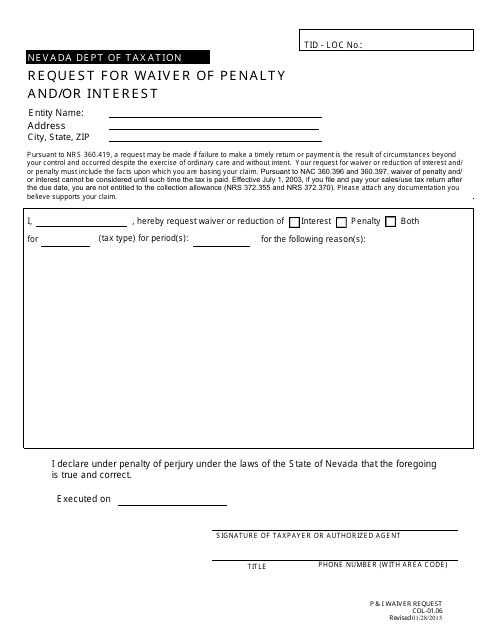

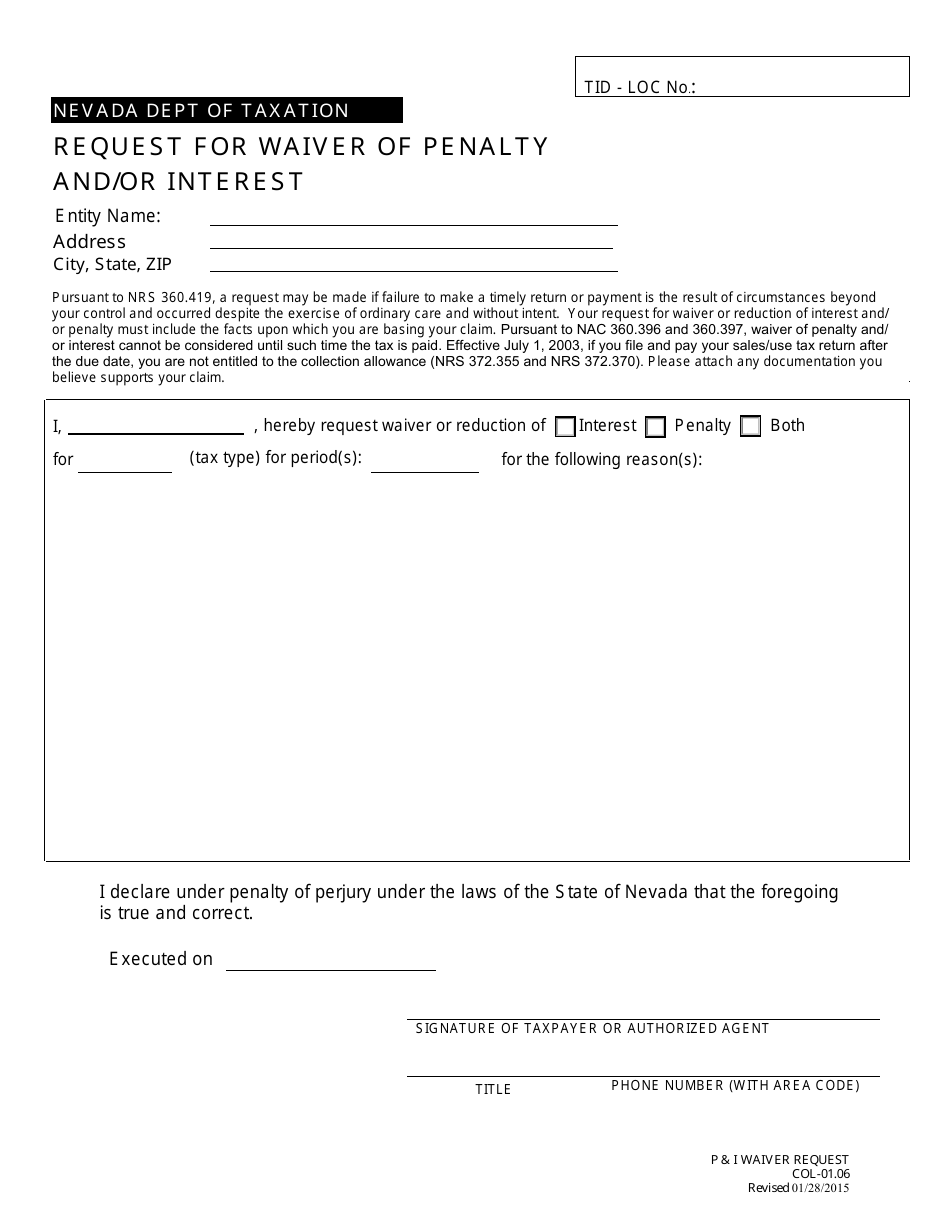

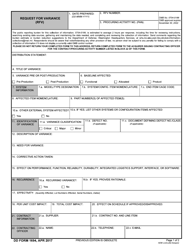

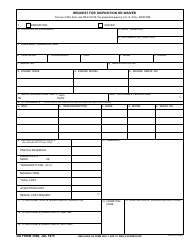

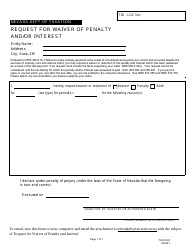

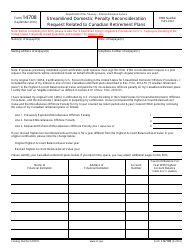

Request for Waiver of Penalty and / or Interest - Nevada

Request for Waiver of Penalty and/or Interest is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is a Request for Waiver of Penalty and/or Interest?

A: A Request for Waiver of Penalty and/or Interest is a formal request to the state of Nevada to waive the penalty and/or interest associated with a tax liability.

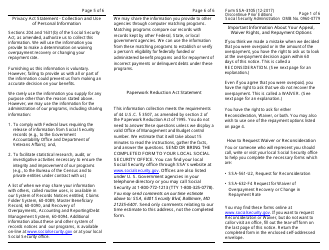

Q: Who can submit a Request for Waiver of Penalty and/or Interest?

A: Any taxpayer who believes that they have reasonable cause for the abatement of penalties and/or interest can submit a Request for Waiver of Penalty and/or Interest.

Q: What is considered reasonable cause for the waiver of penalty and/or interest?

A: Reasonable cause for the waiver of penalty and/or interest would be circumstances beyond the taxpayer's control, such as a natural disaster, serious illness, or death in the family.

Q: How can I submit a Request for Waiver of Penalty and/or Interest in Nevada?

A: You can submit a Request for Waiver of Penalty and/or Interest by completing Form Waiver-P for individual income tax or Form Waiver-P(corp) for corporate income tax and mailing it to the Nevada Department of Taxation.

Q: Is there a deadline to submit a Request for Waiver of Penalty and/or Interest?

A: Yes, the request must be filed within three years from the date of the tax payment or the date the tax return was filed, whichever is later.

Q: What supporting documentation is required for a Request for Waiver of Penalty and/or Interest?

A: You must provide a detailed explanation of the reasonable cause for the penalty and/or interest abatement, along with any supporting documentation that confirms the circumstances.

Q: How long does it take to receive a decision on a Request for Waiver of Penalty and/or Interest?

A: It typically takes the Nevada Department of Taxation approximately 90 days to review and make a decision on the request.

Q: What happens if my Request for Waiver of Penalty and/or Interest is approved?

A: If your request is approved, the penalty and/or interest associated with your tax liability will be waived, reducing the amount you owe.

Q: What happens if my Request for Waiver of Penalty and/or Interest is denied?

A: If your request is denied, you will still be responsible for paying the penalty and/or interest on your tax liability.

Q: Can I appeal the decision on my Request for Waiver of Penalty and/or Interest?

A: Yes, if your request is denied, you have the right to appeal the decision to the Nevada Board of Equalization within 30 days of receiving the denial letter.

Form Details:

- Released on January 28, 2015;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.