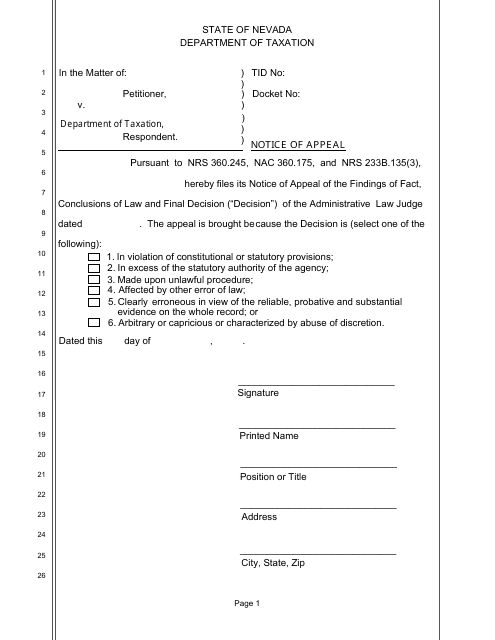

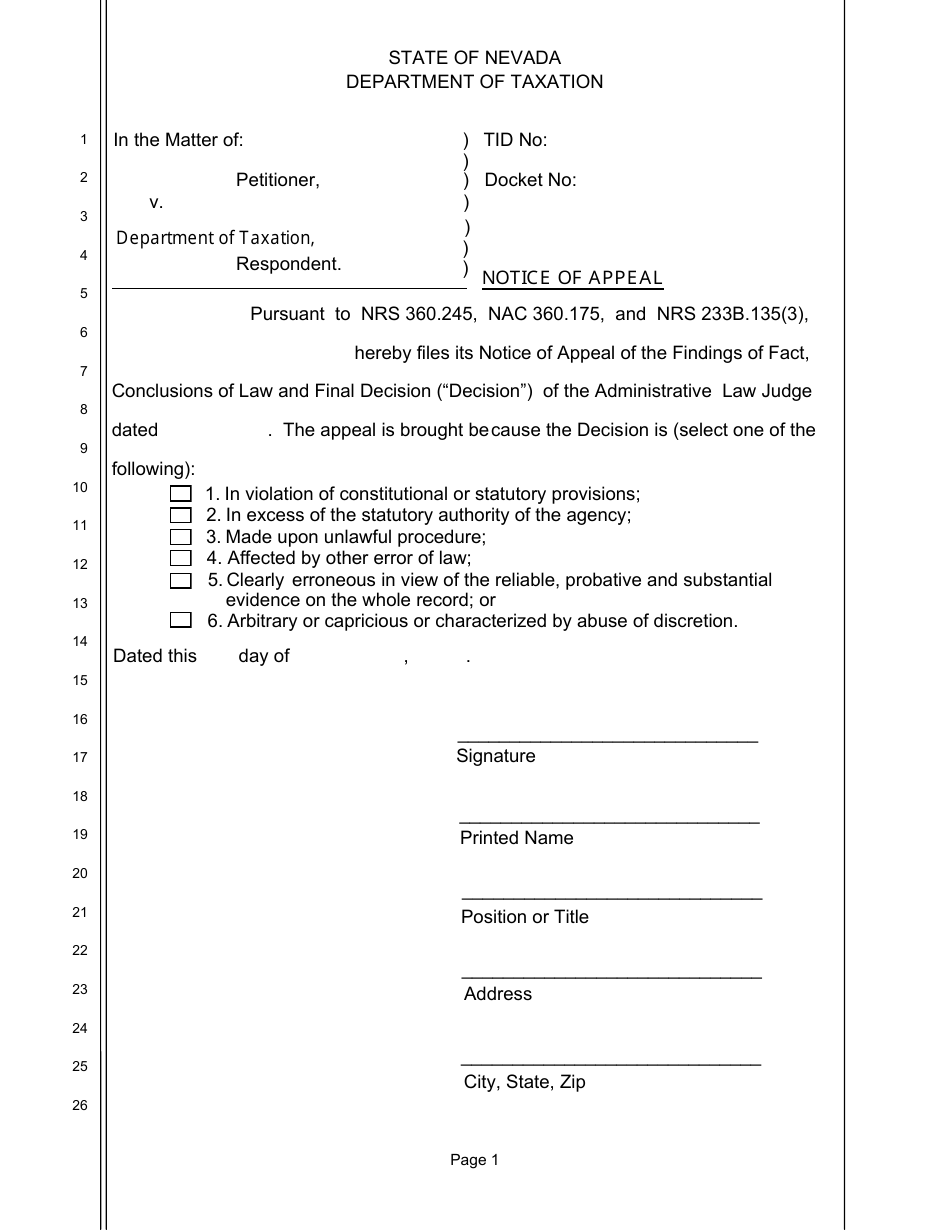

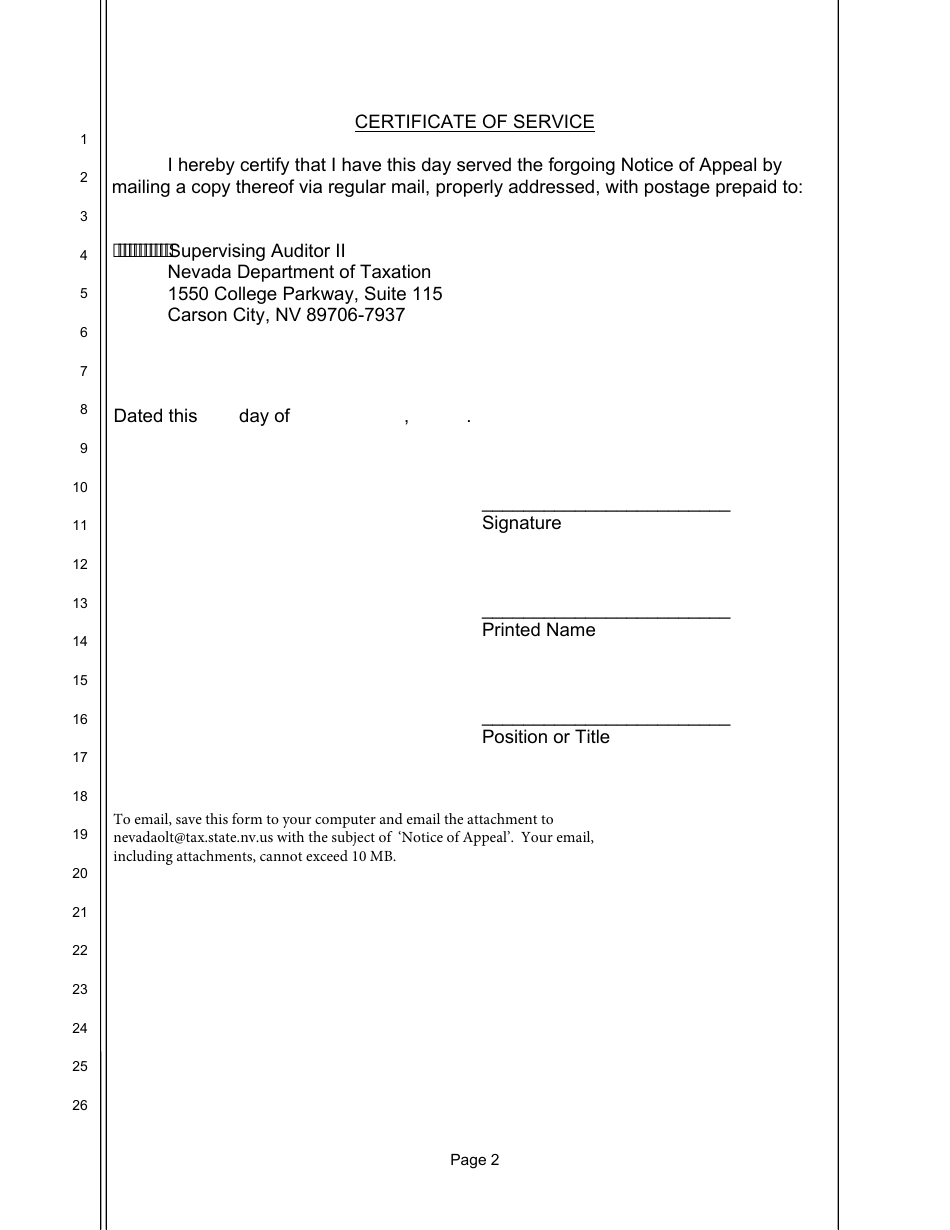

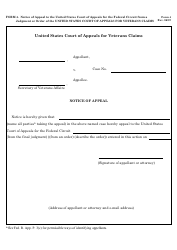

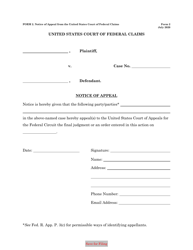

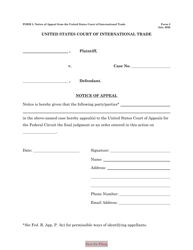

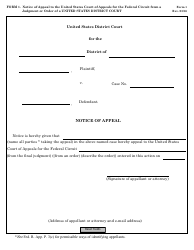

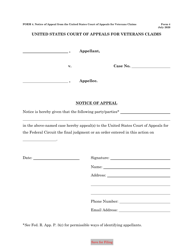

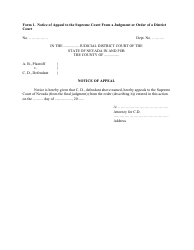

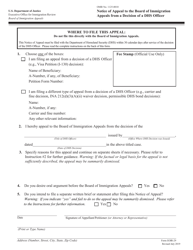

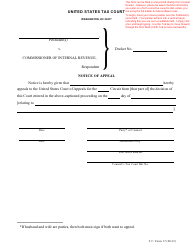

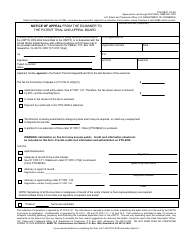

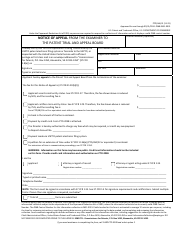

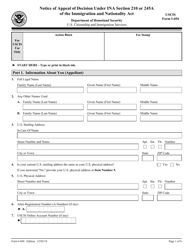

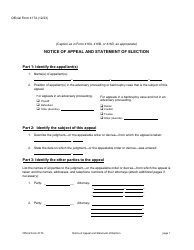

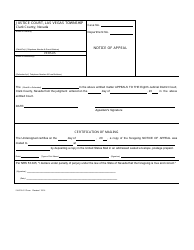

Notice of Appeal - Nevada

Notice of Appeal is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is a Notice of Appeal?

