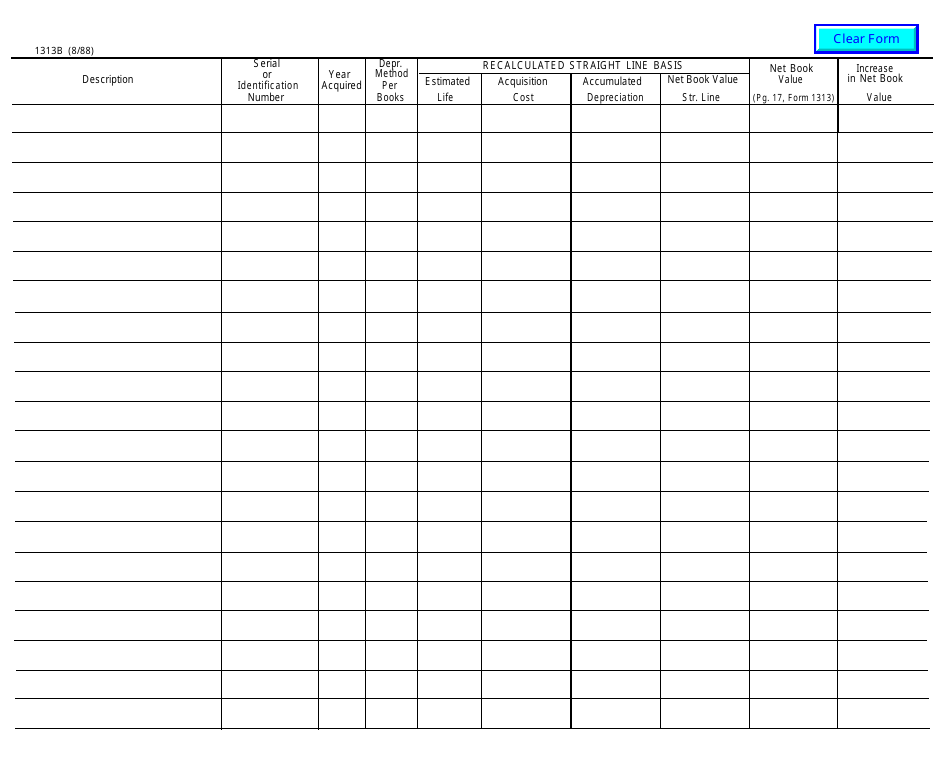

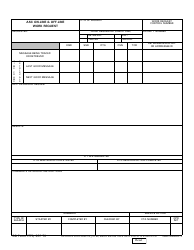

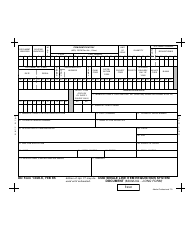

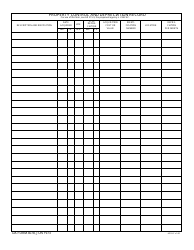

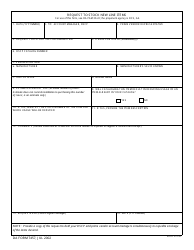

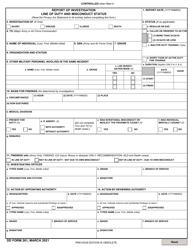

Form 1313B Straight Line Depreciation Schedule - Michigan

What Is Form 1313B?

This is a legal form that was released by the Michigan Department of Transportation - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1313B?

A: Form 1313B is a Straight Line Depreciation Schedule form.

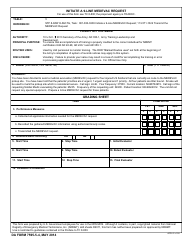

Q: What is a Straight Line Depreciation Schedule?

A: Straight Line Depreciation Schedule is a method of allocating the cost of an asset over its useful life in equal installments.

Q: Is Form 1313B specific to Michigan?

A: Yes, Form 1313B is specific to Michigan.

Q: What is the purpose of Form 1313B?

A: The purpose of Form 1313B is to report the depreciation of assets in a straight-line method for tax purposes in Michigan.

Q: Who needs to file Form 1313B?

A: Taxpayers in Michigan who have assets subject to straight-line depreciation for tax purposes need to file Form 1313B.

Q: Are there any deadlines for filing Form 1313B?

A: Yes, the deadline for filing Form 1313B in Michigan varies depending on the fiscal year of the taxpayer.

Q: Is there a fee for filing Form 1313B?

A: No, there is no fee for filing Form 1313B in Michigan.

Q: What should I do if I have questions or need assistance with Form 1313B?

A: If you have any questions or need assistance with Form 1313B, you can contact the Michigan Department of Treasury for guidance.

Form Details:

- Released on August 1, 1988;

- The latest edition provided by the Michigan Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1313B by clicking the link below or browse more documents and templates provided by the Michigan Department of Transportation.