A: A Notice of Appeal is a document filed by a party who wishes to challenge a court's decision.

Q: What is the purpose of a Notice of Appeal?

A: The purpose of a Notice of Appeal is to initiate the appeals process and notify the higher court that a party is dissatisfied with a lower court's decision.

Q: When should a Notice of Appeal be filed in Nevada?

A: In Nevada, a Notice of Appeal should be filed within 30 days from the date of the judgment or order being appealed.

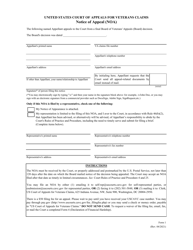

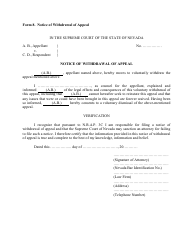

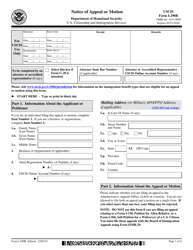

Q: What information should be included in a Notice of Appeal?

A: A Notice of Appeal should include the names of the parties, the court where the decision was made, the date of the decision, and a brief statement explaining the basis for the appeal.

Q: Is there a fee for filing a Notice of Appeal in Nevada?

A: Yes, there is a fee for filing a Notice of Appeal in Nevada. The fee amount may vary depending on the court.

Q: What happens after a Notice of Appeal is filed?

A: After a Notice of Appeal is filed, the case will be transferred to the higher court and the appeals process will begin.

Q: Can a Notice of Appeal be withdrawn in Nevada?

A: Yes, a Notice of Appeal can be withdrawn in Nevada if all parties agree to the withdrawal.

Q: What should I do if I receive a Notice of Appeal?

A: If you receive a Notice of Appeal, you should consult with an attorney to understand your rights and options in responding to the appeal.

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.